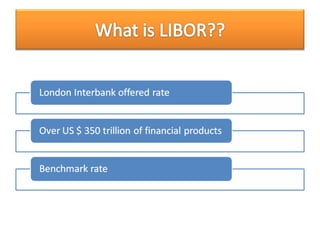

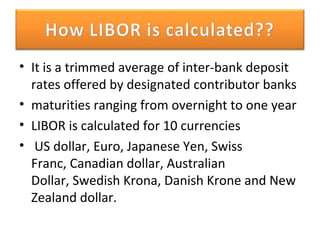

LIBOR is the average interest rate that large global banks charge each other for short-term loans. It is calculated daily for 10 currencies based on submissions from a panel of banks and serves as a benchmark for pricing various financial instruments including mortgages, corporate loans, and interest rate derivatives. The prime rate is the interest rate that banks charge their most creditworthy corporate customers and is used as a benchmark to measure other lending rates.