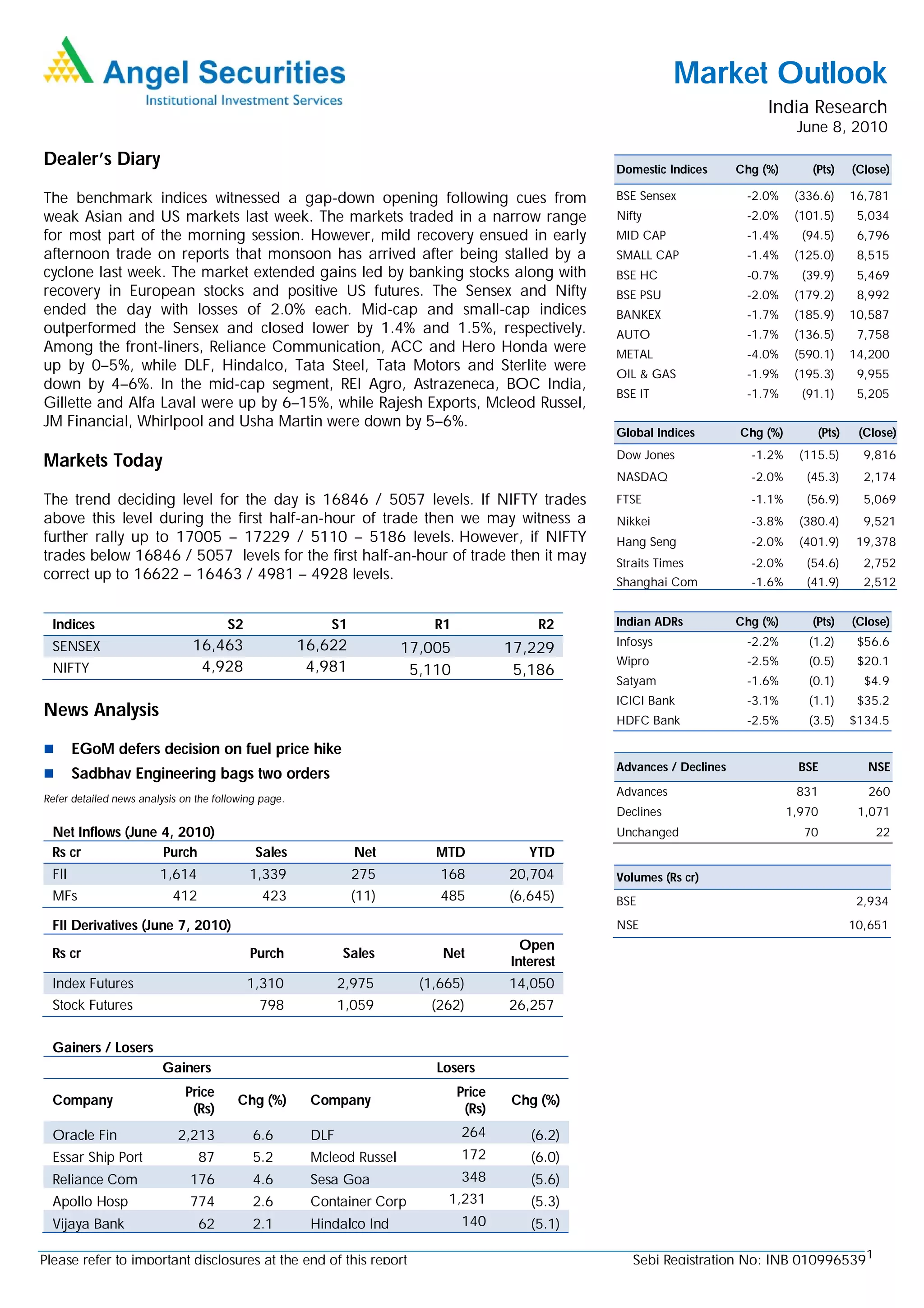

The Indian stock market indices witnessed losses of 2% on June 8, 2010. Mid-cap and small-cap indices outperformed but still ended lower by 1.4%. Banking and metal stocks pulled the markets down, while some recovery was seen in real estate and telecom stocks. An expert panel meeting was deferred on deregulating fuel prices, dampening prospects for oil marketing companies. Infrastructure company Sadbhav Engineering secured two new orders worth $15 million.