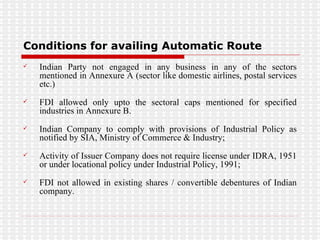

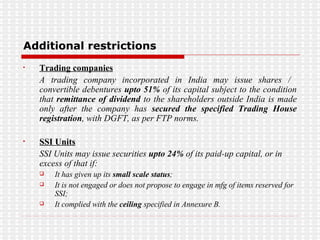

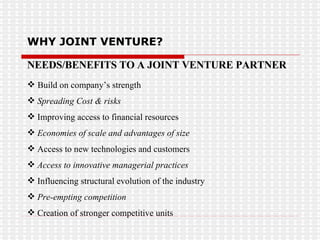

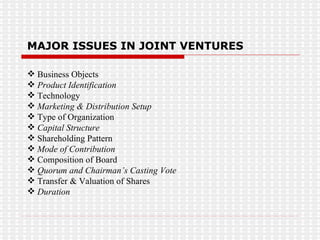

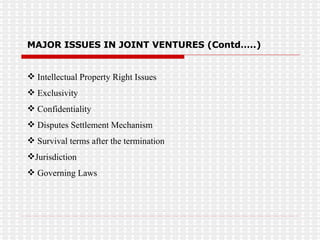

The document provides information on joint ventures and foreign collaborations in India. It defines a joint venture as an association between two or more business entities who combine resources for common goals. Benefits of joint ventures include spreading costs and risks, improving access to finance, technology, and new markets. Recent examples of joint ventures in India are provided. Major issues in structuring joint ventures like capital structure, governance, intellectual property rights are highlighted. India's liberal foreign direct investment policy allowing up to 100% foreign ownership in most sectors is summarized. The legal and regulatory framework governing joint ventures is outlined.

![FEMA implications for foreign collaborations Direct Investment Outside India [FEM (Transfer or issue of any foreign security) Regs., 2004] Foreign Direct Investment [FEM (Transfer of any security by a PROI) Regs., 2000]](https://image.slidesharecdn.com/joint-ventures-foreign-coolaborations3483/85/Joint-Ventures-Foreign-Coolaborations-10-320.jpg)

![Direct Investment outside India (ODI) [FEM (Transfer or issue of any foreign security) Regs., 2004] 5 Definitions: Direct Investment outside India: includes investment by way of: either by market purchase, or private placement or through stock exchange. (c) market purchase of existing shares of foreign entity; (b) Subscription to MoA of foreign entity (a) Contribution to the capital;](https://image.slidesharecdn.com/joint-ventures-foreign-coolaborations3483/85/Joint-Ventures-Foreign-Coolaborations-11-320.jpg)