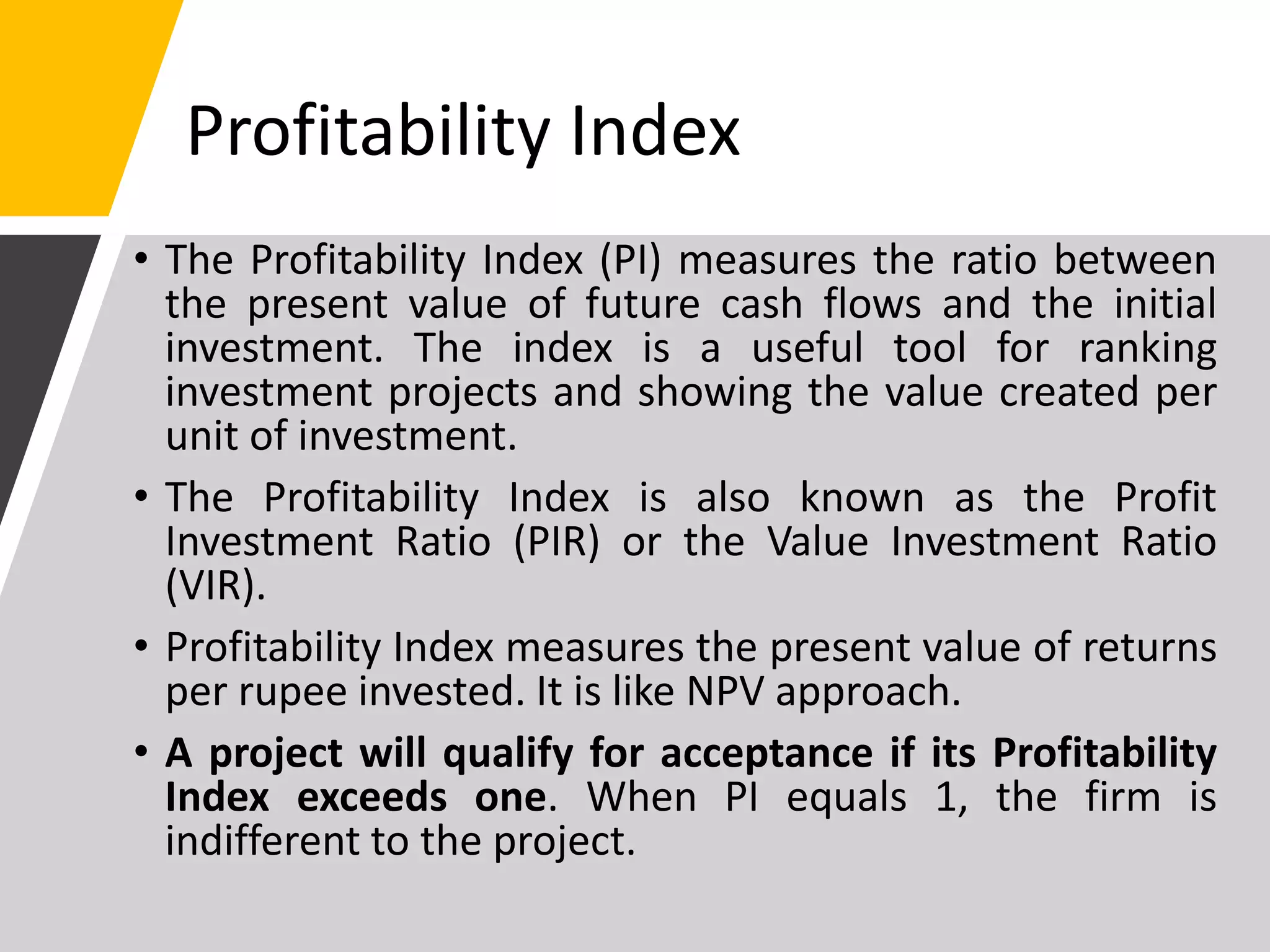

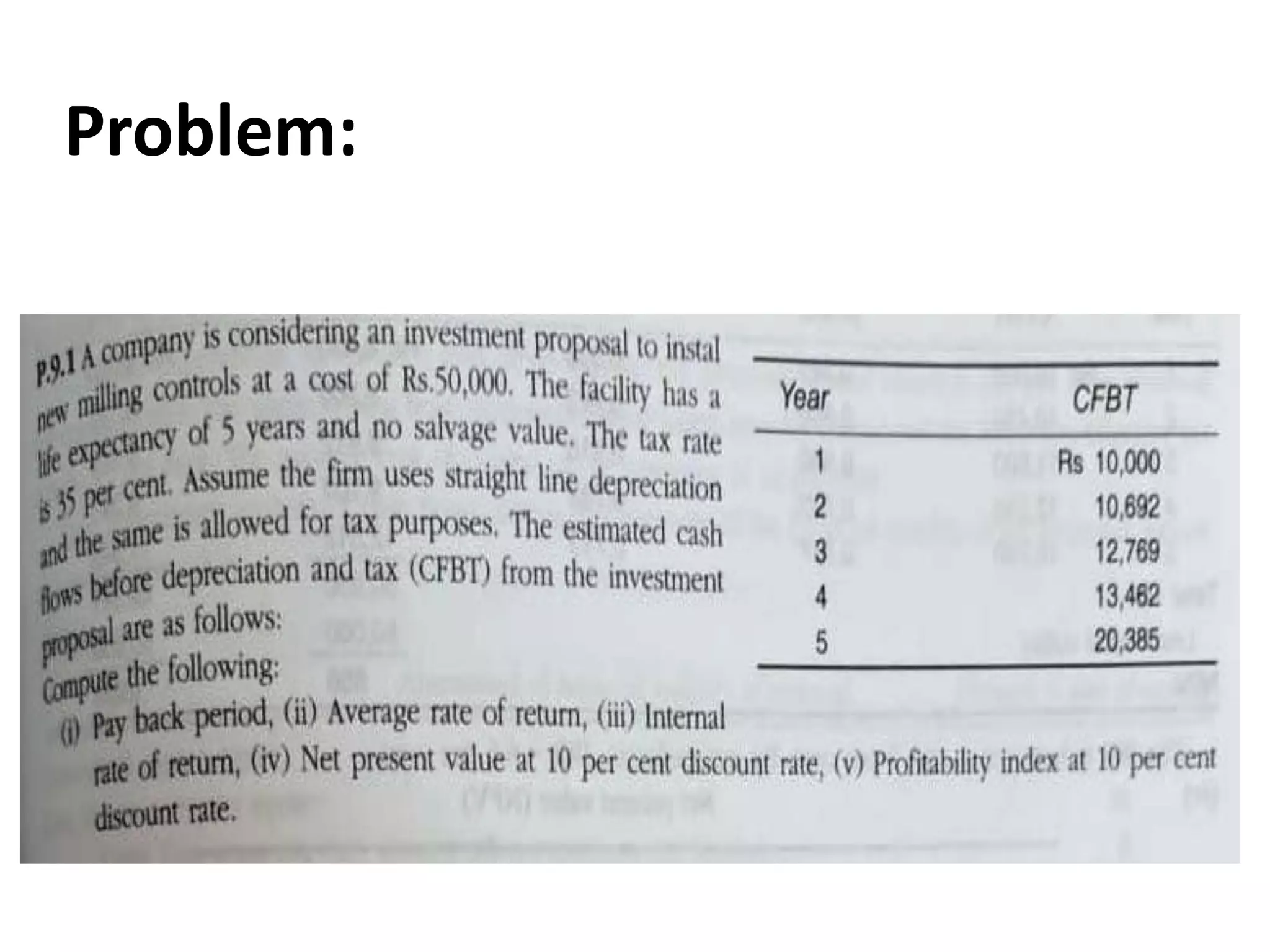

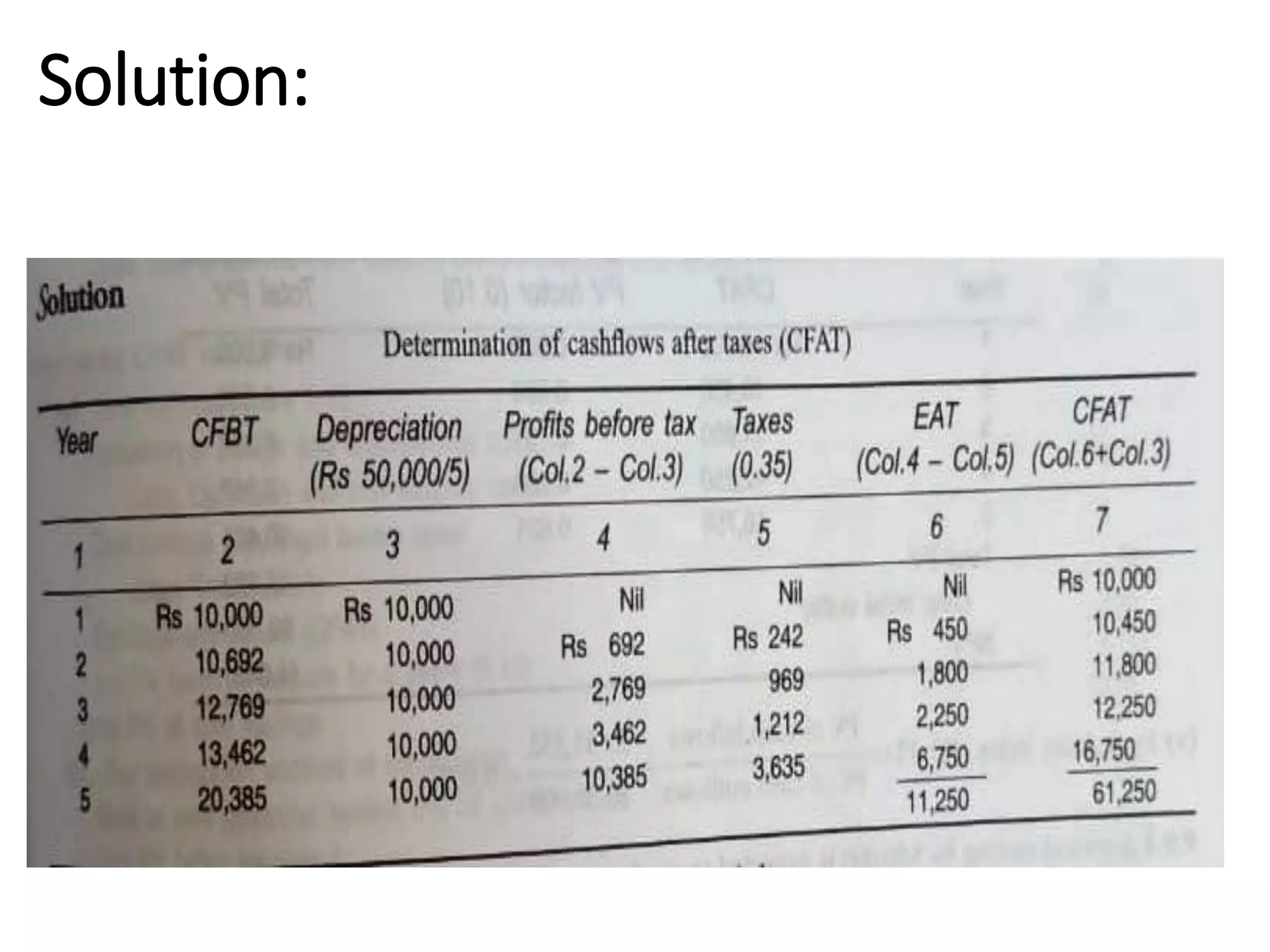

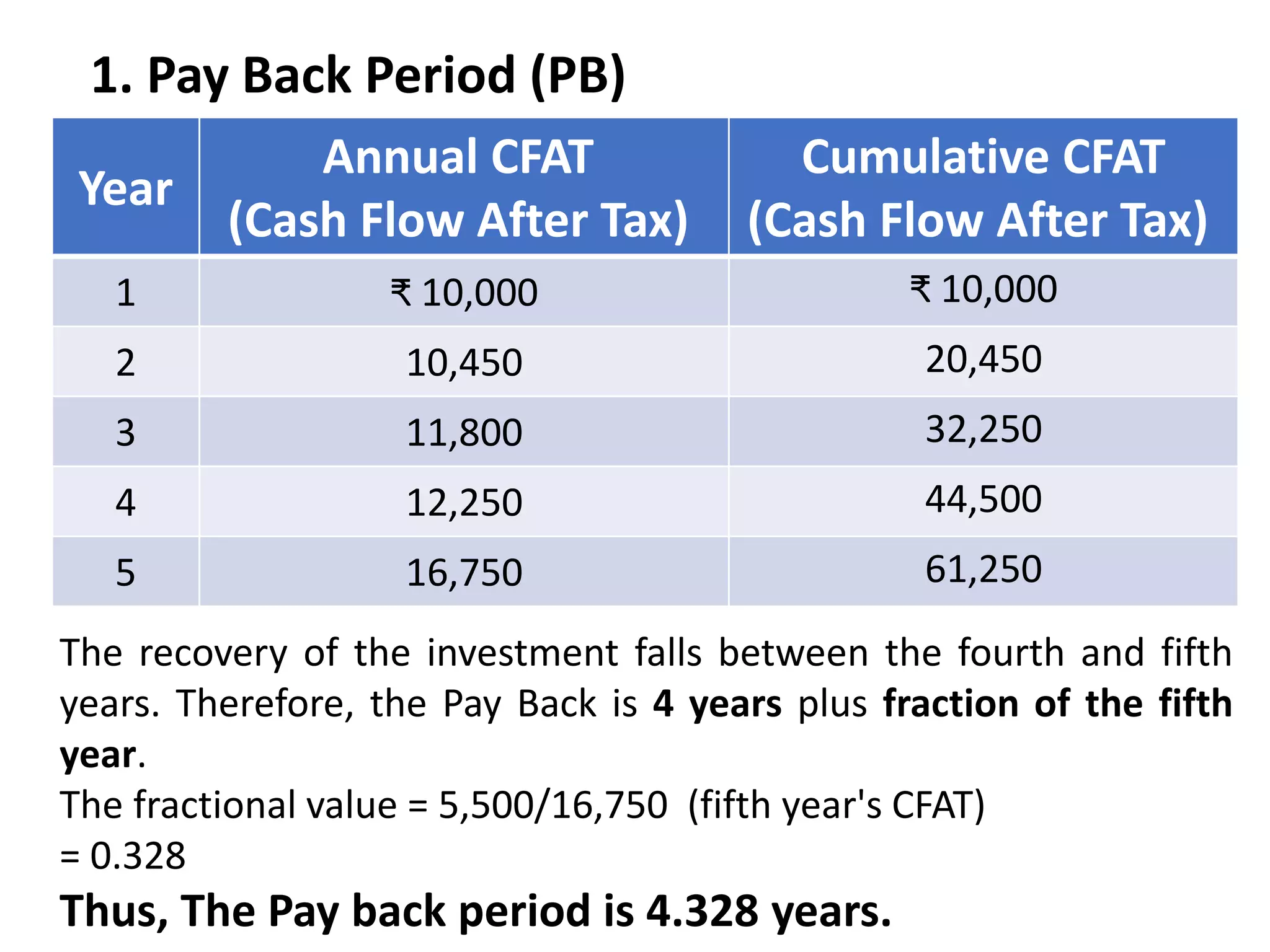

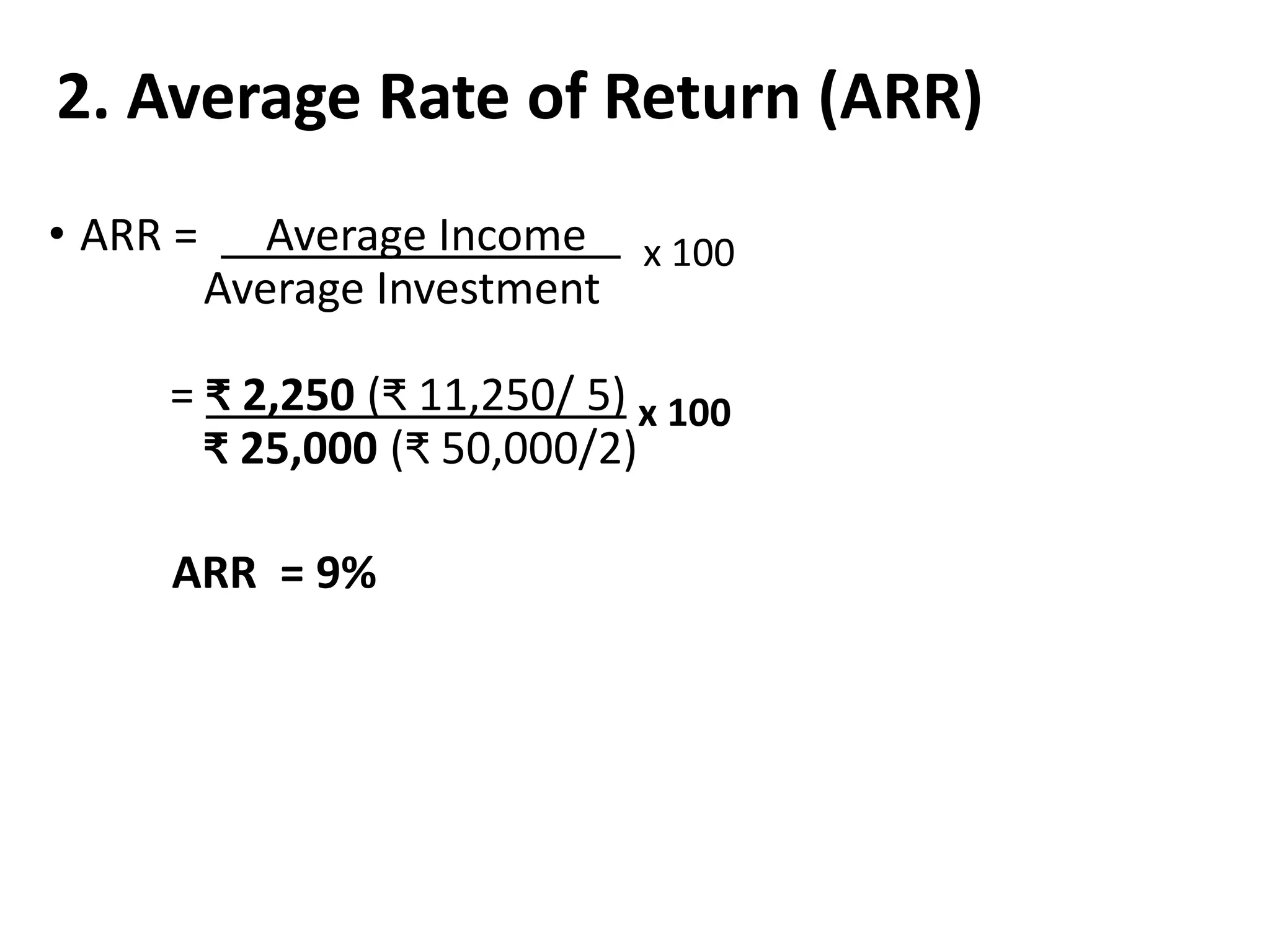

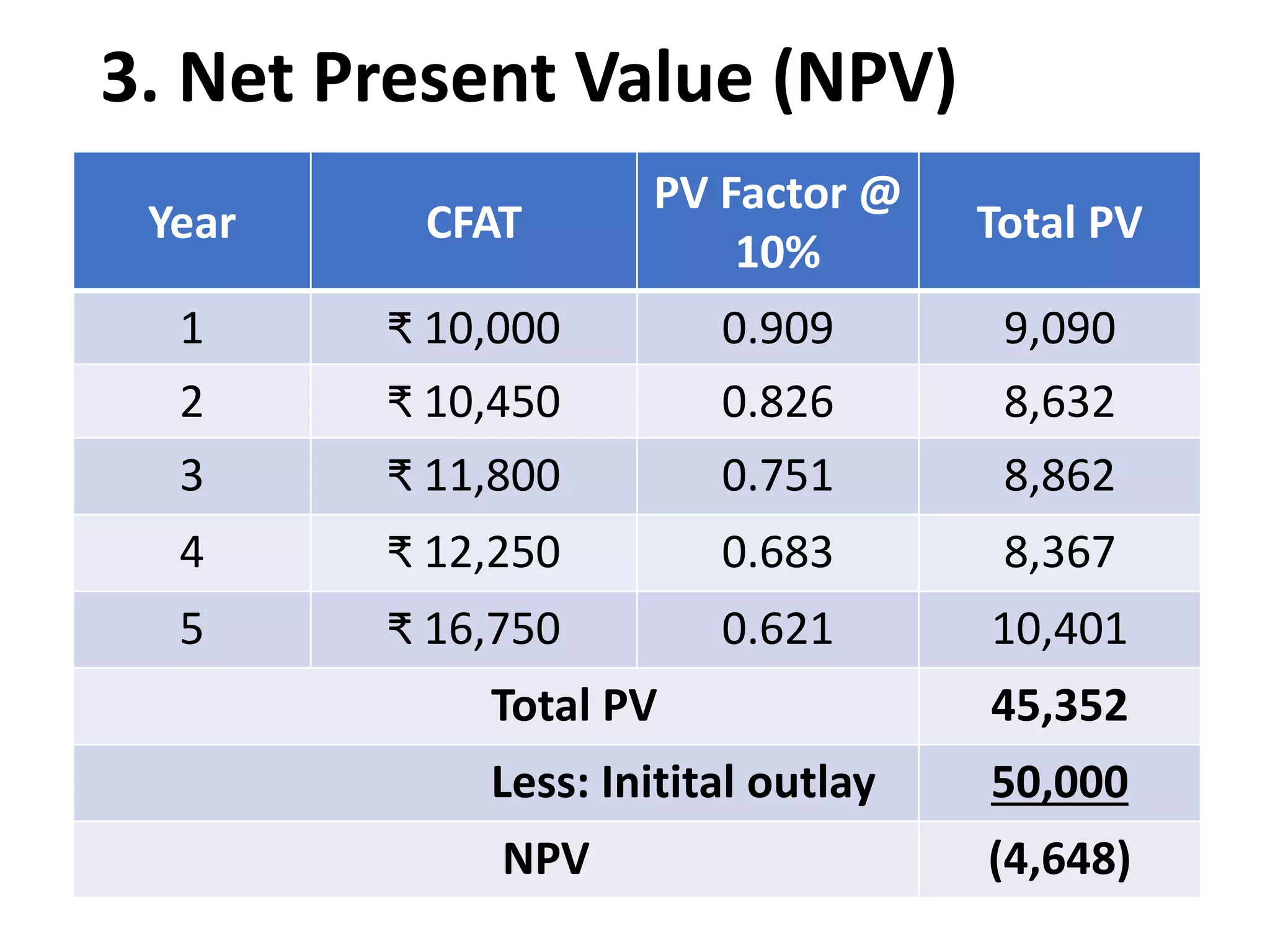

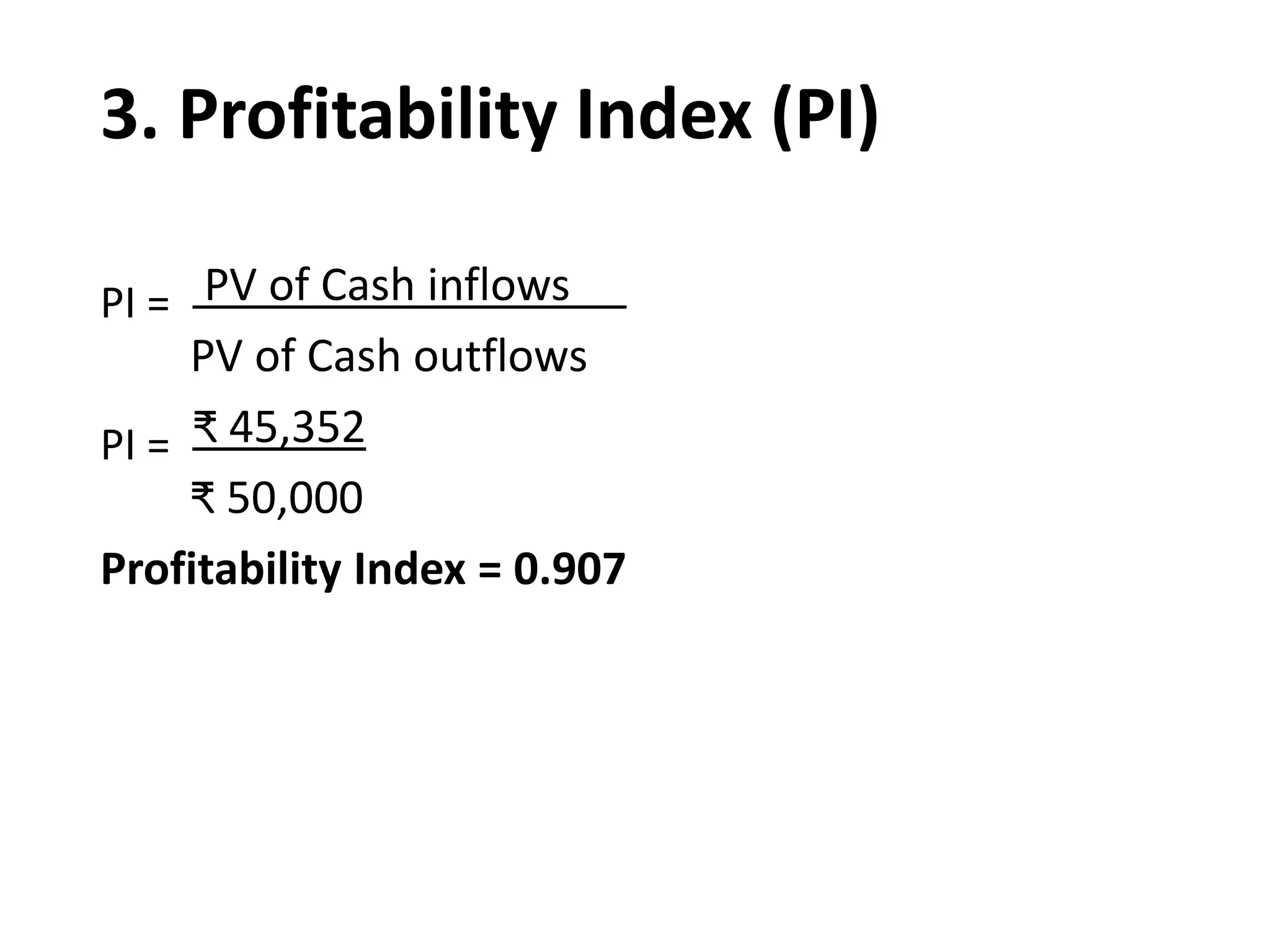

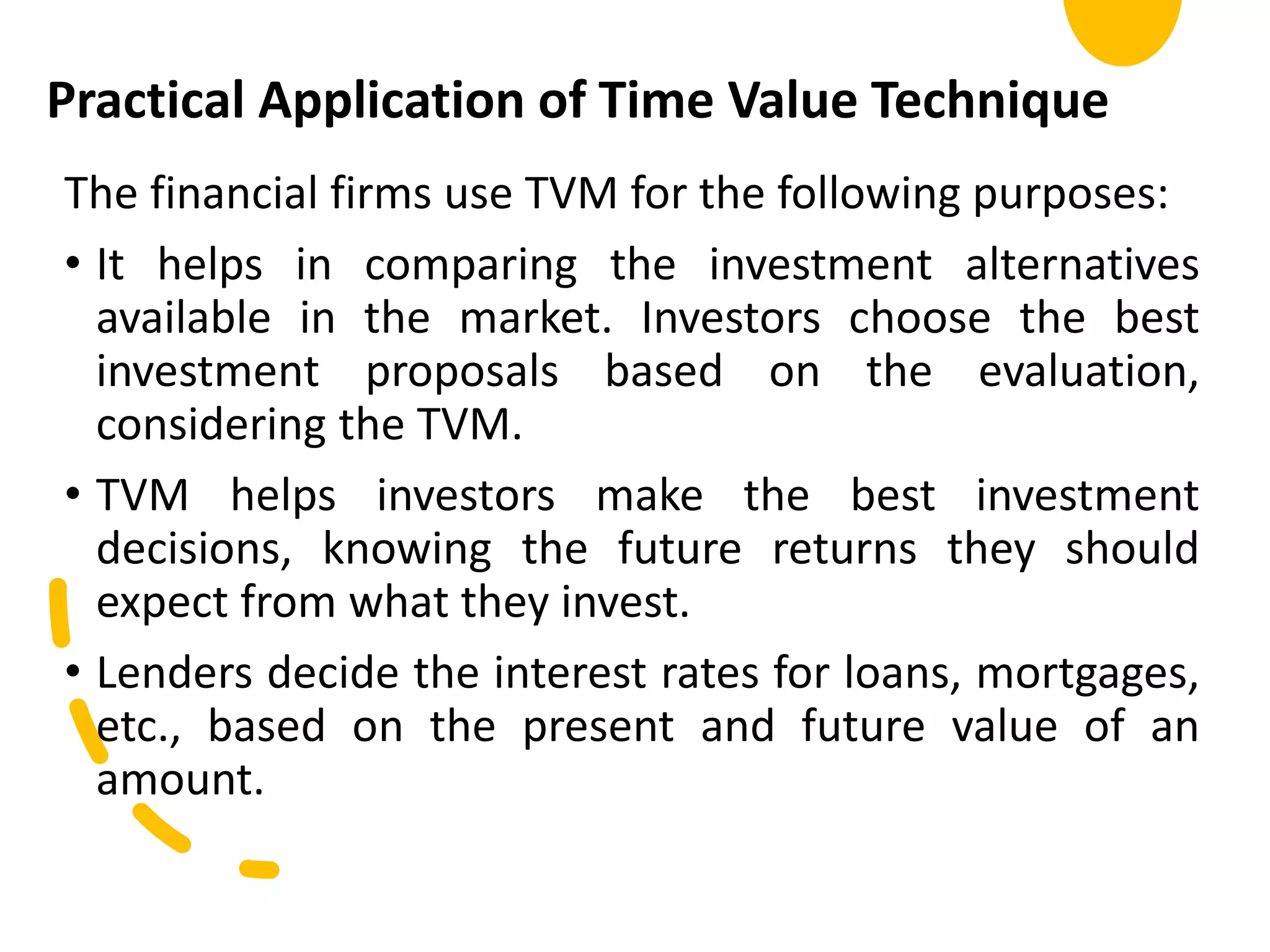

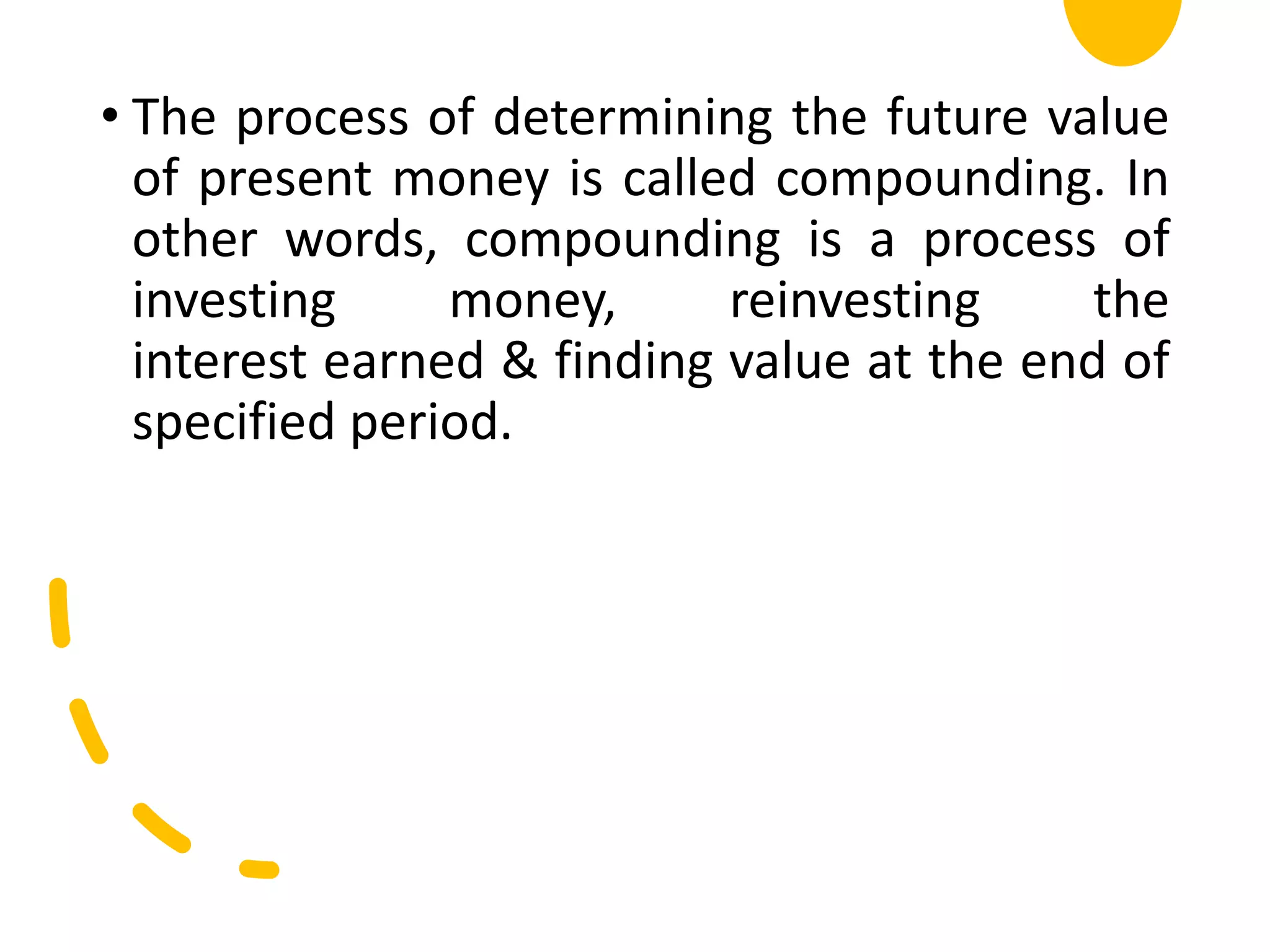

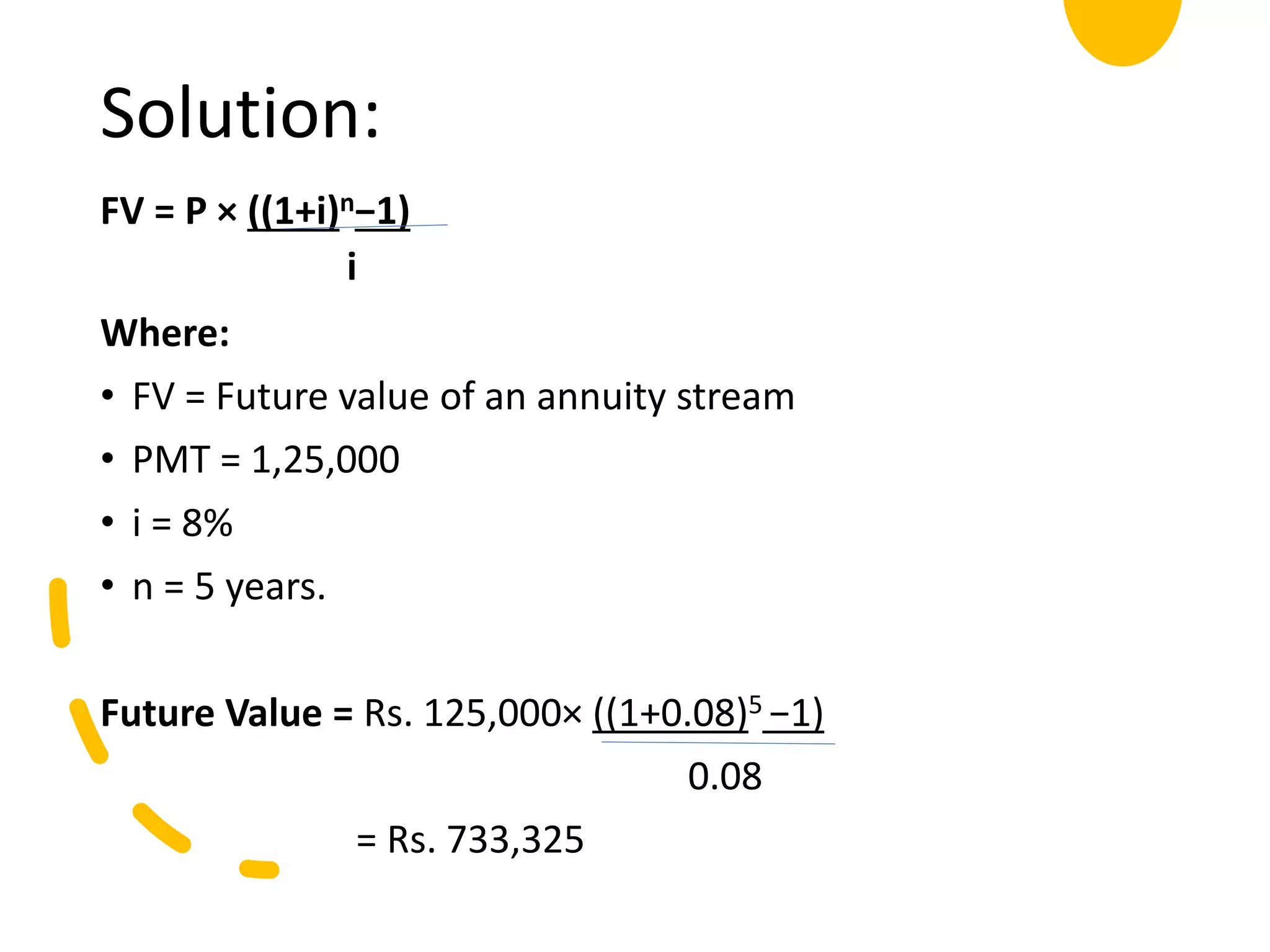

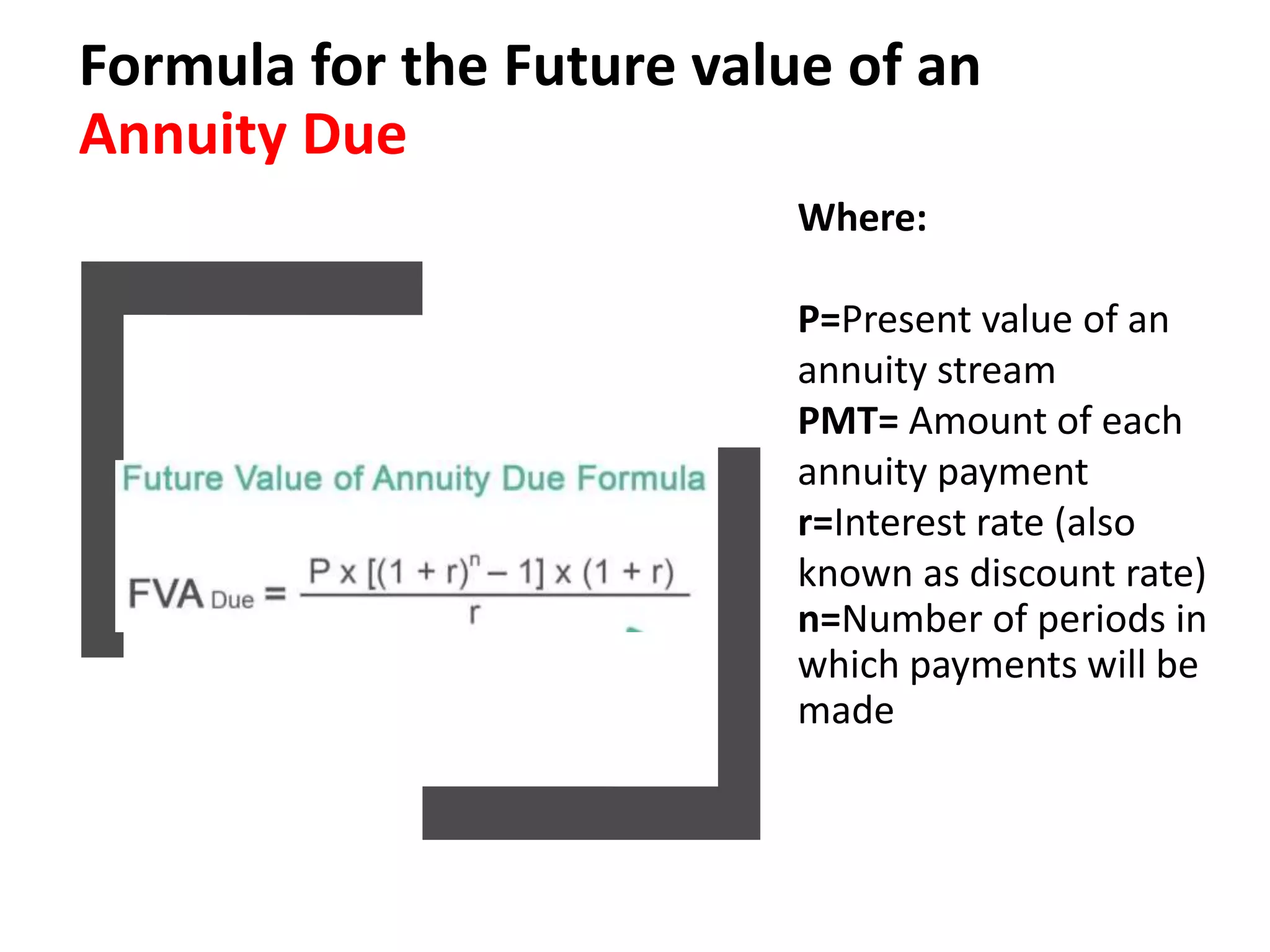

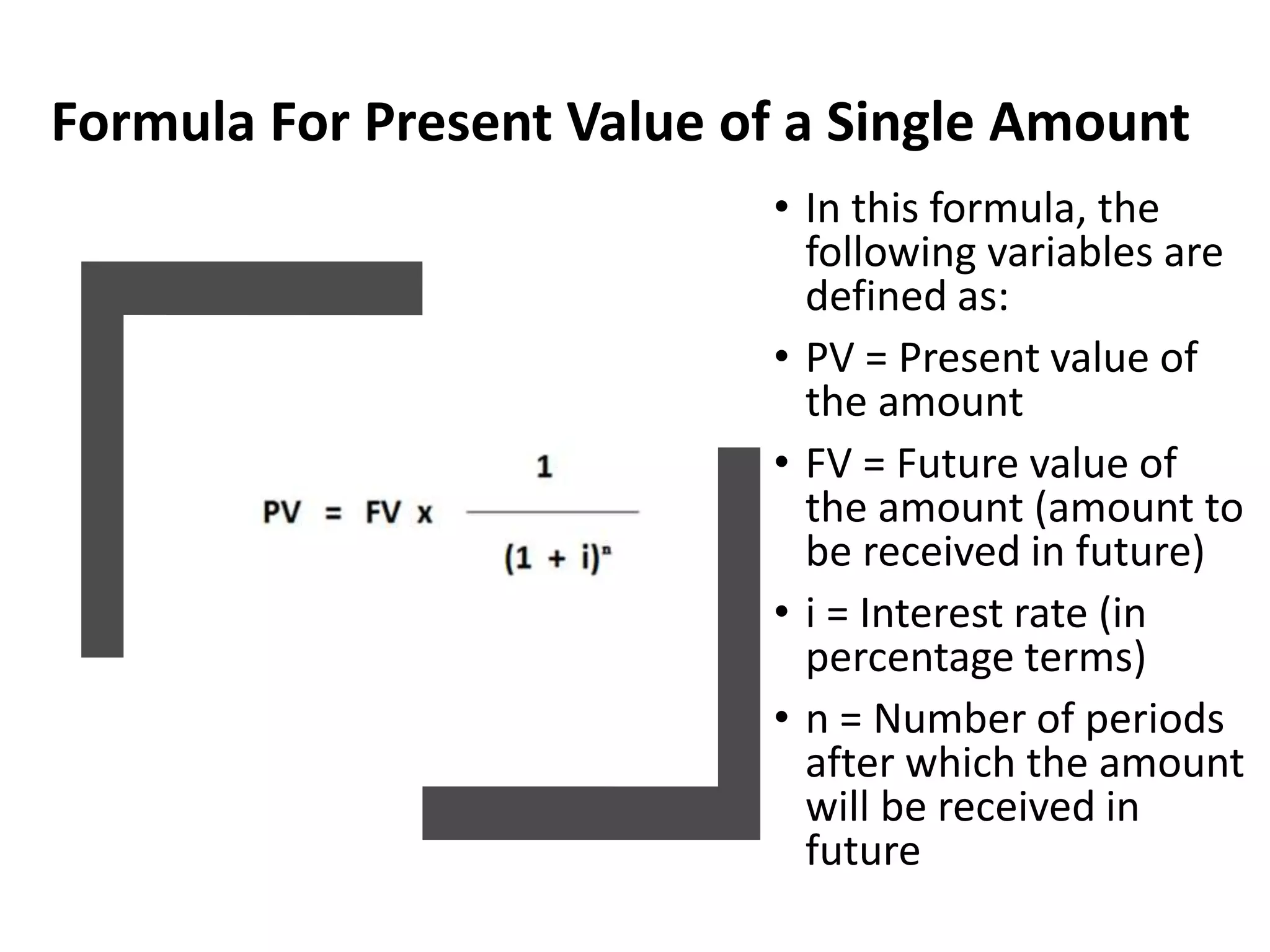

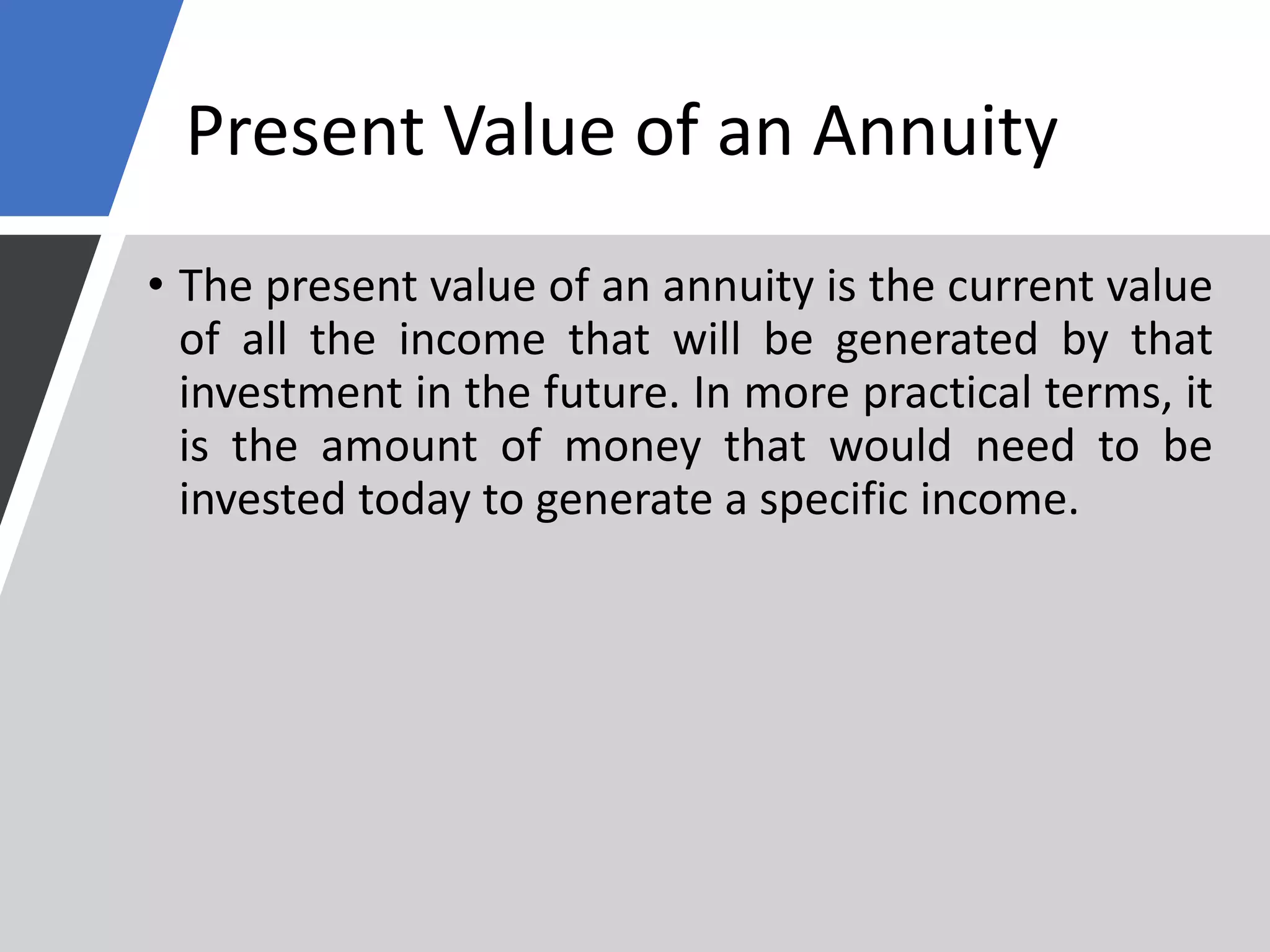

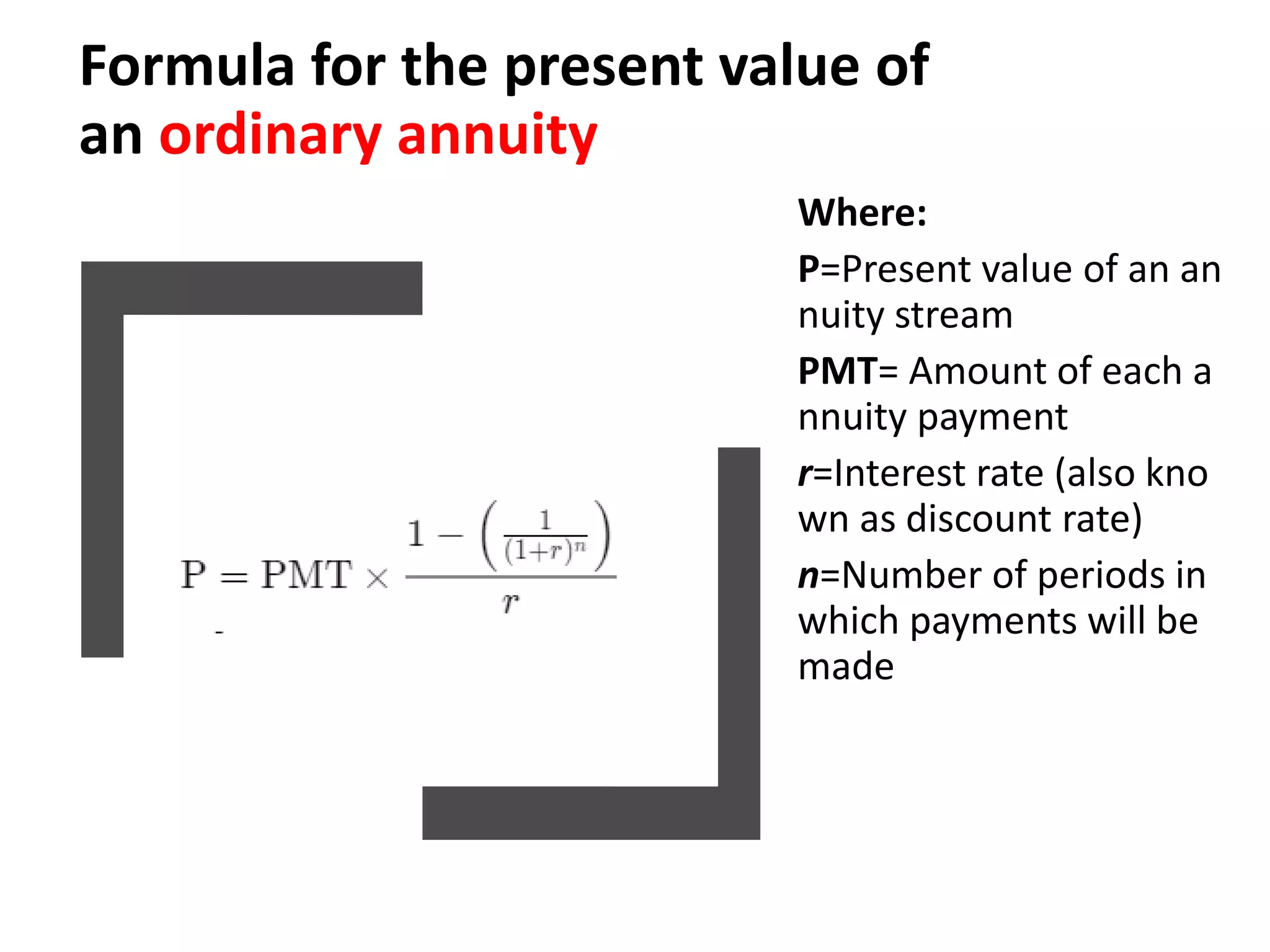

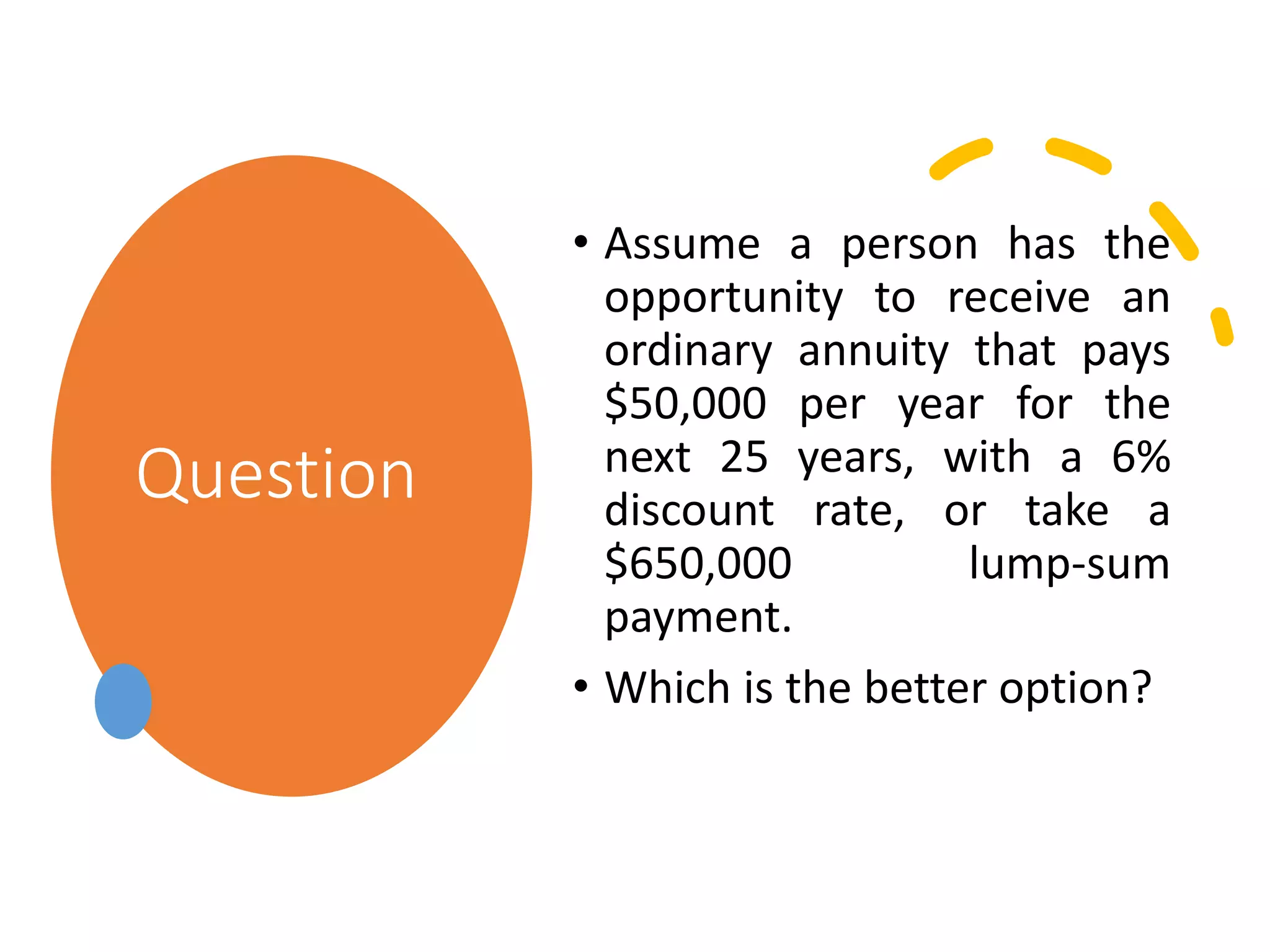

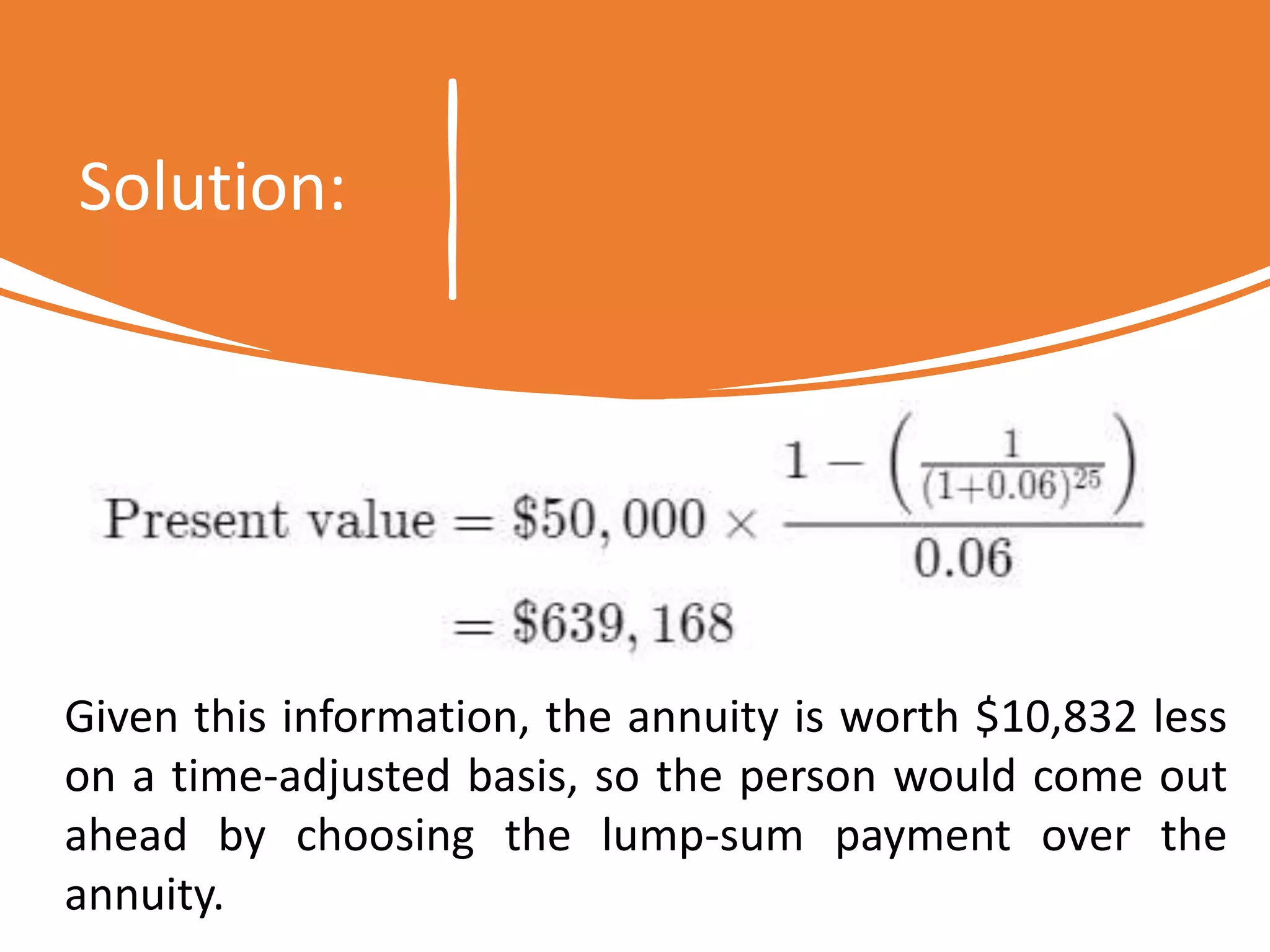

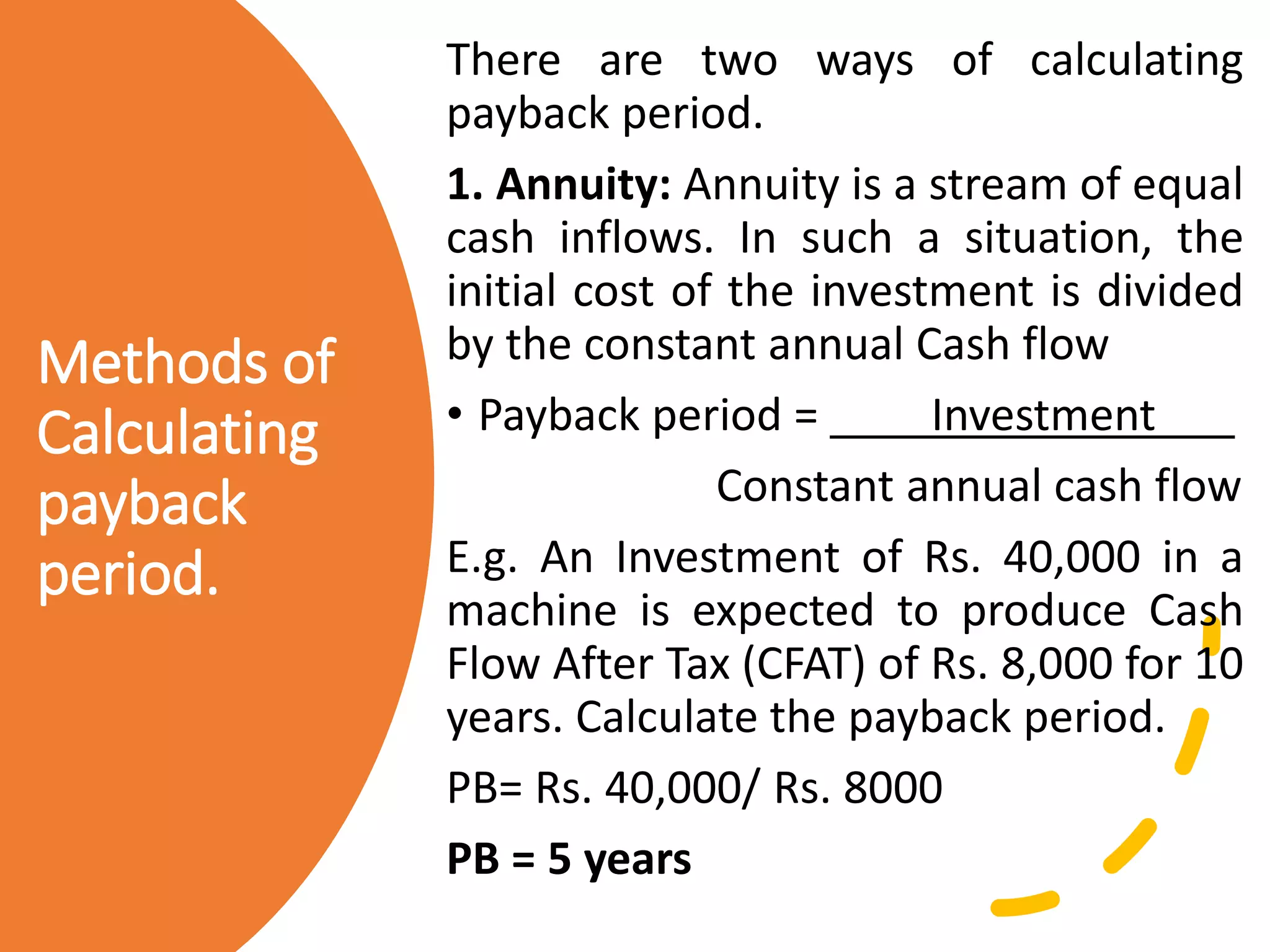

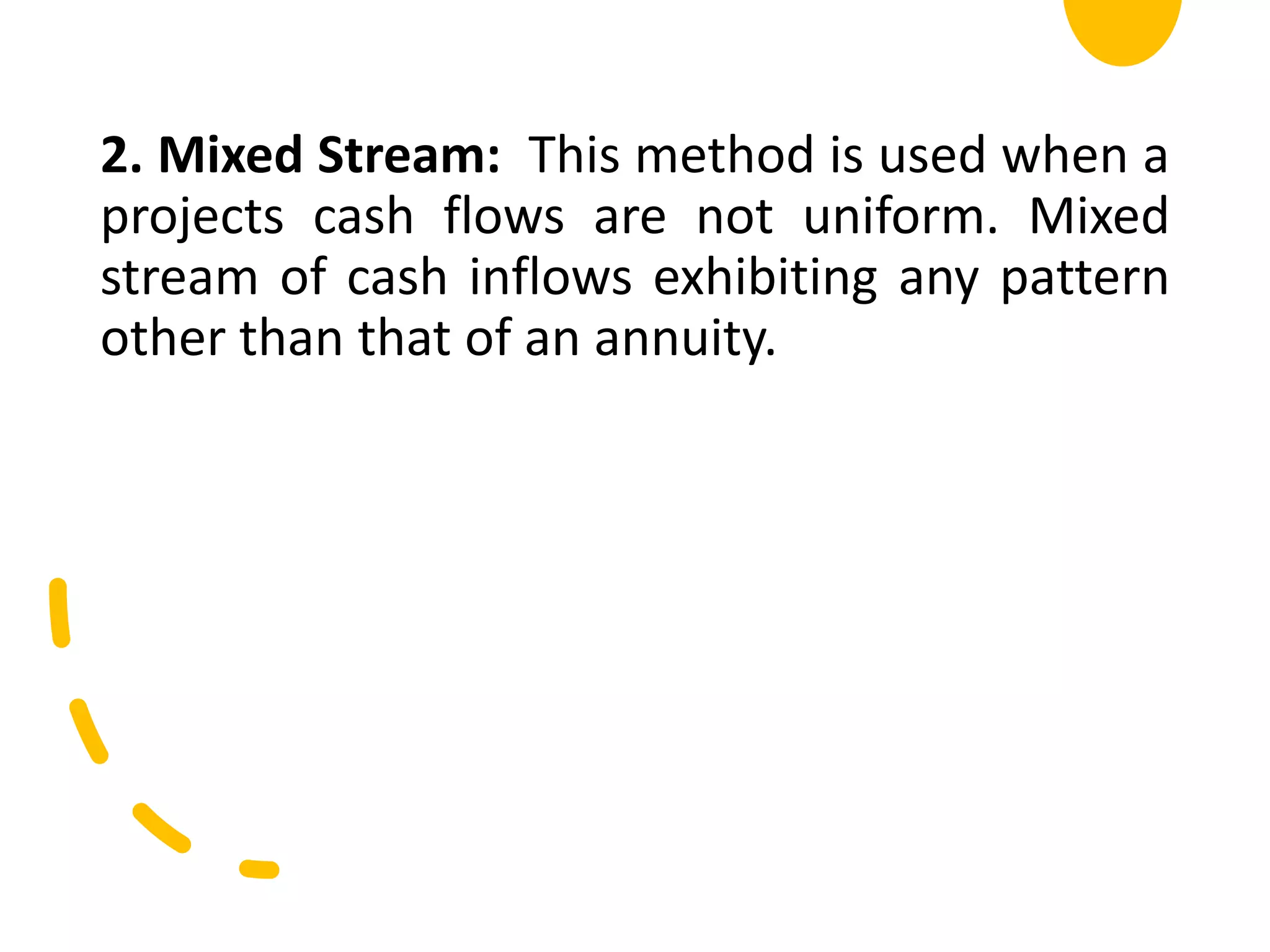

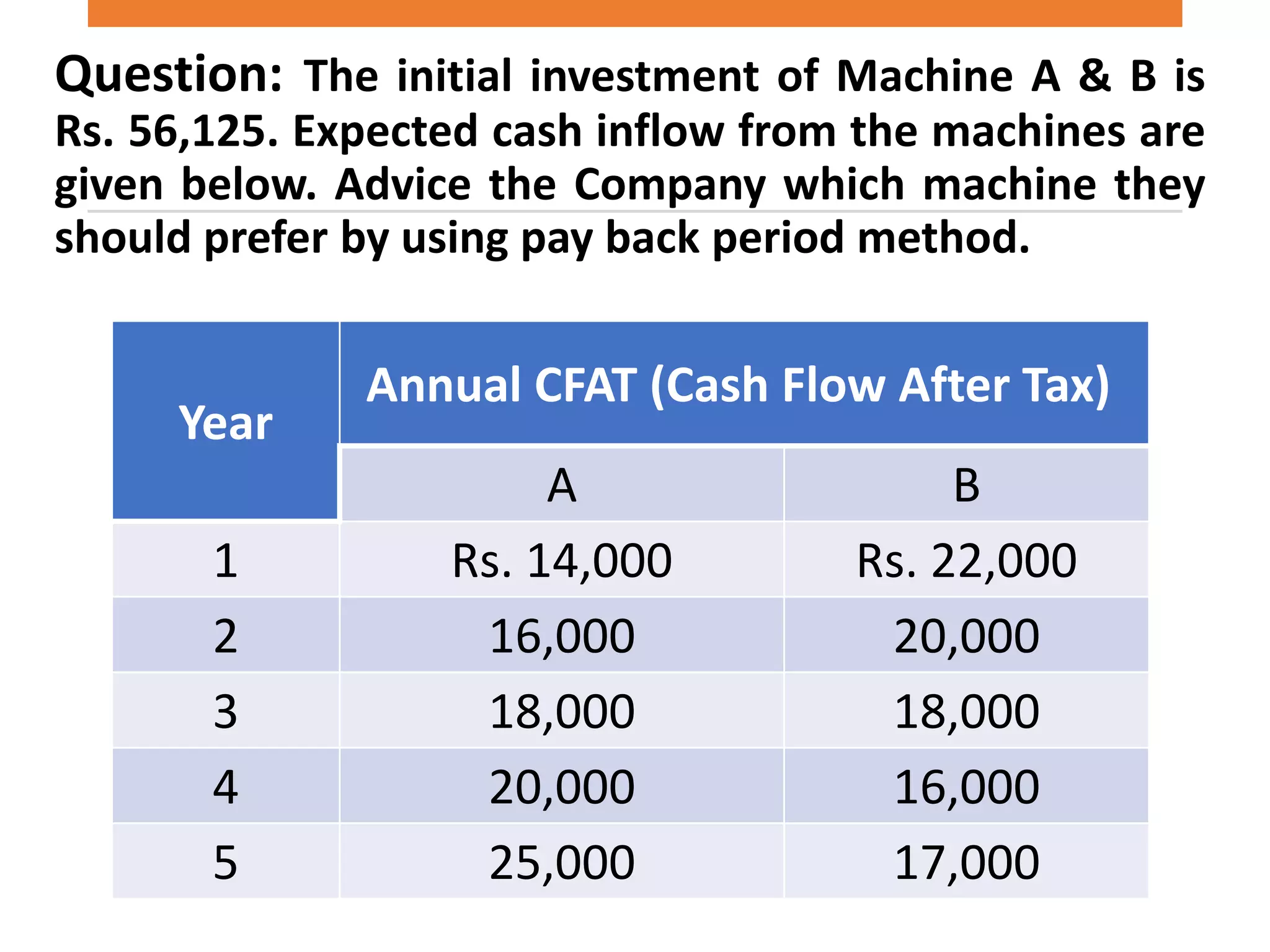

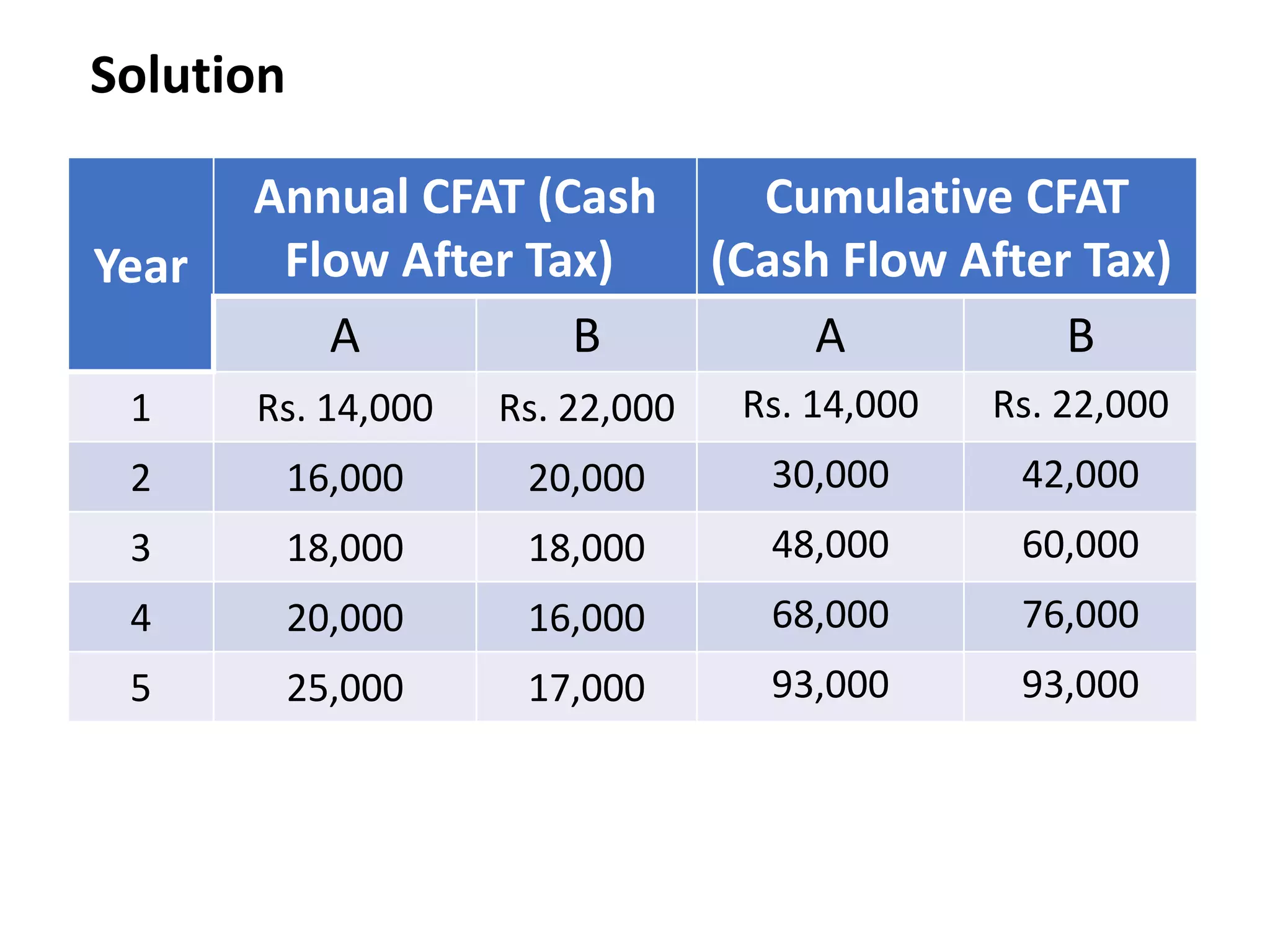

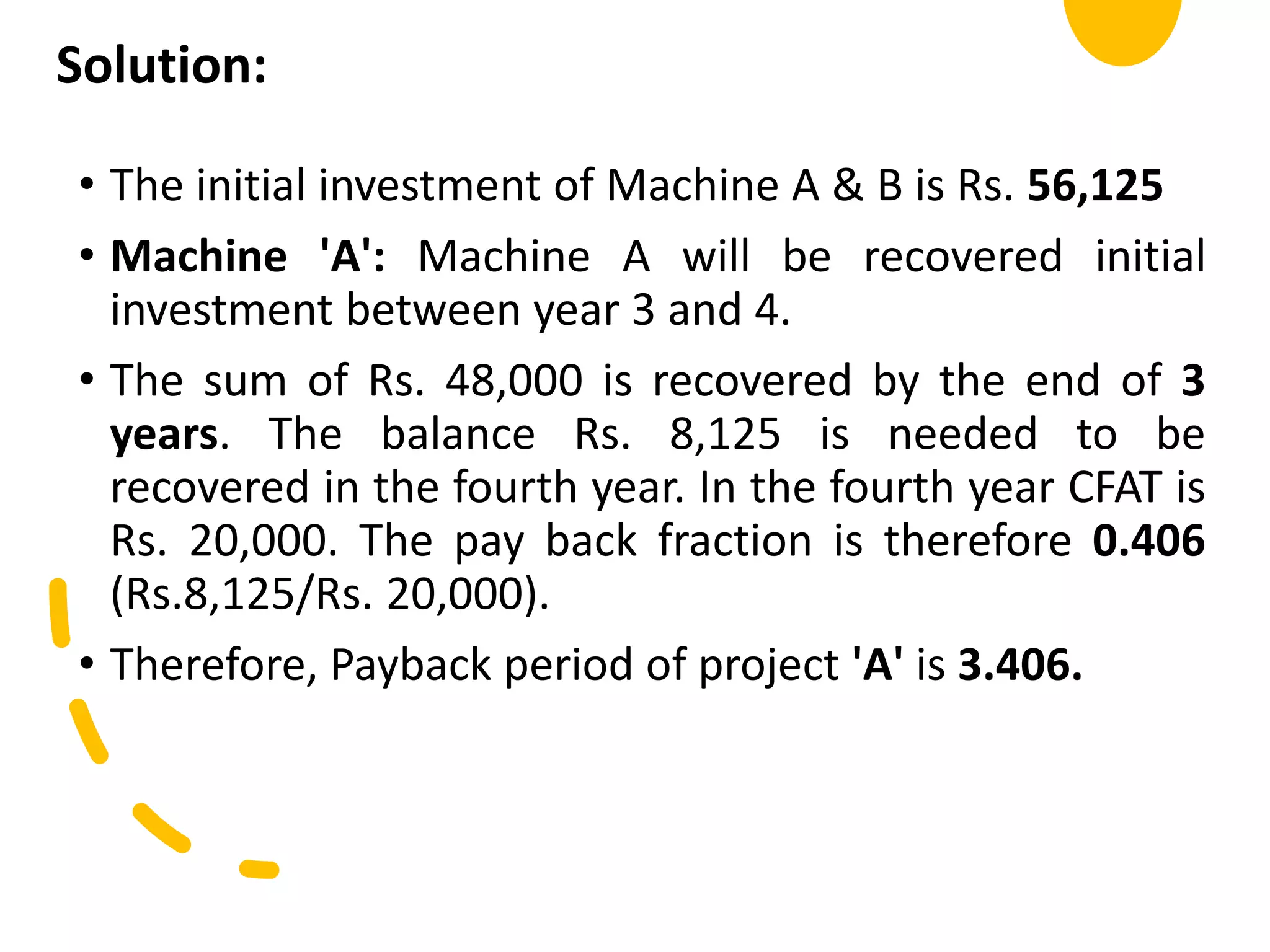

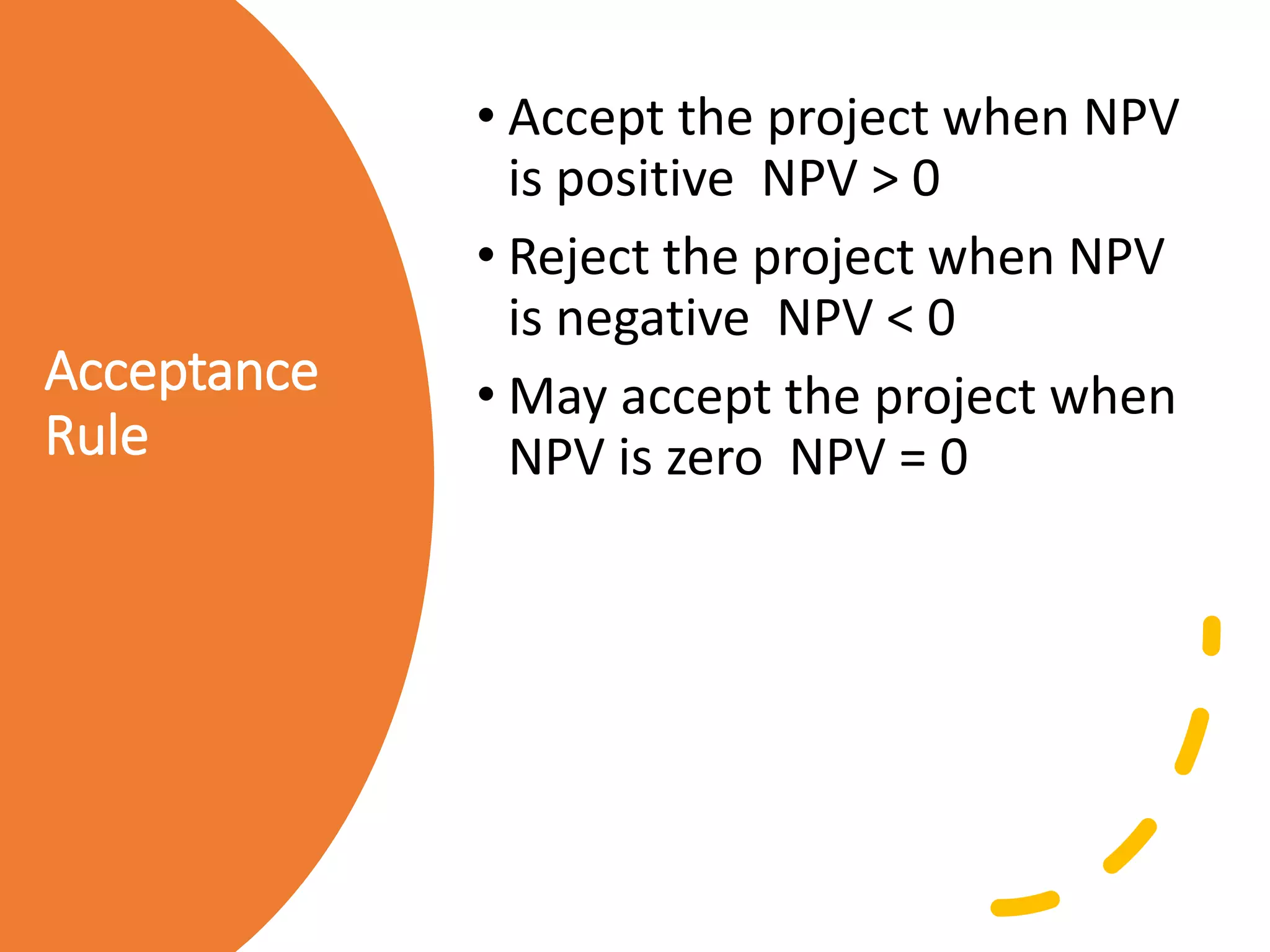

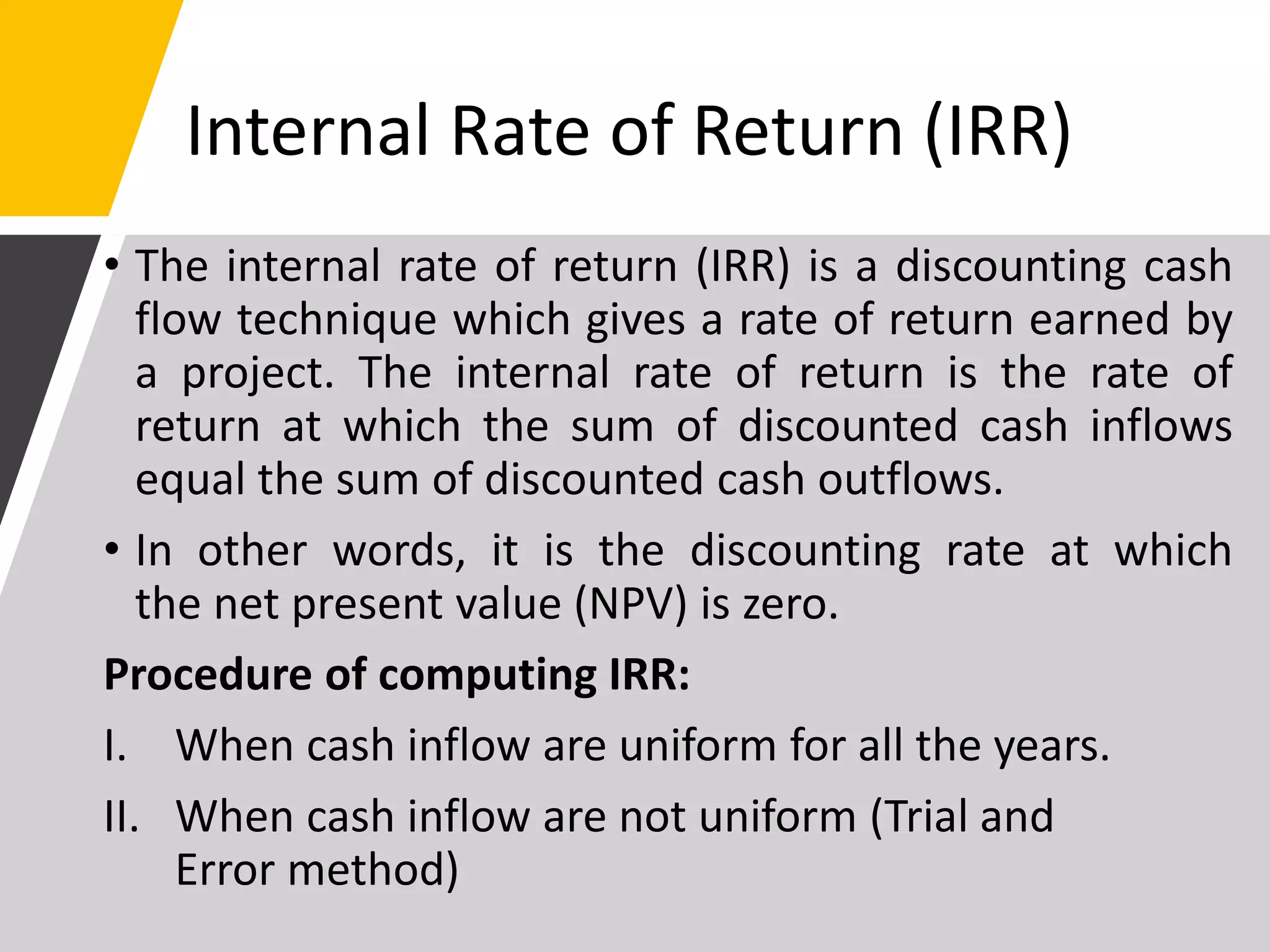

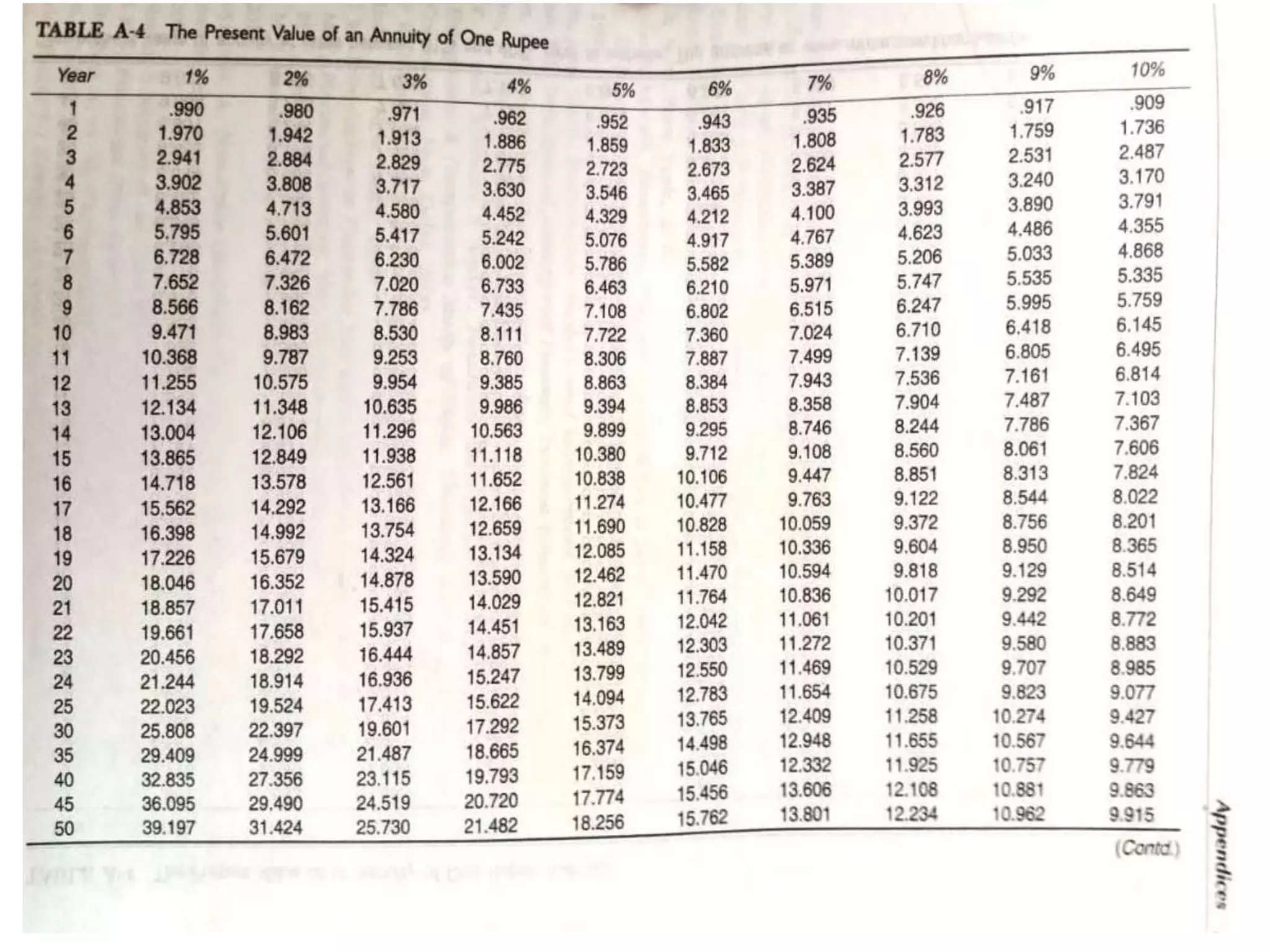

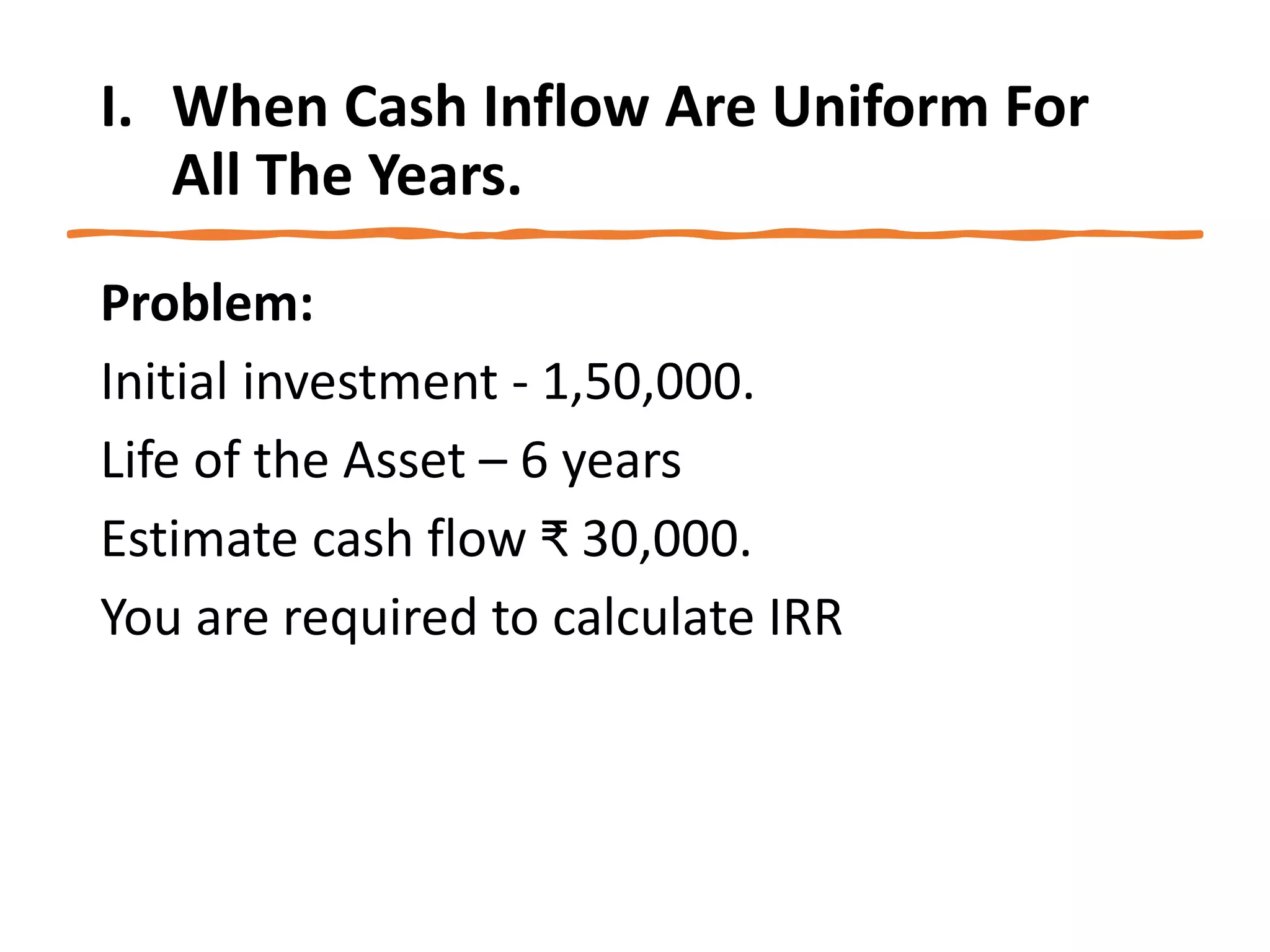

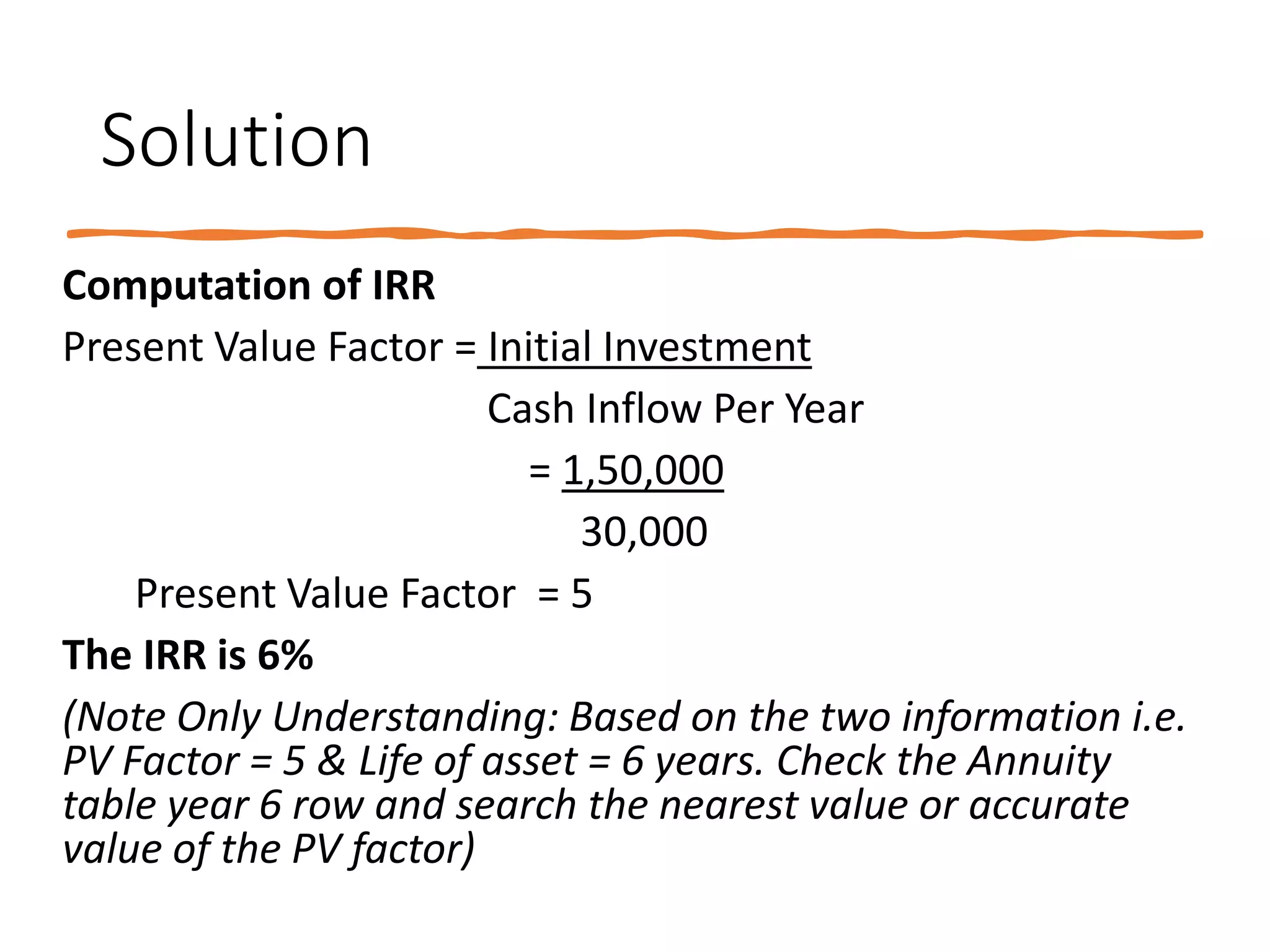

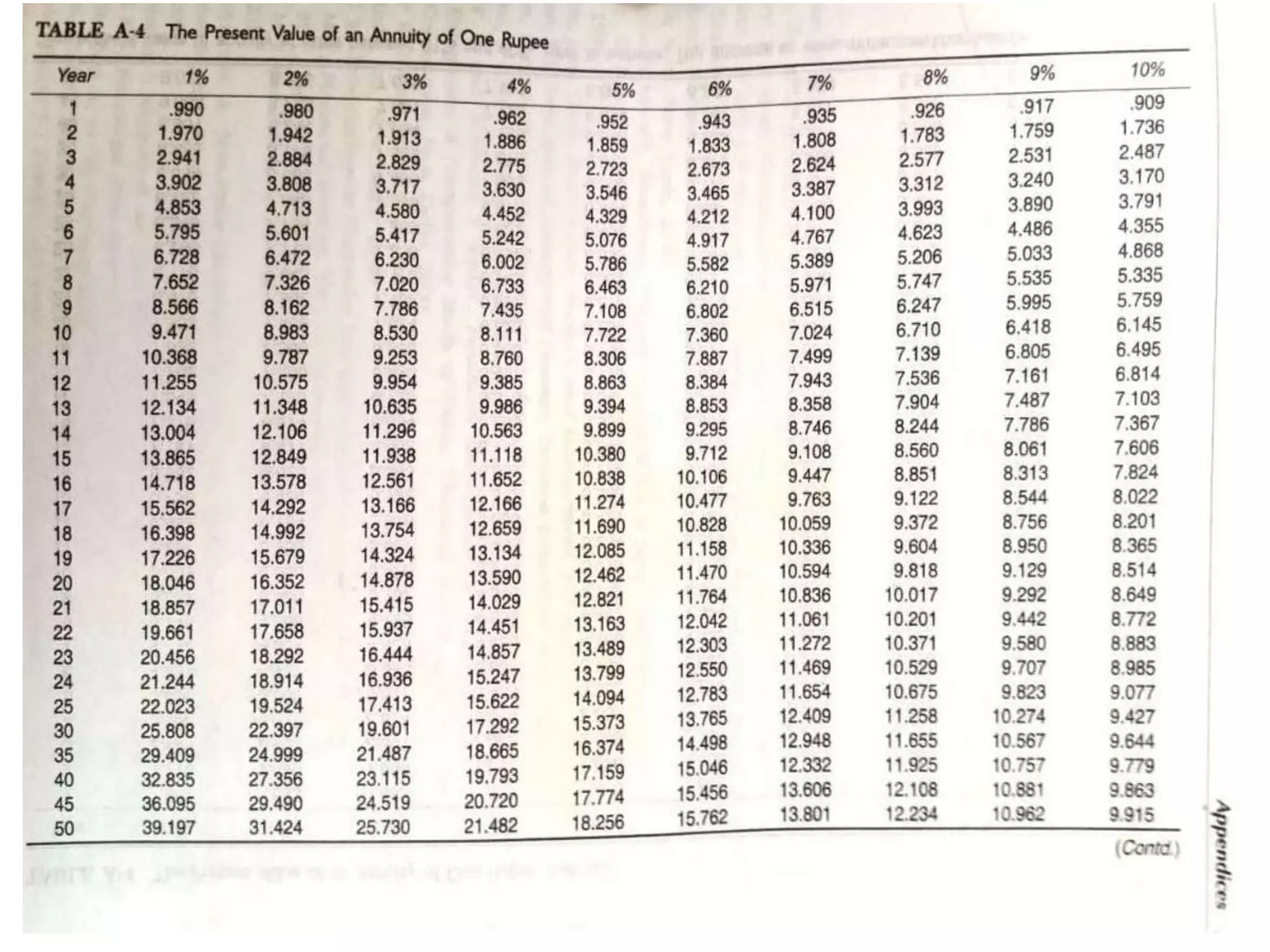

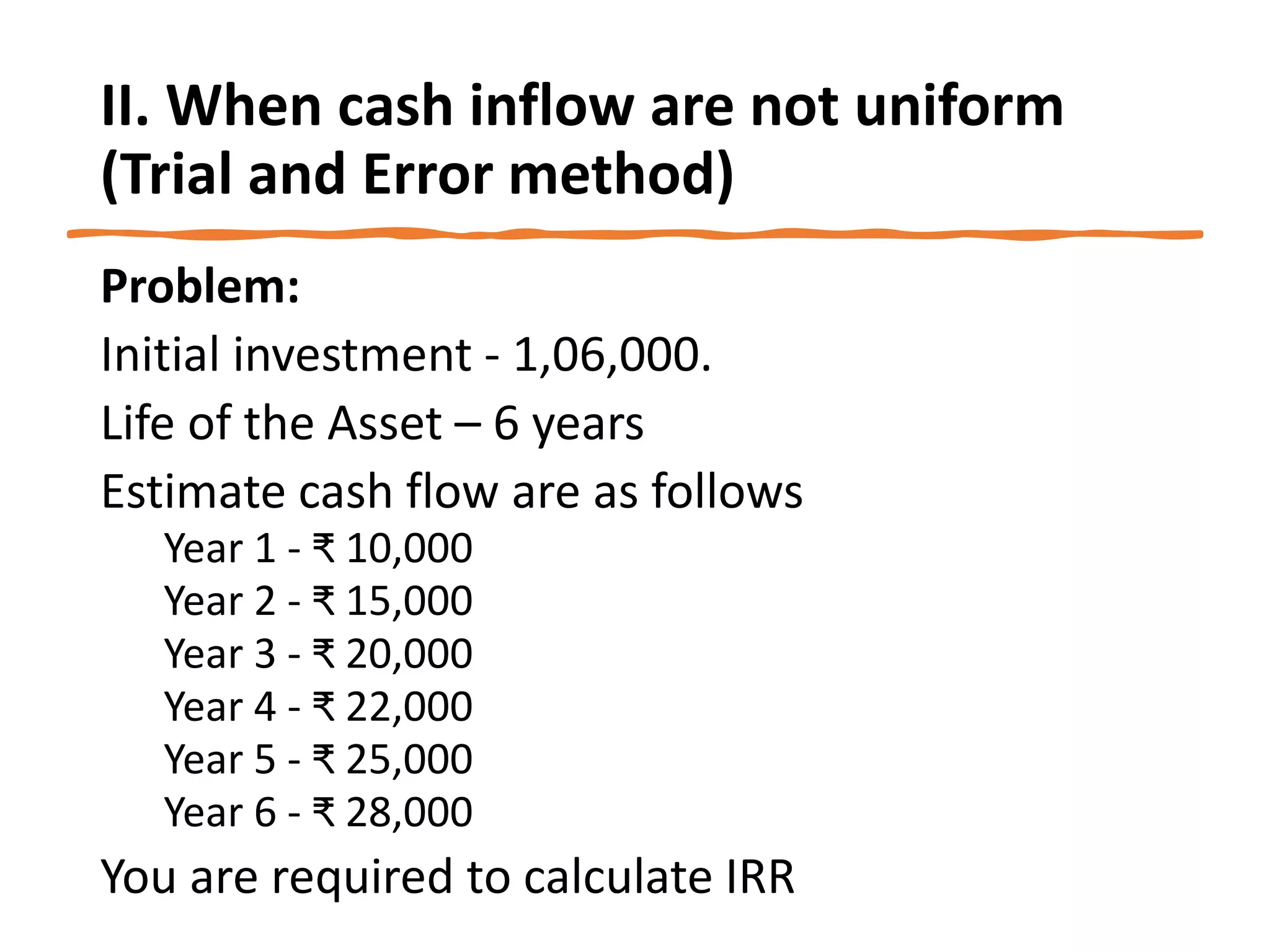

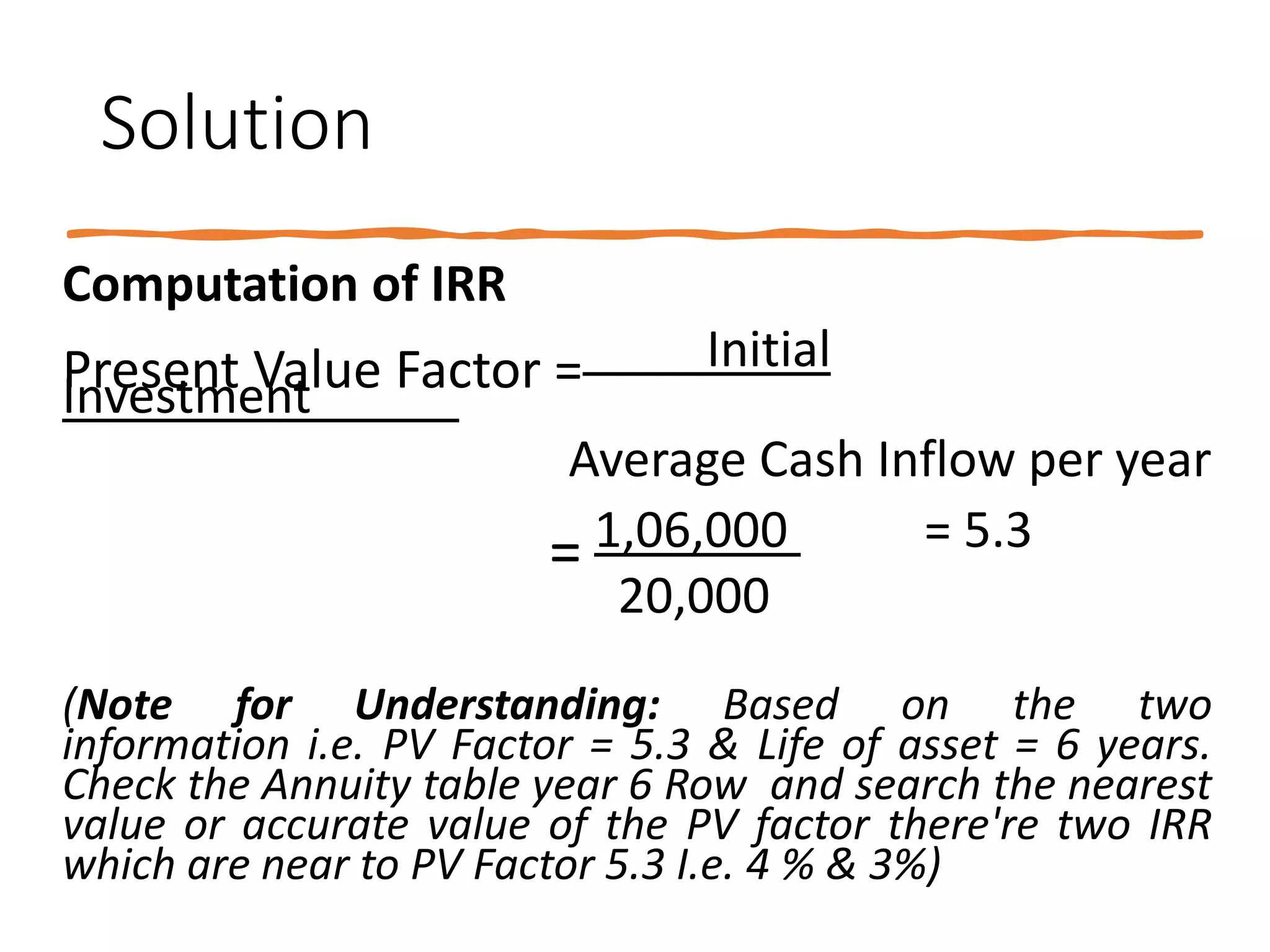

The document discusses various concepts related to time value of money and capital budgeting. It defines time value of money as the principle that money available now is worth more than the same amount in the future. It then discusses practical applications of time value techniques in investment decisions. The document also covers compounding and discounting methods, formulas for calculating future and present values of single amounts and annuities. Finally, it discusses various capital budgeting techniques like payback period, accounting rate of return, net present value, internal rate of return, and profitability index.

![Another

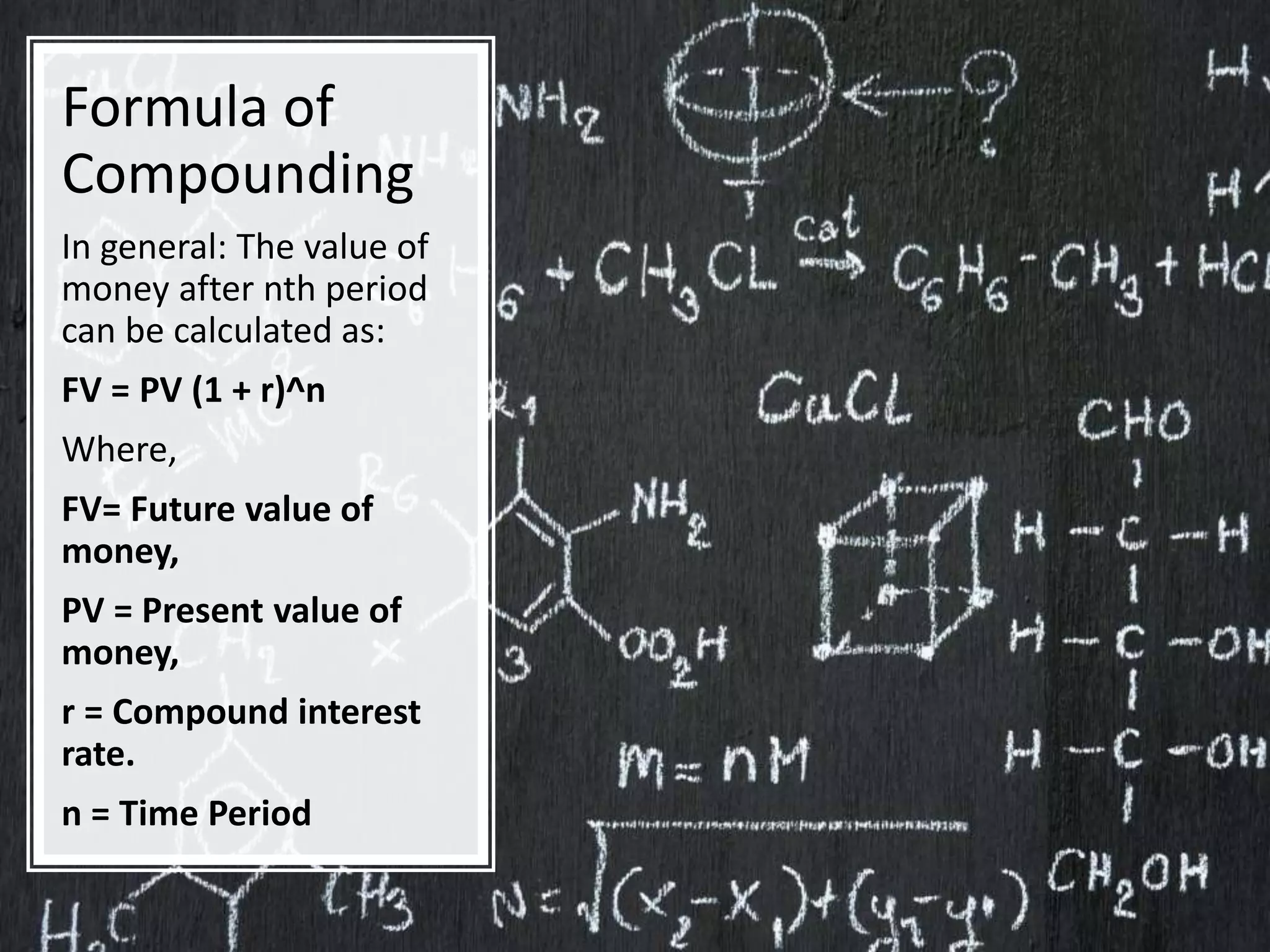

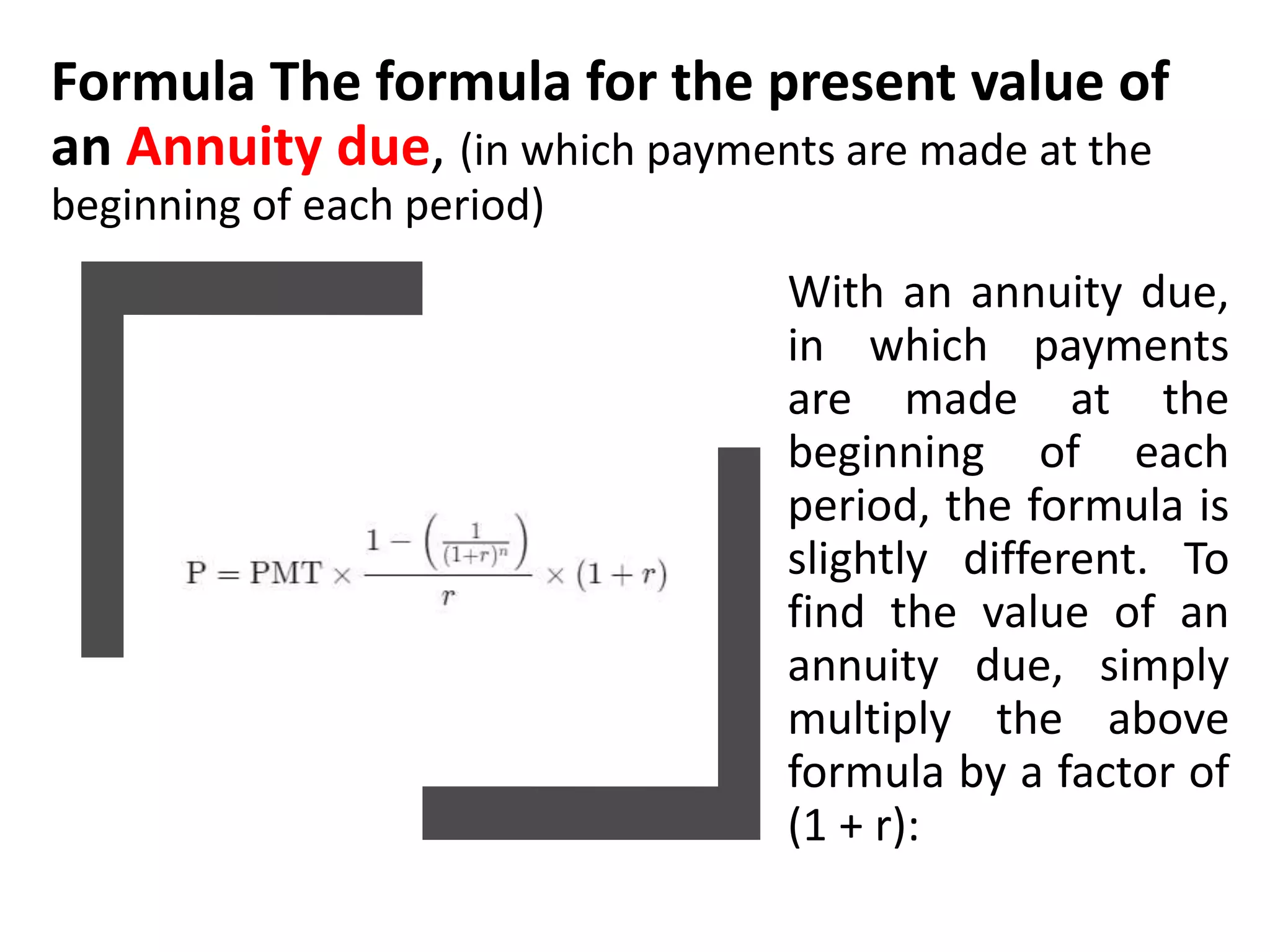

Formula for

Time Value of

Money/

Compounding

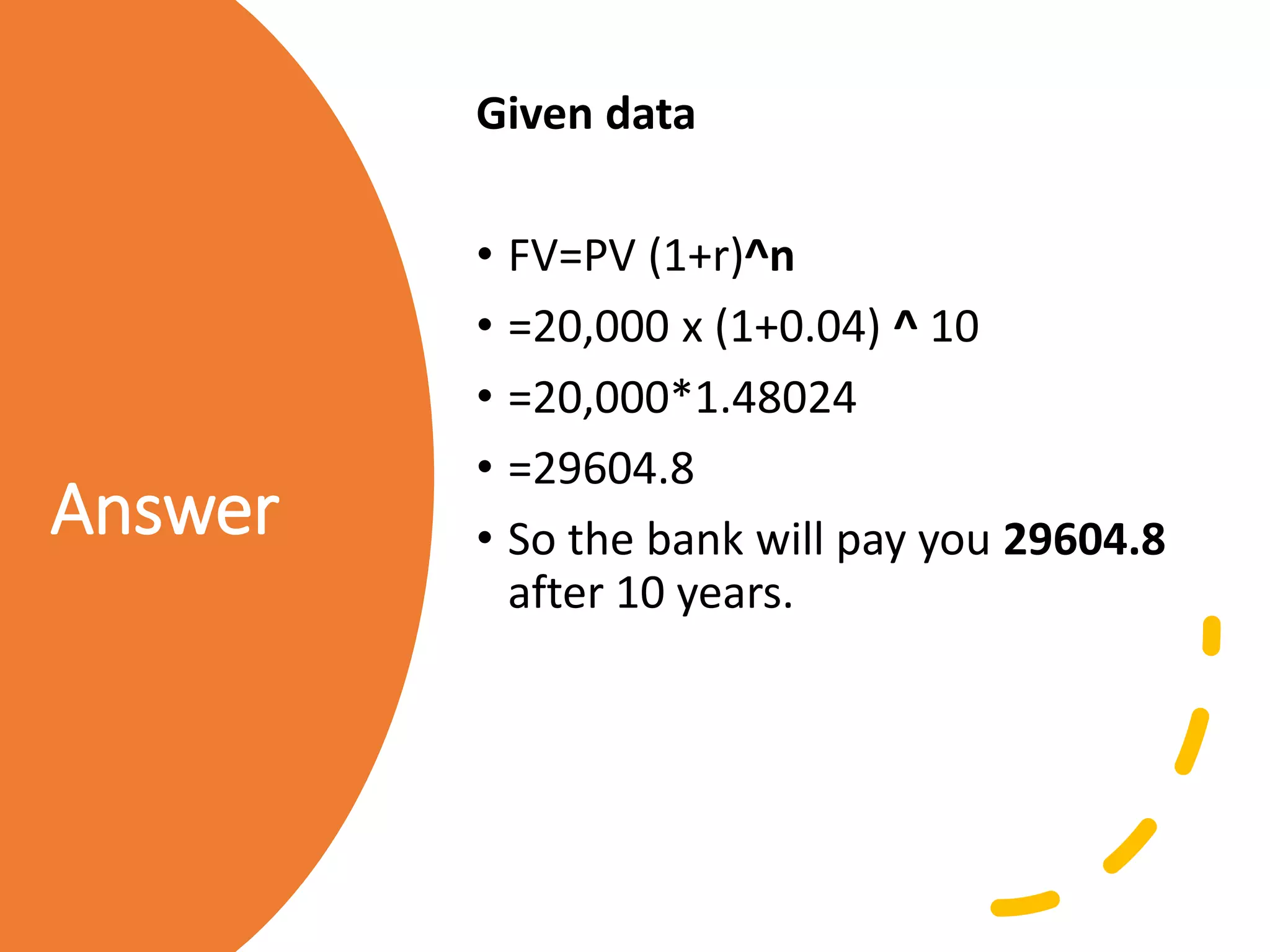

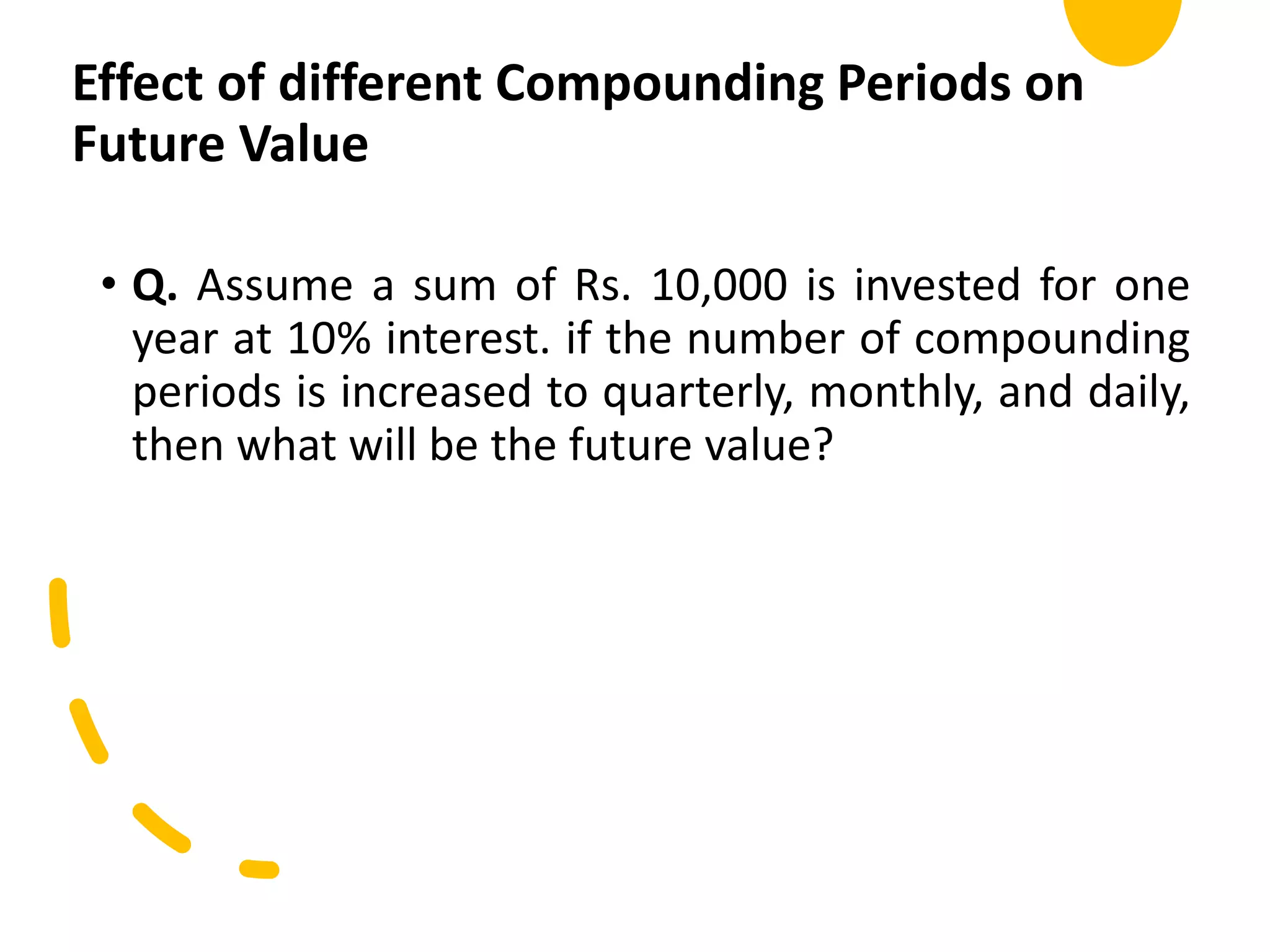

• Depending on the exact situation,

the formula for the time value of

money may change slightly. But in

general, the most fundamental TVM

formula considers the following

variables:

• FV = Future value of money

• PV = Present value of money

• i = interest rate

• n = number of compounding periods

per year

• t = number of years

Based on these variables, the formula

for TVM is:

• FV = PV x [ 1 + (i / n) ] (n x t)](https://image.slidesharecdn.com/unit-5fmetc1-230728095846-9f2577f6/75/UNIT-5-FM-ETC1-pptx-17-2048.jpg)

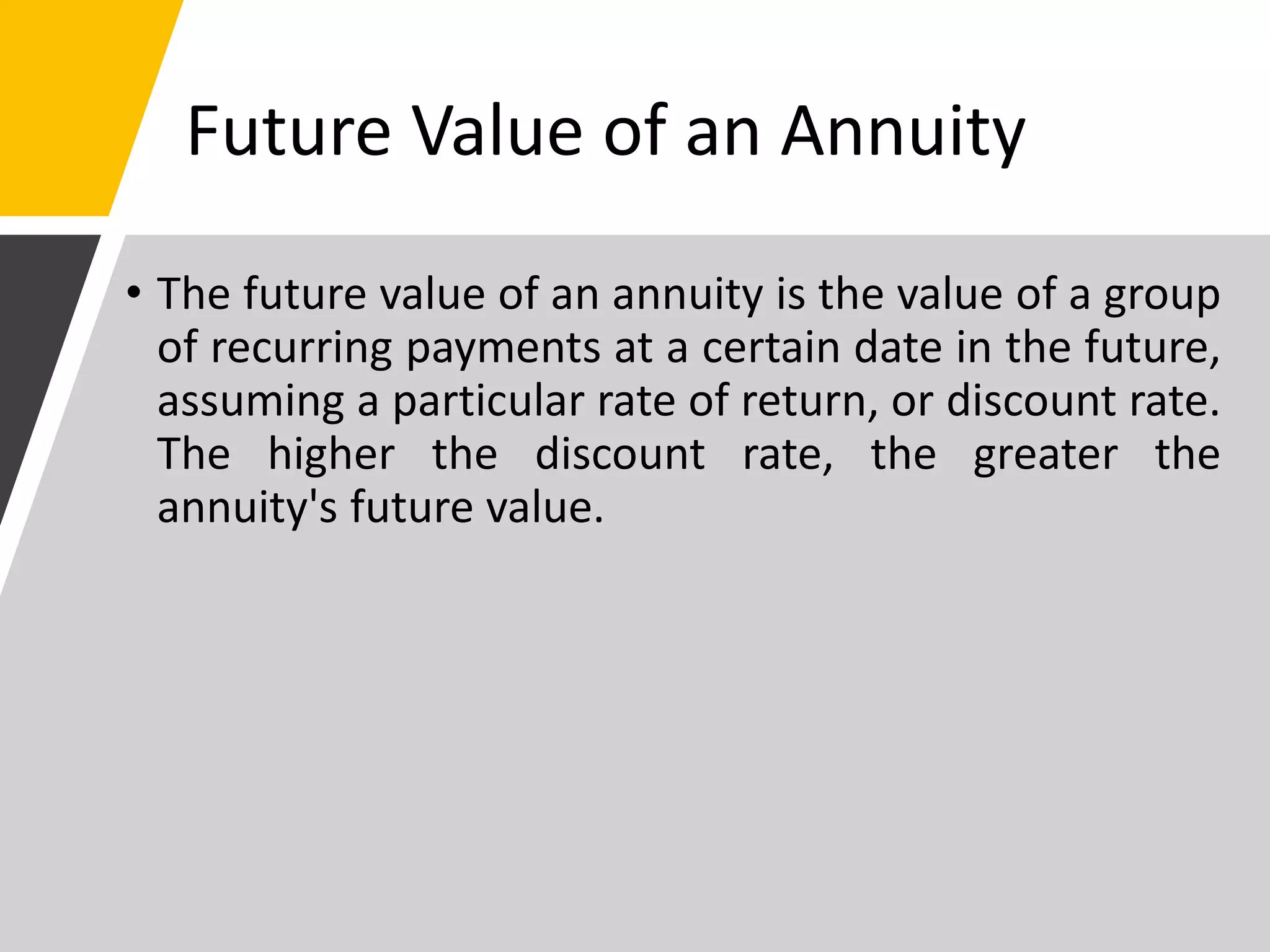

![Answer:

Given data,

PV= 10,000

i = 10%

t = 1

n= 1

Formula for calculating Future Value is;

FV = PV x [ 1 + (i / n) ] (n x t)

FV = Rs. 10,000 x [1 + (0.10 / 1)] (1 x 1)

= Rs. 11,000

The Future value of that money is Rs. 11,000/-.](https://image.slidesharecdn.com/unit-5fmetc1-230728095846-9f2577f6/75/UNIT-5-FM-ETC1-pptx-19-2048.jpg)

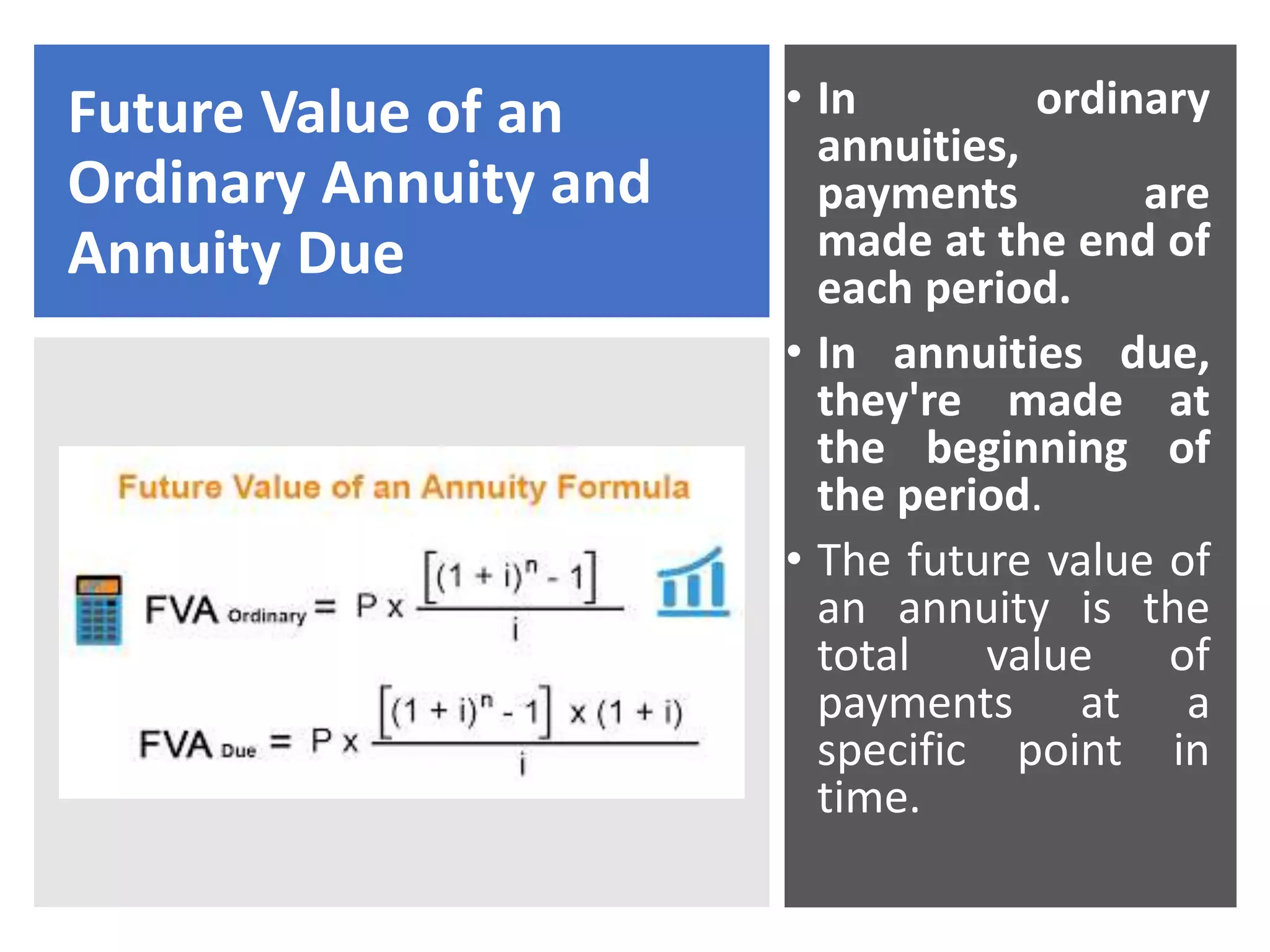

![Answer

Quarterly Compounding:

FV = ₹ 10,000 x [1 + (10% / 4)] (4 x 1)

= Rs. 11,038

Monthly Compounding:

FV = ₹ 10,000 x [1 + (10% / 12)] (12 x 1)

= Rs. 11,047

Daily Compounding:

FV = ₹ 10,000 x [1 + (10% / 365)] (365 x 1)

= Rs. 11,052](https://image.slidesharecdn.com/unit-5fmetc1-230728095846-9f2577f6/75/UNIT-5-FM-ETC1-pptx-21-2048.jpg)

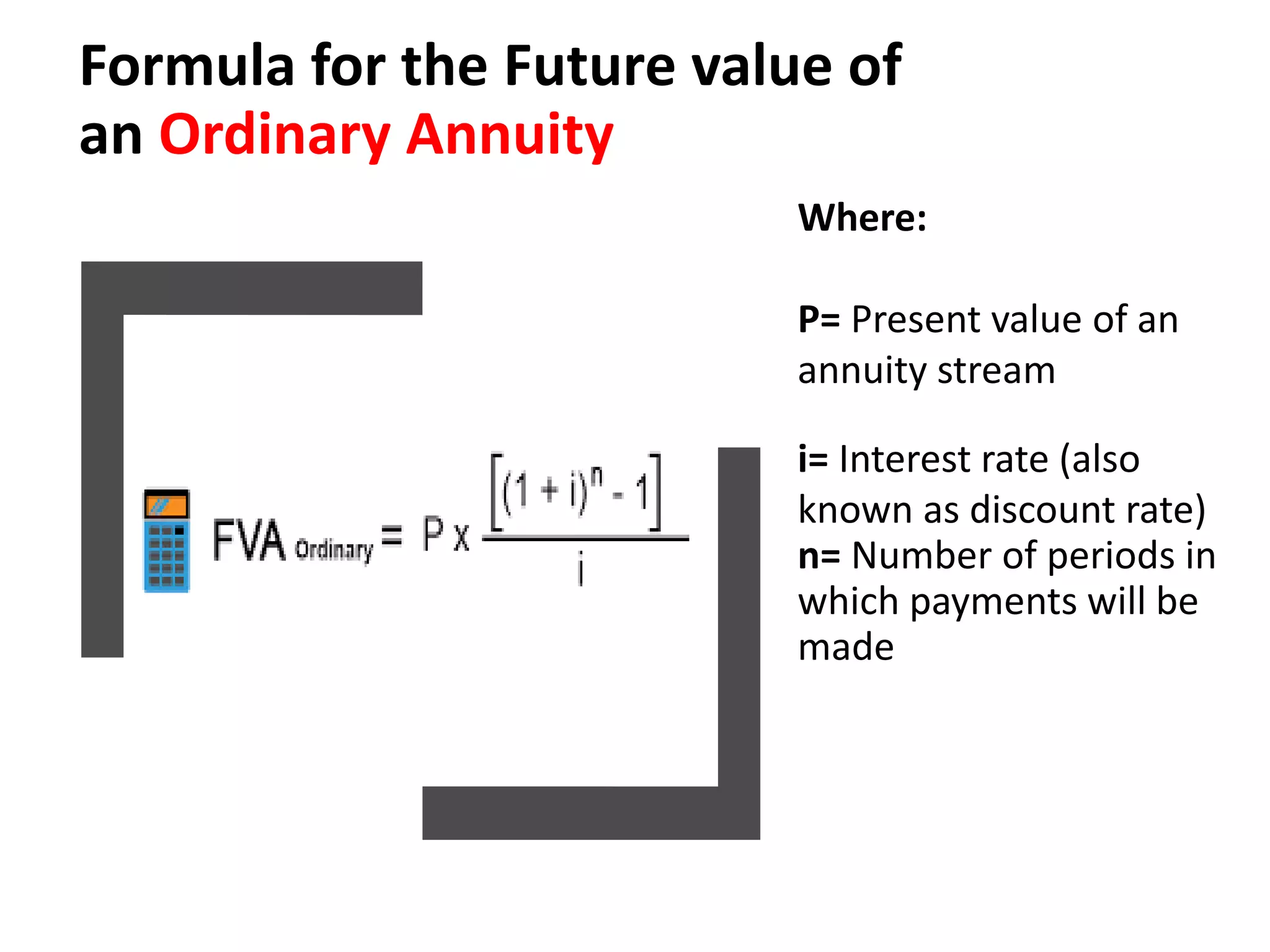

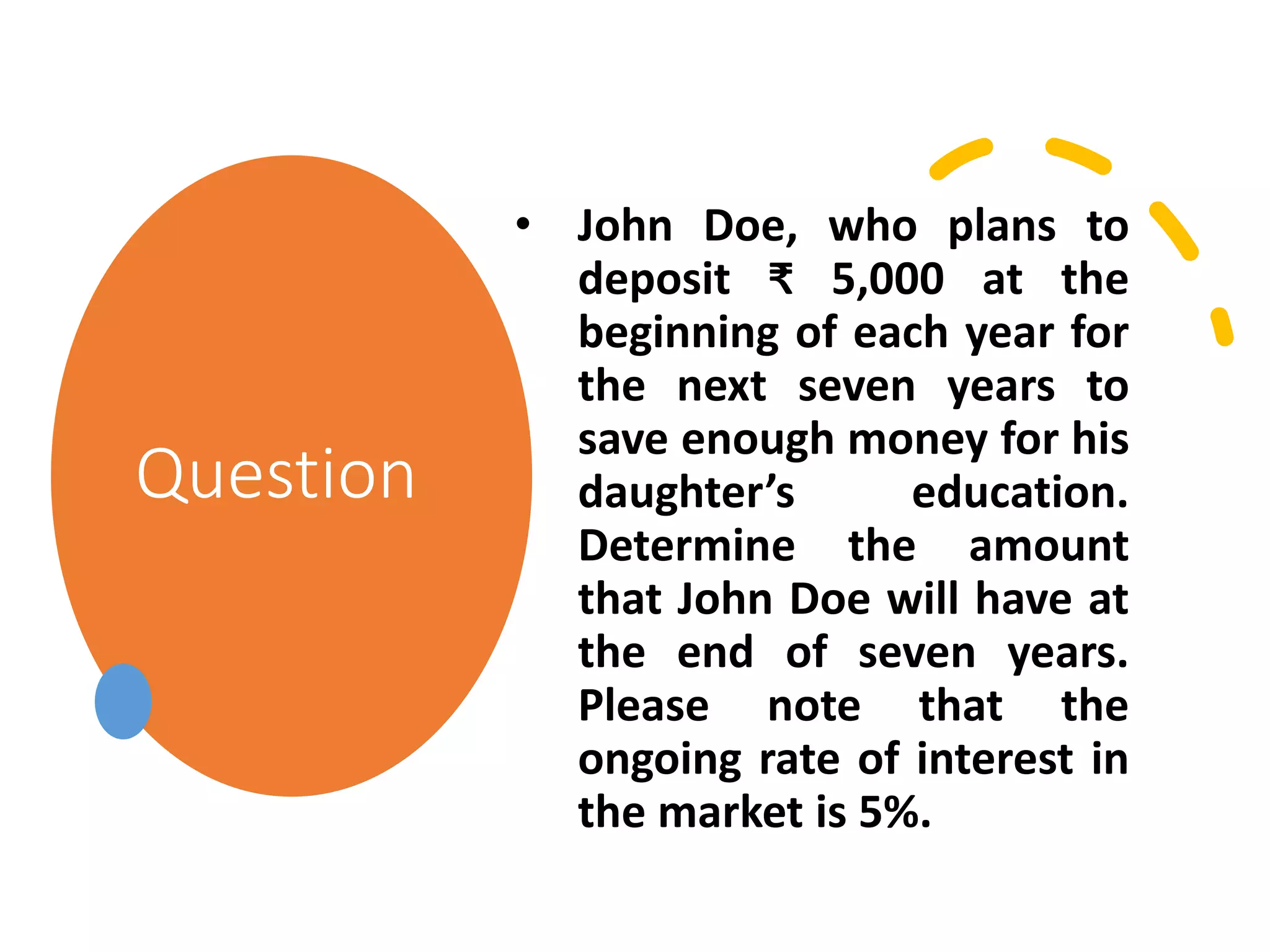

![Solution:

Given Data,

P= ₹ 5,000

r= 5% or 0.05

n= 7 years

Future Value =

FV = 5,000 [(1 + 0.05)7 – 1] x (1+ 0.05)

0.05

= ₹ 42,745.54](https://image.slidesharecdn.com/unit-5fmetc1-230728095846-9f2577f6/75/UNIT-5-FM-ETC1-pptx-29-2048.jpg)

![Solution

Given data

• F= ₹100

• n =5

• i =0.1

P = F[1/(1 + i)n]

= 100[1/(1 + 0.1)5]

= ₹ 62.09](https://image.slidesharecdn.com/unit-5fmetc1-230728095846-9f2577f6/75/UNIT-5-FM-ETC1-pptx-37-2048.jpg)

![Techniques of

Capital Budgeting

A] Traditional Methods

1. Pay Back Method.

2. Accounting rate of return.

B] Discounted Cash Flow Methods (DCF)

1. Net Present Value Method (NPV)

2. Internal Rate of Return (IRR)

3. Profitability index.](https://image.slidesharecdn.com/unit-5fmetc1-230728095846-9f2577f6/75/UNIT-5-FM-ETC1-pptx-54-2048.jpg)

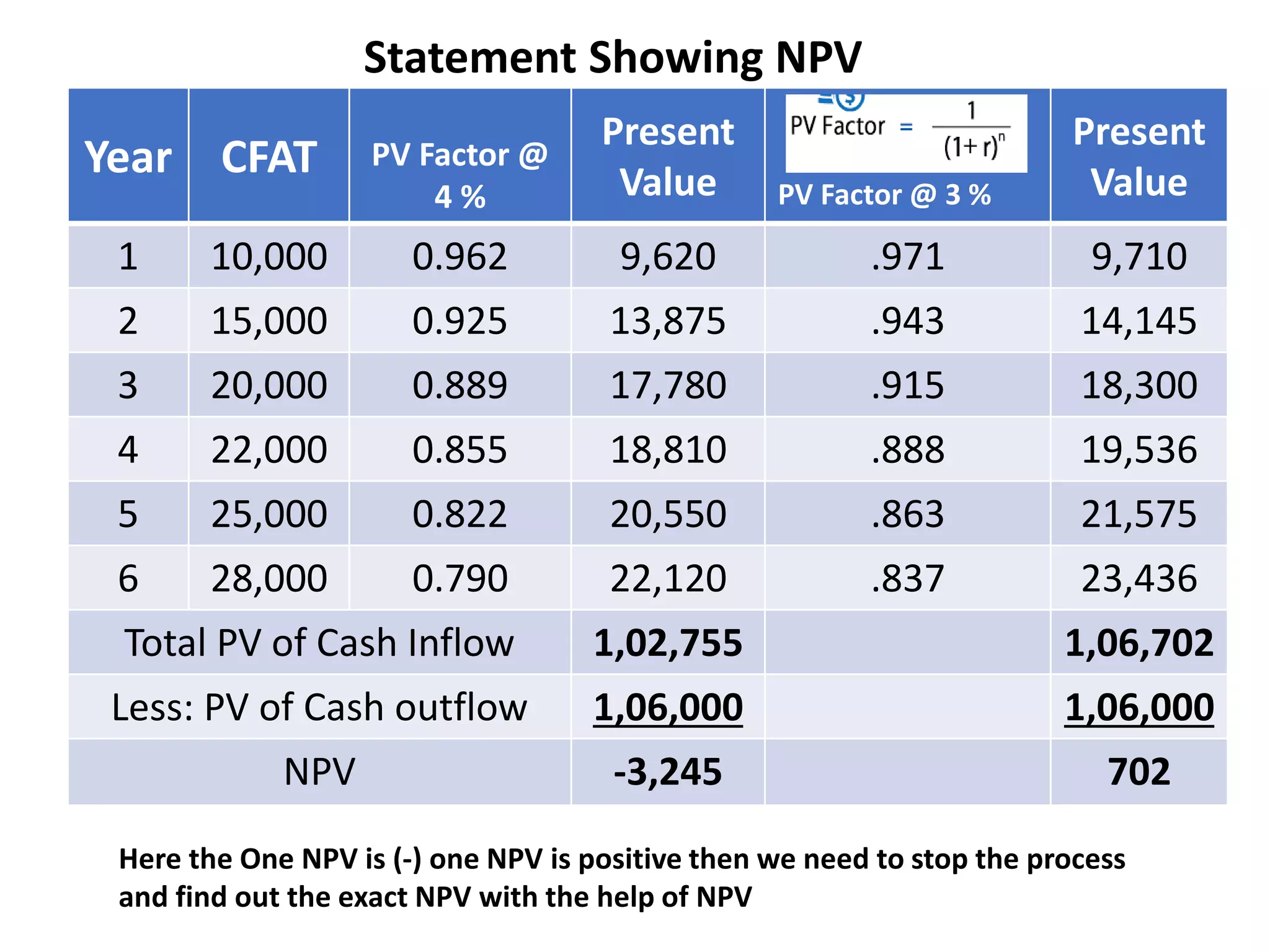

![Calculation of Exact IRR

IRR = 3% + 702 x [4% - 3%]

1,06702 - 1,02,755

IRR = 3% + 702 x 1%

3,947

IRR = 3.18%](https://image.slidesharecdn.com/unit-5fmetc1-230728095846-9f2577f6/75/UNIT-5-FM-ETC1-pptx-76-2048.jpg)