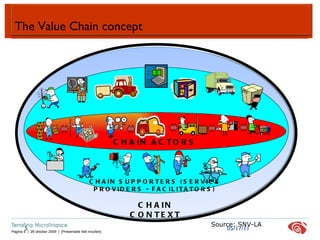

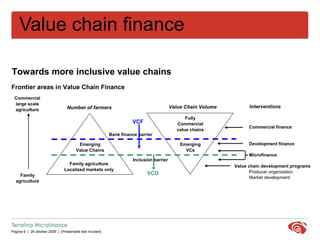

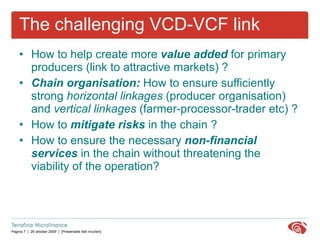

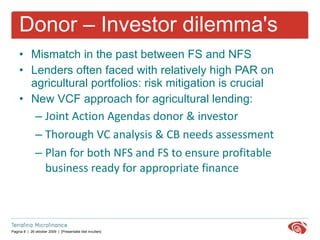

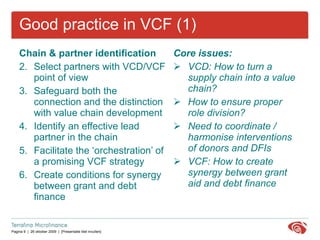

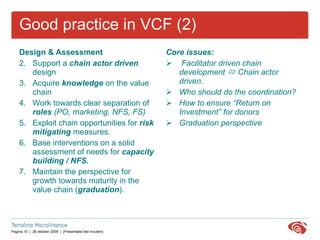

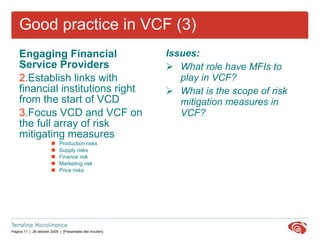

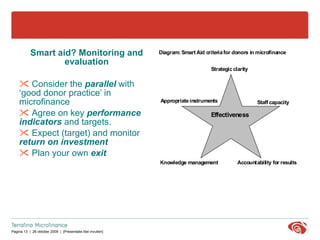

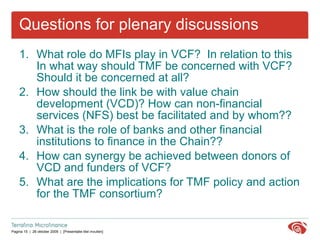

This document discusses value chain finance (VCF) and related topics. It poses questions about the roles of microfinance institutions, donors, and other organizations in VCF. It also addresses how to link value chain development with VCF, facilitate non-financial services, and achieve synergy between donors and funders. Best practices are outlined around chain and partner identification, needs assessment, engaging financial service providers, and using appropriate aid instruments while planning for exit.

![CONTACT P.O. Box 8190 3503 RD Utrecht The Netherlands T +31 (0)30 880 18 96 [email_address] www.terrafina.nl](https://image.slidesharecdn.com/pptvcfjoostvoortmfworkshop18apr11final-110515065623-phpapp01/85/Value-Chain-Finance-16-320.jpg)