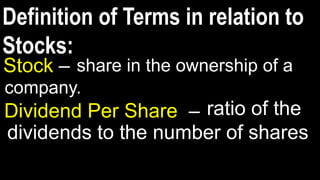

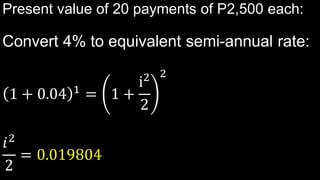

The document provides information about stocks and bonds. It defines key terms related to stocks like stock, dividend, dividend per share, stock market, market value, par value, and stock/current yield ratio. It also defines terms related to bonds like bond, coupon, coupon rate, price of a bond, term of a bond, fair price of a bond, par value, and provides examples of calculating dividend per share, stock yield ratio, semi-annual coupon amount, and fair price of a bond. The document aims to illustrate and distinguish between stocks and bonds for learners.