- Treasury departments are structured differently depending on a company's size and complexity, ranging from one person to multiple divisions.

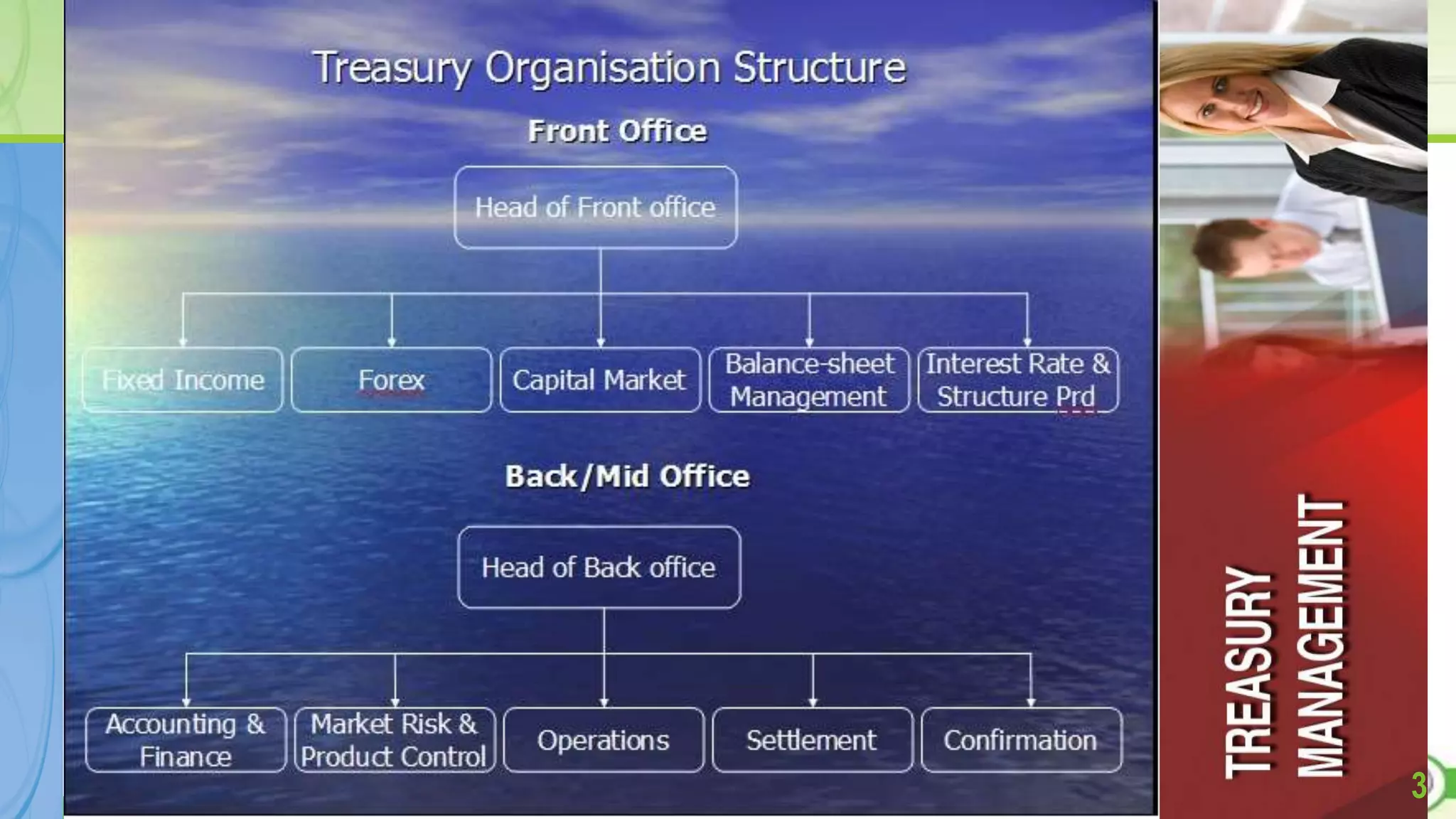

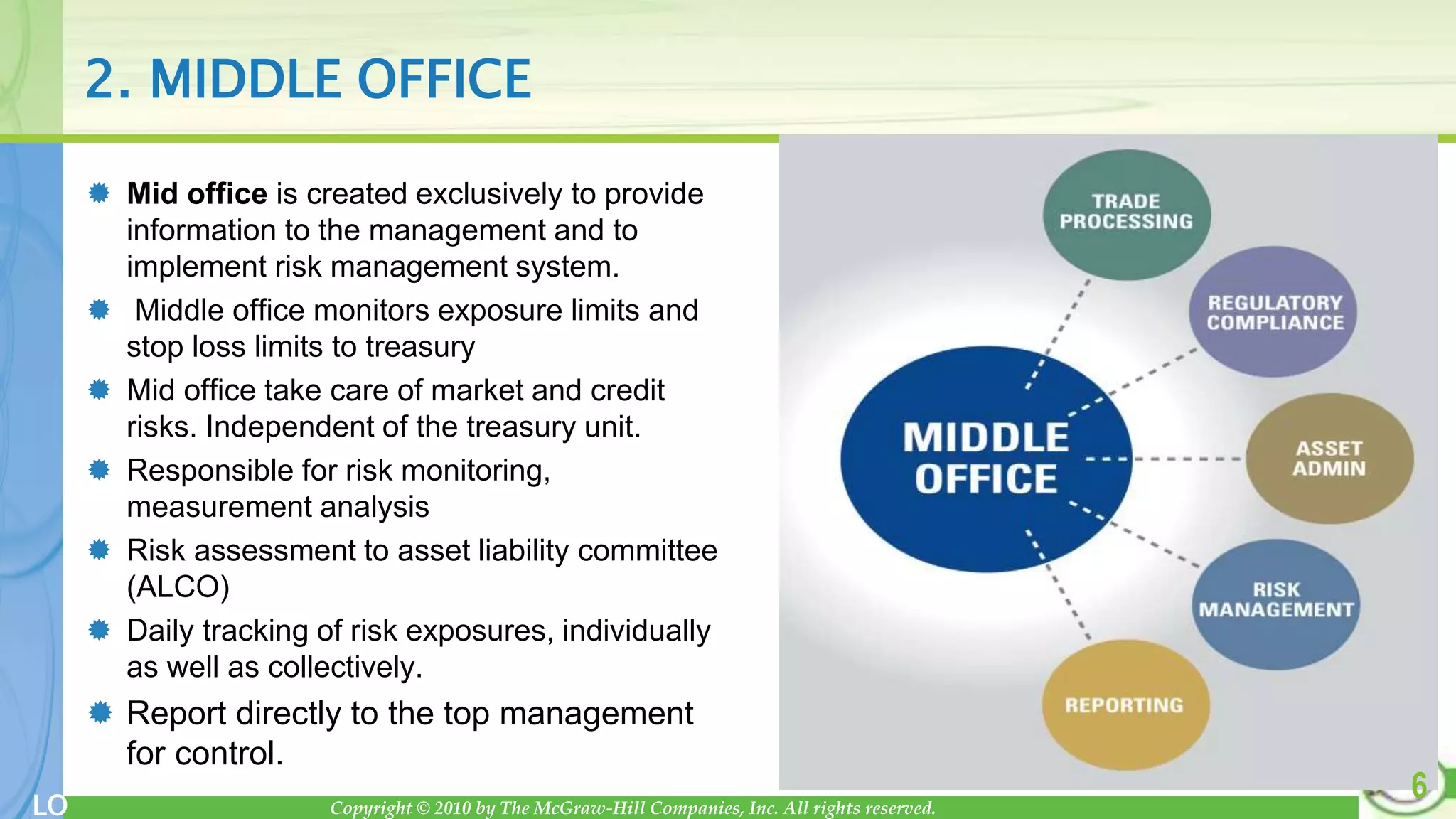

- They typically have three main divisions: front office for daily transactions/risk management, middle office for independent risk monitoring and reporting, and back office for validation, settlement, accounting.

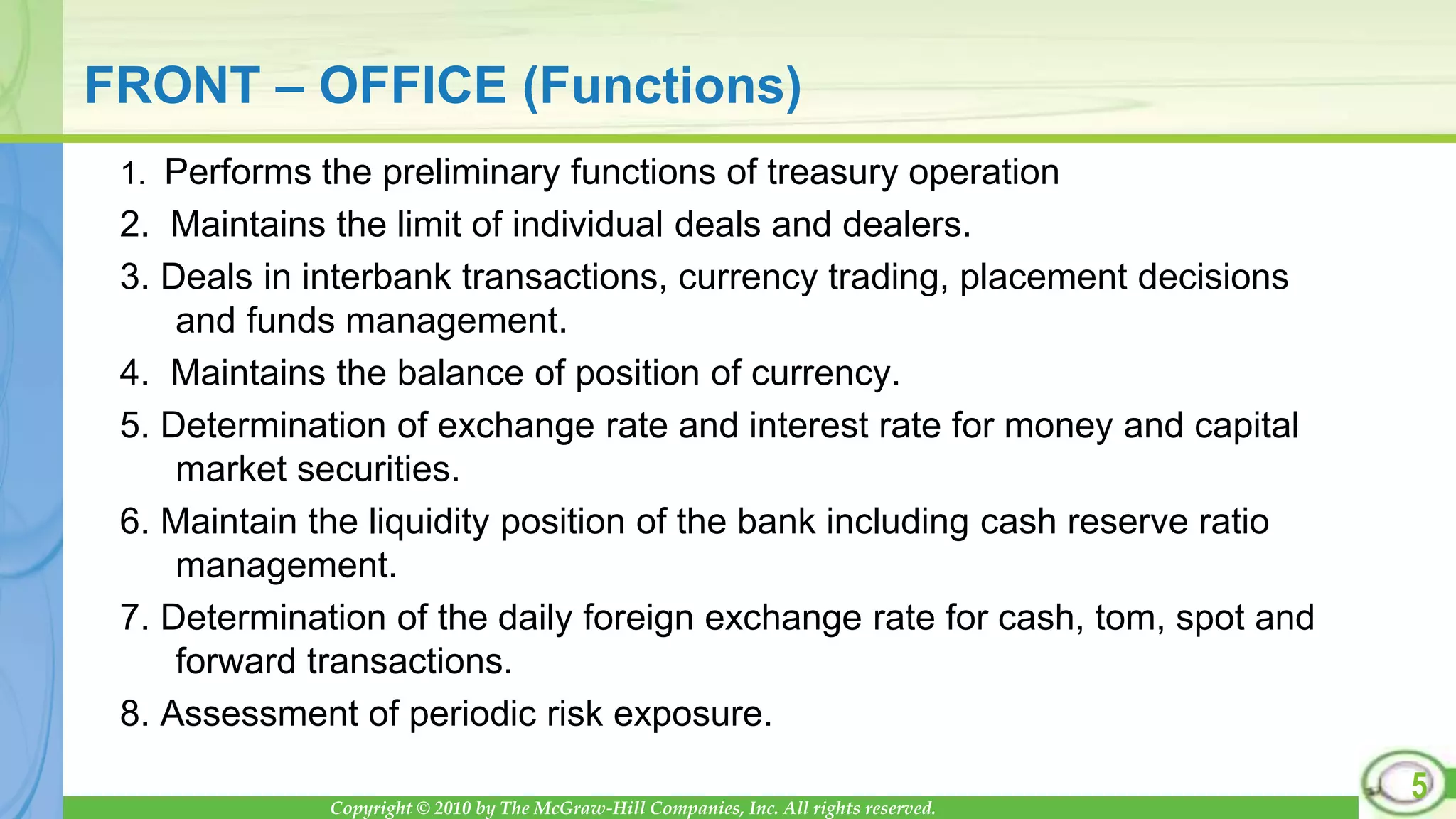

- The front office includes dealers and traders who take positions and manage market risks. The middle office monitors exposures and reports to management. The back office confirms deals and handles bookkeeping. An audit team also inspects daily operations.