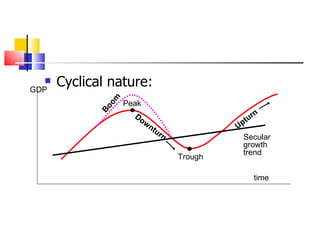

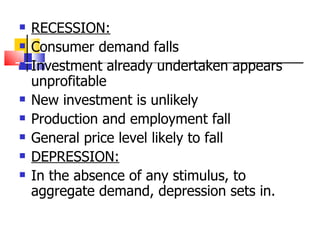

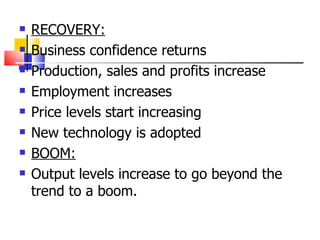

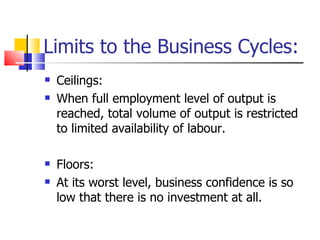

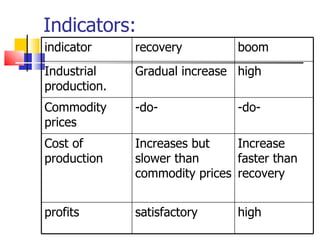

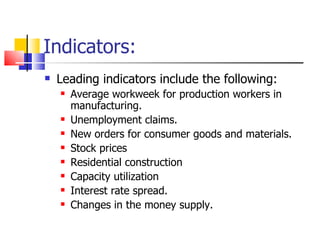

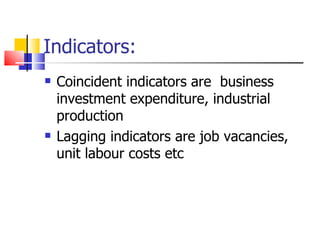

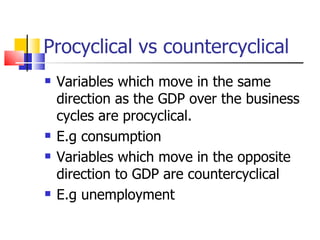

The business cycle refers to the periodic but irregular up and down movements in economic activity, as measured by real GDP. Business cycles involve alternating periods of expansion (boom) and contraction (recession or depression). Recent cycles have become less severe, with expansions lasting longer and contractions shorter on average. The four main phases of the business cycle are recession, depression, recovery, and boom. Leading economic indicators can provide insight into where the economy may be in the business cycle around 12-15 months in the future.