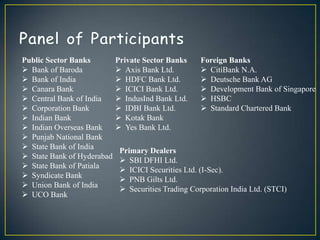

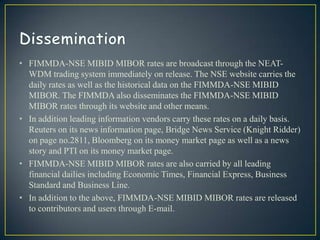

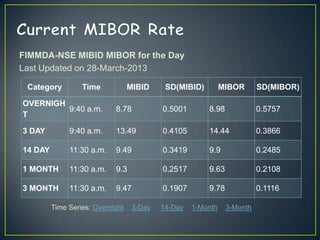

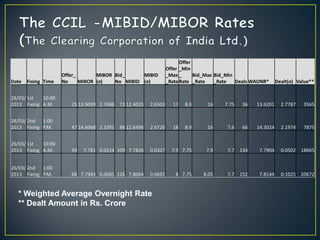

The Mumbai Interbank Offer Rate (MIBOR) is a benchmark interest rate at which banks in India lend to other banks. It is calculated daily by the National Stock Exchange of India (NSEIL) based on the rates submitted by a panel of banks. The Fixed Income Money Market and Derivative Association of India (FIMMDA) and NSEIL jointly disseminate the MIBOR rate to provide a transparent and reliable reference rate for the banking and financial markets in India. The MIBOR rate is used as a benchmark for pricing various interest rate instruments such as interest rate swaps, floating rate notes, and term deposits.