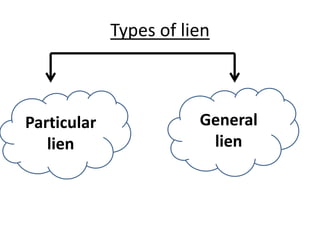

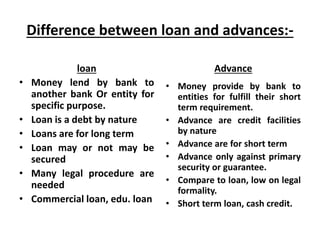

Loan and advances are forms of debt provided by banks. A loan is money lent for a specific purpose that is generally long term in nature, while an advance is short term credit provided to fulfill immediate requirements. Loans can be secured or unsecured based on collateral, whereas advances are usually secured by assets or guarantees. Common types of secured loans include those backed by goods, land, buildings, or securities. Unsecured loans rely solely on the borrower's creditworthiness without collateral. Banks can create security interests for loans through lien, pledge, hypothecation, or mortgage on borrowers' property.