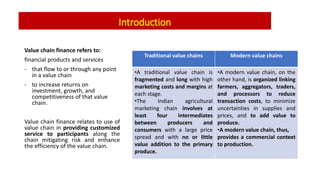

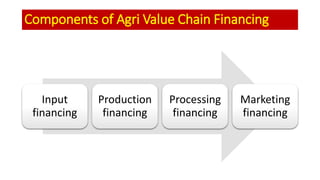

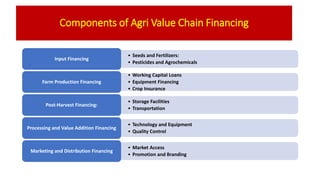

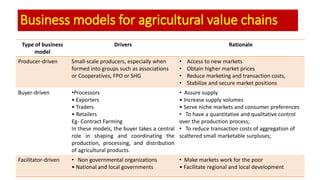

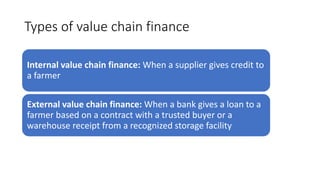

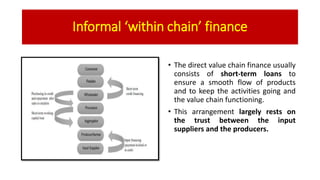

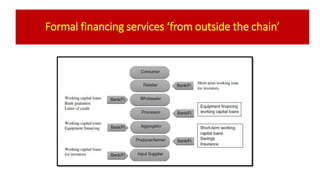

The document discusses the value chain finance approach for smallholders, highlighting how it connects various actors in the agricultural sector to mitigate constraints and enhance competitiveness. It compares traditional and modern value chains, explaining the components of agricultural value chain financing, including different business models and financing types, such as internal and external finance. Additionally, it addresses various financial instruments and risk mitigation products that support the agricultural value chain and improve access to finance for small producers.