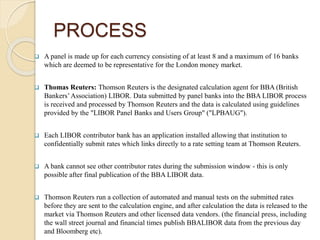

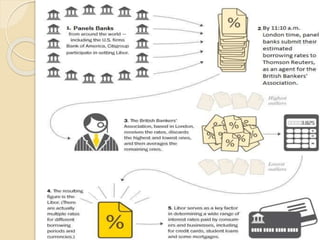

Libor is the average interest rate calculated by contributing panel banks in London that they determine they would be charged if borrowing from other banks. It is used as a benchmark for short-term global interest rates and is referenced in over $800 trillion in financial products. Libor submissions and calculations have faced scrutiny over manipulation by banks for profit. Regulators have since levied billions in fines against banks for attempted manipulation of Libor submissions between 2007-2012.