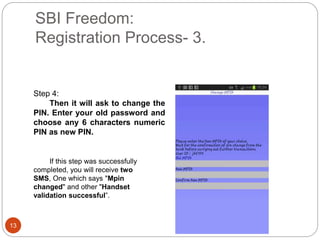

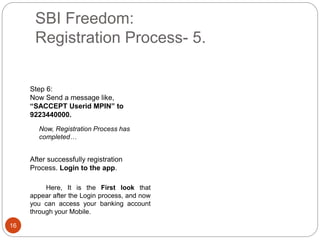

This document provides information about mobile banking services in India. It discusses how mobile banking allows customers to access and manage their bank accounts through a mobile application. The document outlines several typical mobile banking services including balance inquiries, fund transfers, bill payments, and ATM location services. It also discusses the advantages of mobile banking for both customers and banks, including increased convenience and reduced costs. Security measures for mobile banking transactions are also described, such as encryption, user IDs, pins, and OTPs. The registration process for State Bank of India's mobile banking app is explained in detail over multiple steps. Overall mobile banking usage in India has grown significantly in recent years.