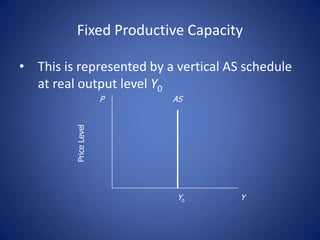

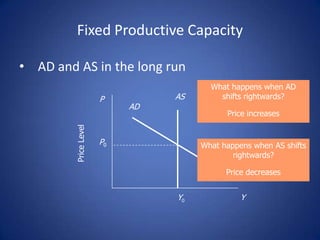

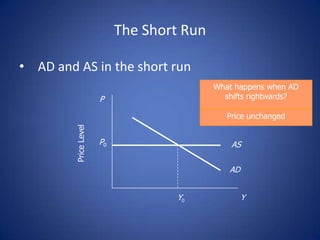

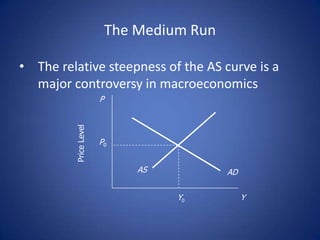

This document provides an introduction to macroeconomics. It discusses that macroeconomics examines the economy as a whole by looking at aggregates like income, consumption, investment, and prices. It then covers key macroeconomic concepts like measuring GDP, inflation, unemployment, and international trade. It introduces three models used in macroeconomics: the long-run model of economic growth, the aggregate supply and aggregate demand model for the short-run and medium-run, and the business cycle model.