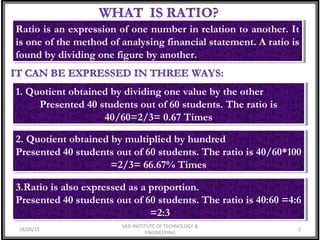

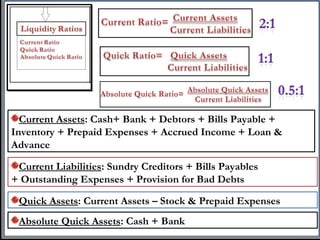

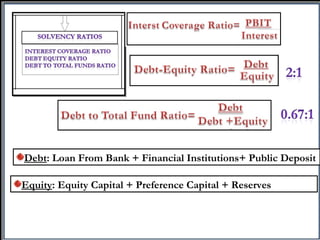

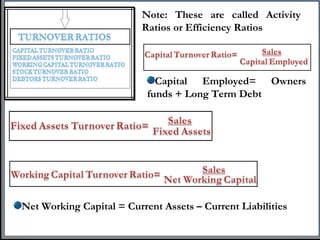

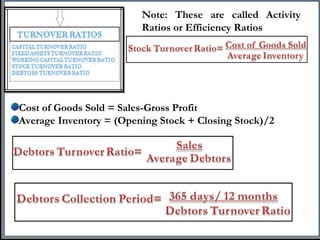

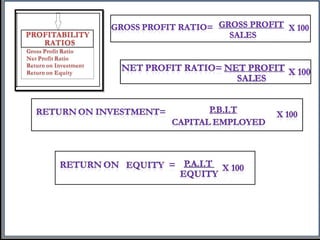

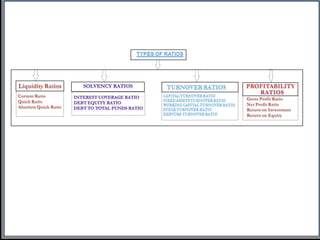

Ratios are expressions of one number in relation to another, and are used to analyze financial statements. A ratio is calculated by dividing one figure by another. Ratios can be expressed as a quotient, percentage, or proportion. Current assets and current liabilities are used to calculate ratios like net working capital, quick assets, and absolute quick assets. Activity ratios measure efficiency and use figures like cost of goods sold and average inventory.