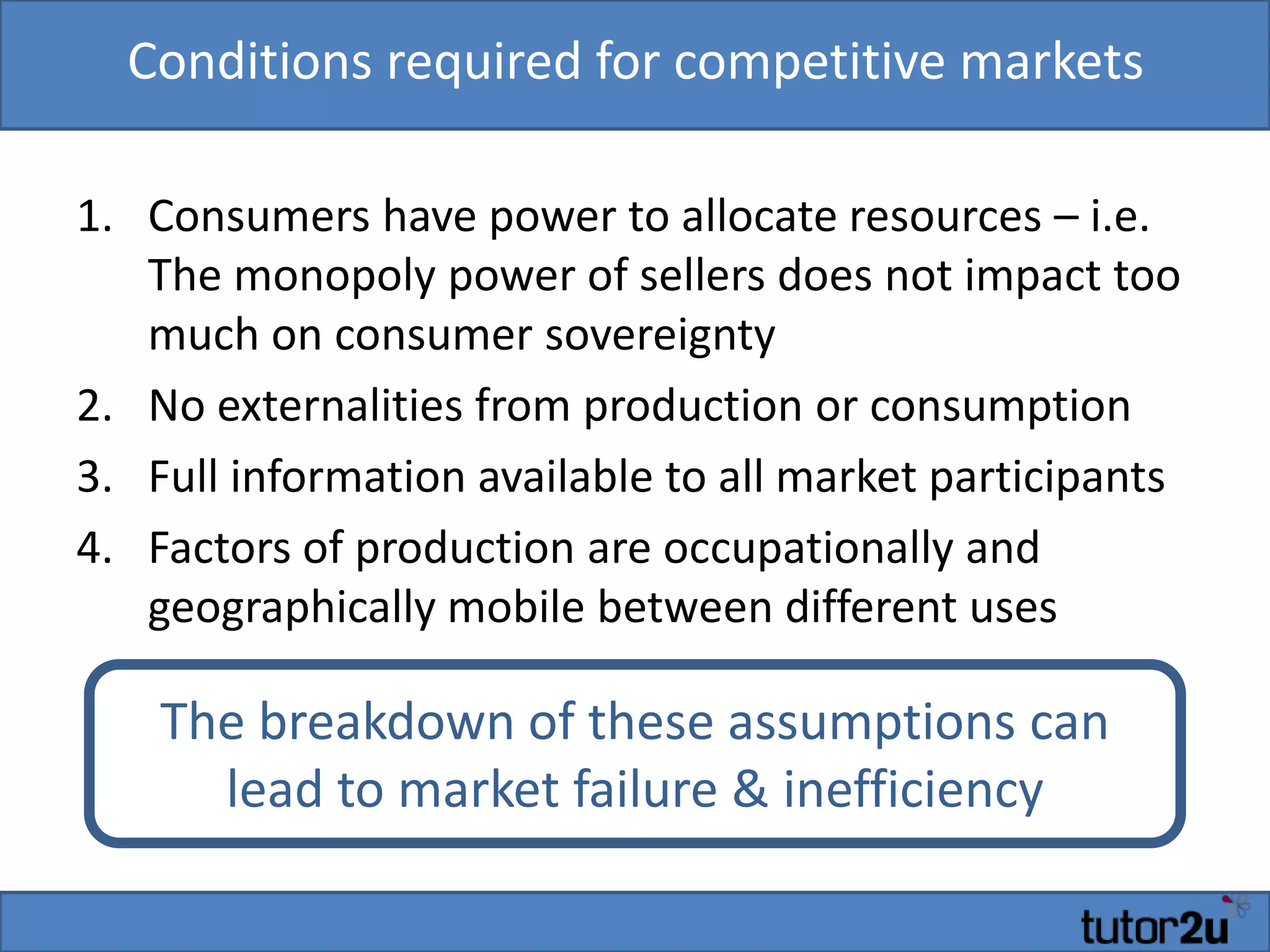

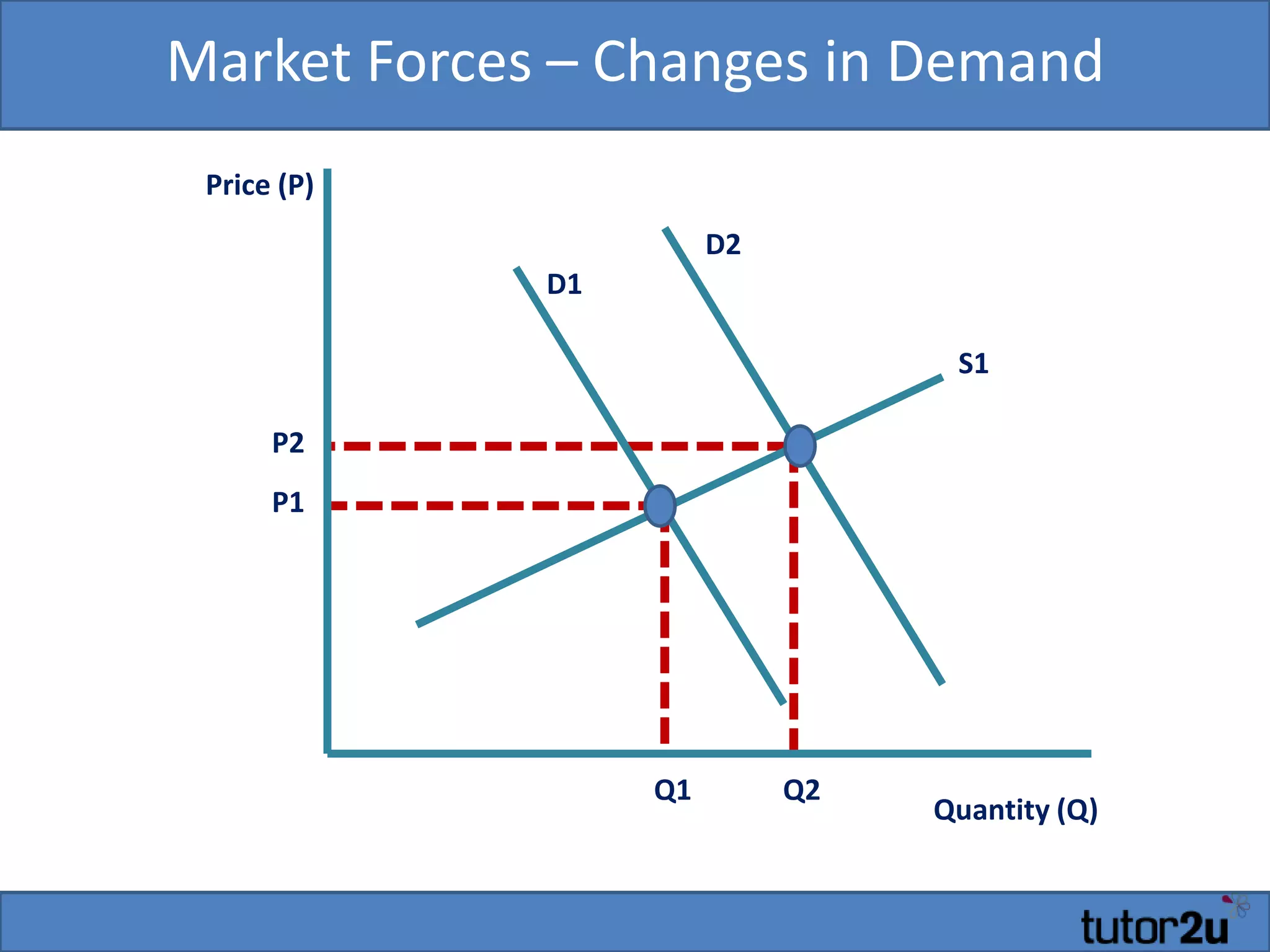

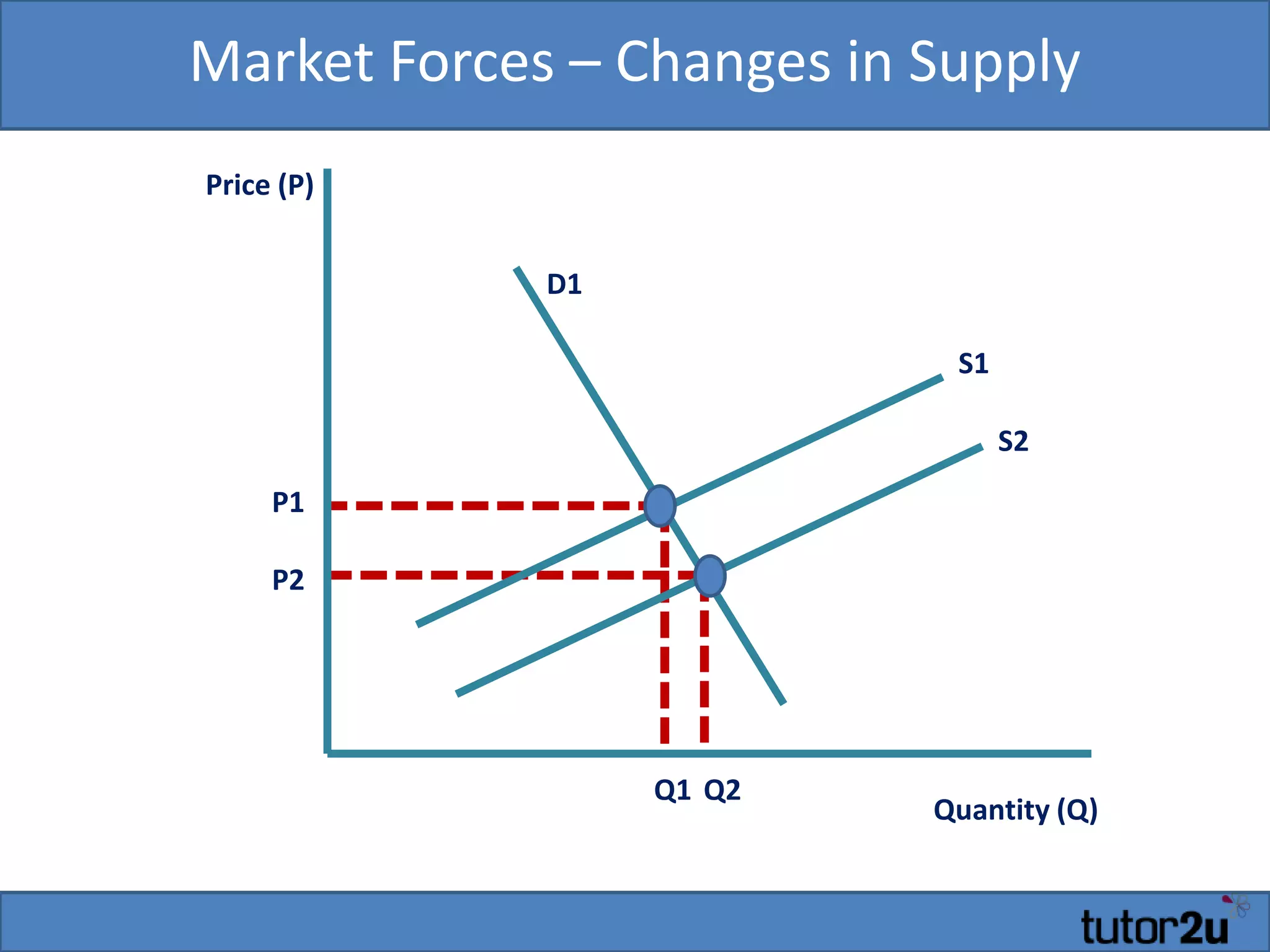

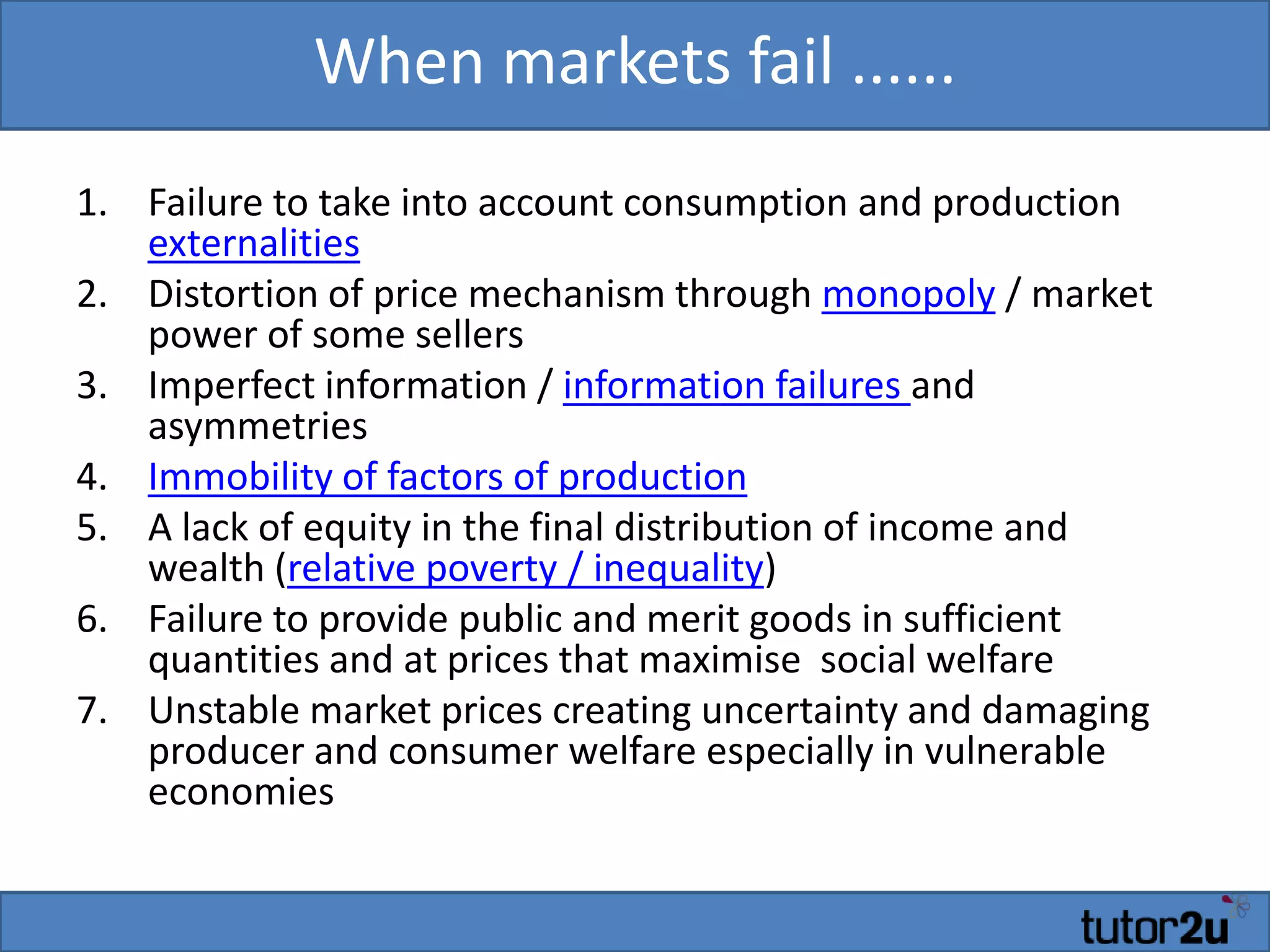

The document discusses the price mechanism and how it allocates scarce resources through market forces. It describes the price mechanism's rationing, signaling, and incentive functions. When supply and demand change, prices adjust to clear the market. The conditions required for competitive markets are also outlined. The document notes that market forces can efficiently allocate resources but market failures can occur due to externalities, imperfect information, and other issues. Government intervention may be needed to address such market failures.