Embed presentation

Downloaded 14 times

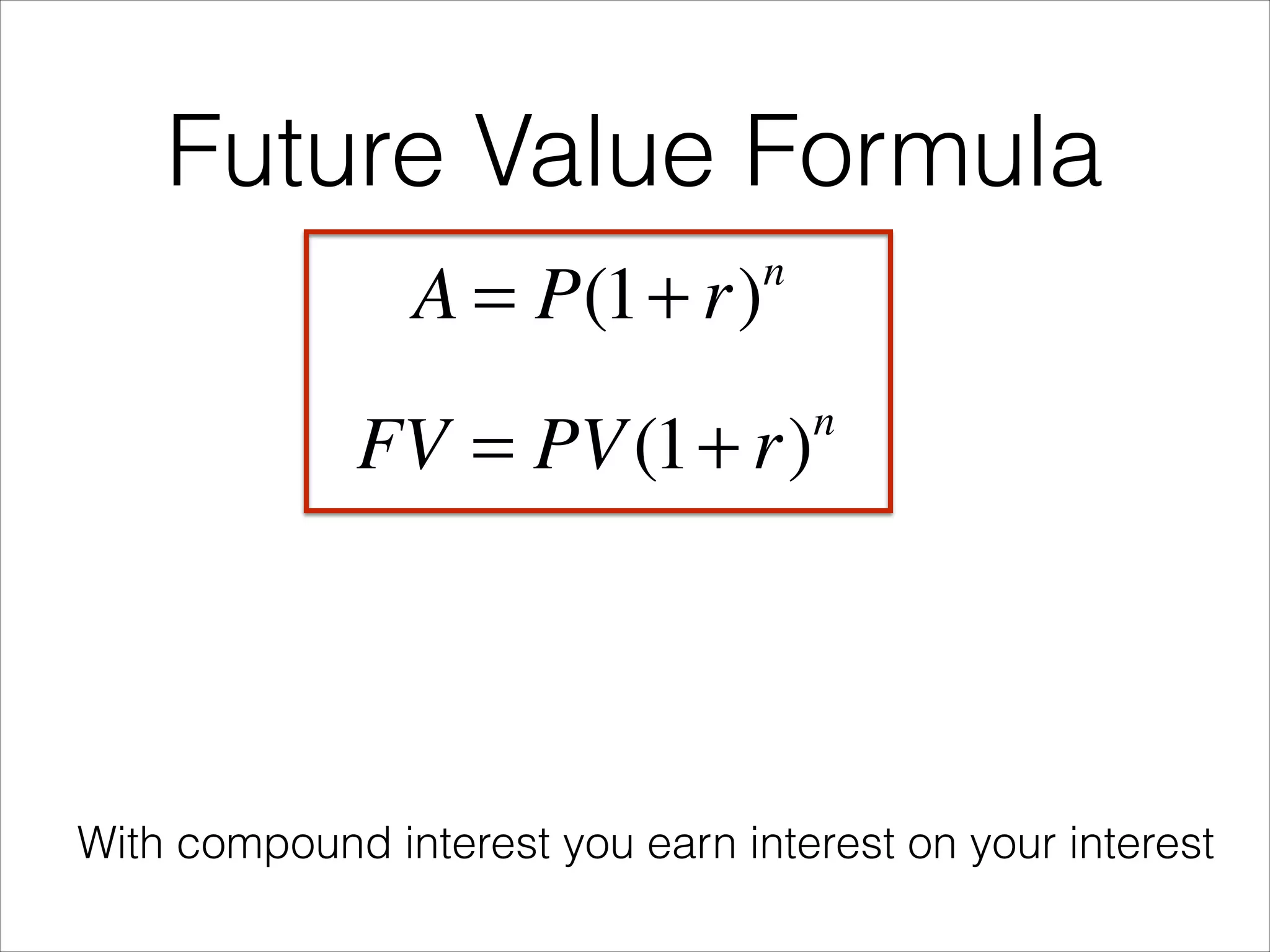

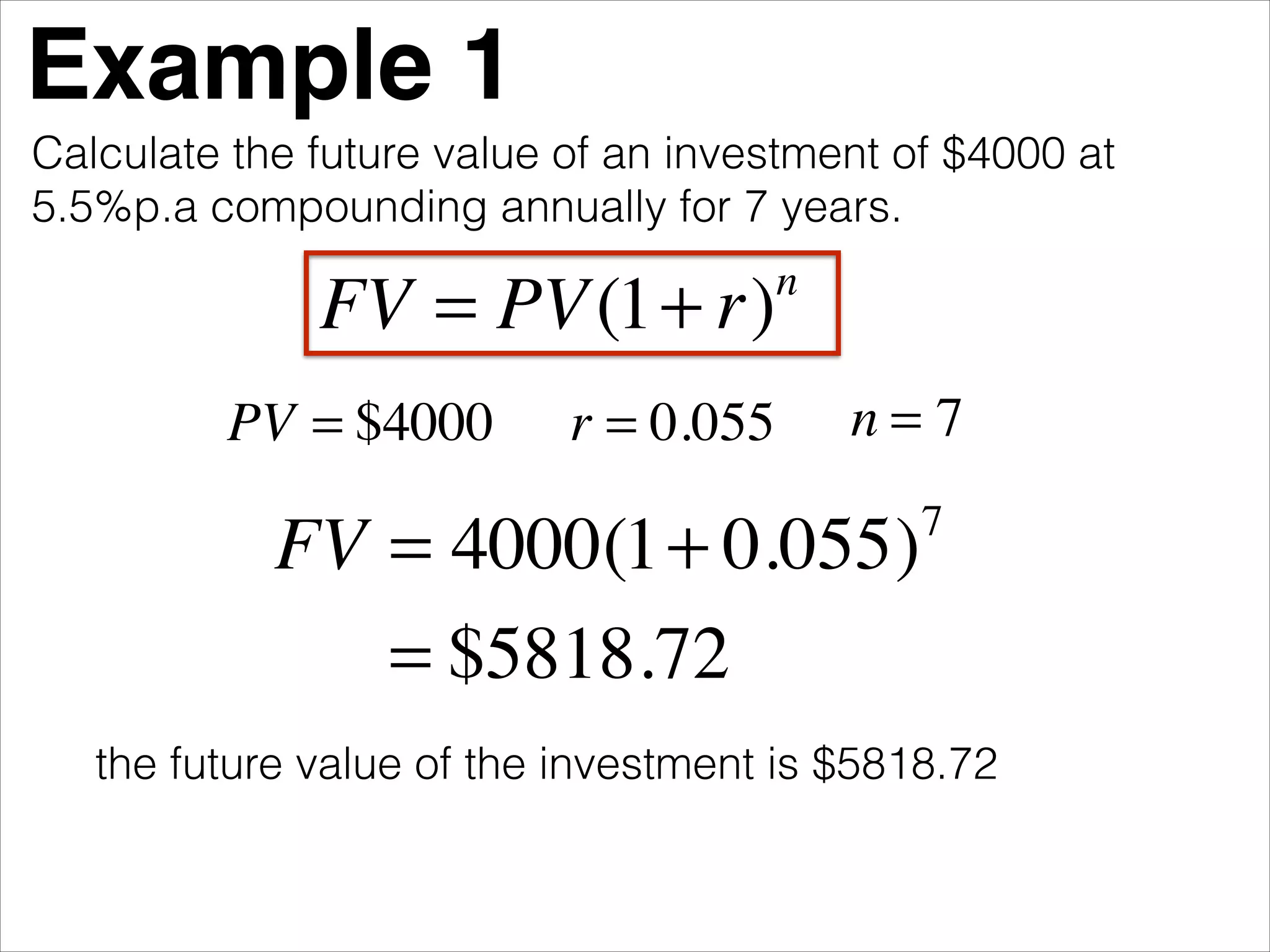

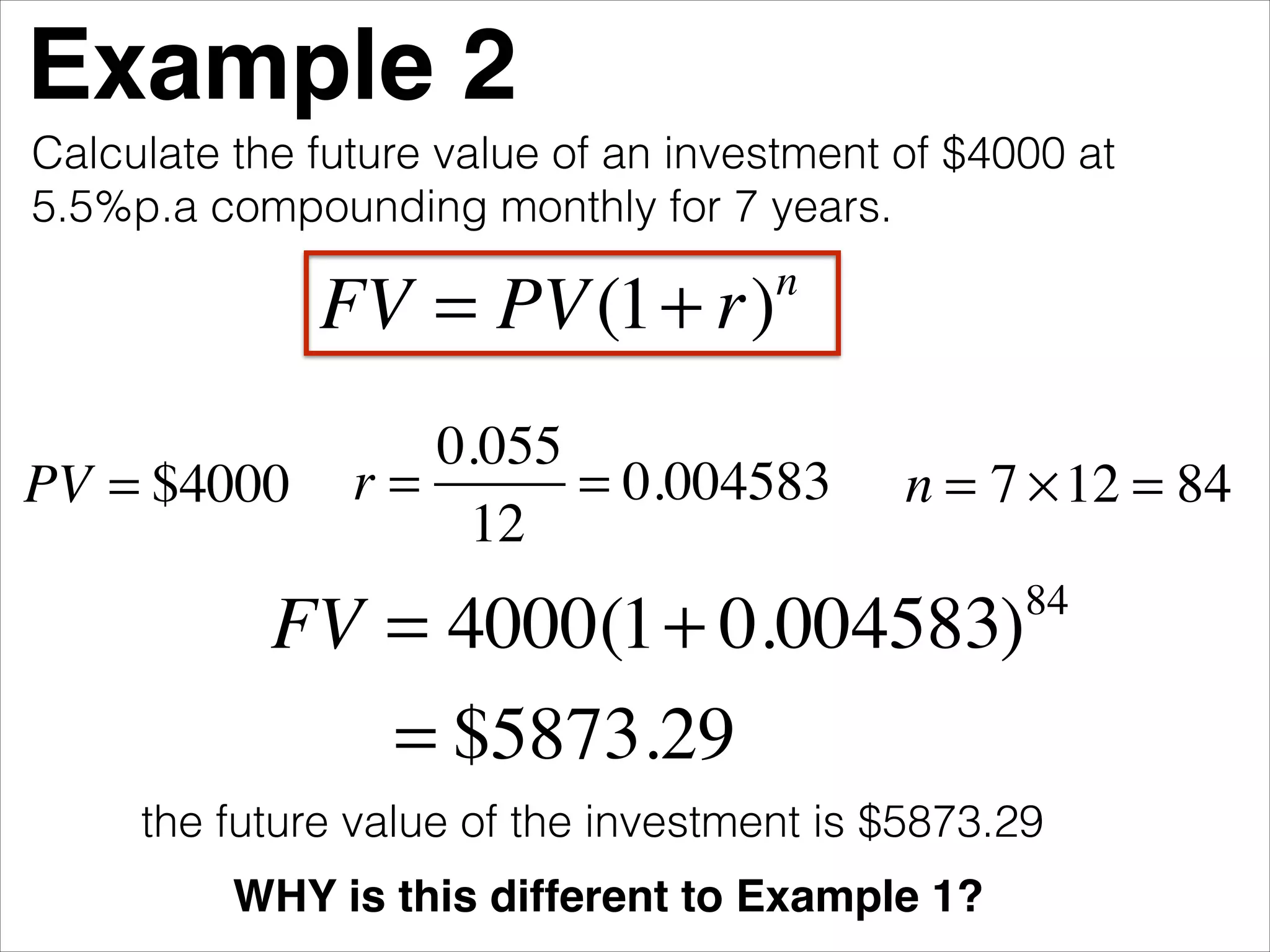

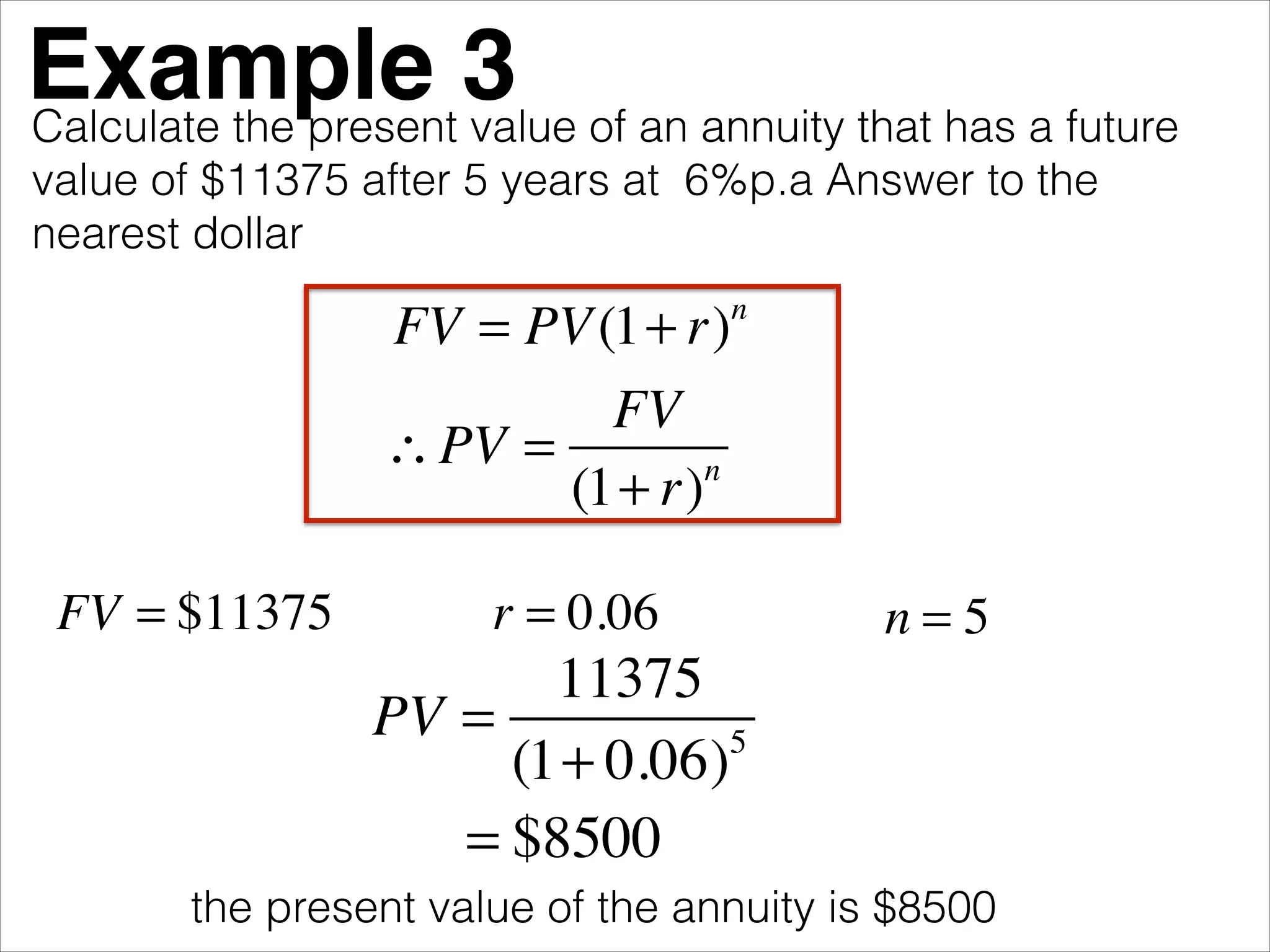

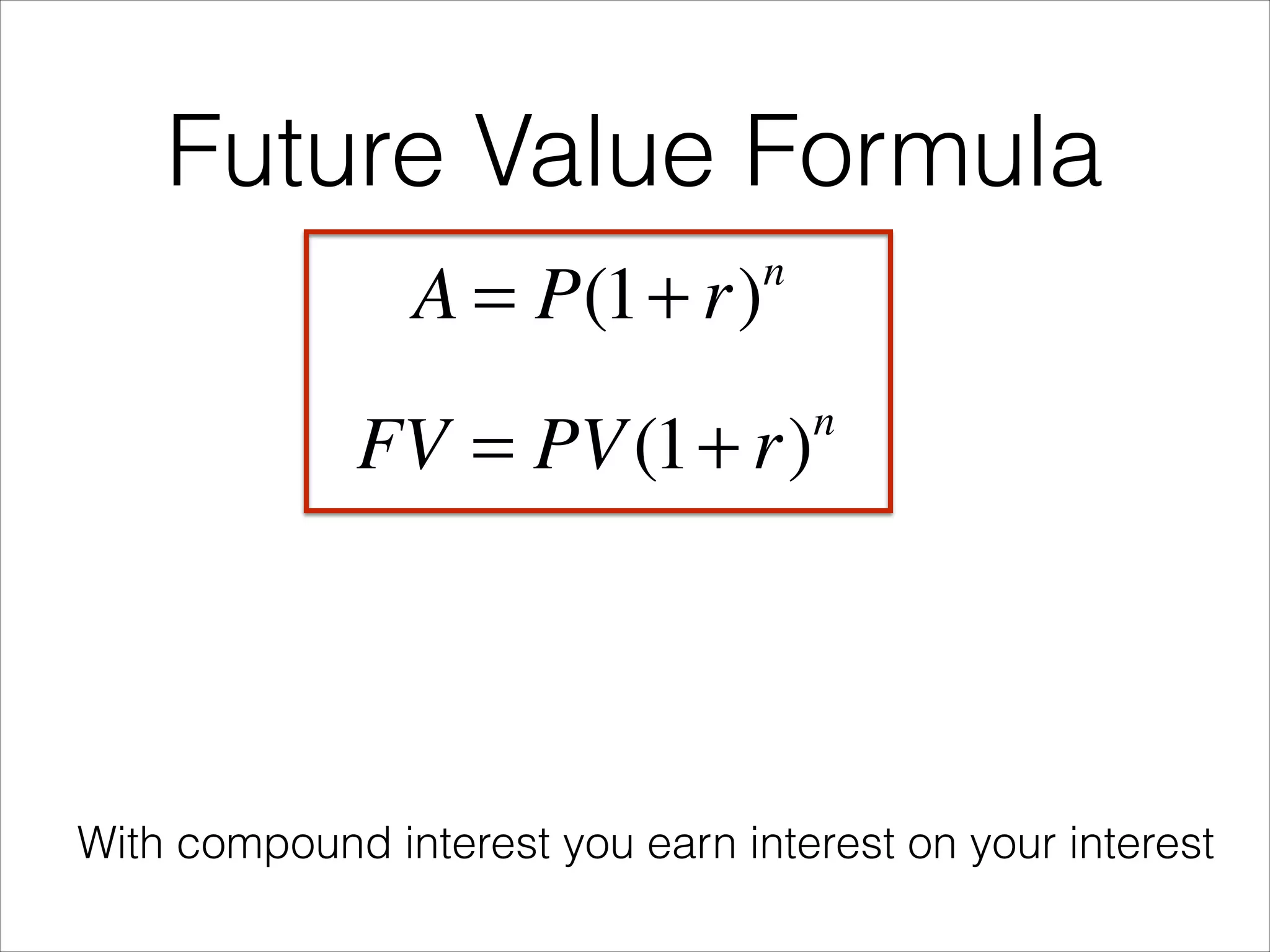

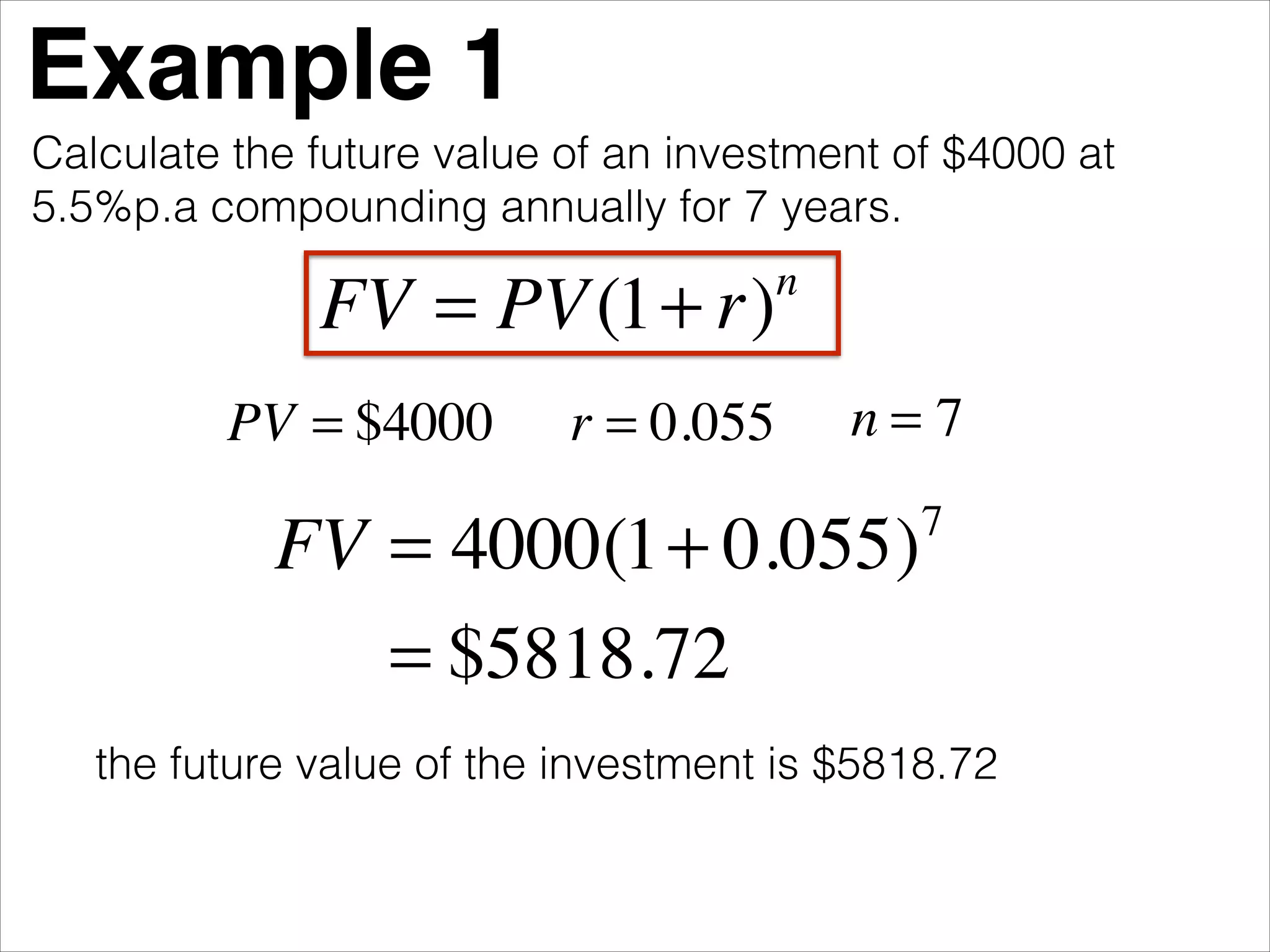

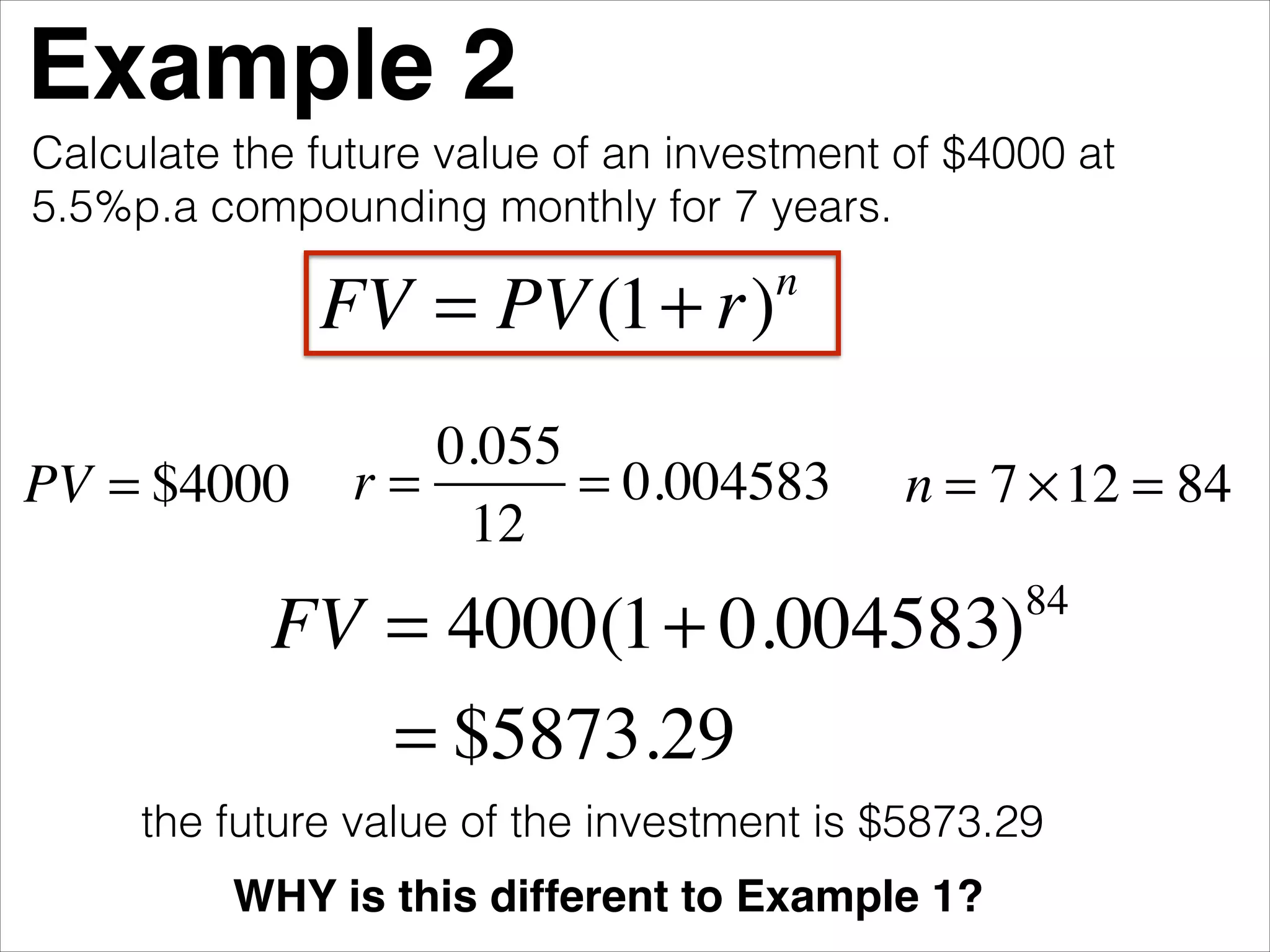

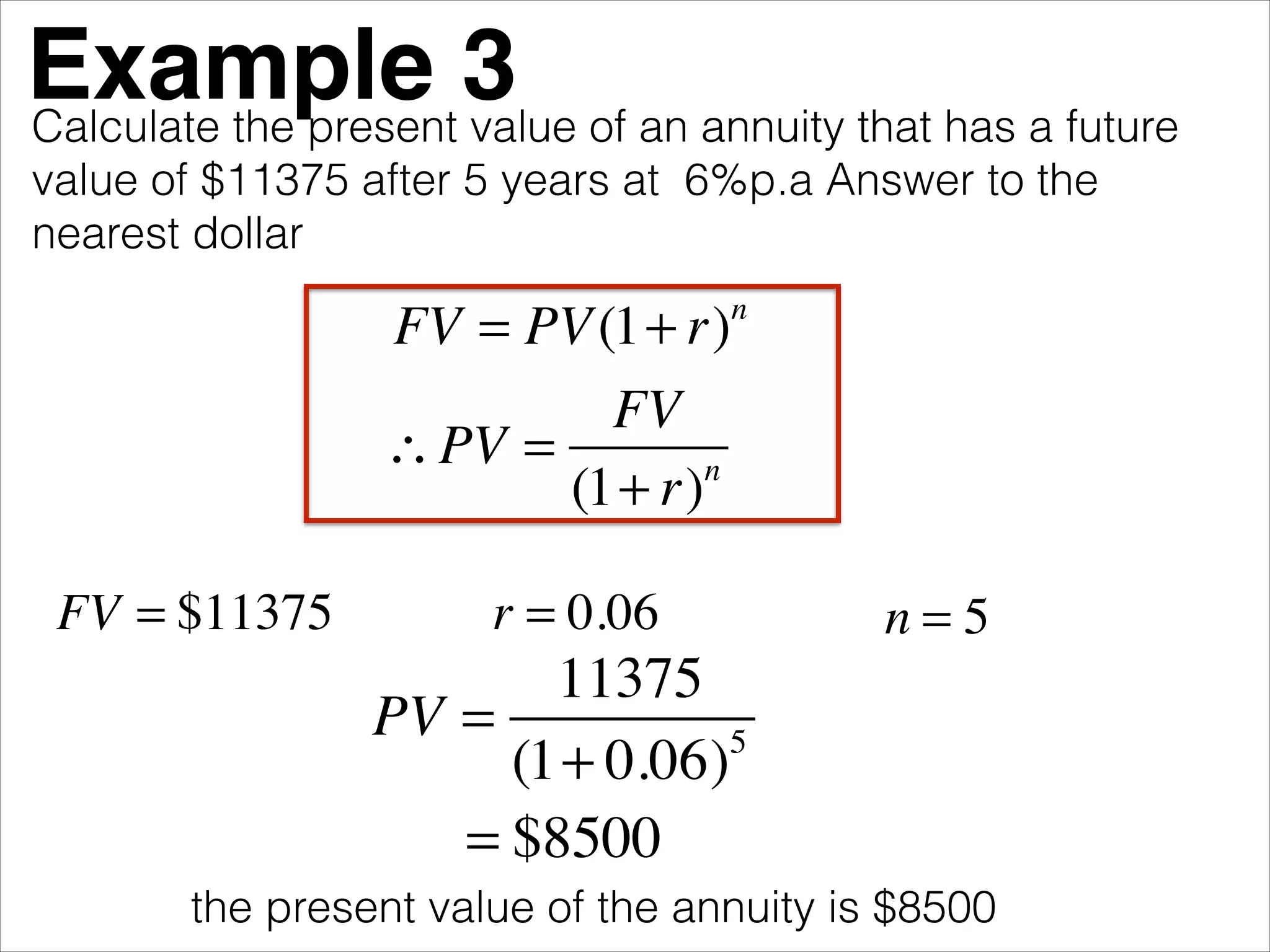

This document provides three examples of calculating future and present values of investments using compound interest formulas. The first two examples show calculating the future value after 7 years of an initial $4000 investment at 5.5% annual interest, with the second example compounding interest monthly rather than annually, resulting in a higher future value. The third example calculates the present value of an annuity worth $11,375 in 5 years at 6% interest per year.