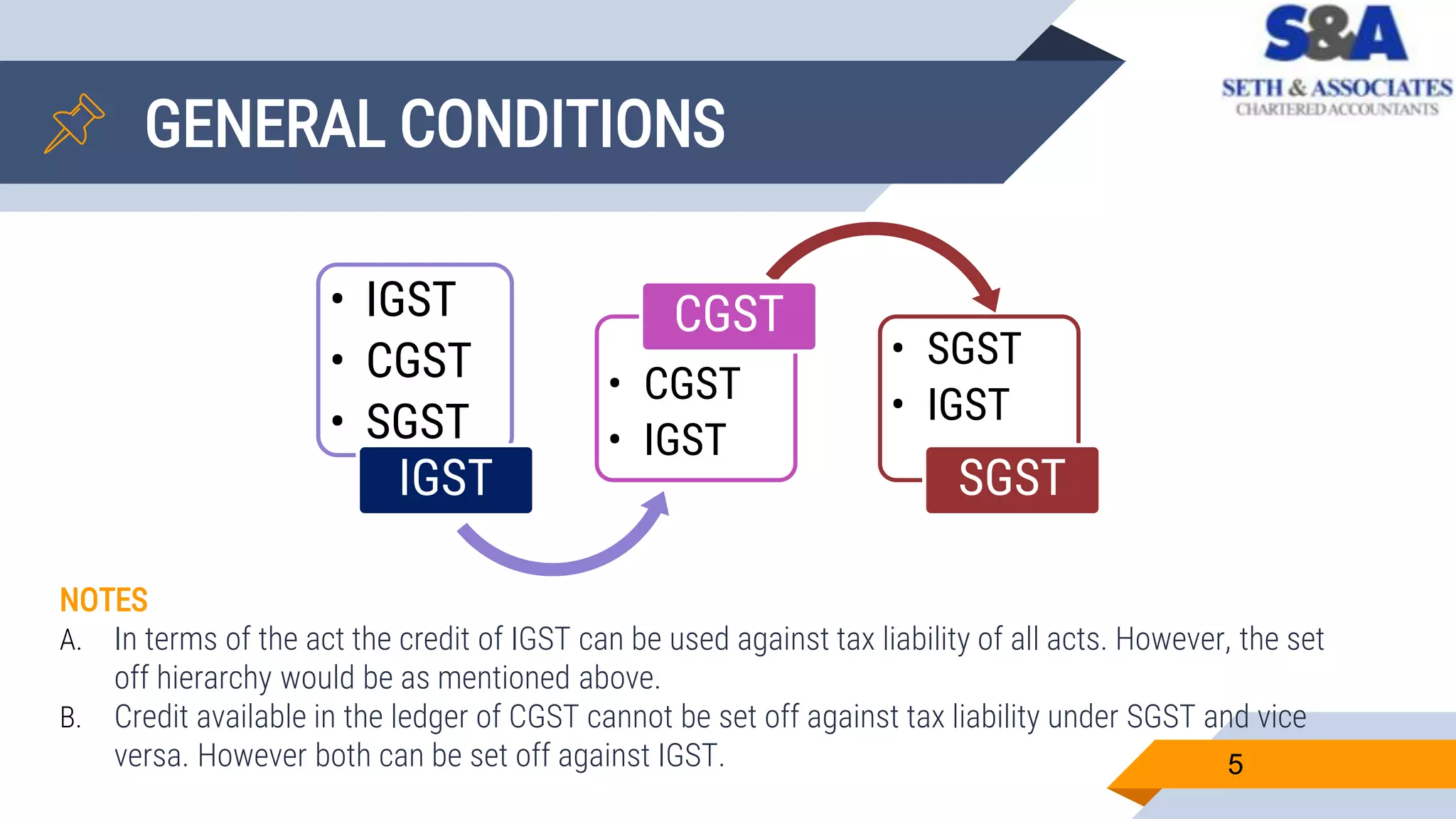

The document provides a comprehensive guide to Input Tax Credit (ITC) under the Goods and Services Tax (GST) framework, outlining its importance in preventing cascading taxes. It details the general rules for availment, eligibility conditions, and restrictions on certain credits, emphasizing the necessity of maintaining compliance with GST regulations. Key points include the stipulation that ITC is only available for goods and services utilized in the course of business and the requirement for proper documentation and timely payment to retain credit.