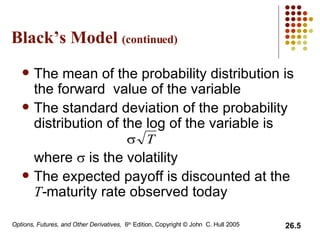

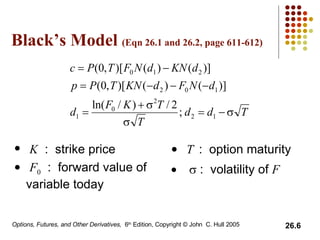

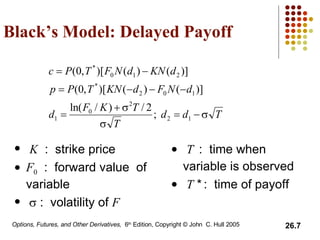

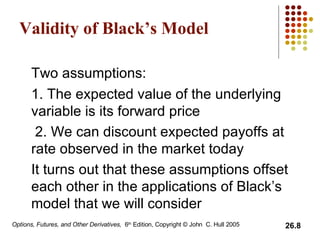

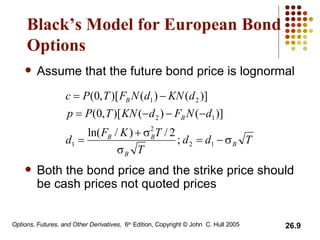

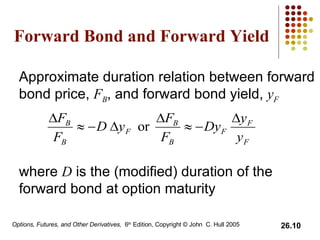

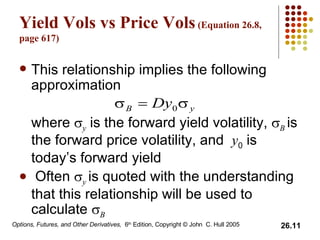

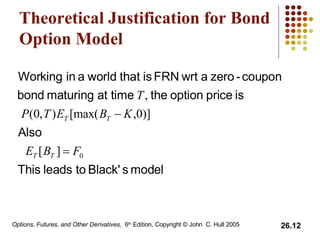

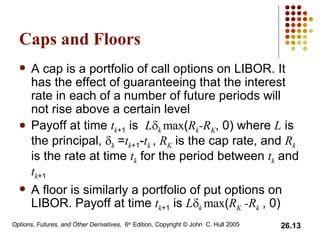

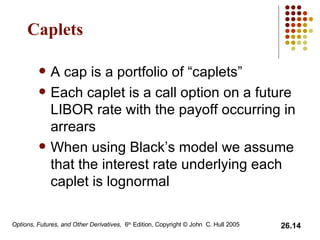

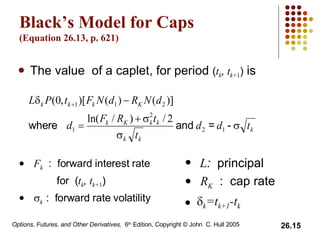

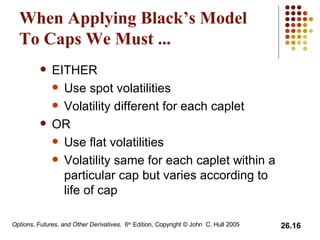

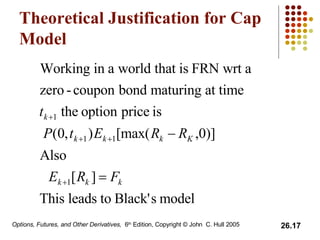

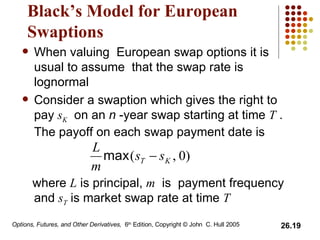

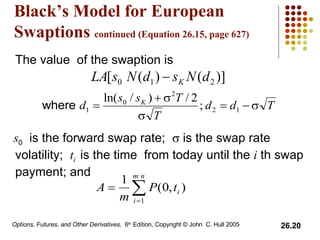

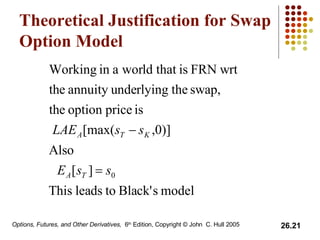

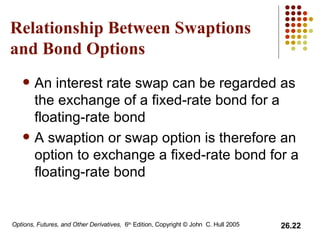

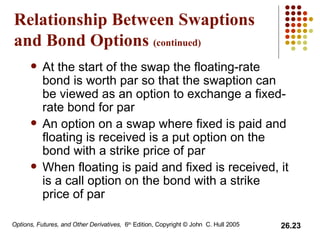

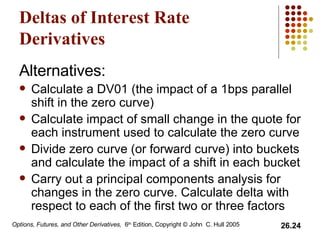

The document discusses various models for pricing interest rate derivatives such as options on bonds, caps, floors, and swaptions. It describes Black's model, which assumes the underlying rate is lognormally distributed. Black's model is then applied to value European bond options, caplets, and swaptions. The relationships between these derivatives and how their values are impacted by shifts in the yield curve are also covered.