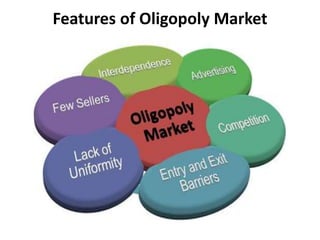

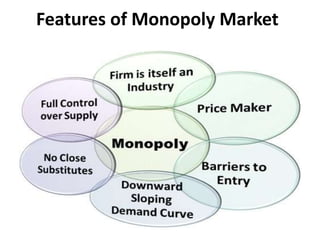

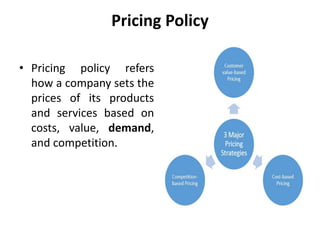

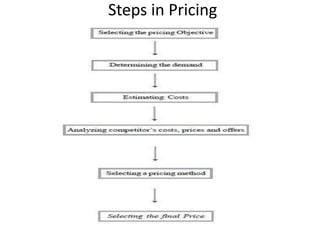

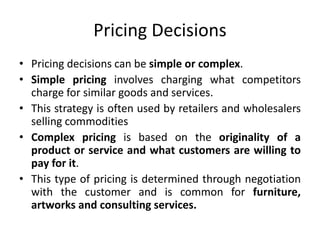

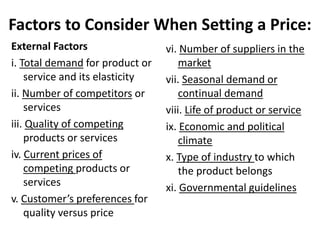

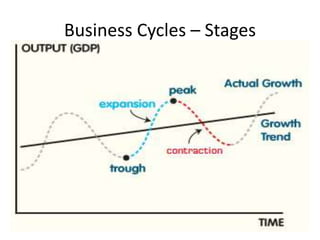

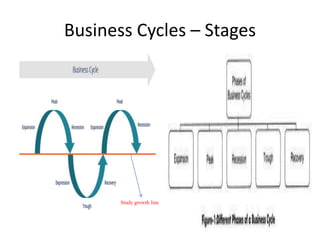

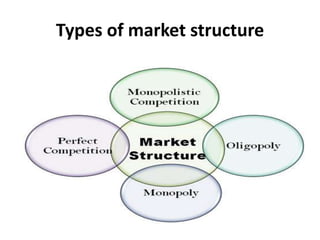

The document discusses different topics related to market structures and business cycles. It defines different market structures - perfect competition, monopoly, monopolistic competition, and oligopoly - and describes their key features. It also outlines the steps involved in pricing policies and decisions, and lists various pricing methods. Finally, it identifies the different stages of business cycles as expansion, peak, recession, depression, trough, and recovery.

![1] Perfect Competition

Definition

• The Perfect Competition is a market structure

where a large number of buyers and sellers

are present, and

• all are engaged in the buying and selling of the

homogeneous(SIMILAR) products at a single

price prevailing in the market.](https://image.slidesharecdn.com/marketstructure-210303074217/85/Market-structure-4-320.jpg)