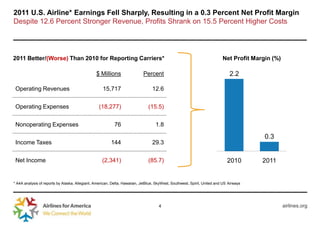

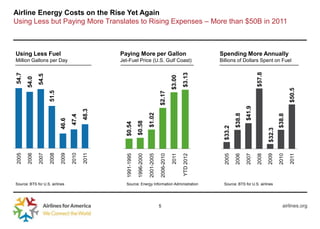

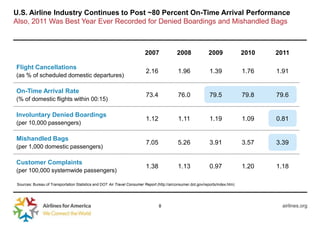

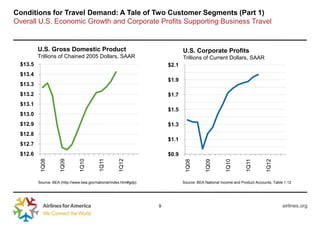

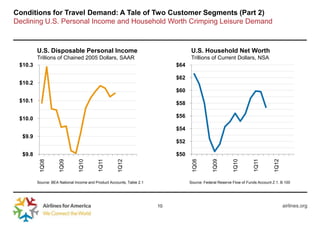

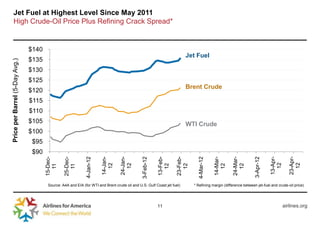

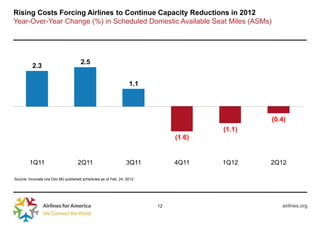

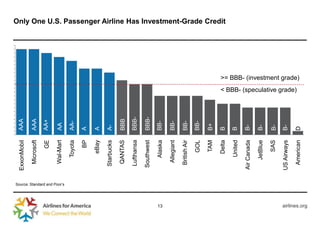

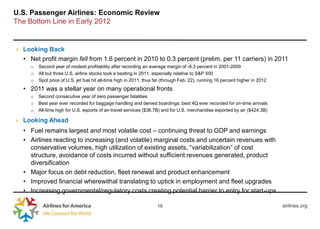

The document summarizes the financial performance and outlook of the U.S. airline industry in early 2012. It notes that while airline revenues grew in 2011, costs increased even more, resulting in an overall net profit margin of only 0.3%. Fuel costs were at record high levels and most airline stocks declined sharply over the year. Looking ahead, fuel remains the largest threat to profits. Airlines are focusing on reducing costs, debt, and capacity while renewing fleets in order to improve financial stability despite high and volatile fuel prices.