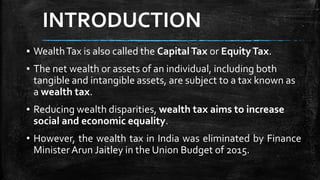

The wealth tax in India, which taxed individuals' net wealth above a certain threshold, was introduced in 1957 but abolished in 2015 due to administrative issues and limited revenue generation. Key concepts included definitions of taxable and exempt assets, the incidence of tax based on residency, and valuation dates for assessment. Instead of a wealth tax, India now relies on income tax, capital gains tax, and property tax to manage wealth taxation.

![DEFINITIONSAND CONCEPTS

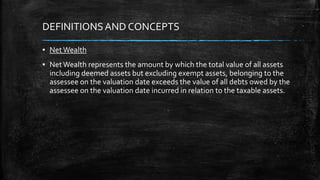

▪ ASSESSMENTYEAR [A.Y.] [Section 2 (d)]

Assessment year means a period of 12 months commencing from 1st day of April every

year falling immediately after valuation dateThus, for the year 2006, A.Y. is from1st

April2006 to 31st March 2007.

▪ VALUATION DATE Section 2 (q)

Valuation date is 31st March immediately preceding the assessment year.

Thus, for assessment year 1st April 2006 to 31st March2007 valuation date is 31st March

2006.Valuation date is very important because: a) It is the tax base for the charge of

wealth tax b)The residential status of an assessee is determined with reference to the

year ending on valuation date c)The value of an asset is determined on valuation date. d)

The wealth as on the last moment of the valuation date is taken to be the net wealth for

Taxation purposes](https://image.slidesharecdn.com/wealth-240501075256-668421d2/85/wealth-tax-chapterization-notecccvhhuhtds-4-320.jpg)

![DEEMED ASSETS [sec. 4]

▪ Deemed assets represent those assets, which belong to some other person but for

the purpose of calculation of wealth tax, these are included in the wealth of the

assessee. (transferor), it is because at time an individual may transfer his assets

without adequate consideration to persons in whom he may be interested.

▪ DEEMED ASSETS u/s 4 (i) are as follows.

▪ 1) Assets transferred to spouse Sec. 4(1) (a) (ii).

▪ 2) Assets held by minor child Sec. 4 (1) (a) (ii)

▪ 3) Assets transferred to a person or toAOP’s, Sec. 4 (1) (a) (iii)

▪ 4) Revocable transfer of asset Sec. 4(1) (a) (iv)

▪ 5) Assets transferred to son’s wife Sec. 4(1) (a) (v)](https://image.slidesharecdn.com/wealth-240501075256-668421d2/85/wealth-tax-chapterization-notecccvhhuhtds-11-320.jpg)

![▪ 6) Assets transferred to a person/AOP for the benefit of son’s wife Sec. 4(1) (a) (vi)

▪ 7) Interest in a Firm or AOP Sec. 4(1) (b)

▪ 8) Converted Property Sec. 4(1A)

▪ 9)Transfer by means of book entry [Sec.4 (5A)]

▪ 10) Impartible Estate Sec. 4(6)

▪ 11) House from a Co-operative Housing society etc. Sec. 4(7)

▪ 12) Building in part performance of a contract Sec. 4(8) (a)

▪ 13) Building on lease Sec. 4(8) (b)](https://image.slidesharecdn.com/wealth-240501075256-668421d2/85/wealth-tax-chapterization-notecccvhhuhtds-12-320.jpg)

![Exempt Assets [Sec 5]

▪ The following assets are exempt from wealth tax

▪ 1) Property held under trust Sec. 5(i).

▪ 2) Interest in the coparcener property Sec. 5(ii)

▪ 3) One building in the occupation of former Ruler Sec. 5(iii).

▪ 4) Jewellery in possession of a former Rule Sec. 5(iv)

▪ 5) Assets of Indian repatriate Sec. 5

▪ 6) House [Sec 5 (vi)]](https://image.slidesharecdn.com/wealth-240501075256-668421d2/85/wealth-tax-chapterization-notecccvhhuhtds-13-320.jpg)