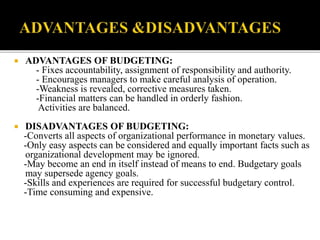

This document discusses nursing management and budgeting in healthcare organizations. It provides definitions of budgets and explains the budgeting process. Key points covered include:

- Budgets are financial plans that estimate expected income and planned expenditures over a set period of time, usually a year.

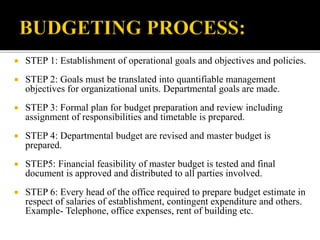

- The budgeting process involves establishing goals, translating goals into quantifiable objectives, preparing formal budget plans, testing and approving budgets, and distributing budgets.

- Budgets help control expenses, coordinate efforts, establish performance measures, and aid in planning and decision making.