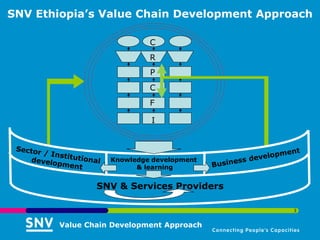

1) SNV Ethiopia uses a value chain development approach to connect farmers, processors, retailers and consumers. It focuses on sector development, business development, knowledge sharing and strengthening service providers.

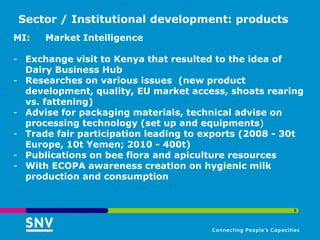

2) Key interventions include creating market opportunities, strengthening cooperatives and businesses, and facilitating partnerships between actors in the chain.

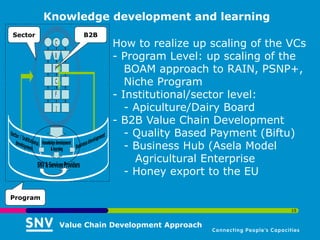

3) The approach aims to develop the agricultural sectors sustainably by building local capacity and financing for innovations.