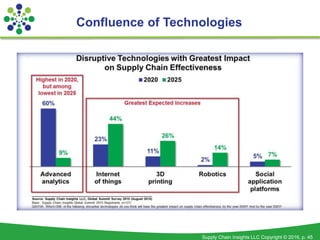

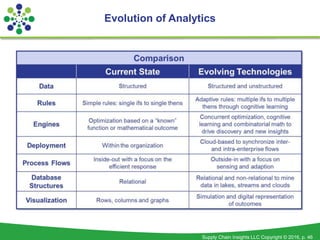

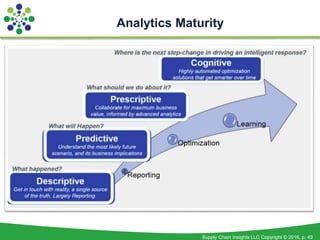

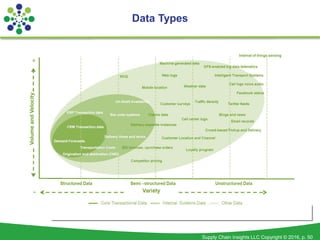

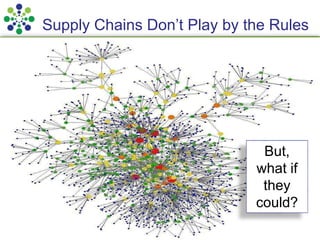

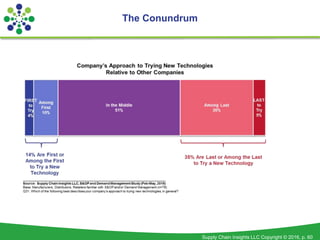

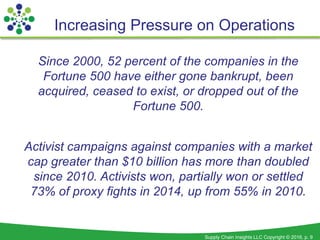

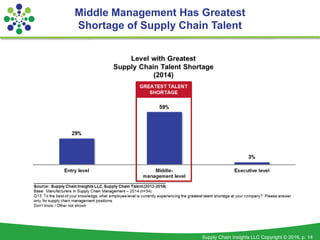

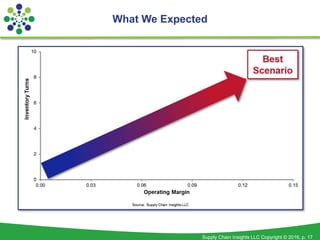

The document discusses the challenges and changes within supply chains, referencing a significant number of Fortune 500 companies that have failed since the year 2000. It emphasizes the evolving technologies and the need for better supply chain visibility and talent, highlighting the pressure on organizations to adapt. The author, Lora Cecere, outlines a vision for future supply chains that learn and evolve continuously through advanced analytics and networked services.

![Supply Chain Insights LLC Copyright © 2016, p. 41

0

0

0

0

0

0

0

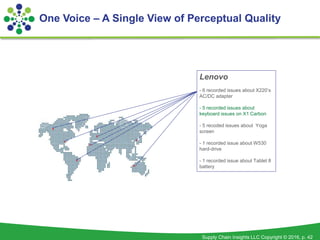

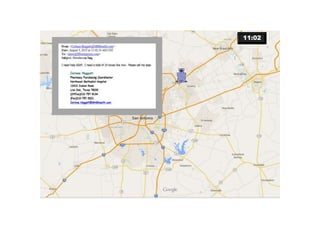

Canada

-Customer A calls about a blue screen on a Yoga

-Customer B posts on Facebook about his X220’s AC/DC adapter issues

Large Enterprise Client experiences 5 keyboard malfunctions in their latest

shipment. Complaints received through account executive

[Critical Situation]

Brazil

-Customer F submits a service from on

esupport.lenovo.com regarding

their W530 hard drive

Morocco

-Customers G & H comment on their

X220’s electrical issues on Twitter.com

-Customer I called about Yoga screen

issues

Australia

-Customer J write a review on

NewEgg.com about AC/DC adapter

issues on X220

-Customer K had an eChat with Lenovo

about Yoga screen issues

China

-Customer L wrote on Weibo about

Yoga screen issues

-Customer M calls about a Tablet 8

battery issues

Voice of Customer Comes in Many Forms

USA

-Customers C & D write X220 product

reviews on amazon.com and mention

issues with AC/DC adapters

-Customer E posts on

forums.lenovo.com that they are

experiencing blue screens on their Yoga](https://image.slidesharecdn.com/presentationforperu2-160623042719/85/Big-Data-Analytics-and-the-Supply-Chain-Opportunity-41-320.jpg)