This document provides an overview of wealth tax in India. Some key points:

- Wealth tax is charged annually on the net wealth of individuals, HUFs, and companies exceeding Rs. 15 lakhs. Net wealth is total assets minus total debts.

- Assets include buildings, cars, jewelry, boats, aircraft, urban land, and cash over Rs. 50,000. Some assets like primary residence, assets used for business, and agricultural land are exempt.

- Deemed assets include assets transferred to a spouse or minor child without adequate payment, assets transferred but retain benefit, assets transferred under a revocable trust. These are included in the transferor's net wealth.

![LESSON – 17

WEALTH TAX-I

Ms. Surinder Kaur

STRUCTURE

17.0 Introduction

17.1 Objective

17.2 Chargeability

17.3 Definitions and Concepts

17.3.1 Assessment Year

17.3.2 Valuation date

17.3.3 Incidence of tax

17.3.4 Net wealth

17.3.5 Assets

17.3.6 Deemed assets

17.3.7 Exempt assets

17.3.8 Debt owed

17.4 Computation of net wealth and wealth tax

17.5 Let us Sum up

17.6 Glossary

17.7 Self Assessment Exercise

17.8 Further Readings

17.0 INTRODUCTION

The Wealth Tax Act came into force on April 1, 1957 and it extends to whole of

India including the State of Jammu and Kashmir. [sec. 1]

Wealth tax is a direct tax, which is charged on the net wealth of the assessee. The

unit of wealth tax has been divided into two lessons. In this lesson we shall be

studying the chargeability and computation of wealth tax and in the next lesson

we will be studying the valuation of assets and provisions relating to filing of

return and assessment.

__________________________________________________________________

17.1 OBJECTIVE

The primary concern in this unit has been to help you to:

i) Understand the charging of Wealth Tax

ii) Identify the various items of assets included in wealth

iii) Describe the deemed assets, exempted assets, deductible debts

iv) Compute Net Wealth and Wealth Tax

205](https://image.slidesharecdn.com/lesson-17wealthtax-120127094256-phpapp02/75/Lesson-17-wealth-tax-1-2048.jpg)

![17.2 CHARGEABILITY

The Wealth Tax is charged for every assessment year in respect of the net wealth

of the corresponding valuation date of every individual, Hindu Undivided Family,

and company, @1% of the amount by which net wealth exceeds Rs.15 lakh. By

virtue of section 45, no wealth tax is chargeable in respect of net wealth of the

following persons:

a) Any company registered under section 25 of Companies Act 1956

b) Any co-operative society

c) Any social club

d) Any political party

e) A Mutual Fund specified under section 10(23D) of the Income Tax Act

17.3 DEFINITIONS AND CONCEPTS

Following are the important definitions and concepts in wealth tax.

17.3.1 ASSESSMENT YEAR [A.Y.] [Sec2 (d)]

Assessment year means a period of 12 months commencing from 1st day of April

every year falling immediately after valuation date

Thus, for the year 2006, A.Y. is from1st April2006 to 31st March 2007.

17.3.2 VALUATION DATE Sec.2 (q)

Valuation date is 31st March immediately preceding the assessment year. Thus,

for assessment year 1st April 2006 to 31st March2007 valuation date is 31st March

2006. Valuation date is very important because:

a) It is the tax base for the charge of wealth tax

b) The residential status of an assessee is determined with reference to the year

ending on valuation date

c) The value of an asset is determined on valuation date.

d) The wealth as on the last moment of the valuation date is taken to be the net

wealth for

Taxation purposes

17.3.3 INCIDENCE OF TAX

Incidence of tax depends on residential status and nationality of the assessee:

Resident and Resident but not Non-resident

ordinary resident ordinary resident

in India [or in India

resident in case of

a company]

In case of Taxable Taxable Taxable

206](https://image.slidesharecdn.com/lesson-17wealthtax-120127094256-phpapp02/85/Lesson-17-wealth-tax-2-320.jpg)

![Following is treated as an “assets”:

a) In case of any individual and HUF, cash in hand on the last moment of the

valuation date in excess of 50,000 shall be treated as “asset”

b) In case of any other person any amount not recorded in the books of

accounts shall be treated as “asset”.

Illustration 17.1

ABC Ltd. owns following assets. State whether these assets are chargeable to

wealth tax for assessment year 2005-06

a) Stock in trade

b) Residential flats given to employees by the company with annual salary of

Rs 3,00,000 each

c) Shares in Indian Companies.

d) Cars used by directors for company’s business purpose.

e) Land acquired in 1992 on which construction of building is not permitted.

Solution 17.1

a) Stock in trade is not an asset under section 2 (ea)

b) Since the residential flats have been given to the employees with annual

salary of less than Rs. 5,00,000, so these are not to be treated as assets

under section 2 (ea) (i)]

c) Shares in Indian companies are not treated as assets under section 2(ea)

d) Since cars are not being used by the assessee for the business of running

them on hire or being held as stock-in-trade, hence cars are to be treated as

assets under Section [2(ea) (ii)].

e) Since the construction of the building is not permitted on the land hence it

is not to be treated as asset under section [2 (ea) (v)]

Illustration 17.2

Discuss whether the following are assets:

a) A residential house property given on rent by X for a period of 320 days.

b) A commercial house property used by Mr. Y for his business purposes.

c) Mr. A was having cash of Rs. 1, 20,000 on 31st March 2006, out of which

he deposited Rs. 40,000 in bank on the same day.

d) Aircrafts owned by Sahara Airlines

e) Amount held by Mr. Z in fixed deposits in bank

Solution 17.2

a) Since the residential house or property has been given for rent on more

than 300 days in previous year, hence it is not be treated as an asset under

section [2 (ea) (i)].

b) Since commercial house or property is being used by assessee for his own

business purposes hence it is not be treated as an asset.

c) Since on the last moment of valuation date i.e. 31st March’2006, Mr. A is

having cash of Rs 80,000 and out of which Rs. 50,000 is not an asset

under section [ 2 (ea) (vi)], thus remaining Rs 30,000 is taken as an asset.

209](https://image.slidesharecdn.com/lesson-17wealthtax-120127094256-phpapp02/85/Lesson-17-wealth-tax-5-320.jpg)

![d) Under section 2 (ea) (iv) aircrafts used by assessee for commercial

purposes is not an asset.

e) Amount held by Mr. Z in fixed deposit is not an asset under section 2 (ea).

CHECK YOUR PROGRESS

ACTIVITY A

Define six key words relating to assets forming part of wealth.

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

17.3.6 DEEMED ASSETS [sec. 4]

Deemed assets represent those assets, which belong to some other person but for

the purpose of calculation of wealth tax, these are included in the wealth of the

assessee. (transferor), it is because at time an individual may transfer his assets

without adequate consideration to persons in whom he may be interested.

Thus to prevent avoidance of wealth tax in this manner, wealth tax Act provides

that assets transferred by an individual after 31-03-1956 (in case of Dadra Nagar

Havely, Goa, Daman and Diu and Pondicherry on after 01-04-1963) shall be

included in the net wealth of the transferor, provided following conditions are

satisfied.

(i) The individual must be the owner of these assets.

(ii) The assets must be transferred without adequate consideration

in money or money is worth. In case of inadequate

consideration, difference between adequate consideration and

inadequate consideration shall be included in the net wealth of

the transferor.

(iii) The asset must be held by the transferor on the valuation date

whether in the same form or in converted form.

If assets have been lost, destroyed, transferred by the transferee to a third party

210](https://image.slidesharecdn.com/lesson-17wealthtax-120127094256-phpapp02/85/Lesson-17-wealth-tax-6-320.jpg)

![4) Revocable transfer of asset Sec. 4(1) (a) (iv)

Revocable transfer means a transfer which can be revoked at any time by the

transferor. Thus, if an individual has transferred any assets to another person or

AOP under revocable transfer then value of such assets is included in the wealth

of the individual.

5) Assets transferred to son’s wife Sec. 4(1) (a) (v)

If an individual transferred an asset to his son’s wife directly or indirectly after

31-05-1973 without adequate consideration then the value of such assets is

included in the net wealth of the individual.

6) Assets transferred to a person/AOP for the benefit of son’s wife Sec. 4(1)

(a) (vi)

If an assessee has transferred his asset to another person or AOP directly or

indirectly after 31-05-1993 without adequate consideration for the immediate or

deferred benefit of his son’s wife then value of such assets shall be included in

wealth of the individual.

7) Interest in a Firm or AOP Sec. 4(1) (b)

If the assessee is a partner in a firm or a member of an AOP (not being a co-

operative housing society), then value of his interest in the assets of firm or

association shall be included in his net wealth. Where a Karta of H.U.F. is a

partner in a firm, his interest in the firm’s assets is includible in the net wealth of

the H.U.F.

8) Converted Property Sec. 4(1A)

If an individual who is a member of an HUF converts his individual property after

31-12-1969 into Joint family property either by throwing it into the common stock

or by making gifts of separate property or through act of impressing such separate

property with the character of property belonging to family without adequate

consideration, such properly is called converted property. In this case value of the

converted property or any part of it held by the family on valuation date is

included in the net wealth of the individual.

However in case the converted property becomes the subject matter of partition

among the members, then the part of the property received by the individual and

his spouse is includible in his net wealth.

9) Transfer by means of book entry [Sec.4 (5A)]

Where a person makes a gift of money to another person by means of entries in

212](https://image.slidesharecdn.com/lesson-17wealthtax-120127094256-phpapp02/85/Lesson-17-wealth-tax-8-320.jpg)

![d) A minor son of Mr. A receives income by acting in films. Out of this

income, he purchased a Car and a residential house; value of these on

valuation date is Rs 50 Lacs.

e) He transferred a house valued at Rs 20 Lacs to his married daughter but he

has reserved the right to live in that house for whole life.

Solution 17.3:

a) Since the gift has been made without adequate consideration, hence the

value of jewellery on valuation date will be included in wealth of Mr. X.

b) Although the gift has been made without any adequate consideration but

as on valuation date it is in form of fixed deposits, which is not an asset

under section 2 (ea), hence it is not an asset.

c) Assets held by minor handicapped child are not taxable in the hands of

parents, hence the value of urban land is not to be included in wealth of

Mr. X, but it is chargeable in hands of the child.

d) The assets acquired by the minor child out of his income arising on

account of any manual work done by him or activity involving application

of his specialized knowledge or skill is not included in the wealth tax of

parents, hence the assets valued at Rs 50 Lacs will be included in the

wealth of the child.

e) Mr. A transferred his house to his married daughter. Hence he does not

remain the owner of the house on the valuation date, but he has reserved

the right to live in that house for whole life, hence it is a revocable transfer

u/s 4 (1) (a) (iv) thus value of the house will be included in wealth of Mr.

A

17.3.7 Exempt Assets [Sec 5]

The following assets are exempt from wealth tax

1) Property held under trust Sec. 5(i)

Any property held under trust or other legal obligations by the assessee for any

public purpose of a charitable or religious nature in India is exempt.

2) Interest in the coparcener property Sec. 5(ii)

if the assessee is a member of H.U.F., he is not liable to pay tax on his share in the

joint property, so long as the property remains joint and he continues as the

member of that family.

3) One building in the occupation of former Ruler Sec. 5(iii)

any one building which is in the occupation of a Ruler and which has been

declared as his official residence by the Central Govt .is totally exempt from tax.

However the exemption available only to the Ruler during his life time.

4) Jewellery in possession of a former Rule Sec. 5(iv)

Jewellery in possession of a former Ruler not being his personal property which

has been recognized by the Central Govt. as his heirloom, before commencement

of Wealth Tax Act or by the board after that shall be exempt. However this

exemption is subject to fulfillment of certain conditions like keeping of jewellery

214](https://image.slidesharecdn.com/lesson-17wealthtax-120127094256-phpapp02/85/Lesson-17-wealth-tax-10-320.jpg)

![in India, in its original shape, allowing authorized person to examine the jewellery

as and when necessary

5) Assets of Indian repatriate Sec. 5 (v)

Indian repatriate means a person of Indian origin or a citizen of India who was

residing in a foreign country and on leaving such country assessee has returned to

India with the intention of permanently residing therein. In this case his following

assets shall be exempt for 7 successive assessment years, commencing with the

assessment year following the date of his return to India.

(i) Money brought by him in India.

(ii) Assets brought by him in India.

(iii) Any balance in Non-Resident External Accounts in India on the date of his

return

(iv) Assets acquired by him out of money in his Non-resident External

Account or by sending money from foreign country within 1 year

immediately preceding the date of his return to India.

(v) Any assets acquired by him out of money brought in by him in India or

out of the balance in NRE account after his arrival in India.

6) House [Sec 5 (vi)]

One house or part of a house or a plot of land belonging to an individual or HUF

is exempt provided size of plot is not bigger than 500 square meters.

Illustration 17.4: How would you treat the following items under the wealth tax

act?

i) Mr. Gupta is a managing trustee of an educational society. The society

is a public charitable trust. The value of trust property is Rs 50 Lacs,

which is held by Mr. Gupta in his name as Managing director.

ii) Mr. G, an Indian repatriate came to India on 1st Oct’2005, The balance

in his non resident external account is Rs 10 Lacs on that day, out of

which he purchased a car for Rs 4 Lacs

iii) Mr. X is a former ruler; his jewellery was recognized by Central Govt.

as his heirloom in 1956.

iv) Interest of Mr. Z in the HUF to which he is a member

v) Mr. Shyam owns only one house valued at Rs. 12 Lacs, the house has

been build on a land area of 450 sq. meter.

Solution 17.4:

i) Any property held by assessee under trust for any public

purposes of charitable nature in India is exempt u/s 5 (I, hence

value of trust property is neither includable in the wealth of Mr.

Gupta nor the society is liable to pay wealth tax on it.

ii) Balance on Non-resident external account is exempt u/s 5 (v),

further Car acquired by him out of that balance is also exempt.

215](https://image.slidesharecdn.com/lesson-17wealthtax-120127094256-phpapp02/85/Lesson-17-wealth-tax-11-320.jpg)

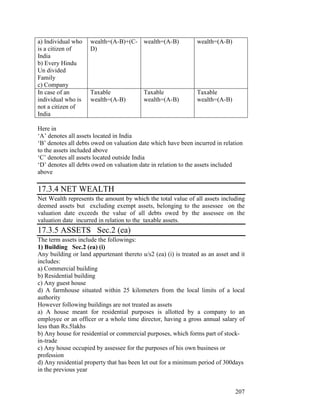

![Assets owned by assessee on valuation date including X

deemed assets and excluding exempt assets

Less Deductible debts owed by assessee on the (Y)

valuation date.

Net Wealth X-Y

Procedure for computation of Wealth tax.

Wealth tax is chargeable @1% of the amount by which net wealth

exceeds 15 lac rupees, hence

If net wealth is up to Rs. 15 lac, there will not be any wealth tax.

If net wealth exceeds Rs.15 lac, wealth tax is calculated as:

Wealth Tax = 1% [Net Wealth – Rs 15 Lac]

Illustration 17.5: Mr. Gupta has the following assets and liabilities on the

valuation date:

S.N. Details Rs.

1 Residential House 40,00,000

2 Cars for personal use 10,00,000

3 Jewellery 16,00,000

4 Aircrafts and boats for personal use 1,30,00,000

5 Farm house 15 Kms away from local limits of Mumbai 12,00,000

6 Cash in hand 2,20,000

7 Shops given on rent 12,00,000

8 Loan taken to purchase aircrafts 50,00,000

9 Loan taken to purchase residential house 22,00,000

Compute Net Wealth and Wealth Tax?

Solution 17.5:

S.N. Details Rs.

1 Residential House (exempt u/s 5 (vi) ) -

2 Cars for personal use 10,00,000

3 Jewellery 16,00,000

4 Aircrafts and boats for personal use 1,30,00,000

5 Farm house 15 Kms away from local limits of Mumbai 12,00,000

6 Cash in hand ( In excess of Rs. 50,000 is an asset) 1,70,000

7 Shops given on rent ( Commercial establishment not an -

asset u/s 2 (ea) )

8 Less - Loan taken to purchase aircrafts (50,00,000)

9 Loan taken to purchase residential house ( Not -

deductible since residential house is exempt)

Net Wealth 1,19,70,000

217](https://image.slidesharecdn.com/lesson-17wealthtax-120127094256-phpapp02/85/Lesson-17-wealth-tax-13-320.jpg)

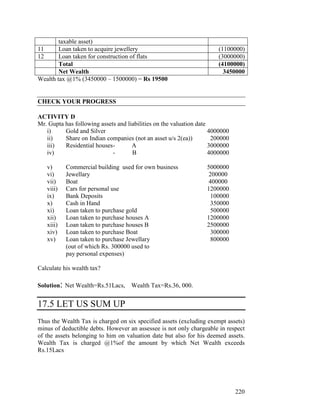

![Wealth Tax = 1% of [Net Wealth – Rs. 15 lakhs] = 1% (1, 04, 70,000) = Rs. 1,

04,700

Illustration17.6: An Indian company has the following assets and liabilities on

the valuation date:

S.N. Details Amount in Rs.

1 Stock in trade 200000

2 Business premises occupied for own business purposes 3800000

3 Residential houses given to employees [ gross salary of 2200000

each employee is less than Rs 500000]

4 Residential house for full time director with gross annual 1200000

salary of Rs 720000

5 Cars held as stock in trade 1800000

6 Cars for use of officers of the company 1000000

7 Bank Balance 1200000

8 Cash in hand recorded in books 200000

9 Guest House 1500000

10 Loan taken for construction of house 1000000

11 Loan taken for construction of residential houses of 1700000

employees

Compute the net wealth and wealth tax of the company?

Solution 17.6: Computation of net wealth and wealth tax of the company:

S.N. Details Amount in Rs.

1 Stock in trade [Not an asset u/s 2 (ea)] -

2 Business premises occupied for own business purposes -

[Not an asset u/s 2 (ea)]

3 Residential houses given to employees [Not an asset u/s 2 -

(ea) as gross salary of employees is less than Rs 500000]

4 Residential house for full time director with gross annual 1200000

salary of Rs 720000 [Since gross annual salary exceed Rs

500000 hence an asset u/s 2 (ea)]

5 Cars held as stock in trade [Not an asset u/s 2 (ea)] -

6 Cars for use of officers of the company 1000000

7 Bank Balance [Not an asset u/s 2 (ea)] -

8 Cash in hand recorded in books [Not an asset u/s 2 (ea) -

since its recorded]

9 Guest House 1500000

Less debts owed by the company:

10 Less - Loan taken for construction of house (1000000)

11 Less - Loan taken for construction of residential houses of (1700000)

218](https://image.slidesharecdn.com/lesson-17wealthtax-120127094256-phpapp02/85/Lesson-17-wealth-tax-14-320.jpg)

![employees

Net Wealth 2700000

Wealth Tax @1% [2700000 – 1500000] = Rs. 120000

Illustration17.7: Mr. Monty is in the business of construction and sale of

residential flats. From the given information compute the Net Wealth and wealth

tax.

S. no. Details Amount

1 Land in Rural Area 1500000

2 Land in urban area [construction is not permitted as per 2500000

municipal laws]

3 Land in urban area [held as stock in trade since 2000] 4200000

4 Motor Cars [Not held as stock in trade] 1250000

5 Jewellery [Not held as stock in trade] 1500000

6 Bank Balance 800000

7 Cash in hand 150000

8 Flats constructed and remaining unsold [ not being held as 4200000

stock in trade]

9 Residence provided to 5 employees with one employee’s 2500000

gross annual salary exceeding Rs 500000

10 Loan taken to acquire land 1200000

11 Loan taken to acquire jewellery 1100000

12 Loan taken for construction of flats 3000000

Solution 17.7: Computation of net wealth and wealth tax of Mr. Monty

Sno Details Amount

1 Land in Rural Area [Not an asset u/s 2 (ea)] -

2 Land in urban area [Not an asset u/s 2 (ea) as construction -

is not permitted]

3 Land in urban area [land held as stock in trade is not -

taxable for 10 years]

4 Motor Cars [Not held as stock in trade] 1250000

5 Jewellery [Not held as stock in trade] 1500000

6 Bank Balance [Not an asset u/s 2 (ea)] -

7 Cash in hand [In excess of Rs 50000 is taxable u/s 2 (ea)] 100000

8 Flats constructed and remaining unsold [not being held as 4200000

stock in trade, hence an asset]

9 Residence provided to 5 employees [ Exempt for 4 whose 500000

salary less than Rs 500000 taxable for one]

Total 7550000

Less debts

10 Loan taken to acquire land (not deductible as land is not -

219](https://image.slidesharecdn.com/lesson-17wealthtax-120127094256-phpapp02/85/Lesson-17-wealth-tax-15-320.jpg)

![17.6 GLOSSARY

1) Previous Year: It is a period of 12 months immediately preceding the

Assessment Year

2) Residential Status: According to Income Tax Act, the residential status of an

assessee can be ordinary resident in India, resident but not ordinary resident in

India, and Non-Resident in India.

3) Assessee: Assessee means a person by whom Wealth Tax or any other sum by

way of interest, penalty is payable under this Act.

4) Hindu Undivided Family [H.U.F.]: A family governed by Hindu Law is an

H.U.F.

17.7 SELF ASSESSMENT EXCERCISE

(1) Write short notes on the following

(a) Valuation date

(b) Net Wealth

(2) Incidence of tax depends on residential status and nationality of an assessee,

Explain

(3) Define ‘assets’ under the Wealth Tax Act.

(4) List out “deemed assets”

(5) What items of Wealth are exempt from Wealth Tax?

(6) How would you treat the following under Wealth Tax Act?

(i) Mr. Gupta gifted to his daughter-in-law jewellary worth Rs. 1.0 Lacs. The

jewellary is held by her on valuation date and its value on this date is Rs. 5

Lacs.

(ii) Mr. Gupta gifted to his daughter-in-law jewellary in shares of some

companies, value of the shares on the valuation date is Rs. 3 Lacs.

(iii) Mr. Romy gifted a piece of land to his daughter in law after obtaining

approval of the authorities constructed 5 shops as at and let out the same.

The value of shops on valuation date is Rs. 50 Lacs.

(iv) Mr. Kumar formed a trust for the benefit of his wife and transferred his

urban land valued at Rs. 20 Lacs to the trust. Income of the land will be

available to his wife through out her whole life.

Hints

(i) The asset transferred to daughter-in-law without adequate

consideration is deemed to be the assets of the transferor

221](https://image.slidesharecdn.com/lesson-17wealthtax-120127094256-phpapp02/85/Lesson-17-wealth-tax-17-320.jpg)