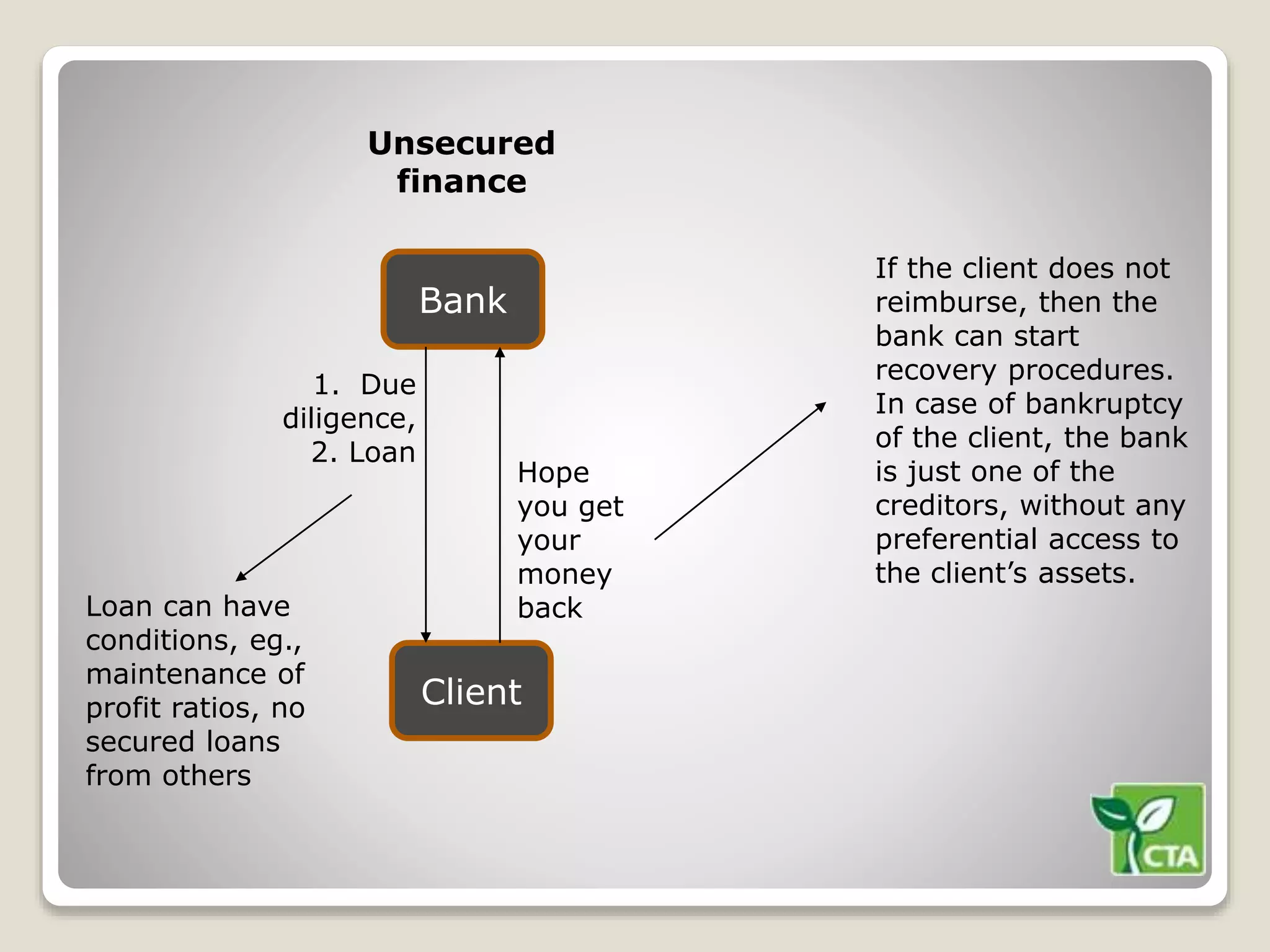

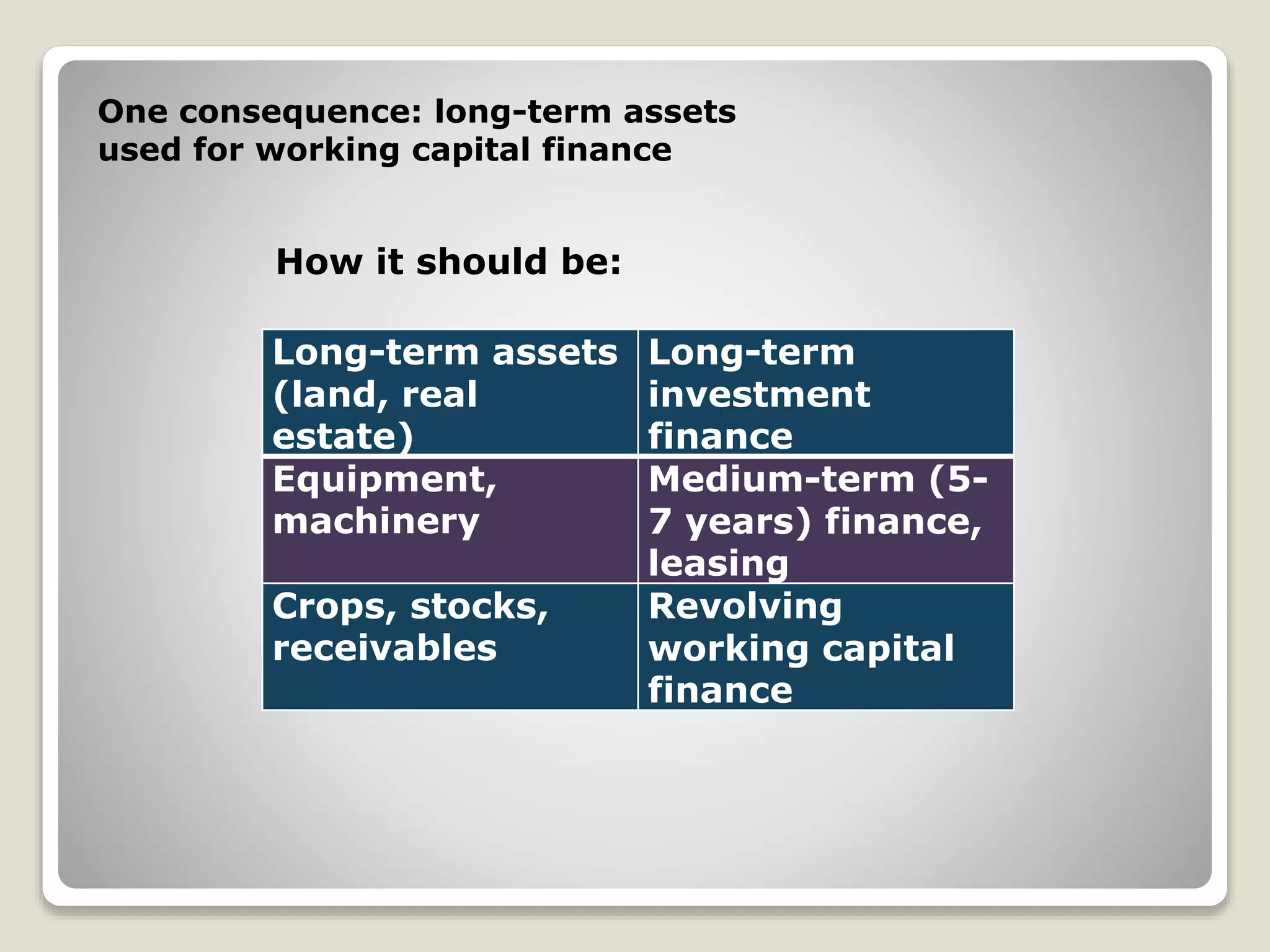

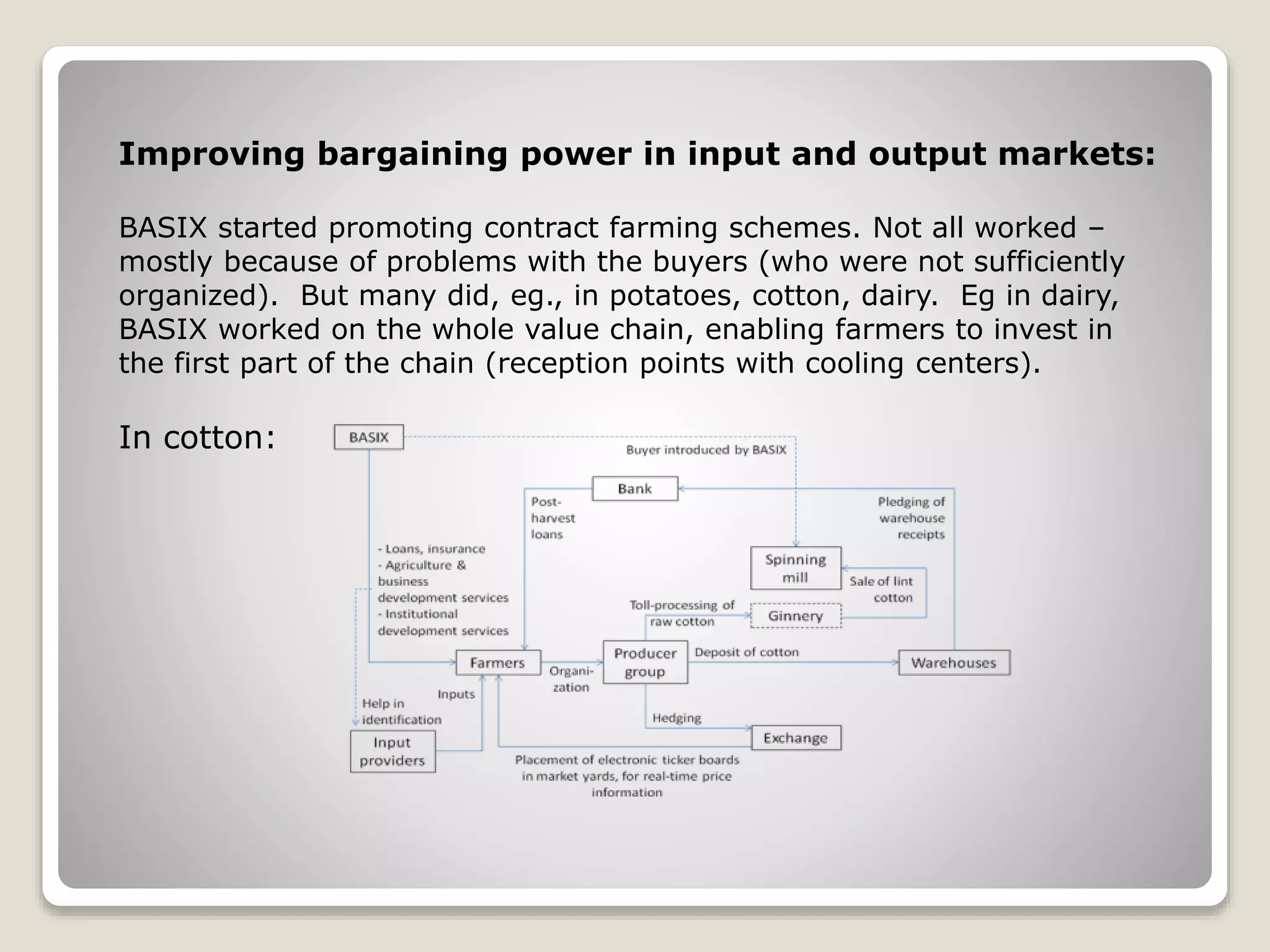

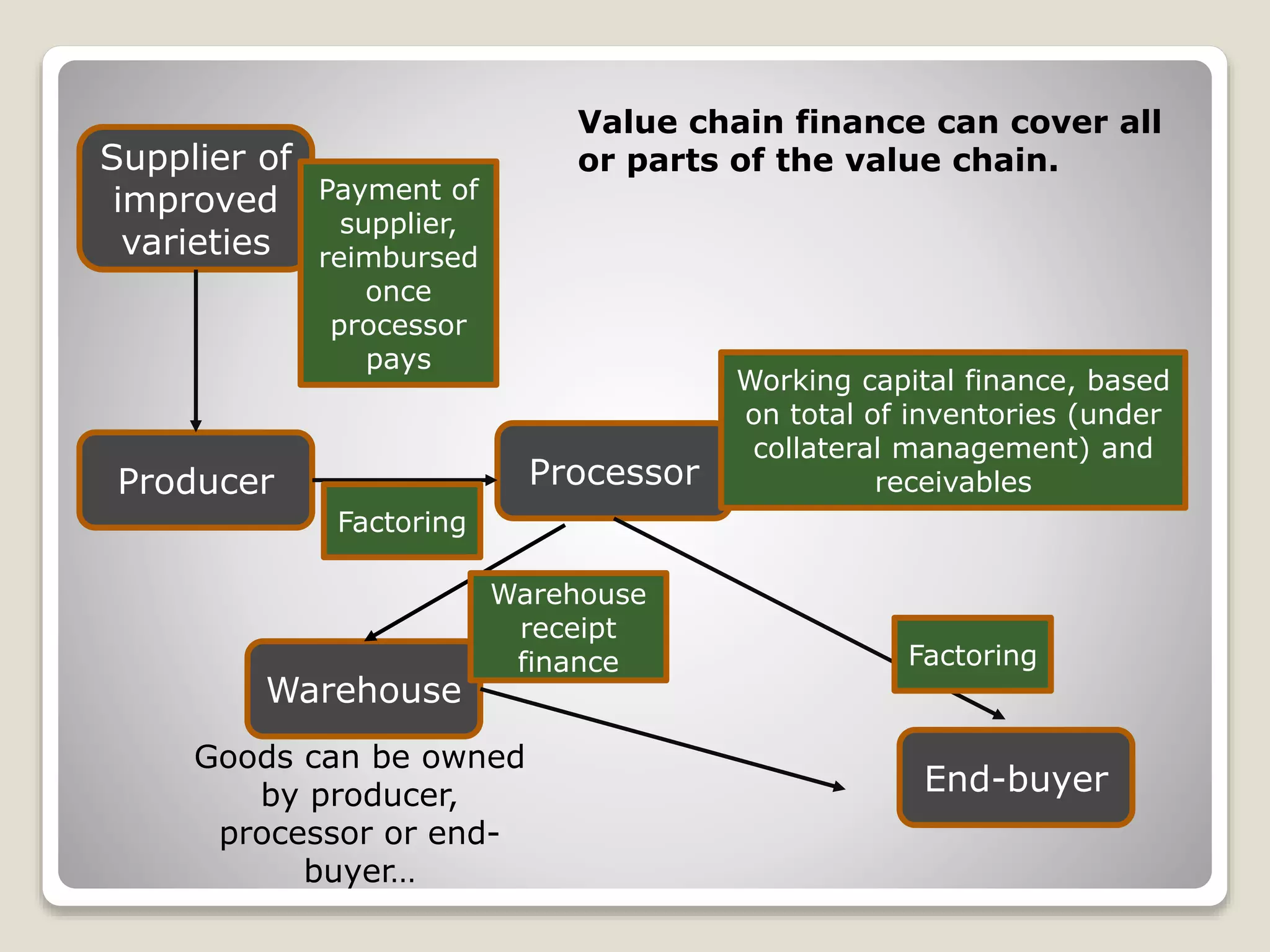

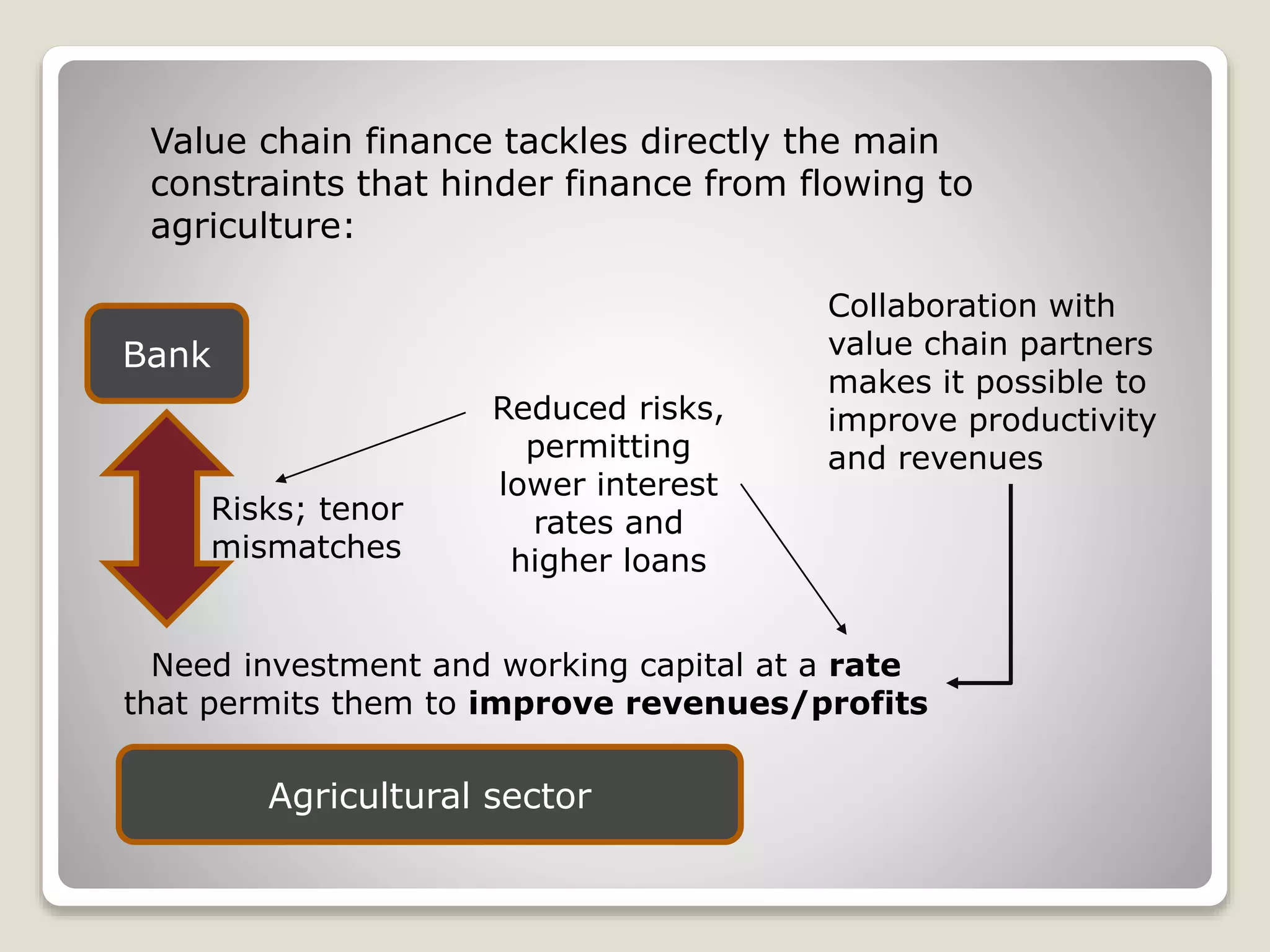

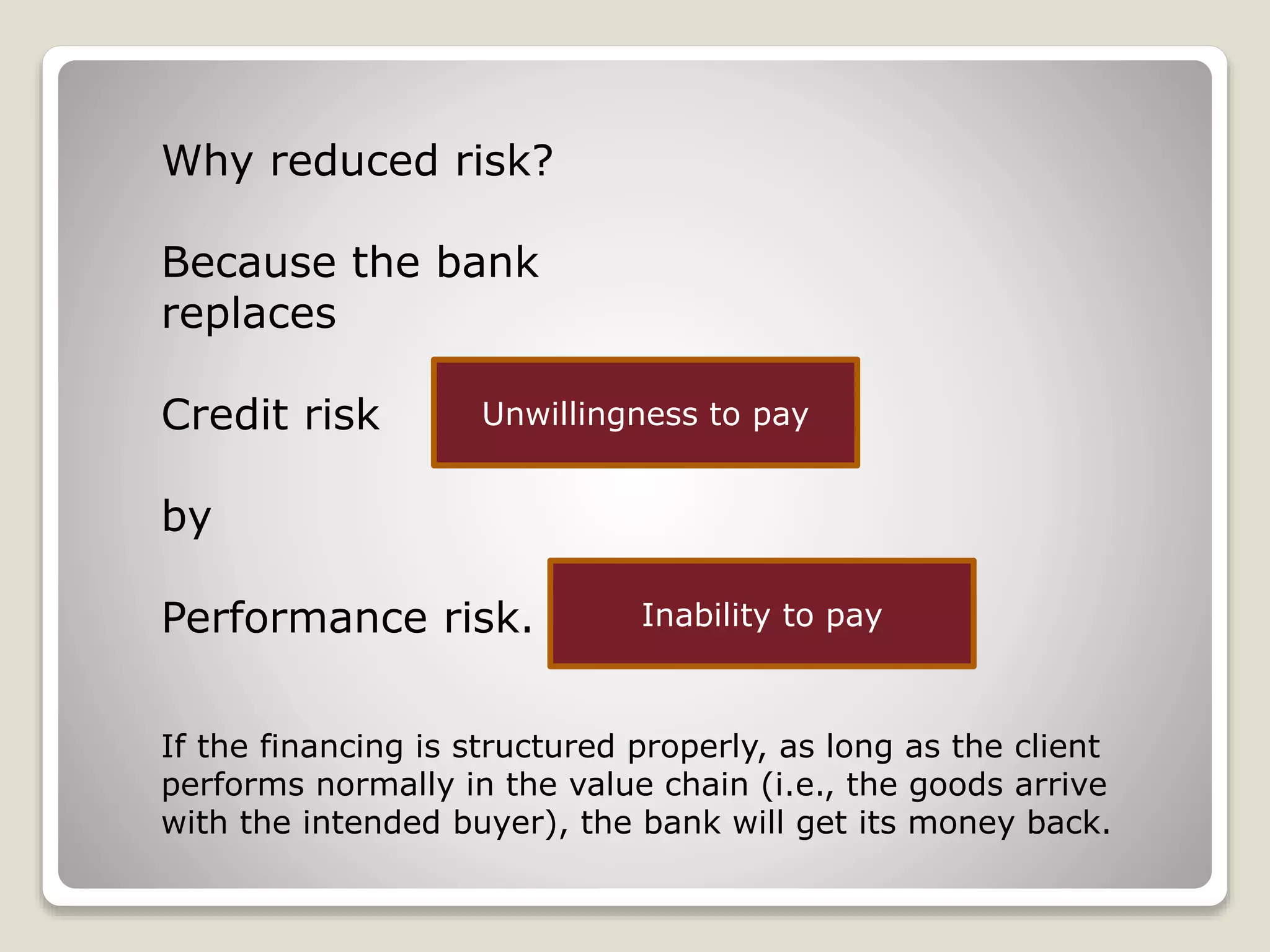

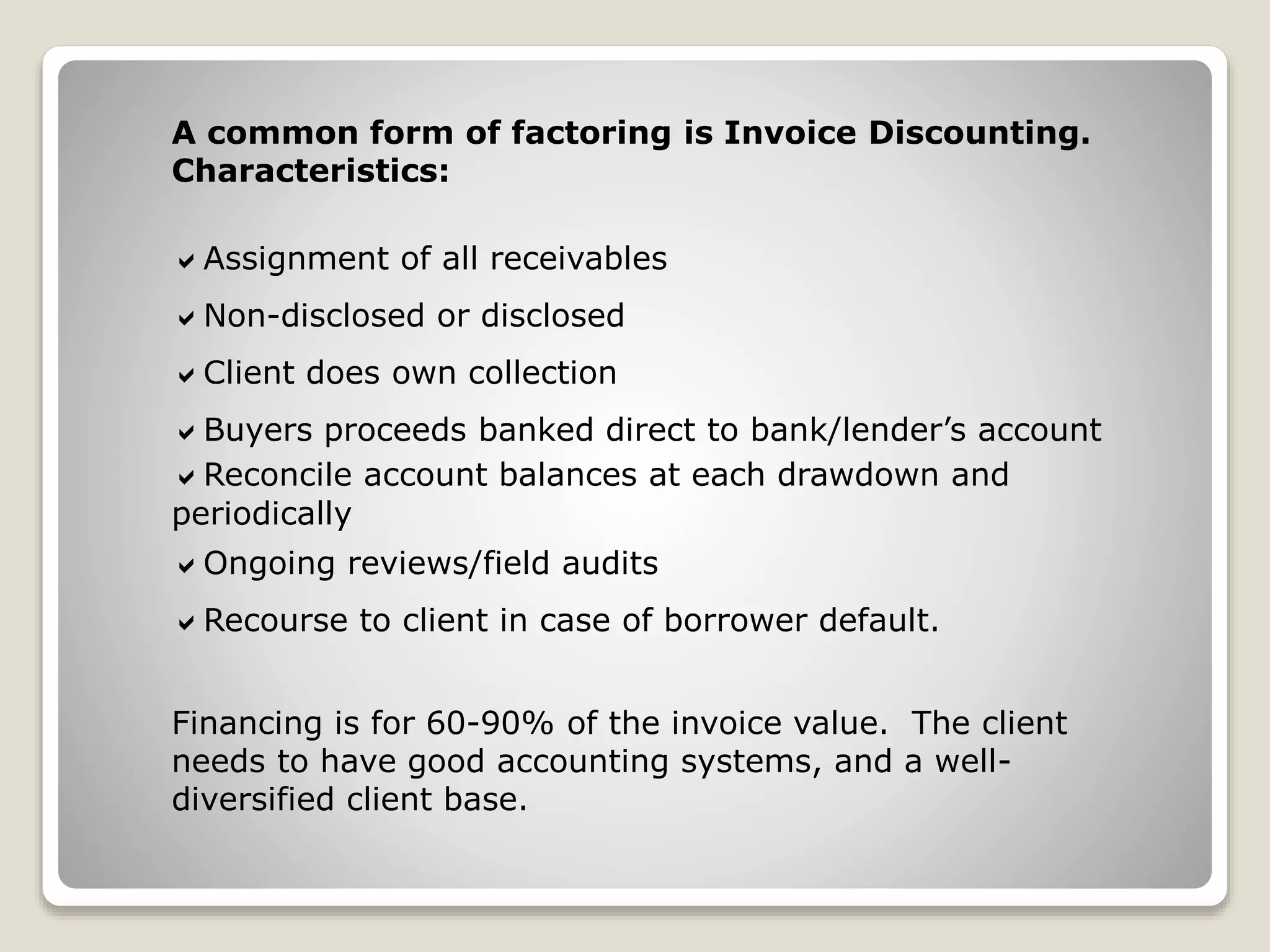

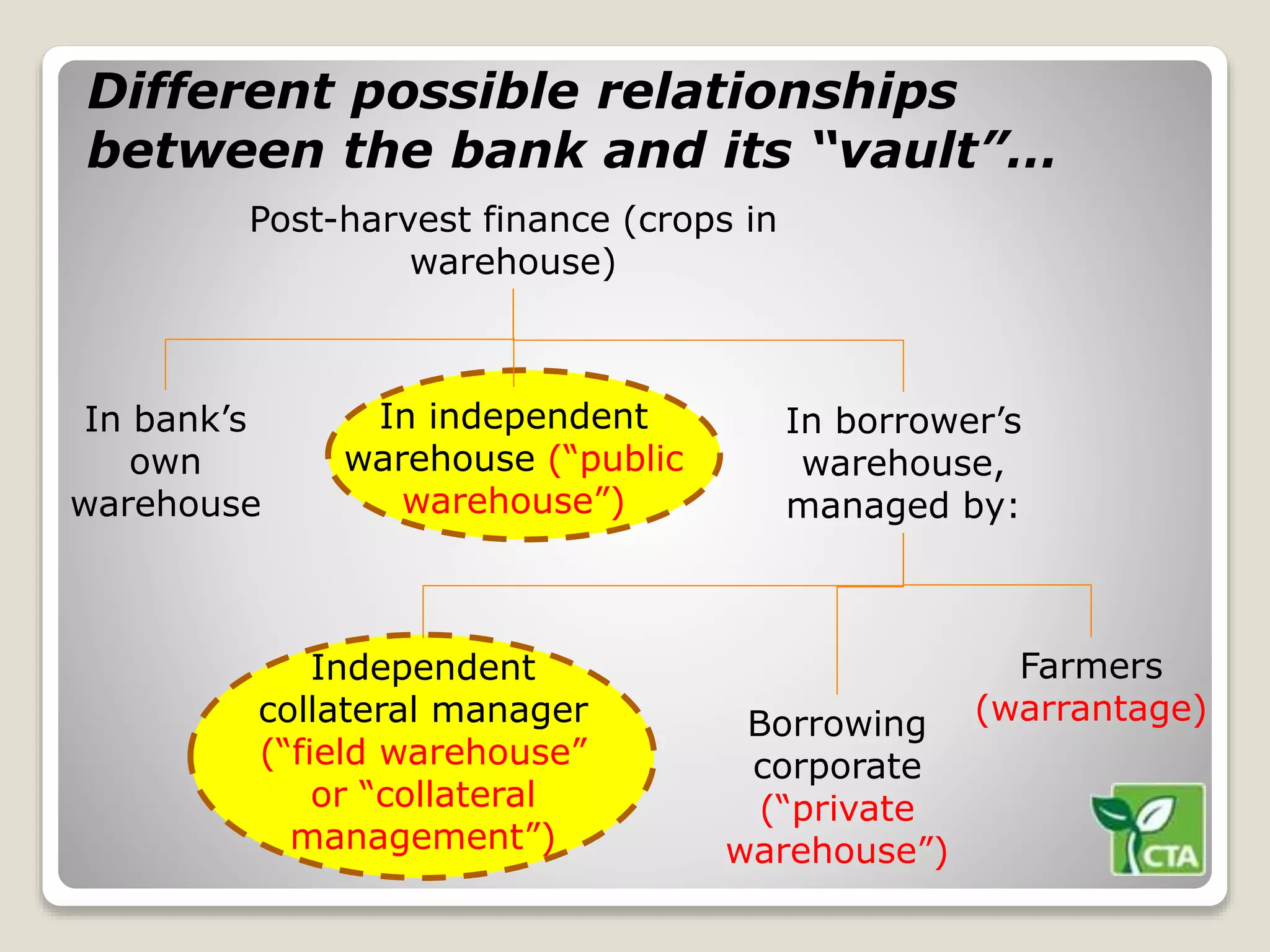

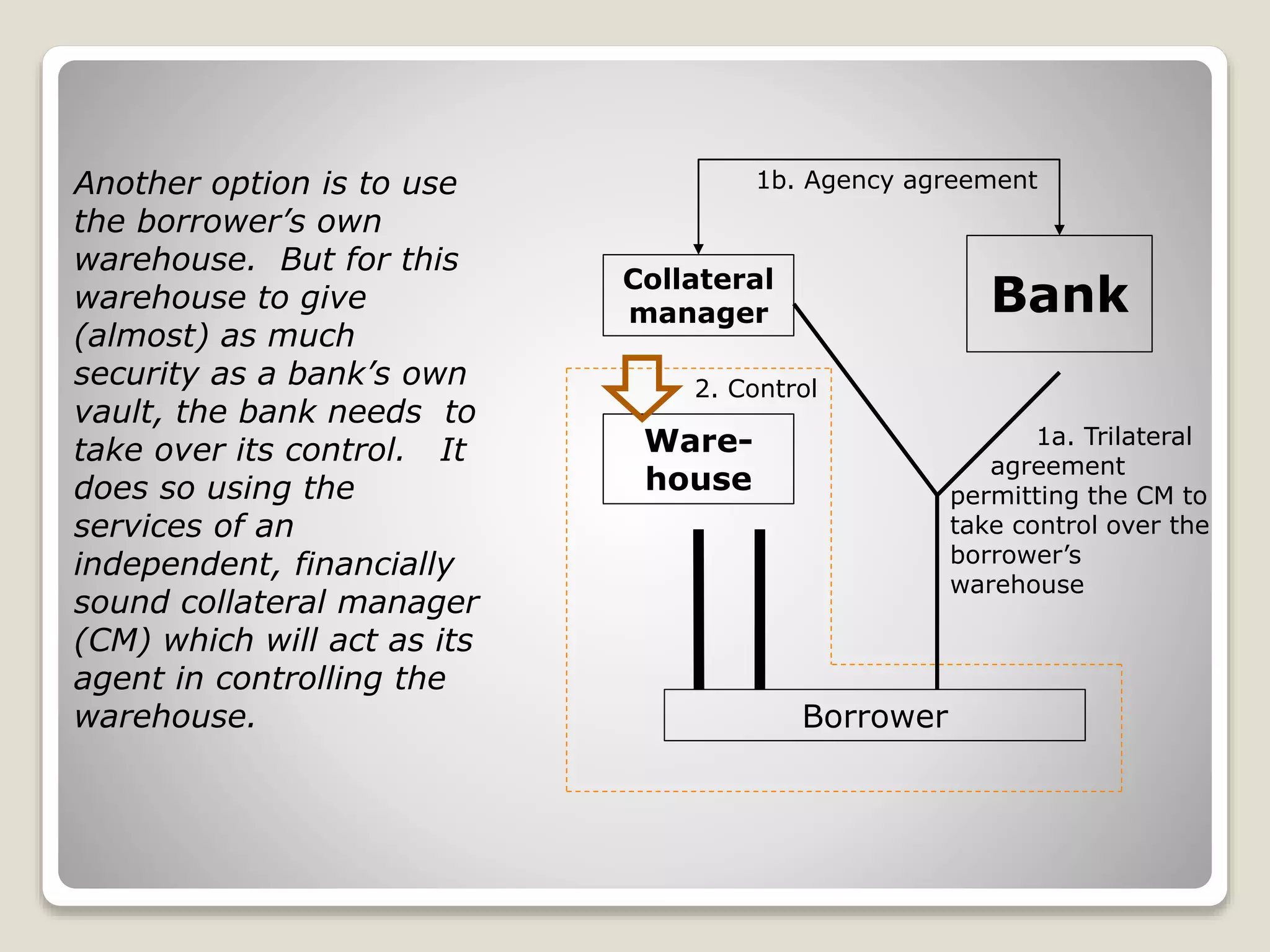

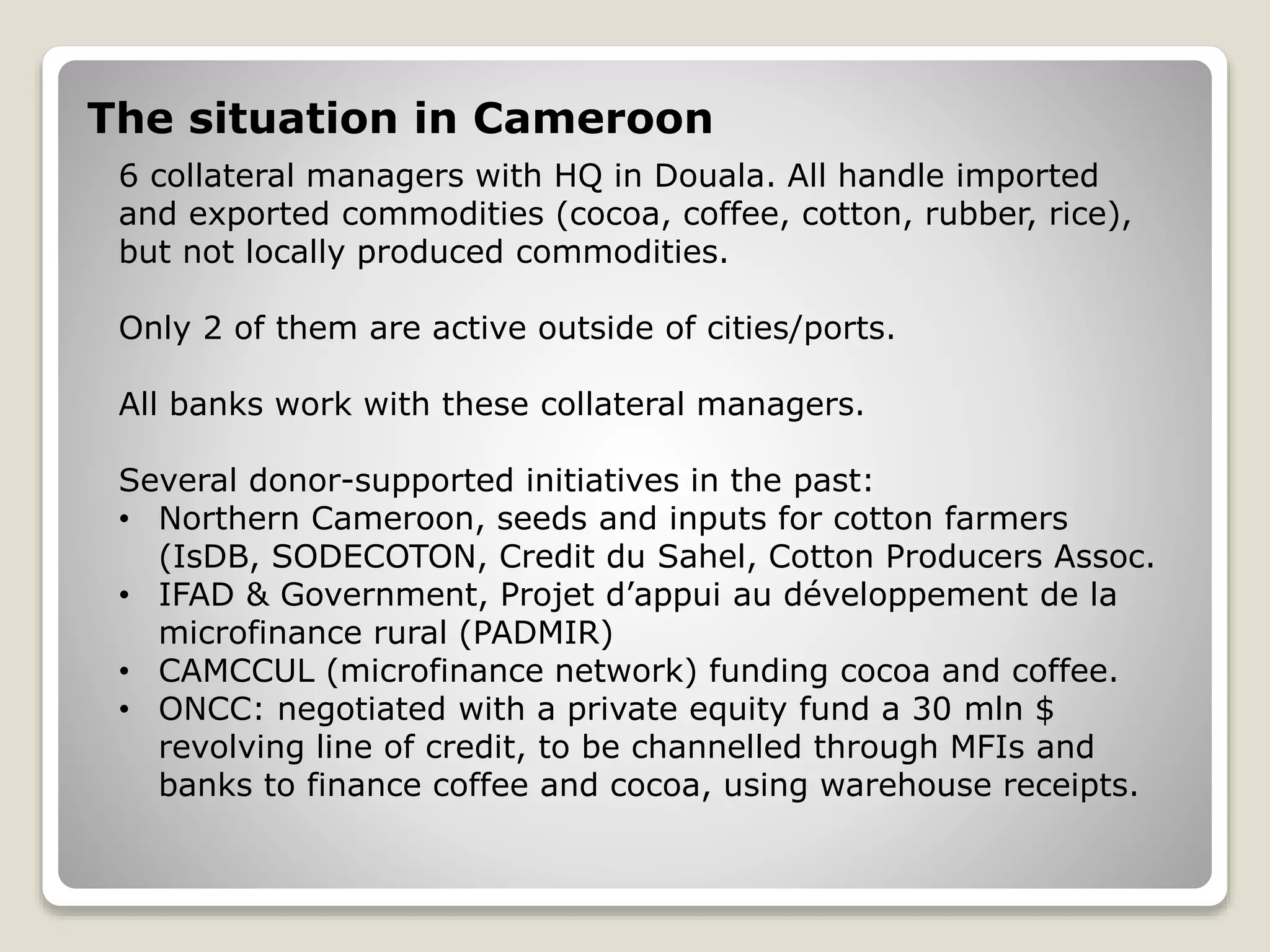

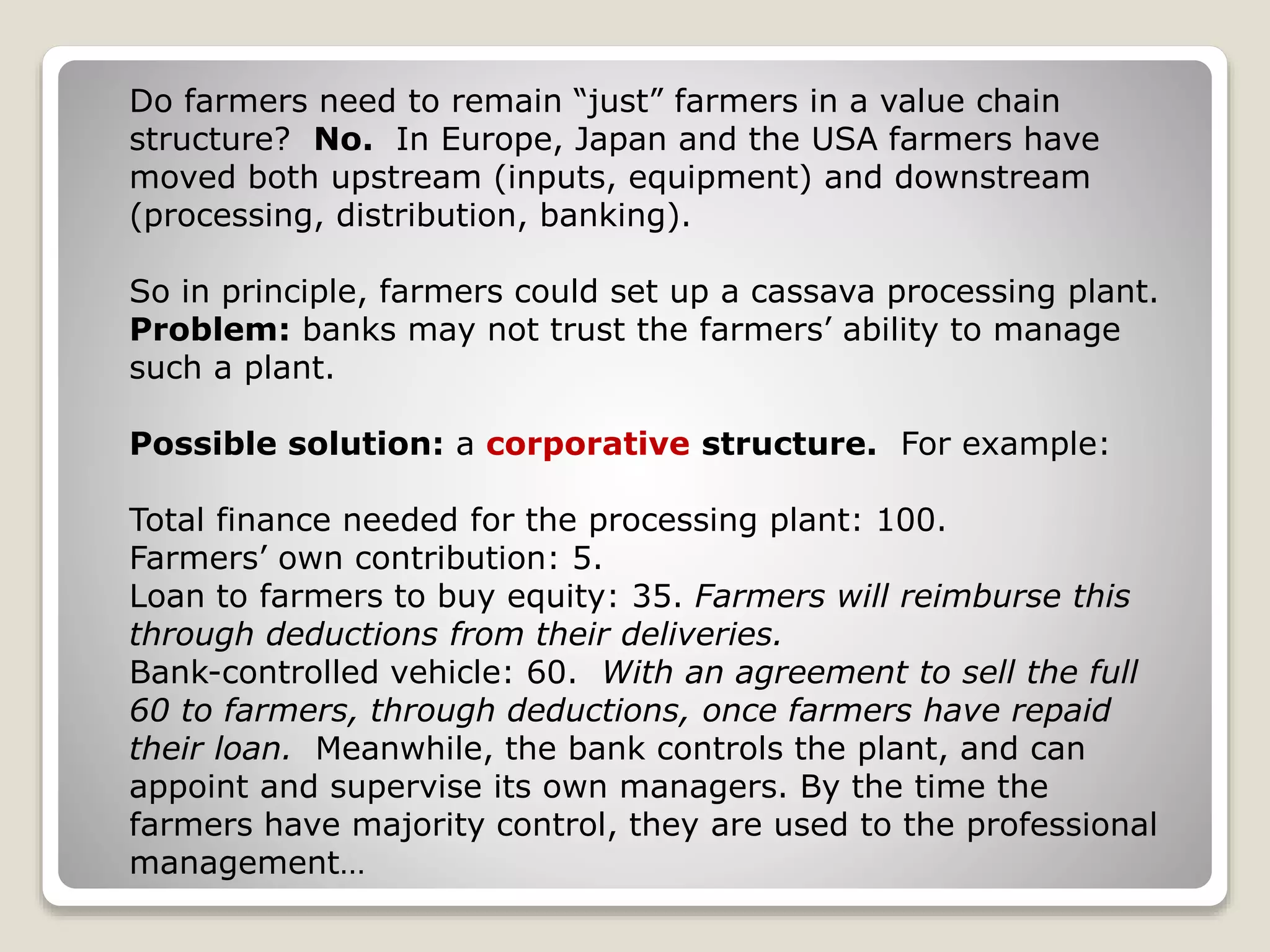

The document discusses the financial challenges and opportunities in the agricultural sector in Central Africa, particularly concerning access to finance for small farmers. It highlights the importance of value chain finance, which links smallholders to larger markets, and outlines various financing models such as secured and unsecured loans, microfinance, and warehouse receipt finance. The text emphasizes the need for proper legal frameworks and mechanisms to reduce risks and improve profitability for agricultural stakeholders.