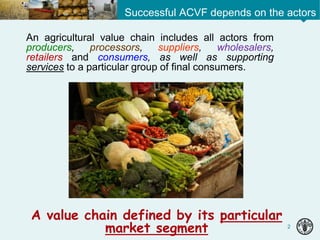

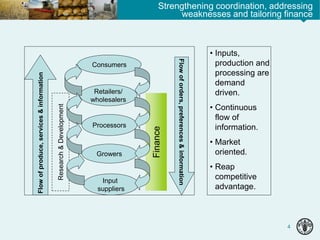

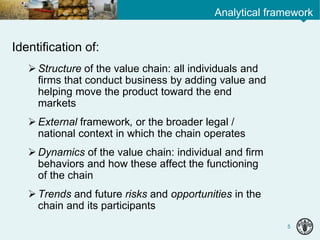

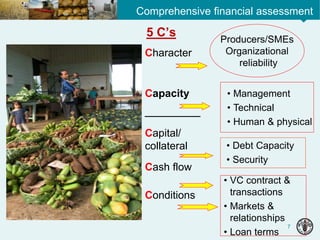

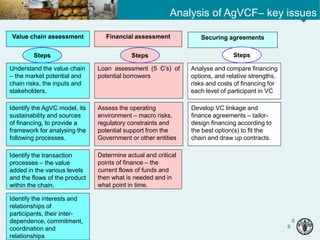

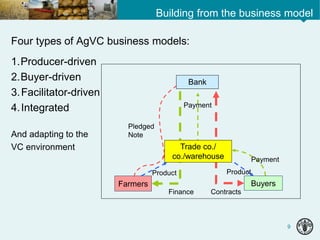

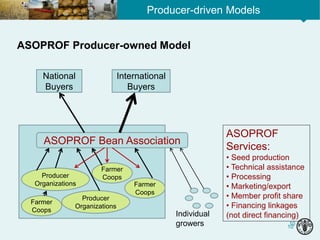

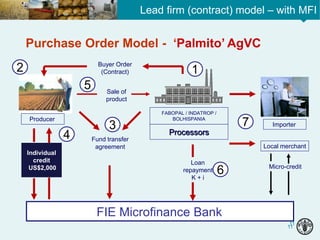

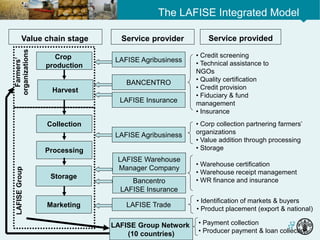

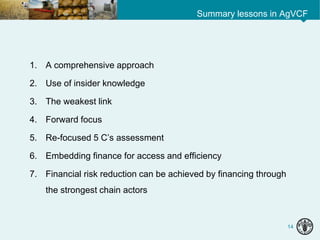

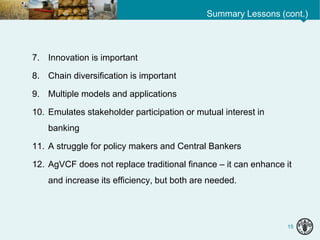

This document discusses agricultural value chain finance. It defines an agricultural value chain and outlines factors that influence the competitiveness and success of value chain finance, including the end market, operating environment, cooperation among value chain partners, and support services like finance. It provides examples of different value chain business models and describes how to conduct an assessment of the value chain, participants, and points where financing is needed. Finally, it outlines various financial instruments that can be used and adapted for agricultural value chain finance.