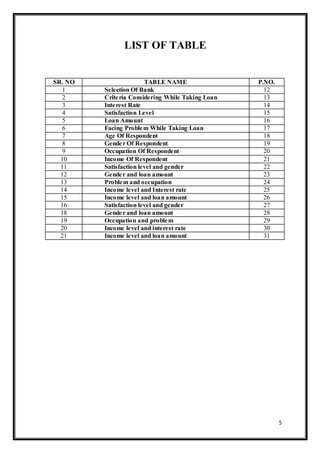

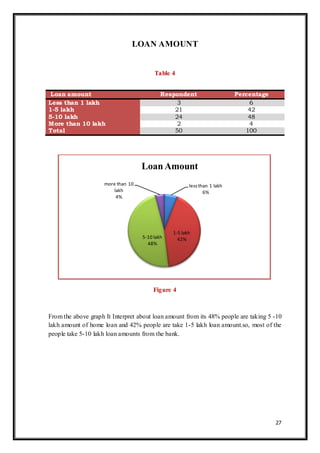

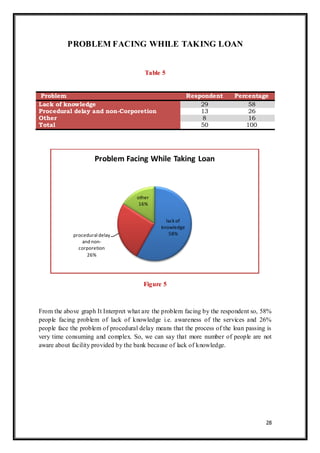

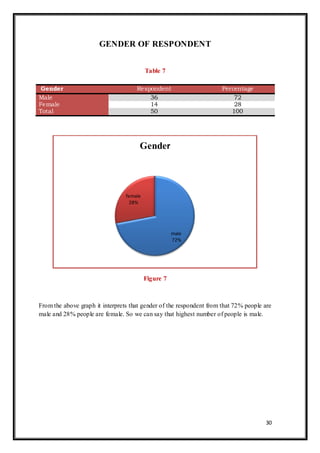

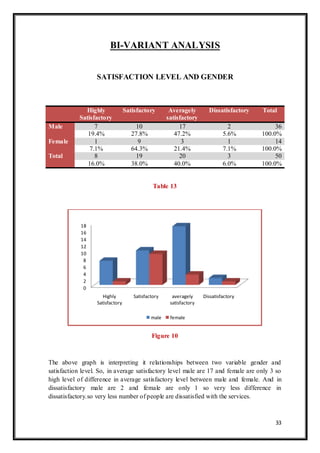

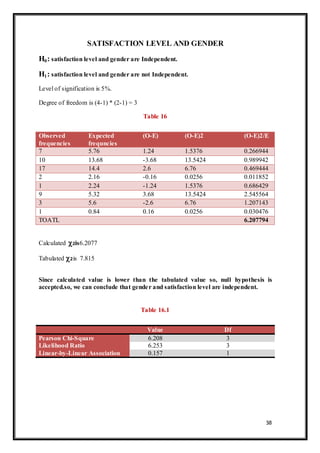

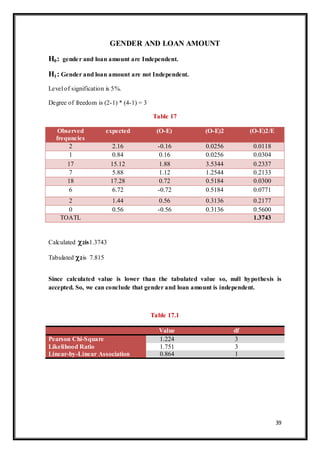

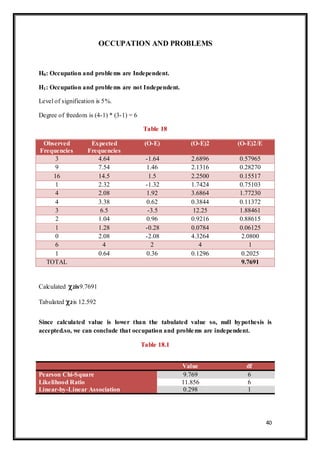

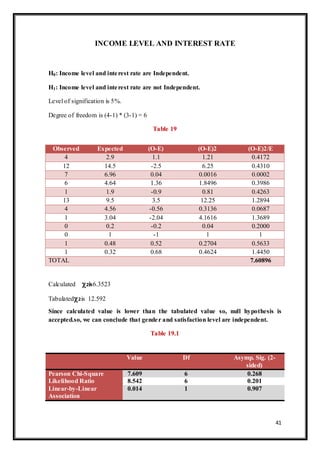

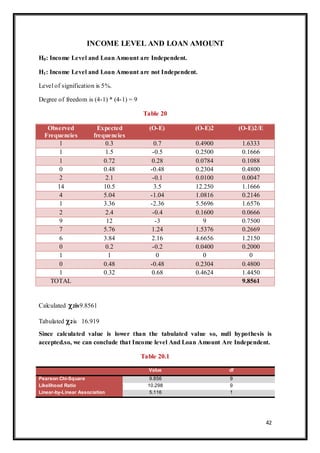

This document provides a summary of a research project on the home loan market from a consumer perspective. It includes an introduction, literature review, research methodology, data analysis, findings, and conclusion sections. The introduction provides background on home loans and their advantages and disadvantages. The literature review summarizes several past studies on topics like housing finance companies, home loan growth rates, and housing credit situations. The research methodology describes the study's objectives, design, data sources, sampling, and data analysis tools. The findings and conclusion sections analyze and summarize the results of the study.