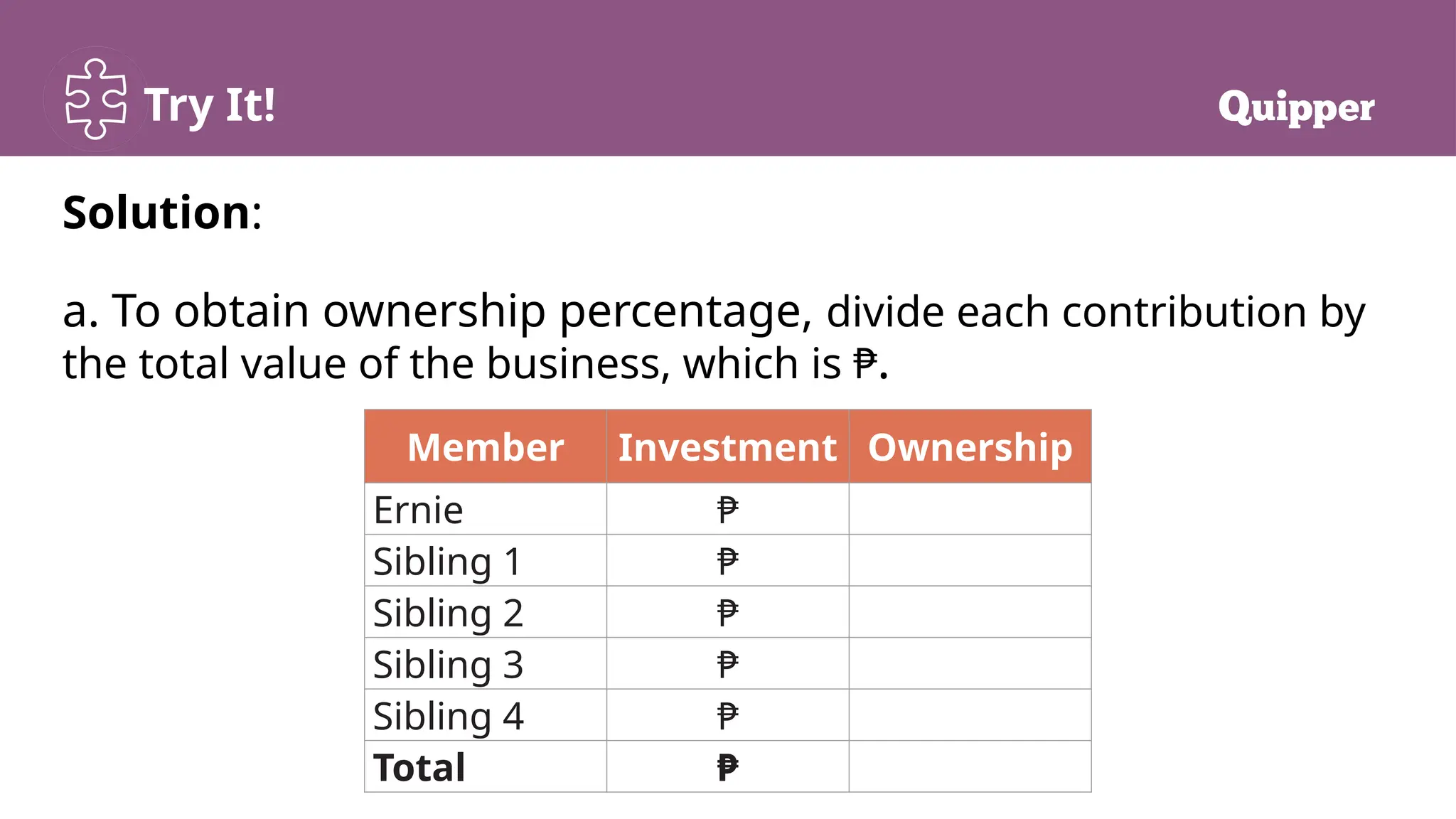

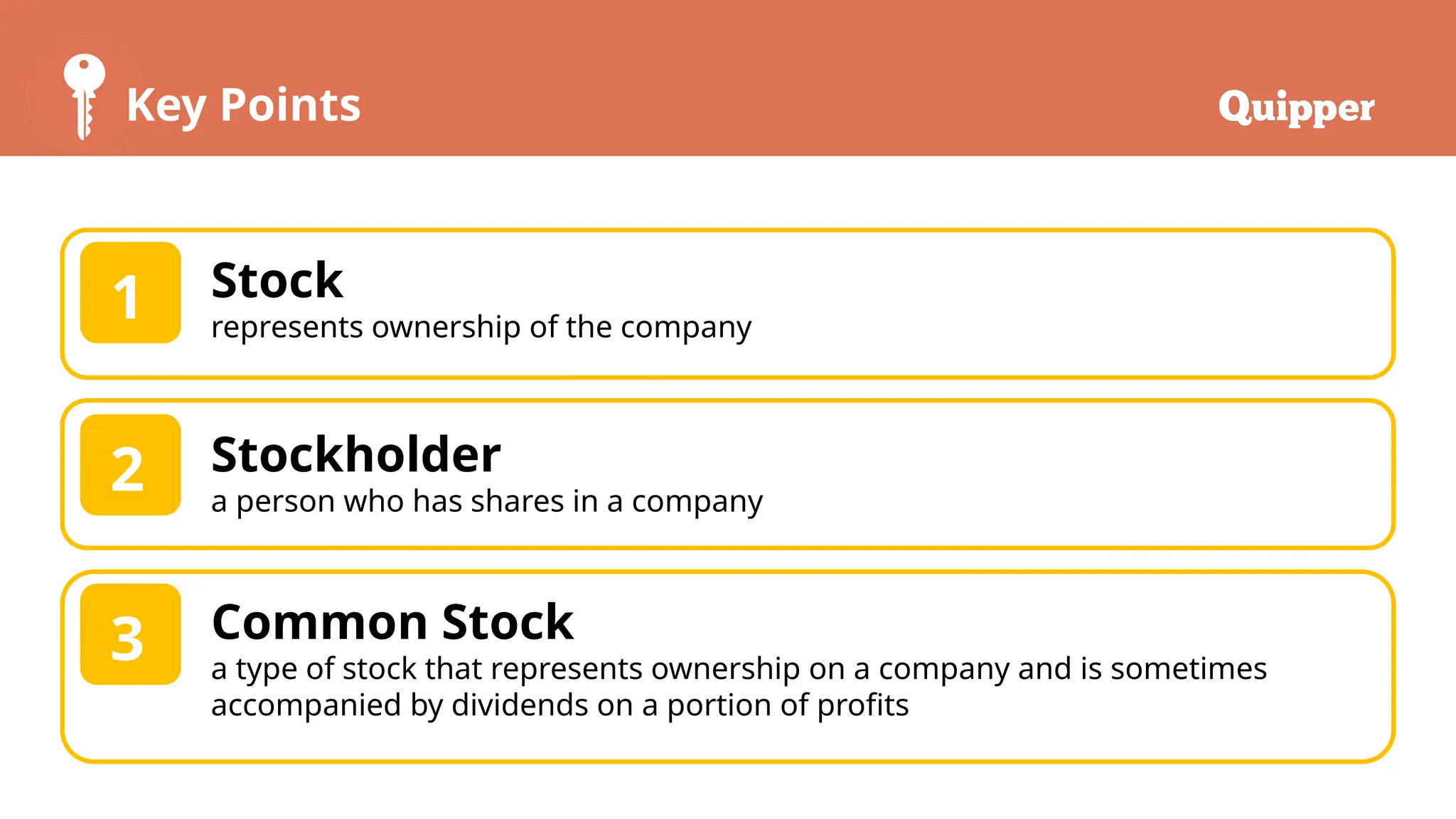

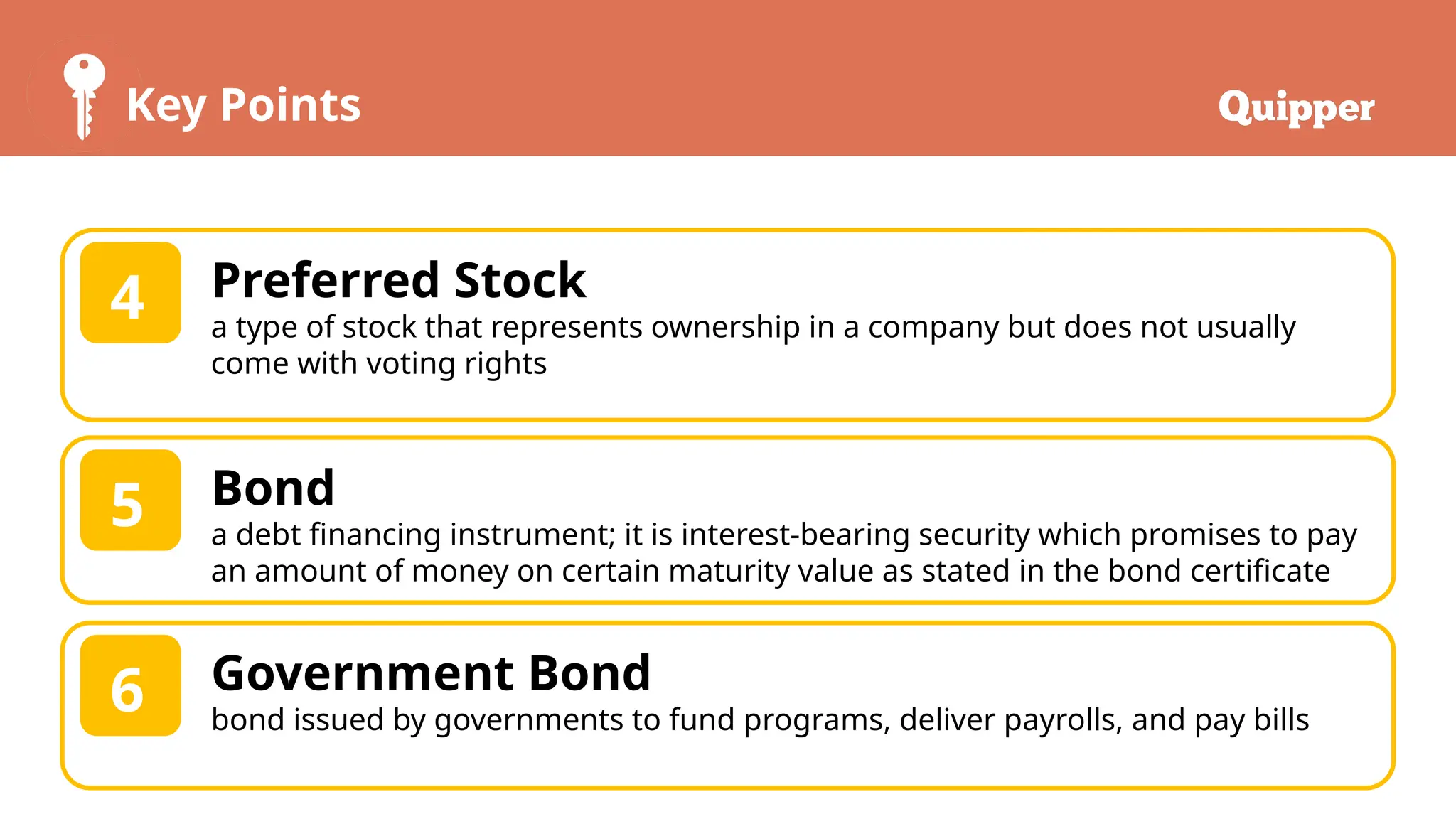

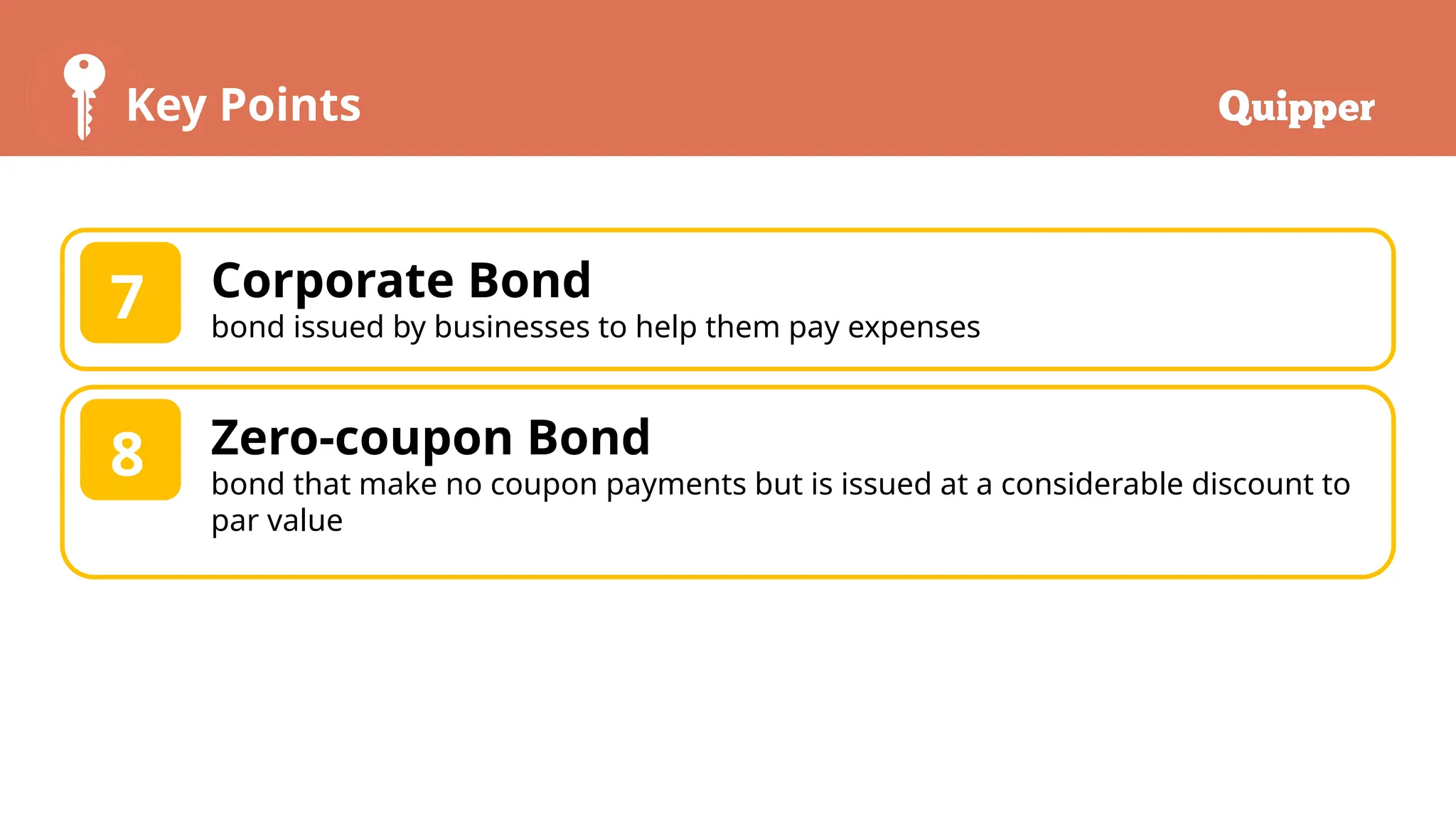

This lesson covers the characteristics and differences between stocks and bonds, detailing types such as common and preferred stocks, as well as government and corporate bonds. It emphasizes ownership and investment calculations, encouraging learners to determine ownership percentages and share costs based on contributions. Additionally, the lesson invites reflections on the value of investing in stocks and bonds at a young age.