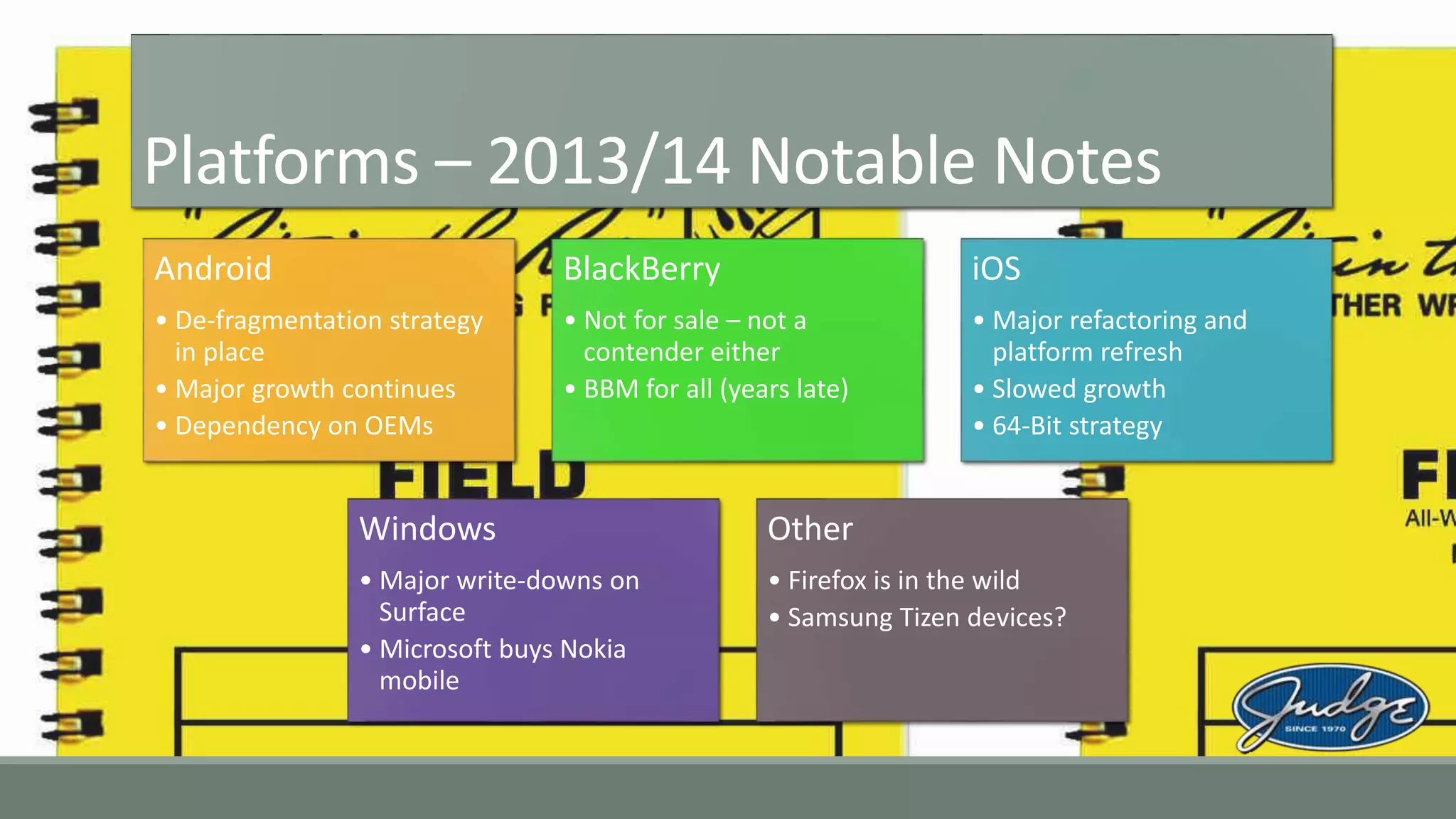

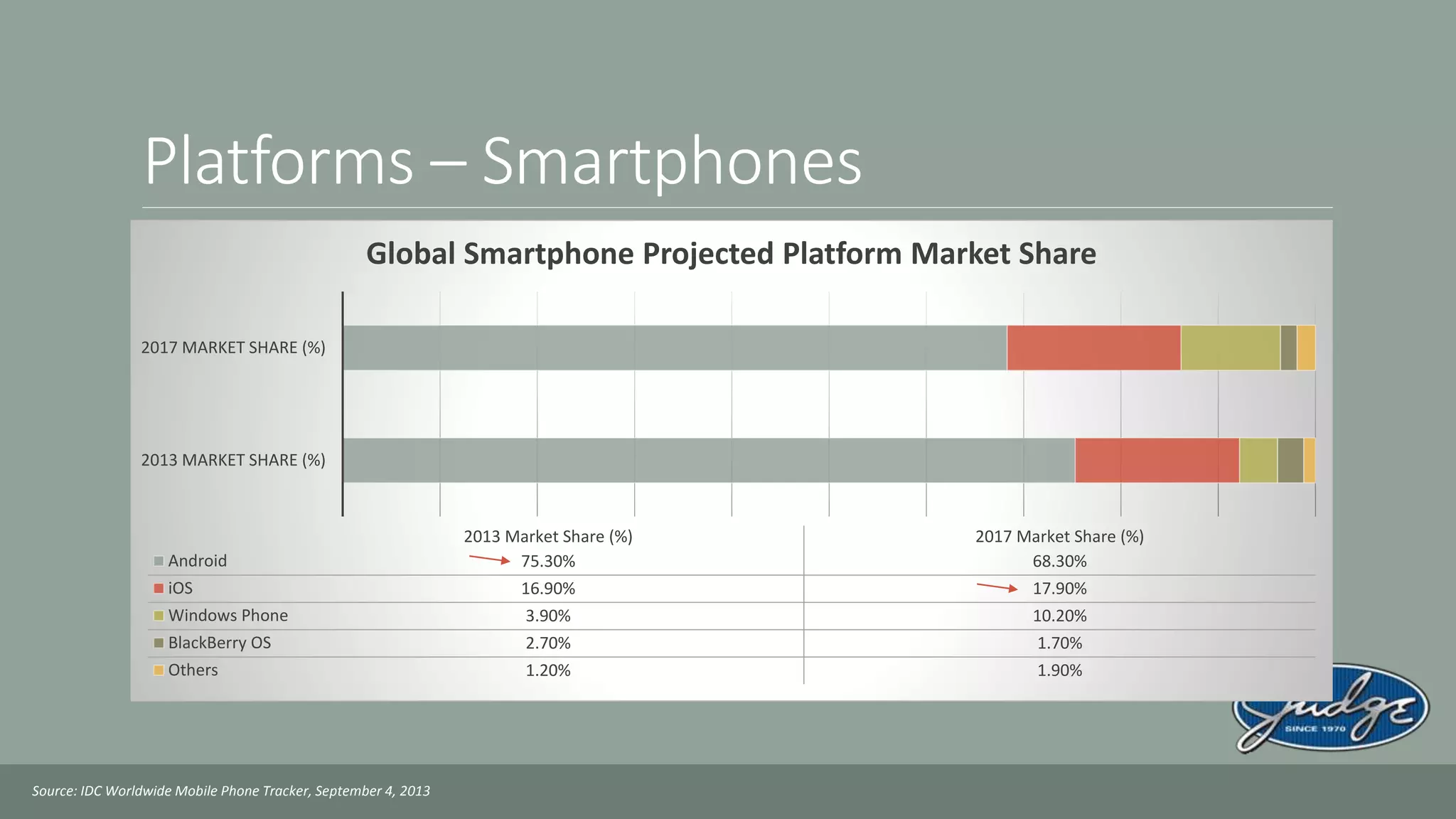

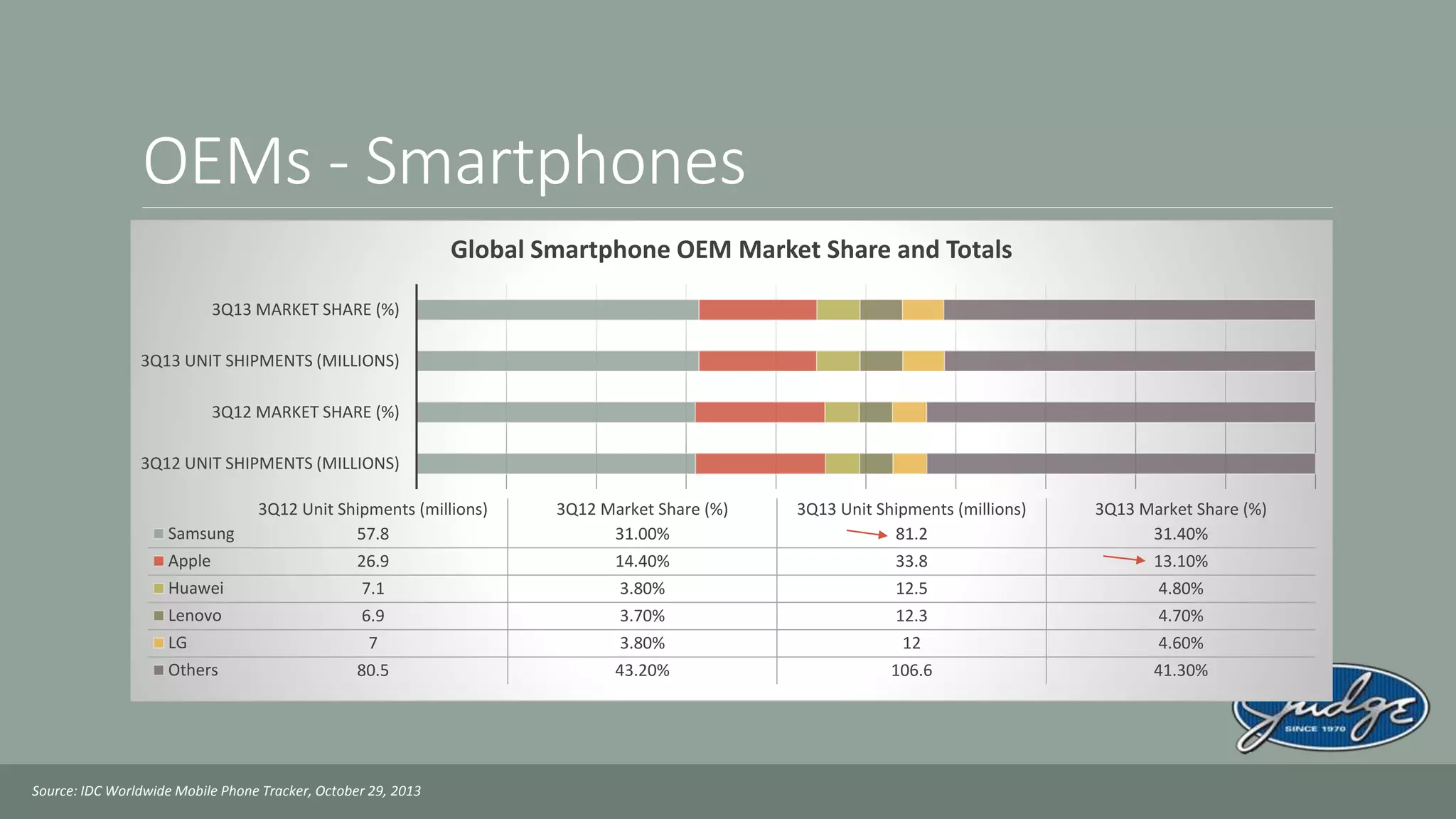

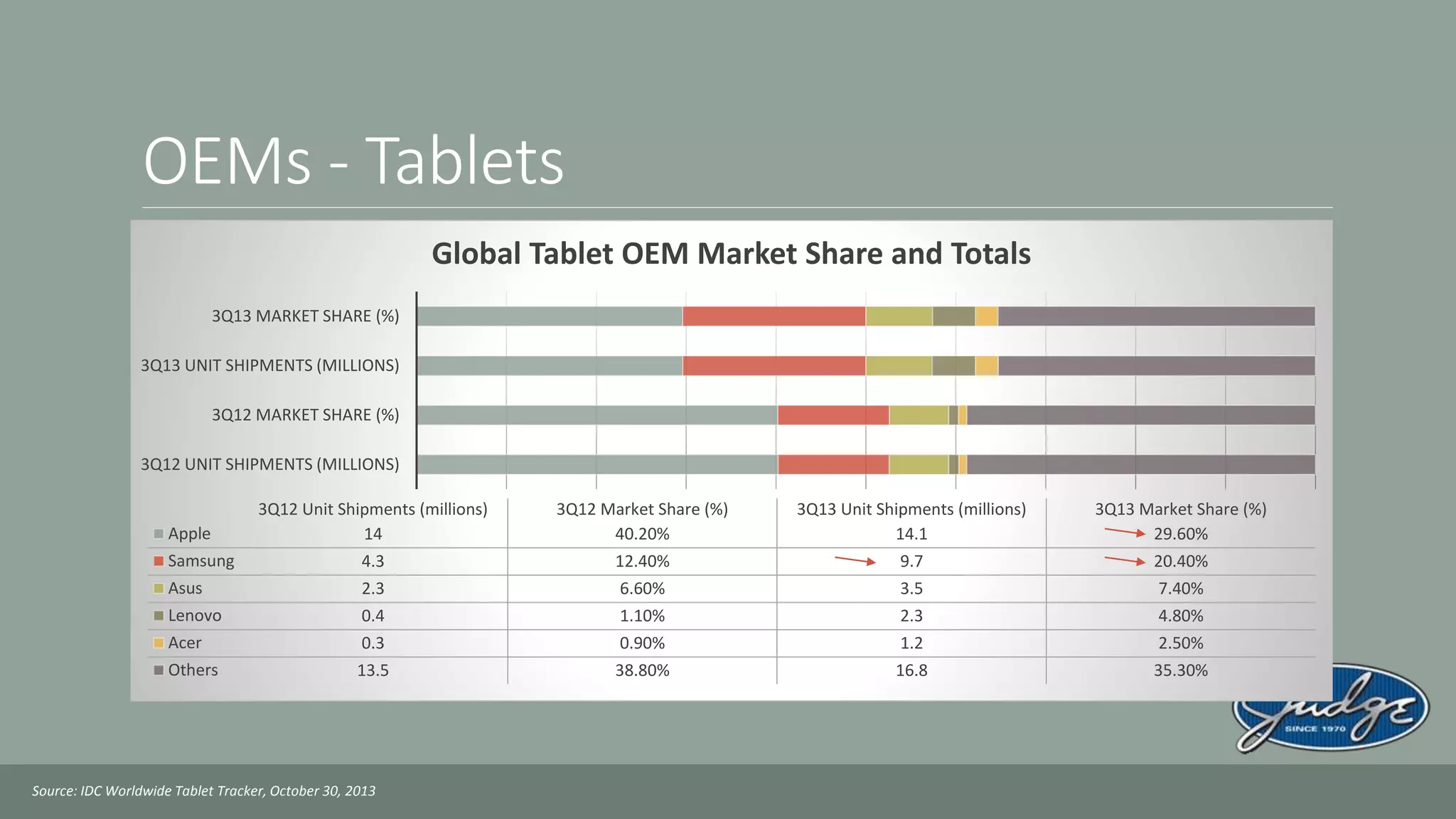

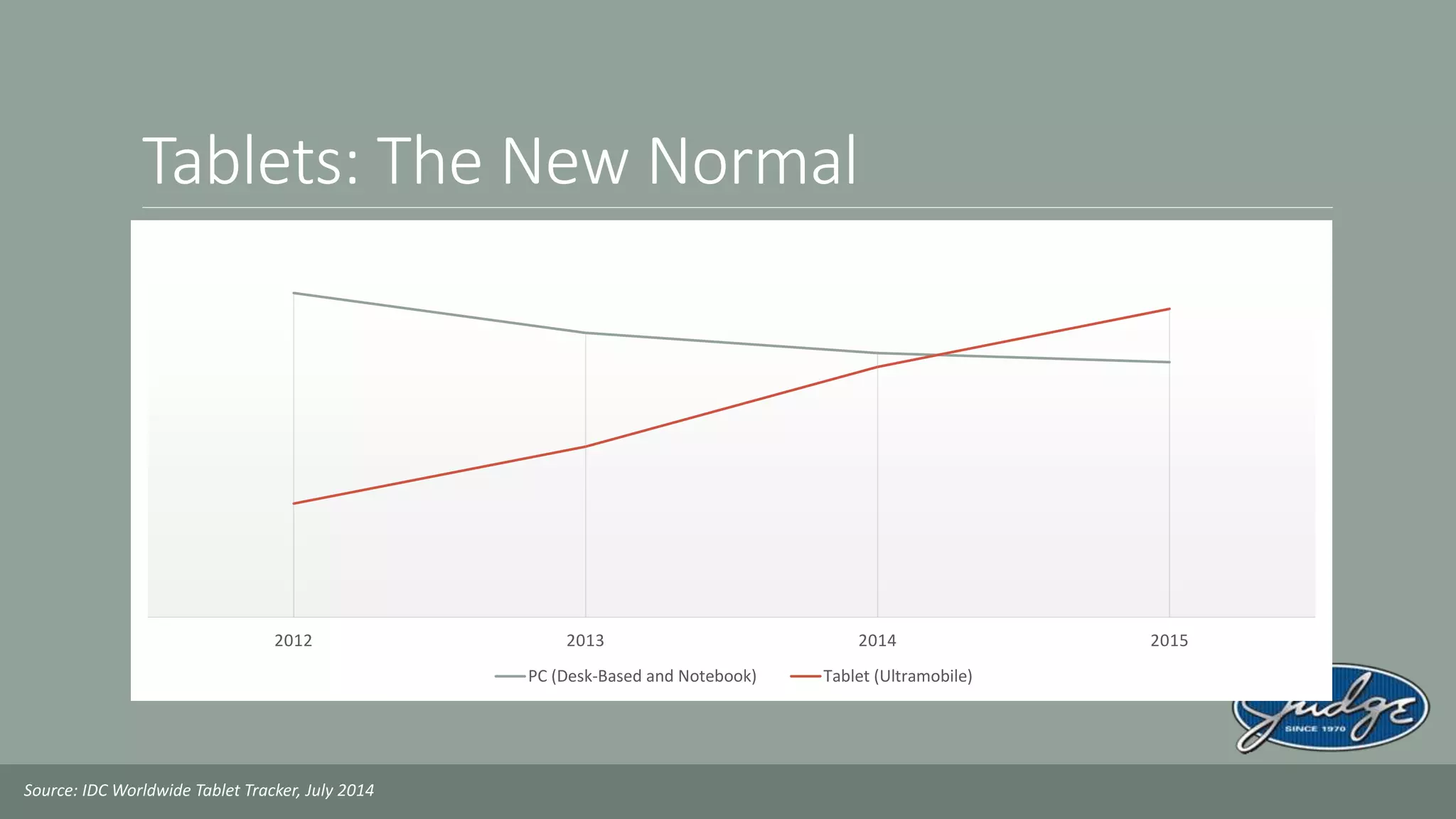

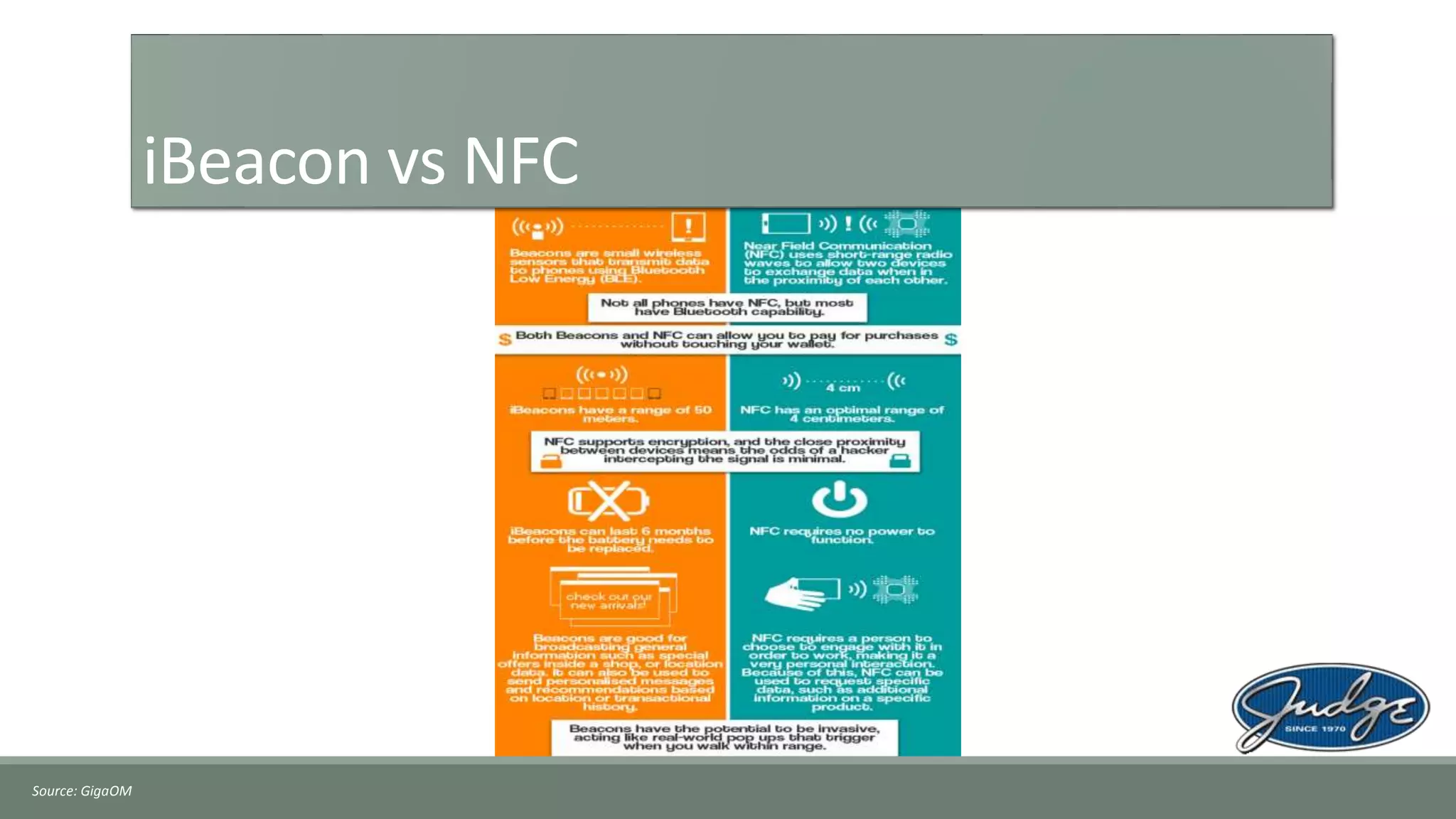

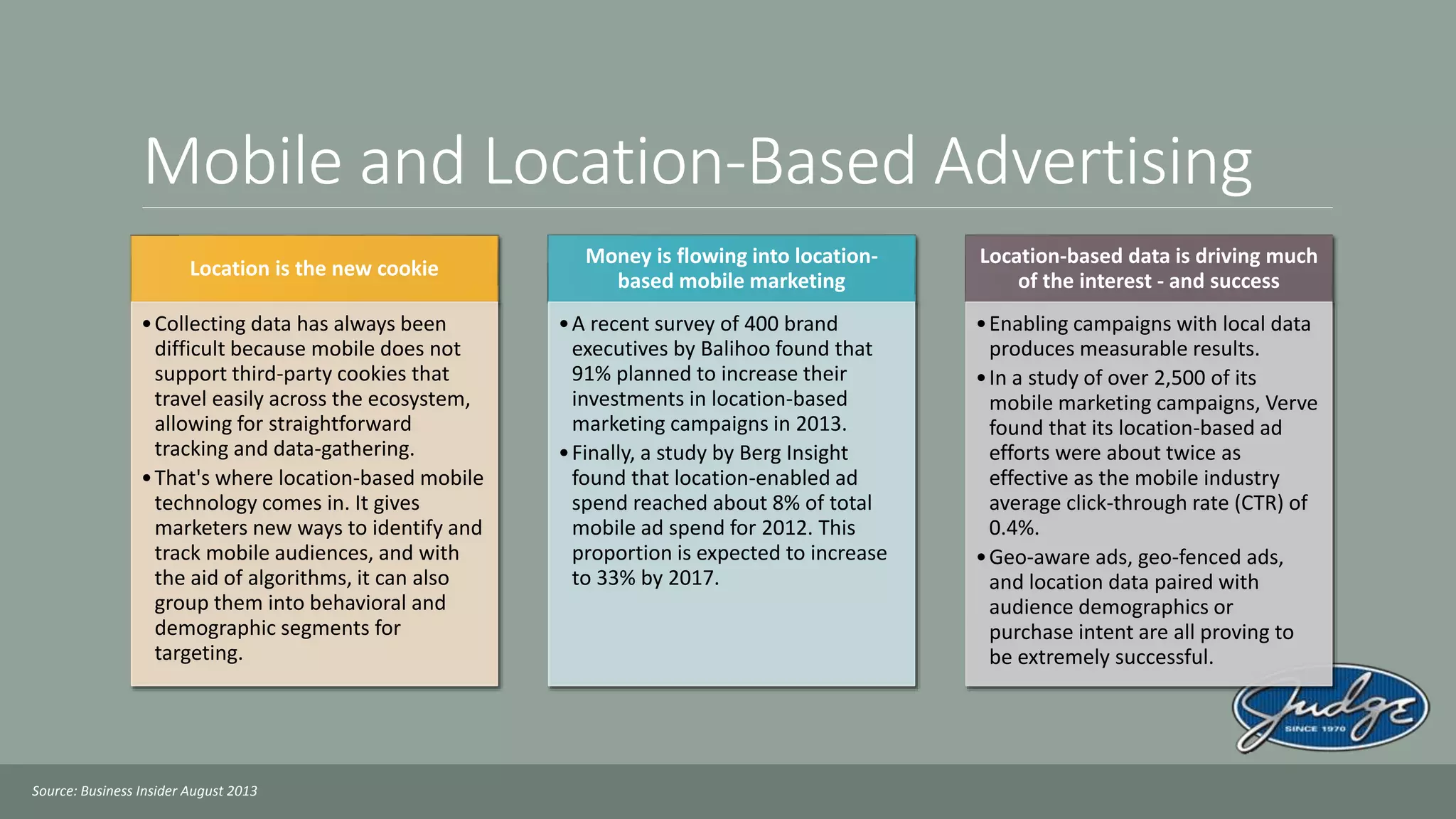

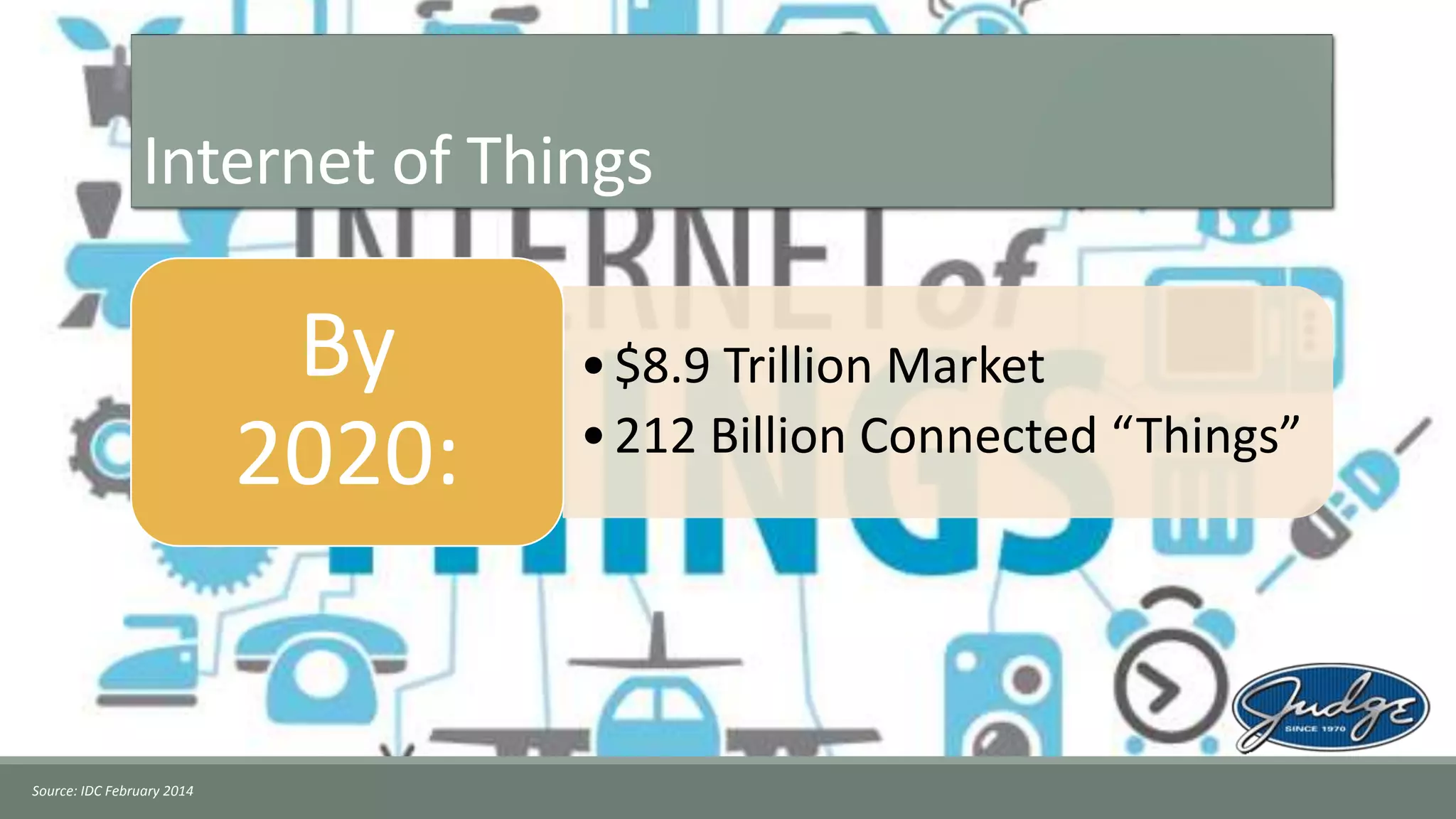

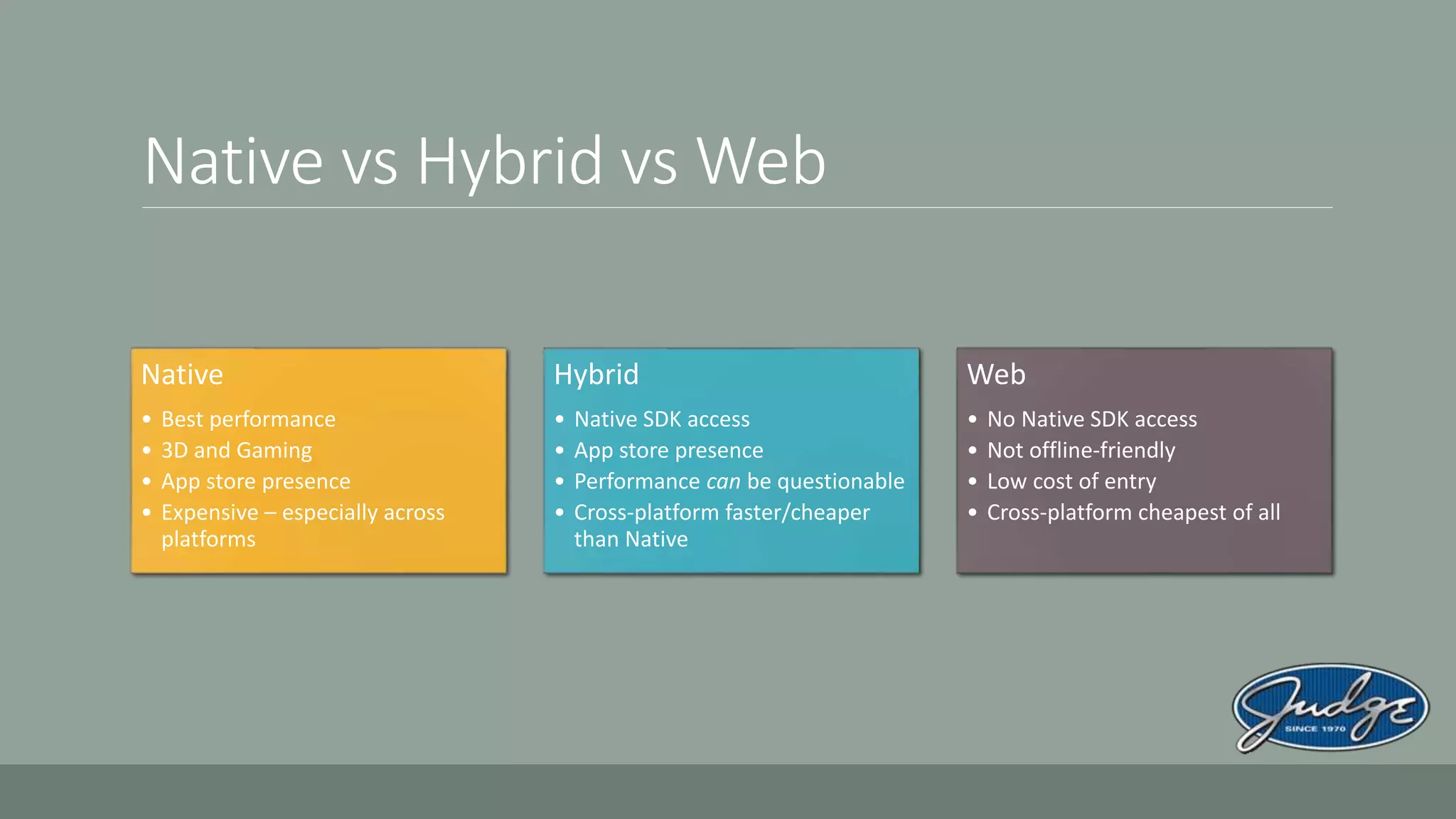

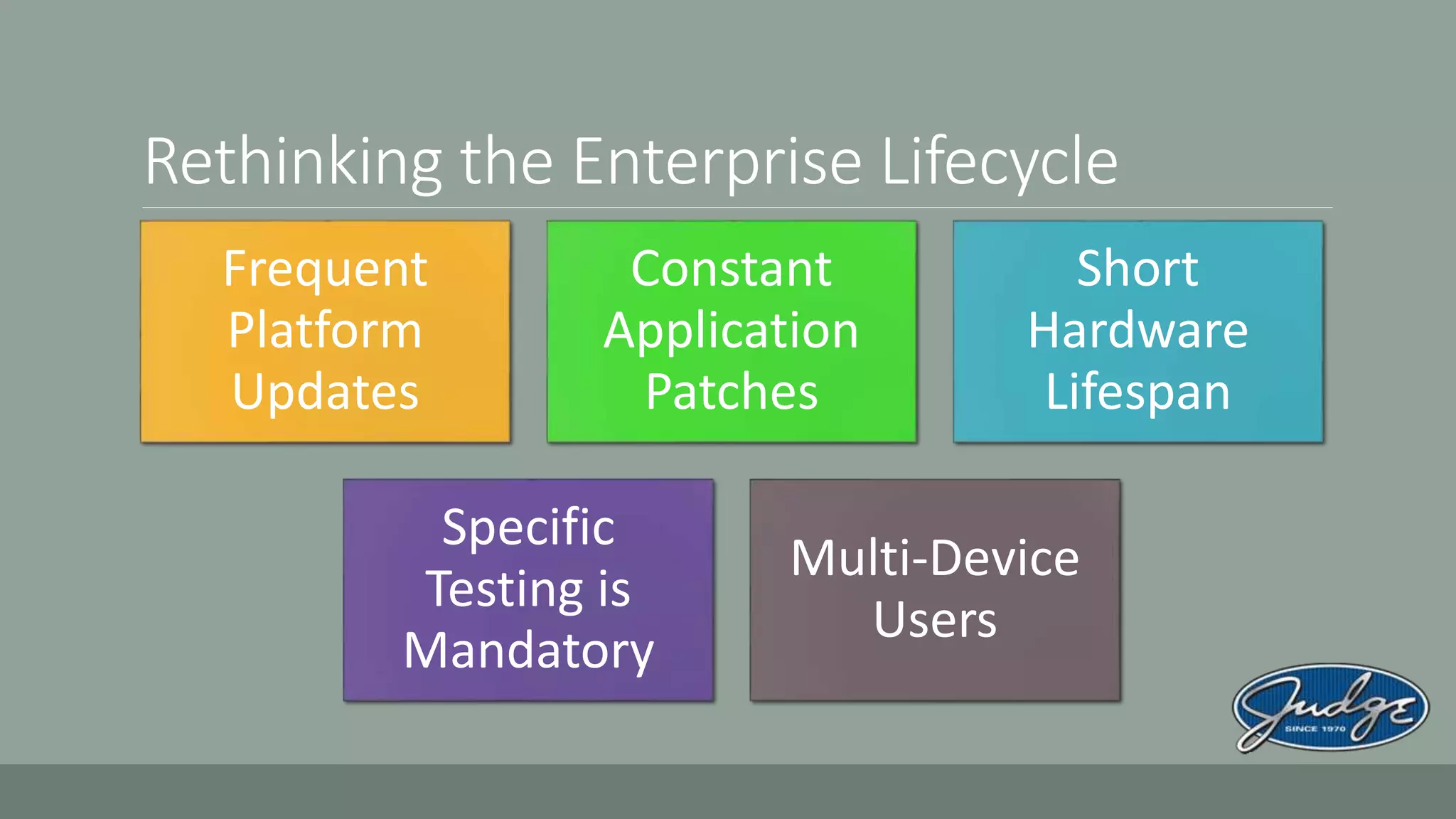

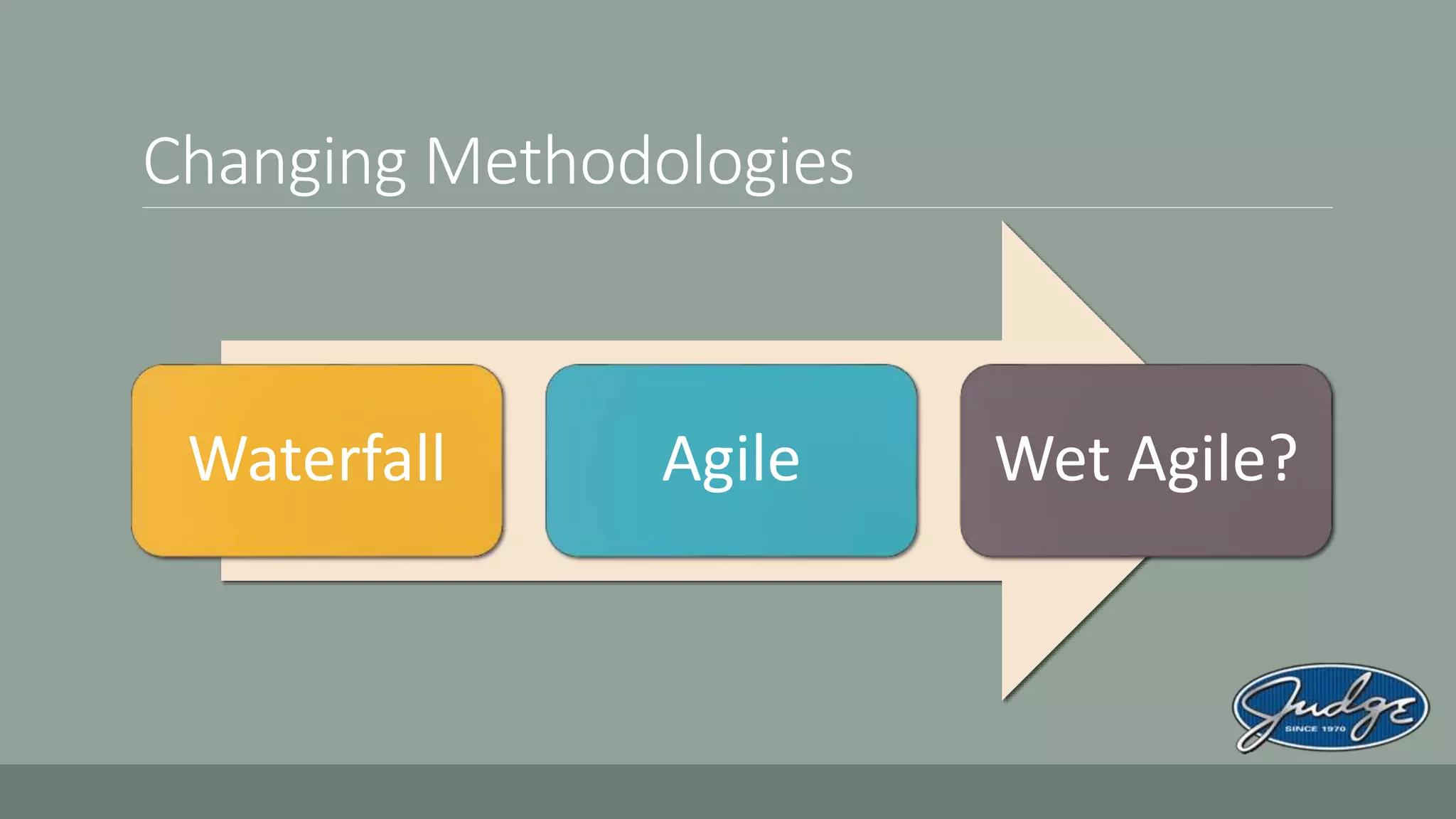

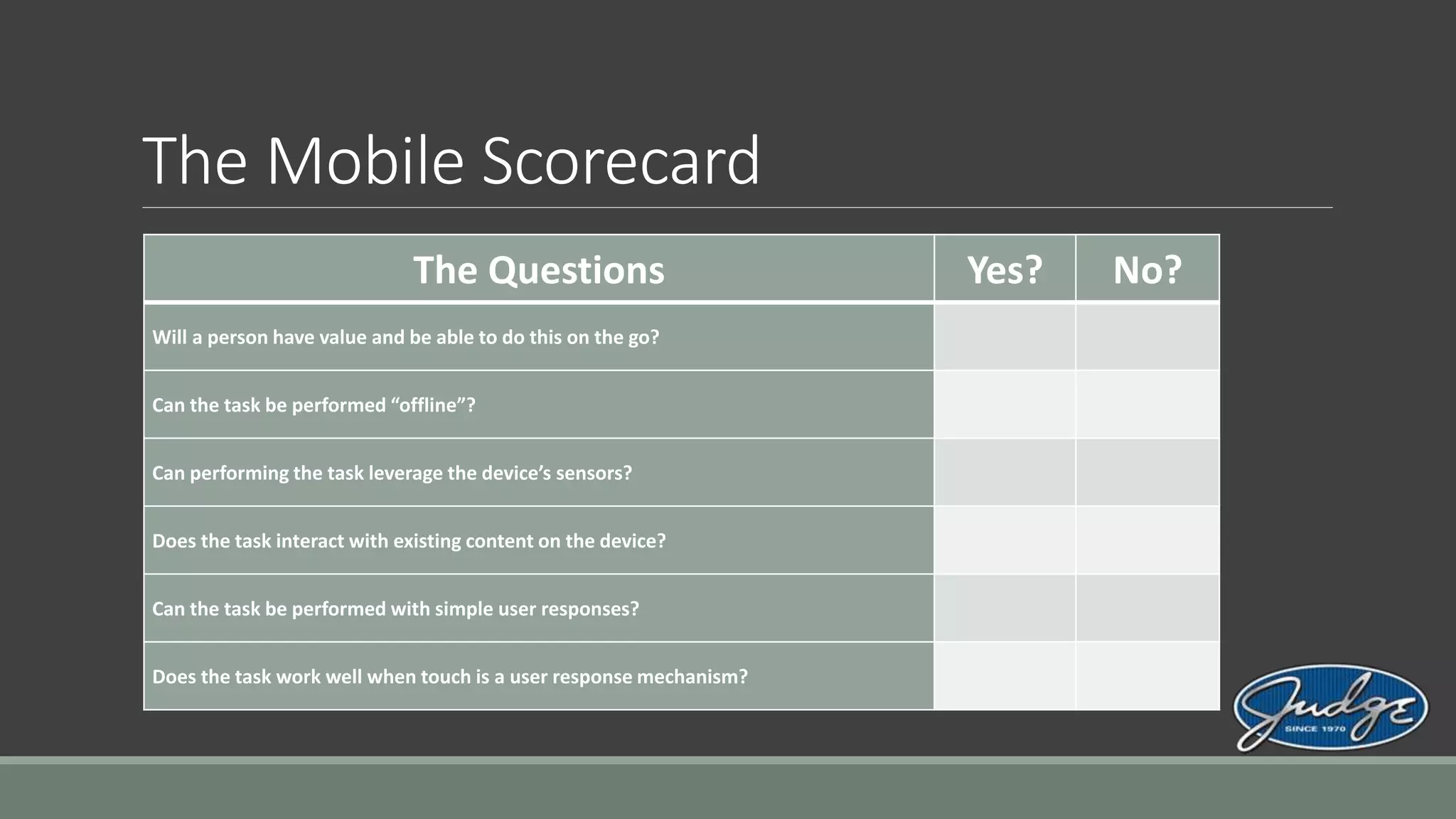

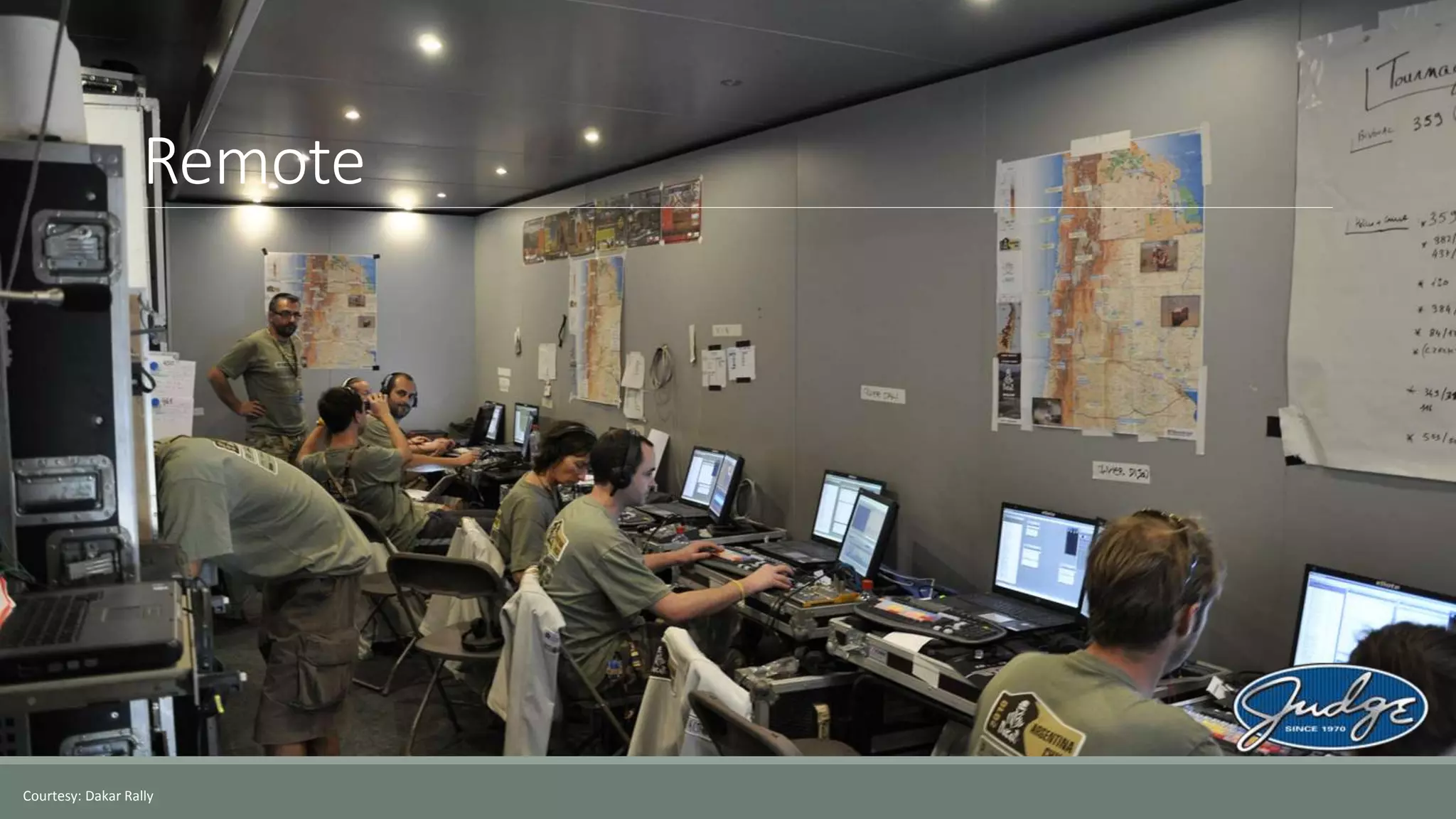

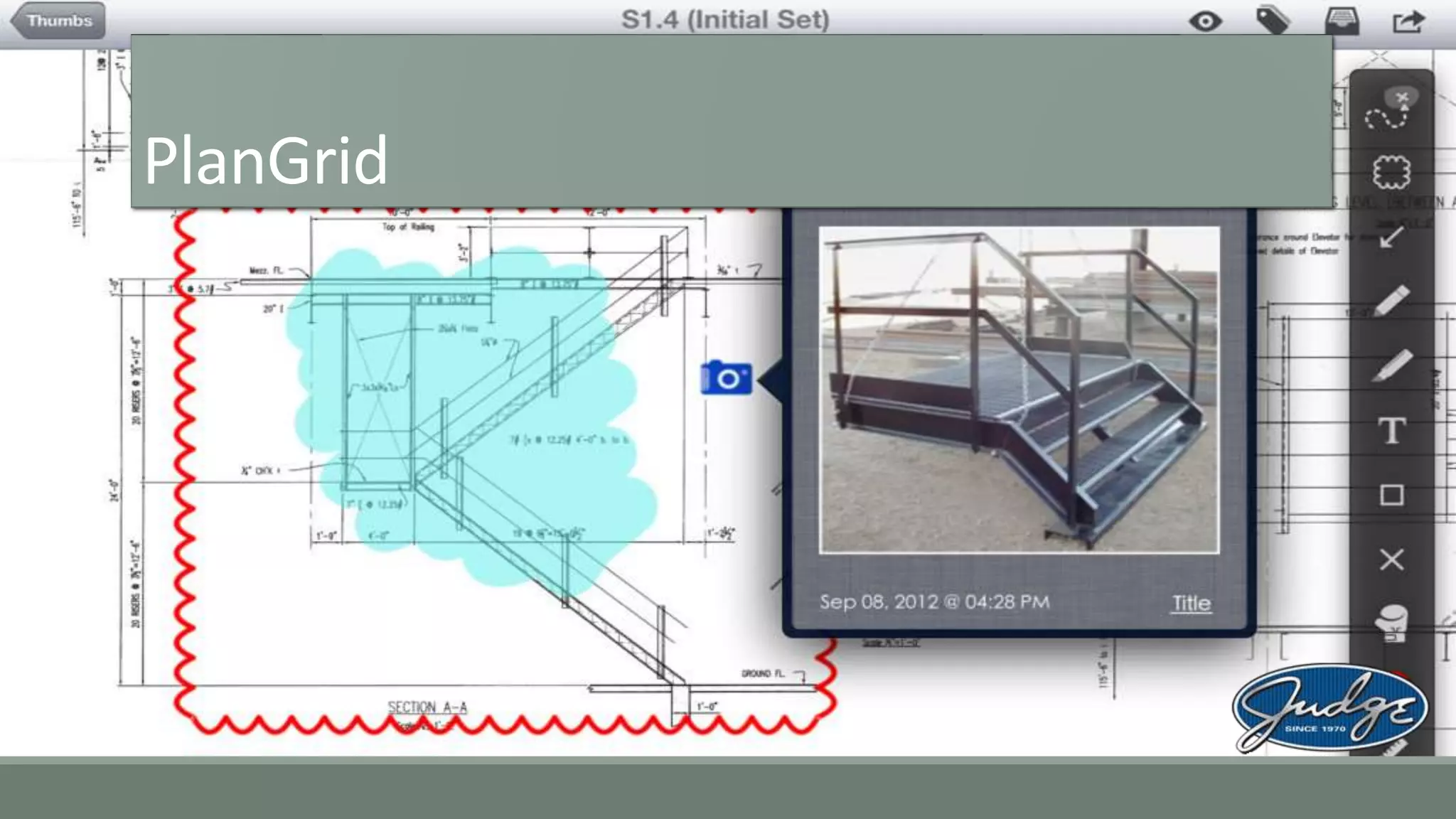

The document presents an analysis of mobile platform trends from 2013 to 2014, highlighting significant changes in market shares for Android, iOS, Windows Phone, and Blackberry. It discusses the rise of mobile payments, the importance of location-based marketing, and the evolving landscape of mobile technology amidst the Internet of Things. Additionally, it explores mobile device development, enabling mobile content creation, and the shift towards empowering mobile workers with new tools and methodologies.