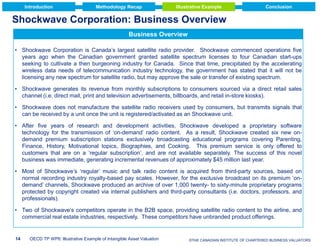

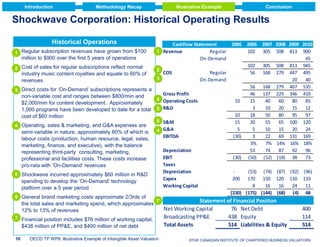

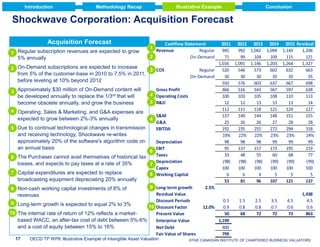

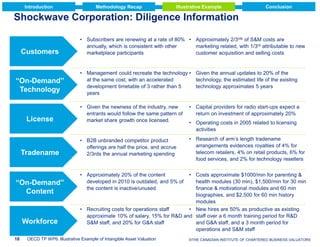

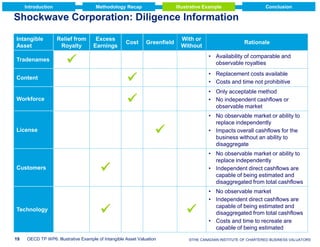

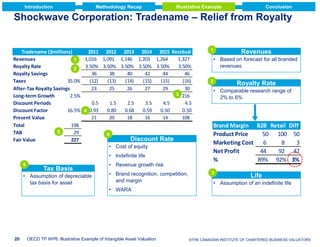

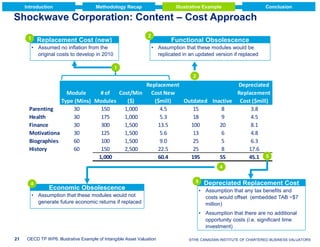

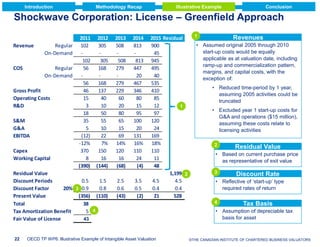

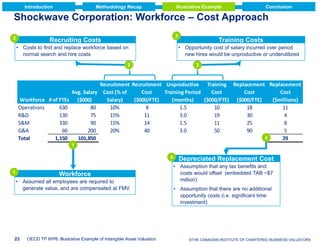

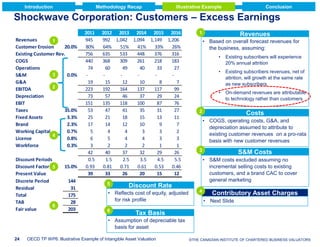

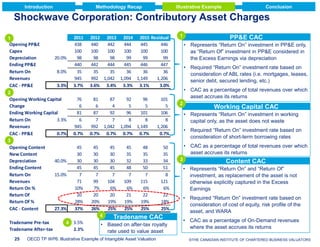

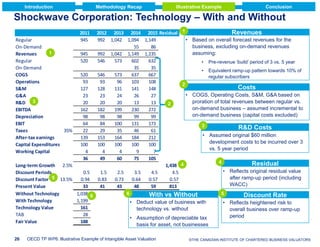

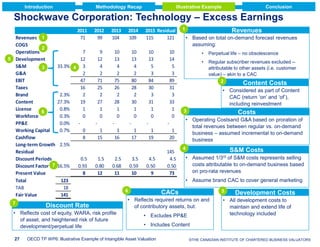

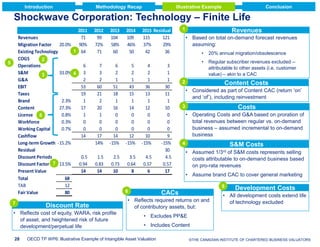

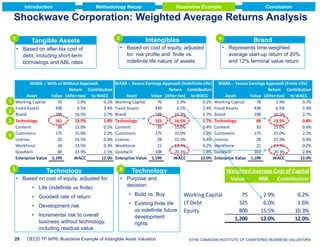

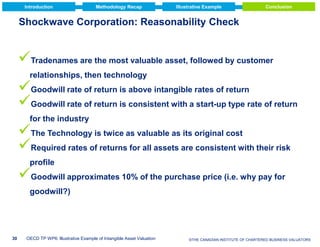

This document provides an illustrative example of valuing intangible assets for Shockwave Corporation, a Canadian satellite radio provider. Shockwave was acquired for $1.2 billion, with $0.5 billion in tangible assets. The purchaser requests valuing Shockwave's intangible assets, including tradename, on-demand technology, customer relationships, broadcast license, program content, and assembled workforce, using relief from royalty, excess earnings, cost, greenfield, and with or without methodologies. Historical financials are presented and an acquisition forecast is provided to estimate future cash flows for valuing the identified intangible assets.