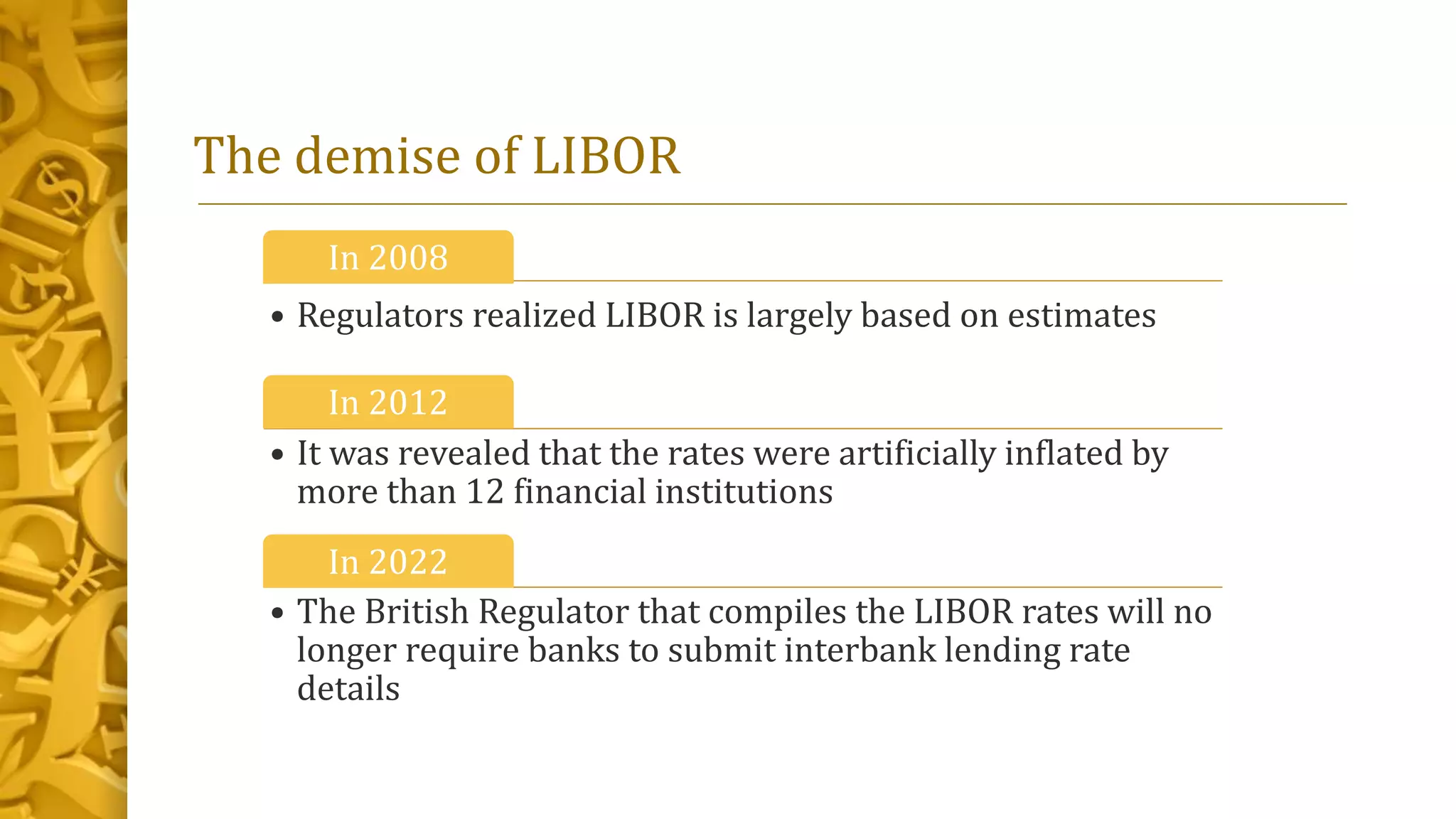

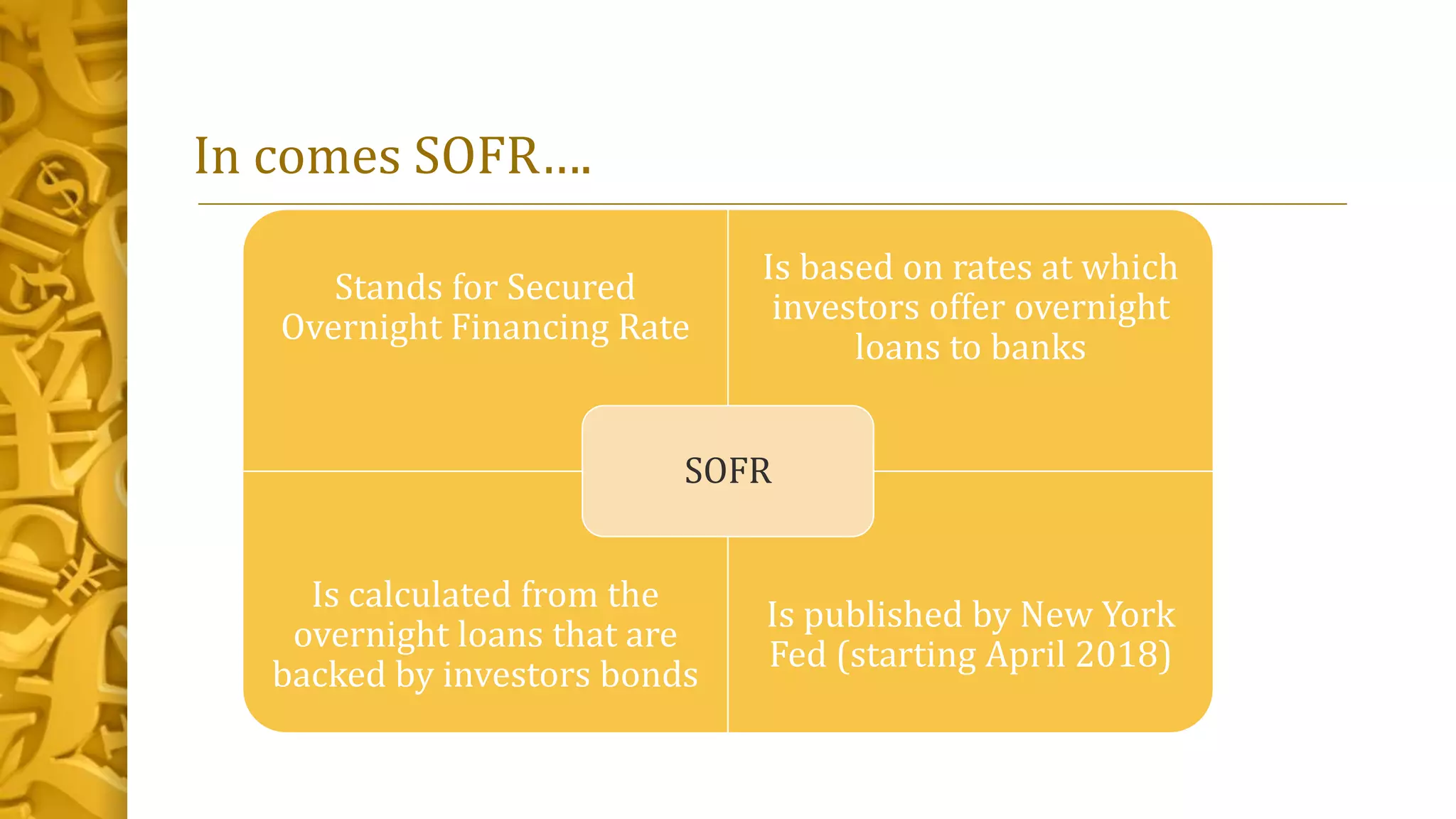

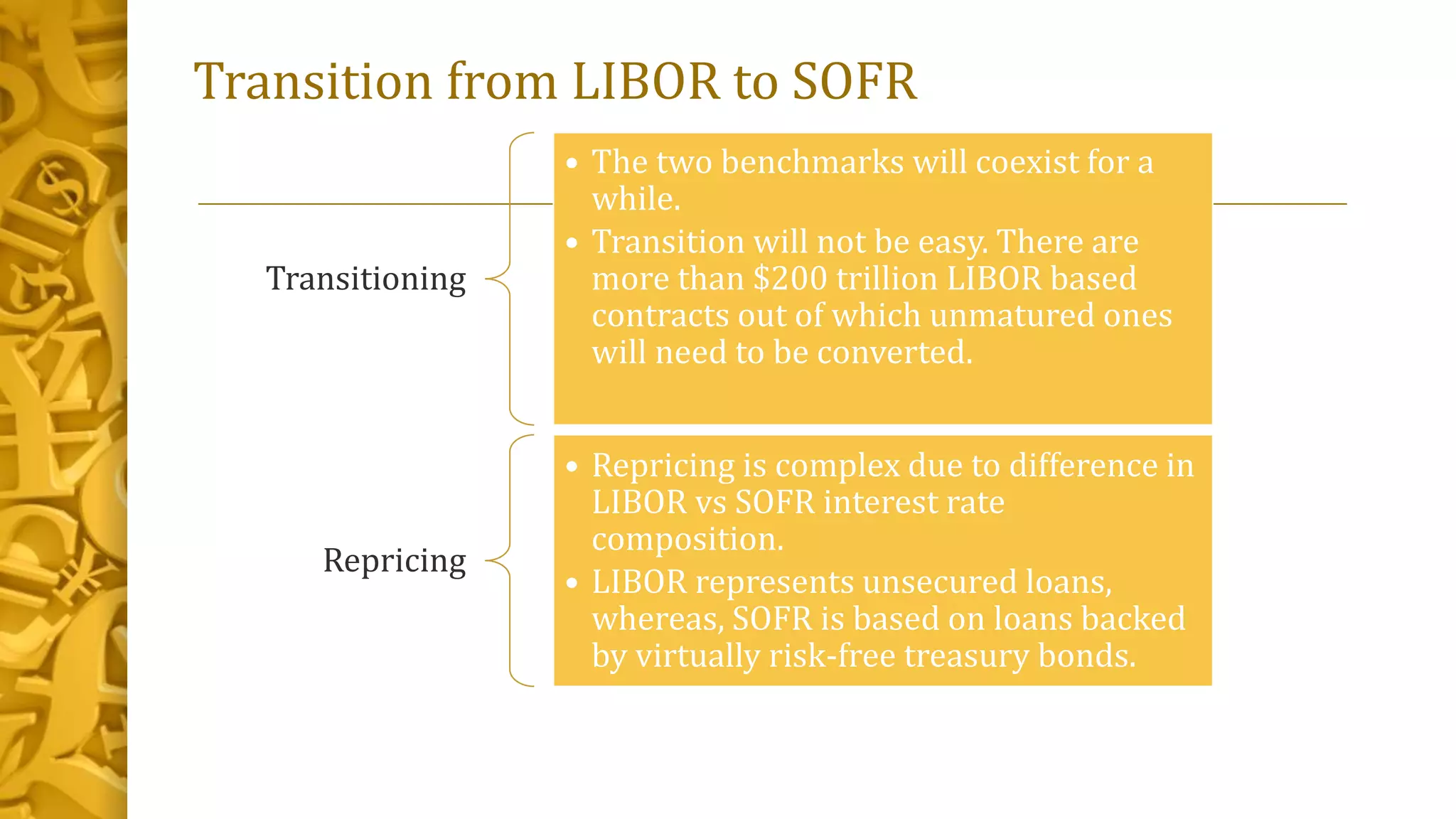

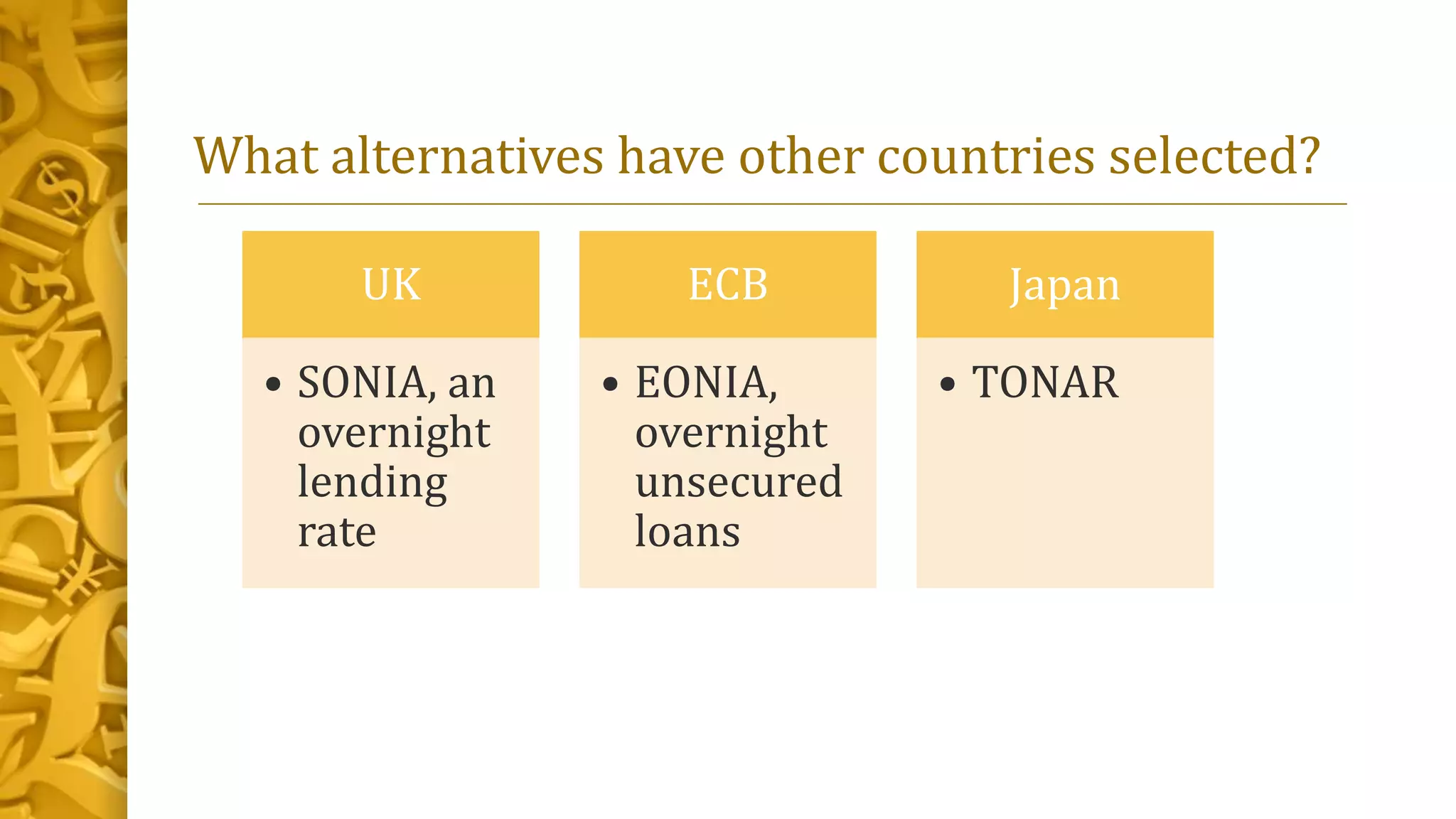

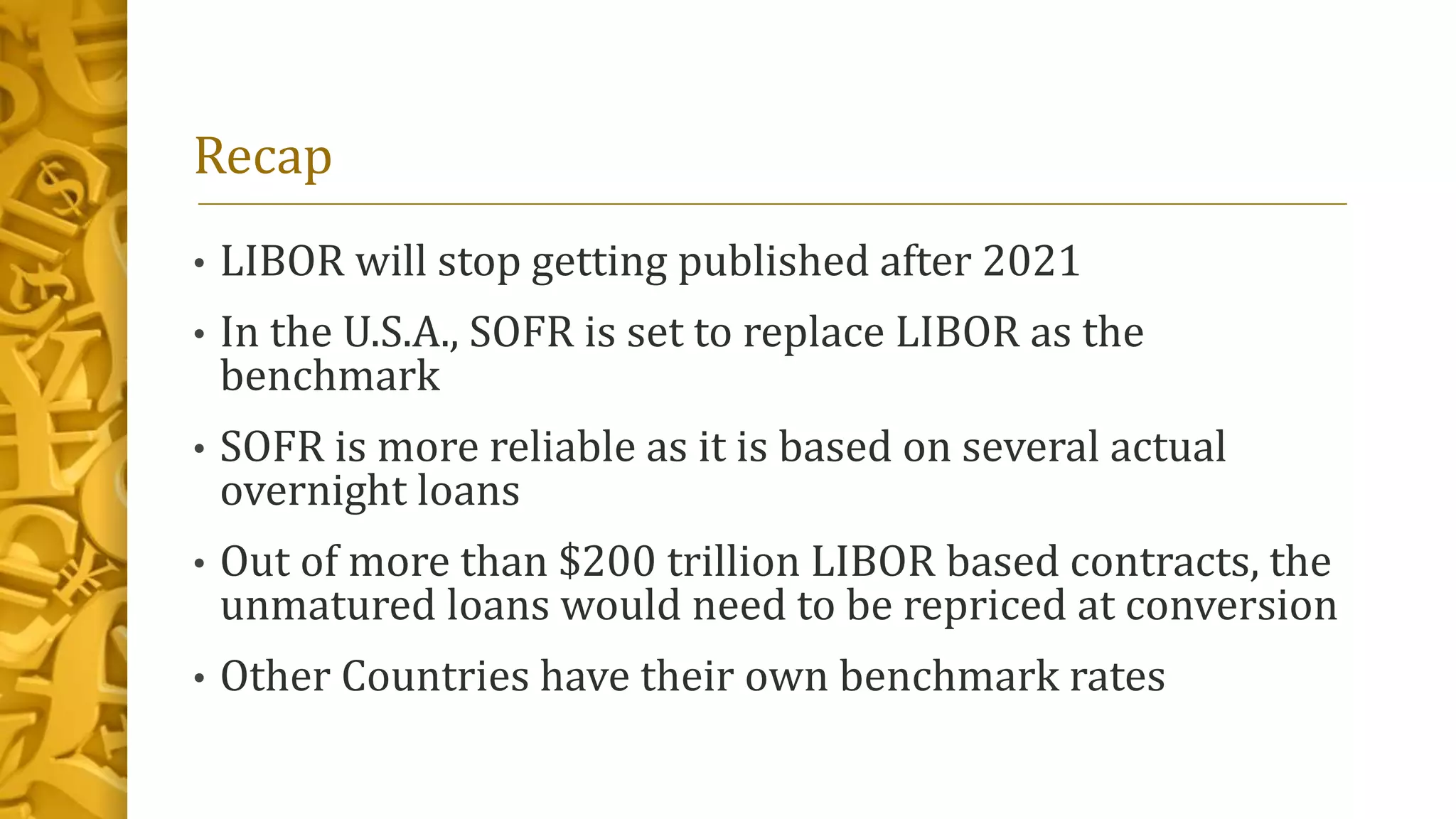

LIBOR, the London Interbank Offered Rate, has been the benchmark for credit agreements since the 1980s. However, regulators realized in 2008 that LIBOR rates were artificially inflated, and banks will no longer submit rates after 2022. The Secured Overnight Financing Rate (SOFR) published by the New York Fed will replace LIBOR in the US. SOFR is based on actual overnight lending transactions backed by treasury bonds, making it more reliable than LIBOR which had different rates and was subject to manipulation. Transitioning the $200 trillion in existing LIBOR contracts to SOFR will be complex due to differences in how interest is calculated. Other countries like the UK and EU are also transitioning to their