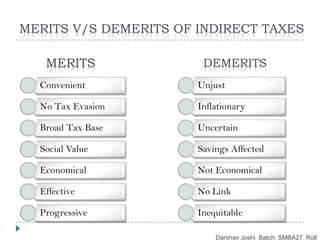

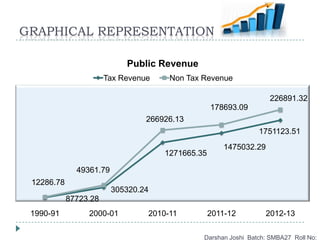

This document discusses public revenue sources for governments. It classifies revenue sources into tax revenue and non-tax revenue. Tax revenue includes direct taxes like income tax and indirect taxes like sales tax. Non-tax revenue comes from sources like profits from public sector undertakings. The document outlines various canons of taxation and analyzes the merits and demerits of direct and indirect taxes. It also provides data on tax collection in India from 1990-1991 to 2012-2013 and shows the increasing trend in tax revenue collection over time.