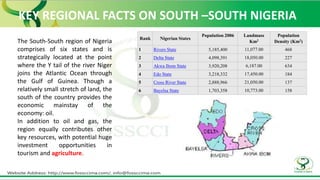

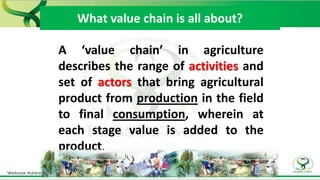

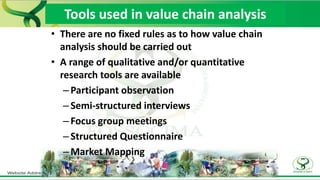

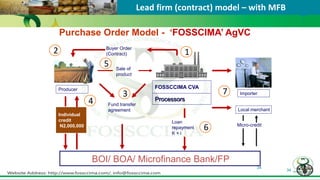

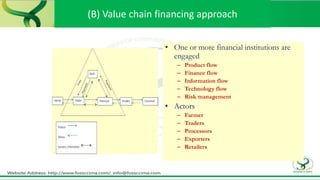

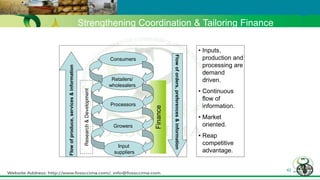

FOSSCCIMA seeks to partner with OSAPND to retrain and develop entrepreneurs from the Amnesty program in the Niger Delta region through agricultural entrepreneurship. They plan to provide training in various agricultural fields like horticulture, crop farming, poultry, and aquaculture. FOSSCCIMA will train over 10,000 participants in batches of 250 using a hybrid approach of value chain analysis and commercial villages to strengthen coordination along the agricultural value chain and facilitate financing. Their goal is to develop sustainable entrepreneurs and improve economic growth in the region.