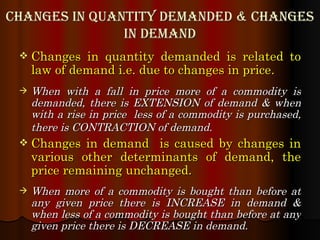

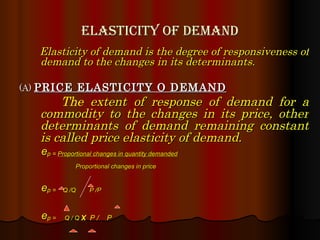

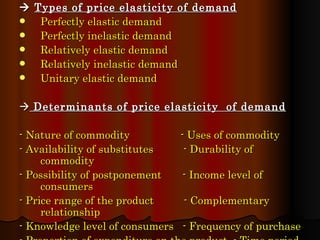

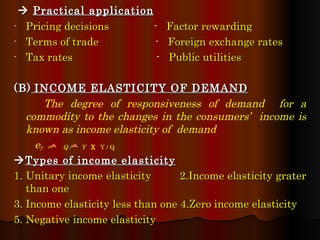

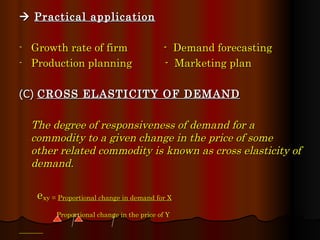

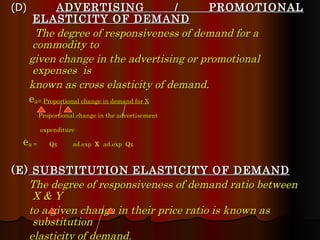

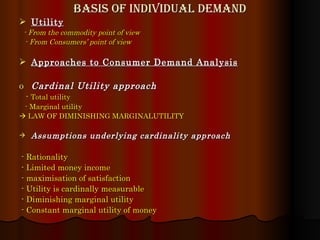

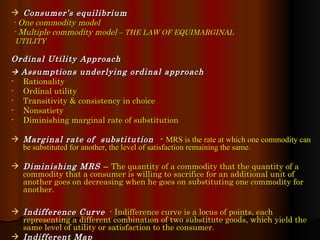

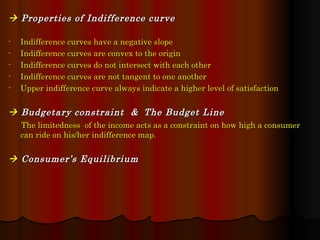

Demand refers to the quantity of a good or service that consumers are willing and able to purchase at various prices. Individual demand is the amount an individual consumer will purchase, while market demand is the total quantity demanded by all consumers in the market. Demand is determined by factors like price, income, tastes, and availability of substitutes. According to the law of demand, demand is inversely related to price - demand decreases as price increases. Changes in demand occur due to non-price factors, while changes in quantity demanded occur due to price changes. Elasticity measures the responsiveness of demand to various determinants like price, income, and prices of related goods. Demand forecasting is used for production, pricing, and other