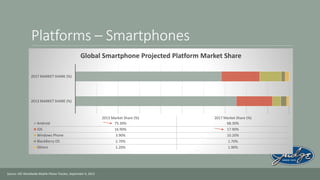

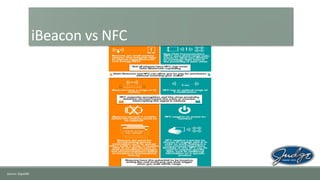

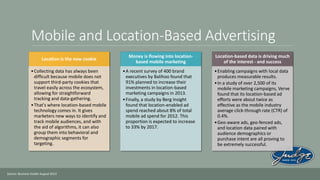

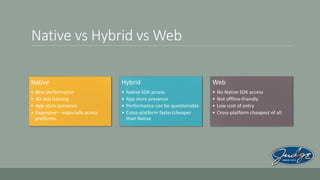

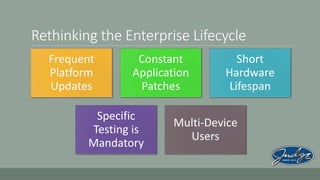

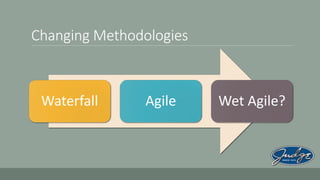

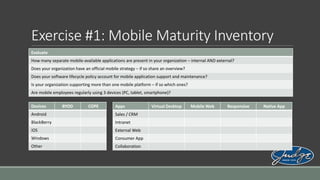

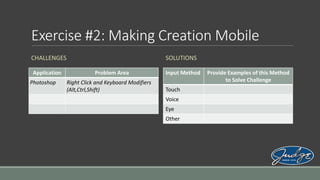

The document discusses mobile insights from 2014 and beyond, focusing on trends and market share in mobile platforms and devices. Key highlights include the growth of Android and iOS, the importance of location-based mobile marketing, and the evolution of mobile technology for enterprise applications. It also emphasizes the need for organizations to evaluate their mobile maturity and adapt to new input methods for content creation.