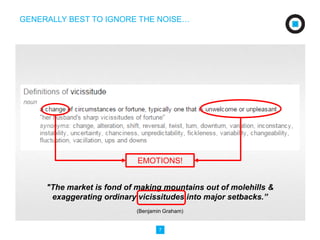

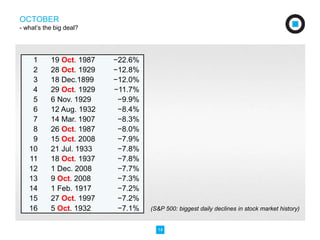

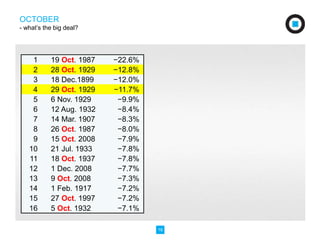

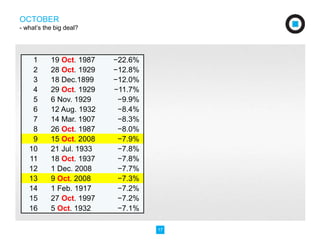

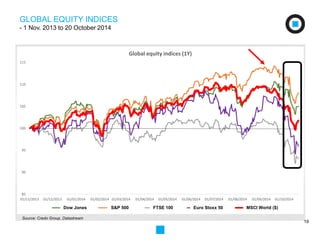

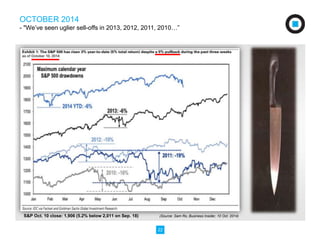

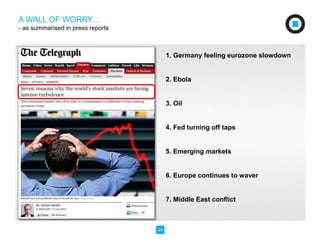

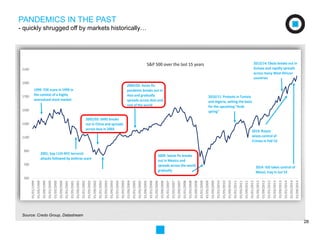

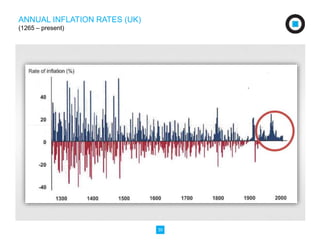

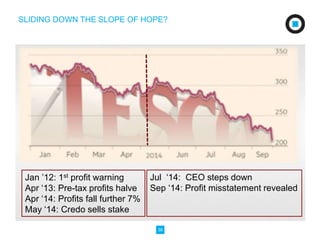

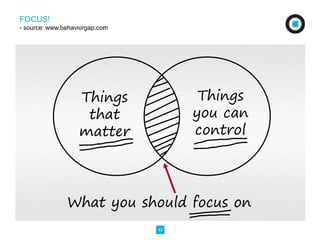

This document summarizes the investment philosophy of Credo Capital Plc, an independent wealth management group. It discusses Credo's long-term value-based approach, which focuses on capital preservation, yield, and transaction costs. The document also examines current market volatility and economic concerns, but argues these issues represent short-term "noise" and that focusing on long-term fundamentals is best. It advocates ignoring daily market fluctuations and remaining optimistic about the long-term prospects for equities.