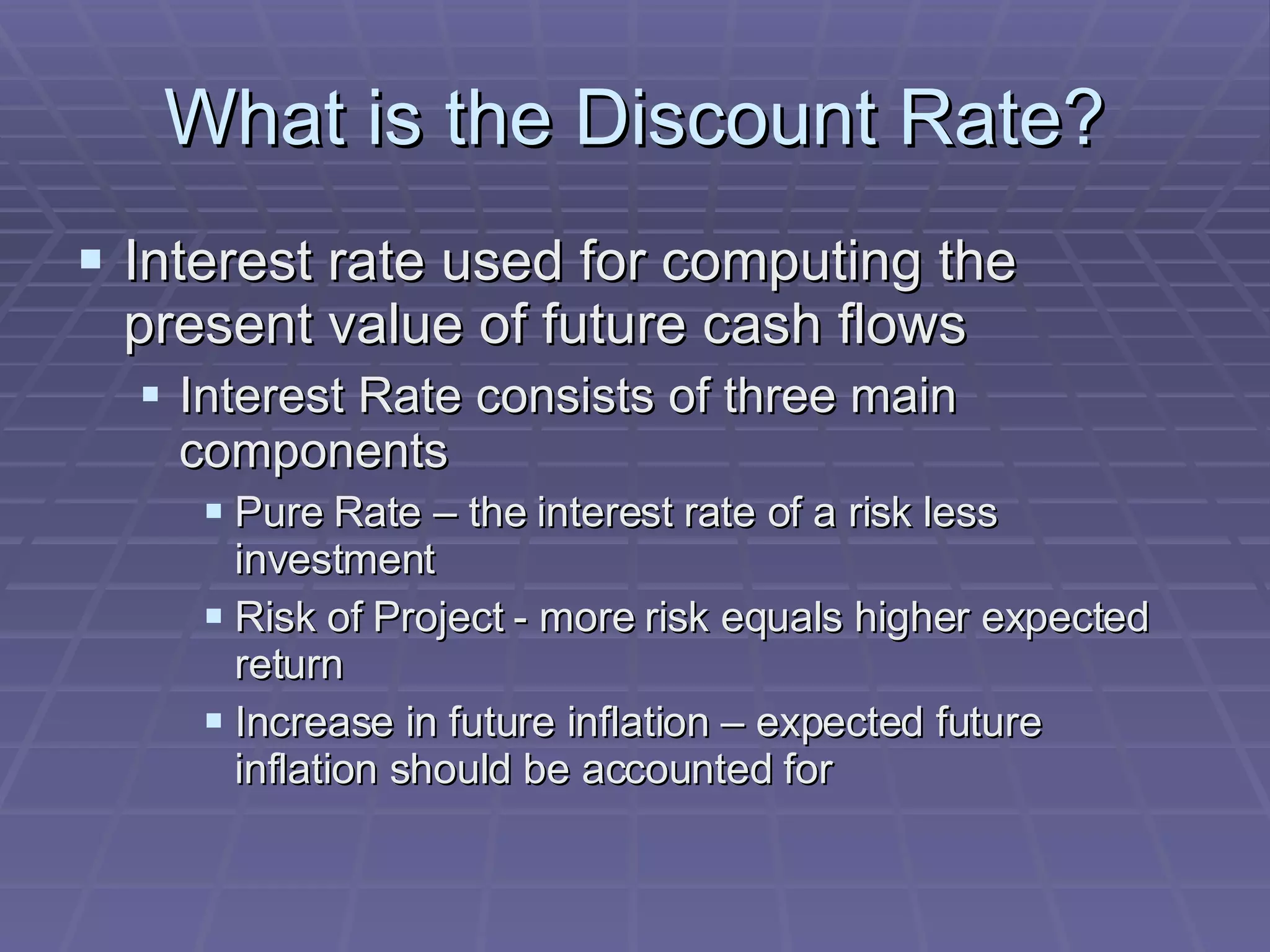

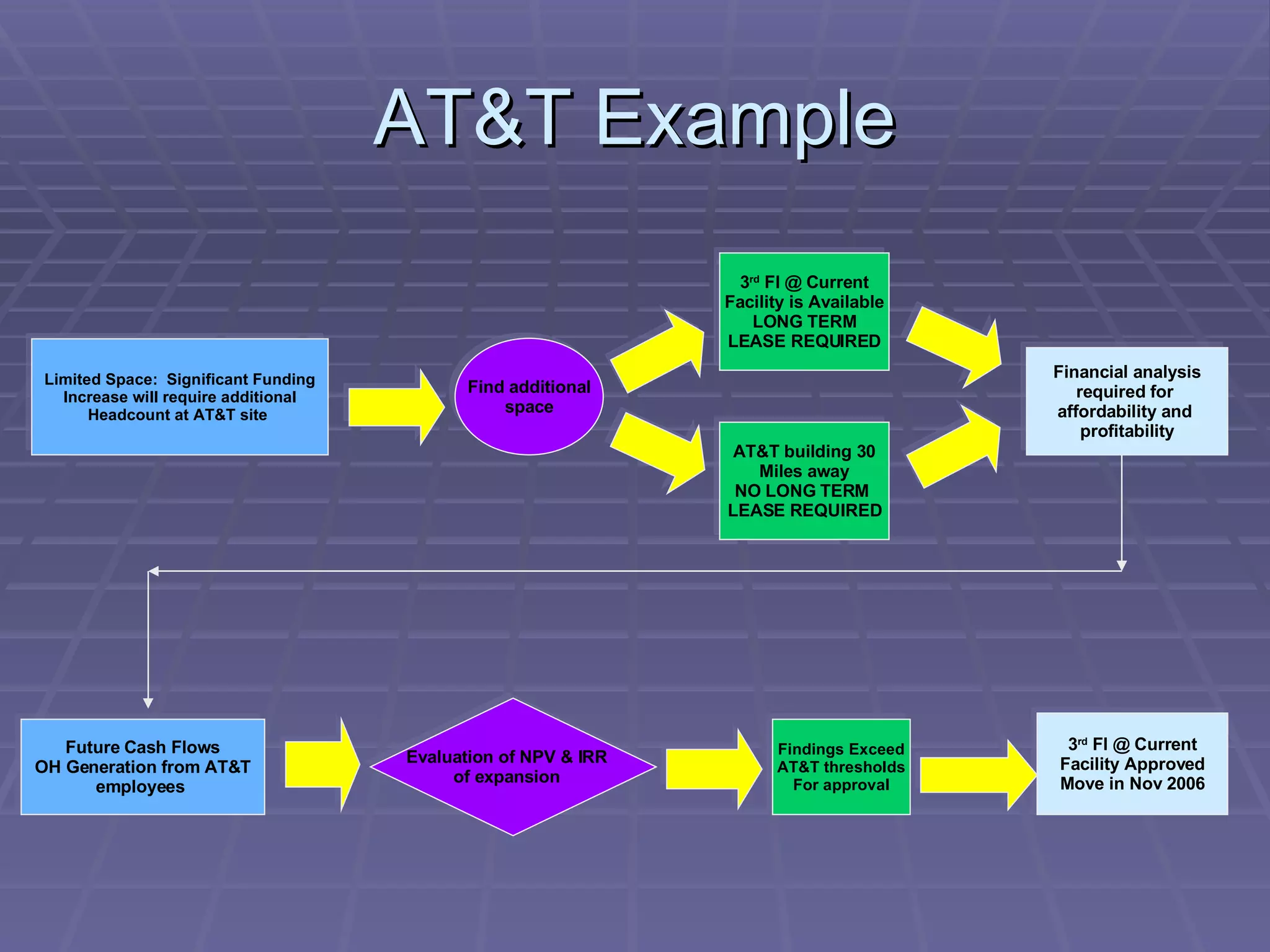

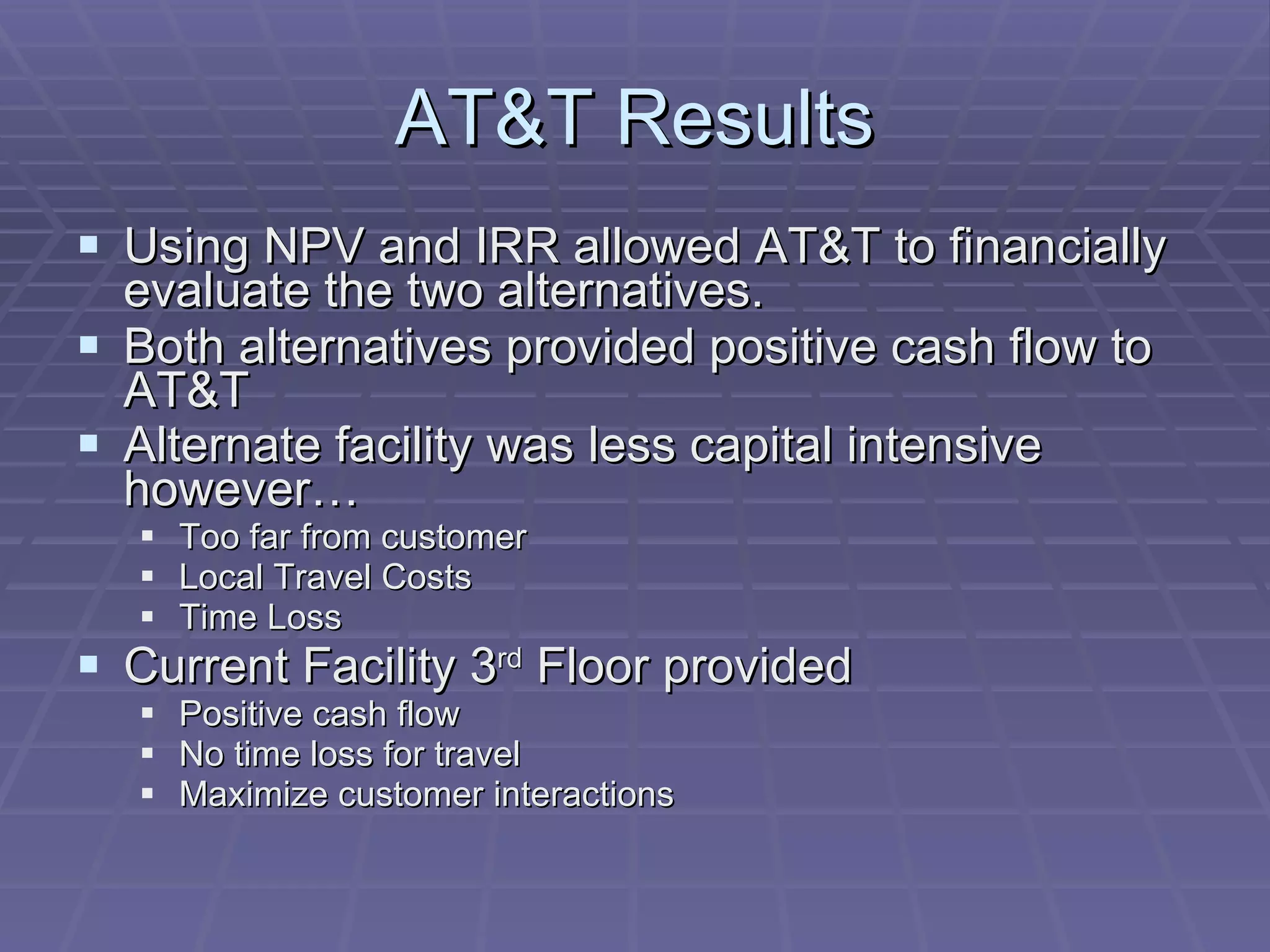

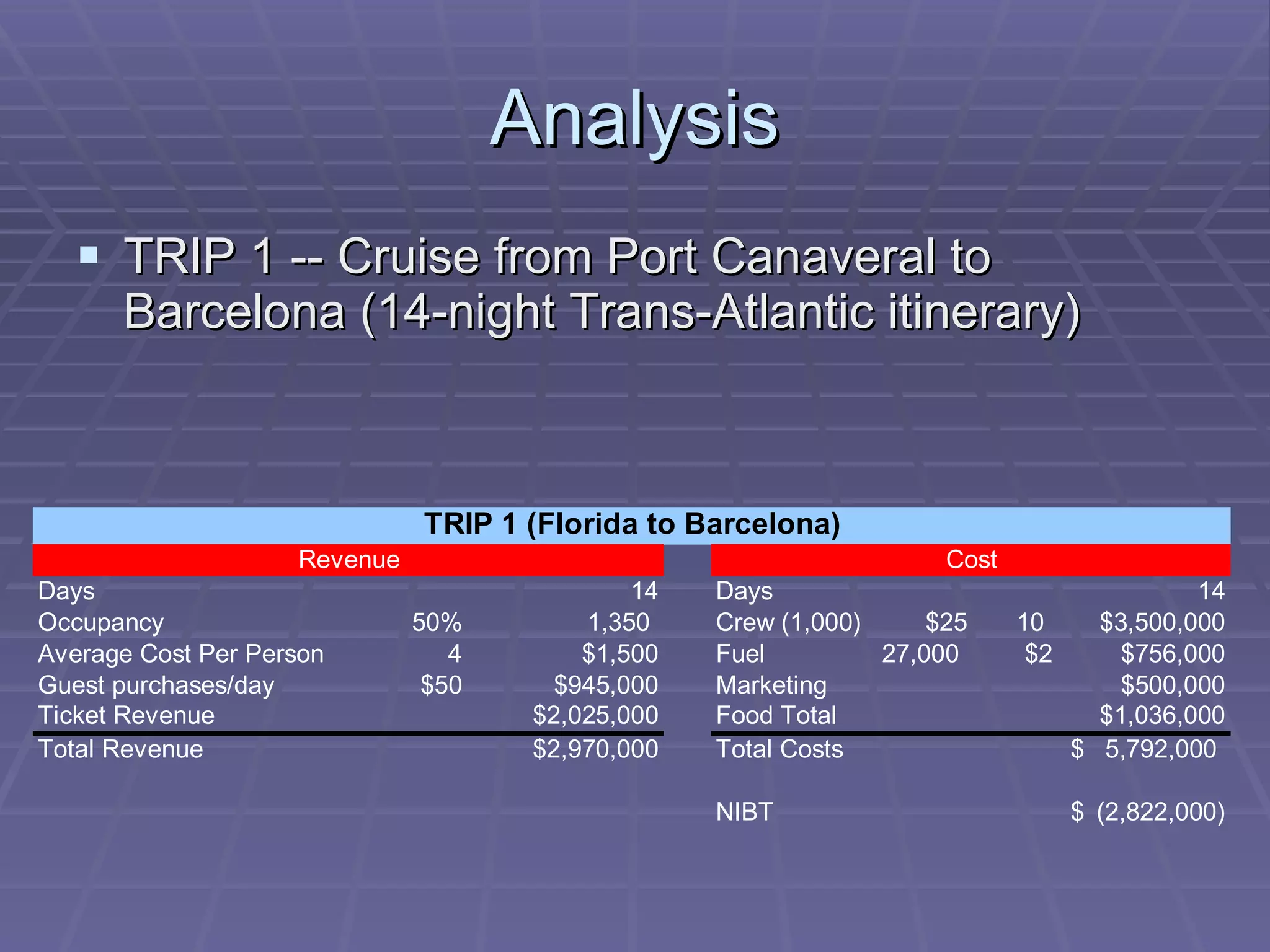

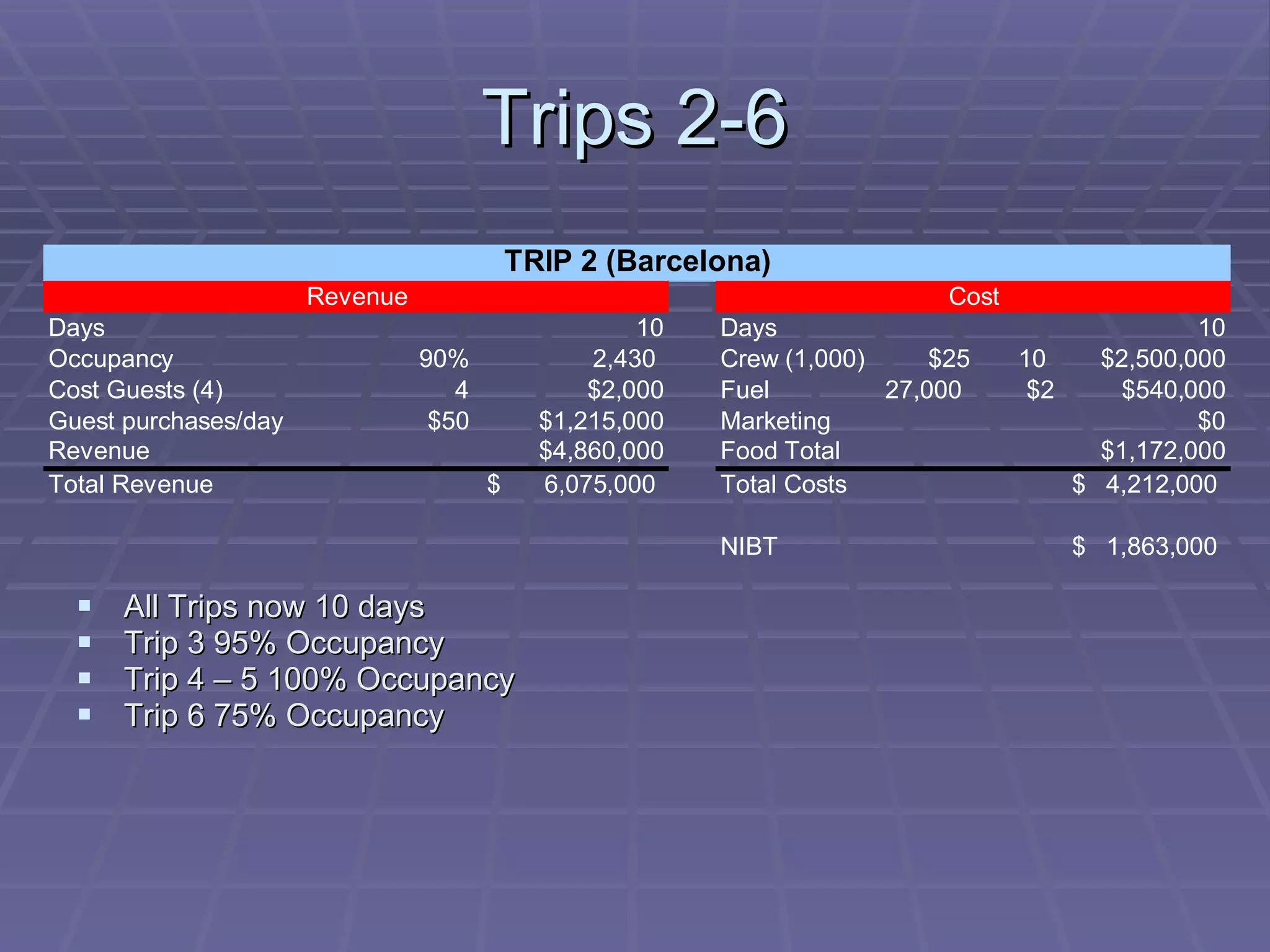

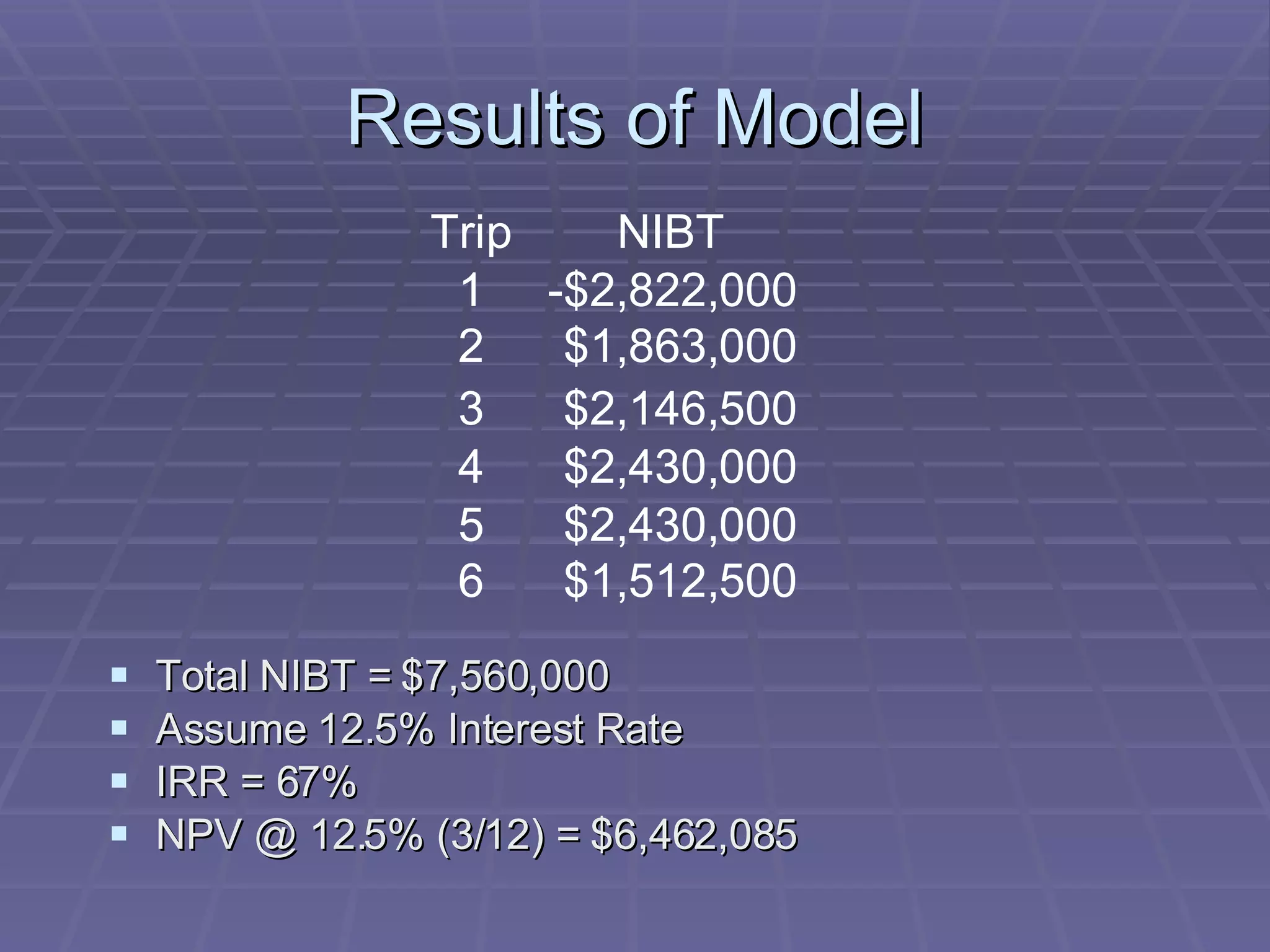

The document discusses capital expenditures and tools for evaluating long-term investment decisions. It provides examples of how Netflix and AT&T used net present value (NPV) and internal rate of return (IRR) analyses to evaluate expanding their facilities. Both alternatives provided positive cash flows but expanding at the current facility was less capital intensive and avoided travel costs and time loss. The document also summarizes how Disney Cruise Line used NPV and IRR models to determine a new Mediterranean itinerary would have a 67% IRR and $6.4M NPV, leading them to approve the new route.