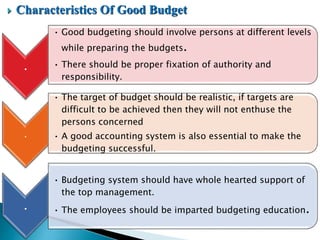

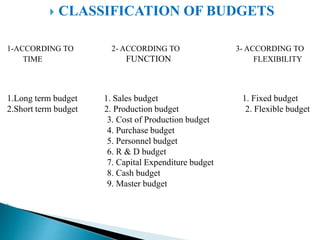

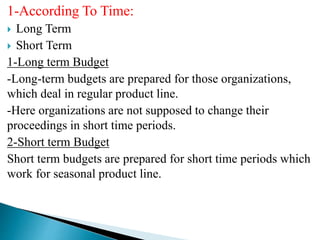

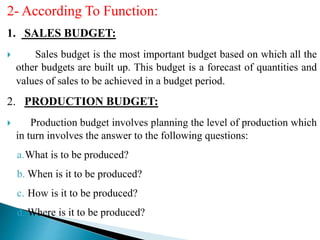

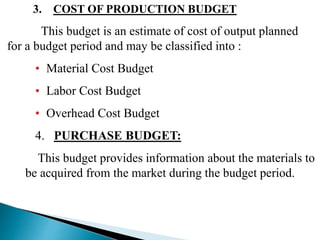

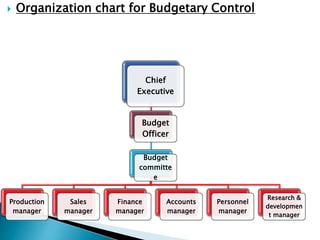

This document provides an outline and overview of budgeting concepts for healthcare systems. It begins with an introduction stating the importance of budgeting for nurse managers to effectively allocate resources. It then defines a budget and lists its importance, purposes, and characteristics of a good budget. The document discusses the budgeting process in healthcare, types of budgets, advantages and disadvantages, and the role of the nurse administrator in budgeting. Key points include that a budget is a financial plan, budgets are important for policy and accountability, and nurse administrators are responsible for formulating nursing department budgets and participating in fiscal planning.