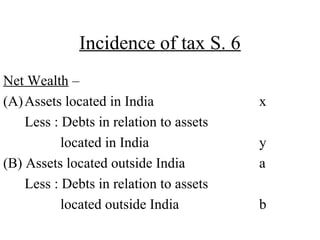

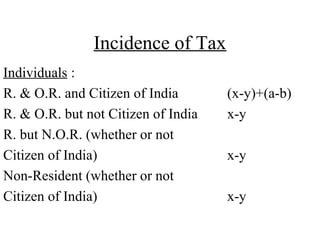

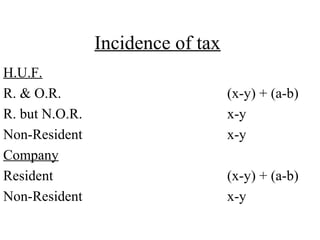

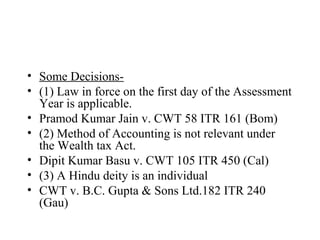

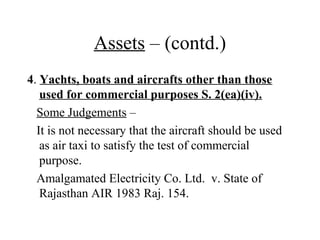

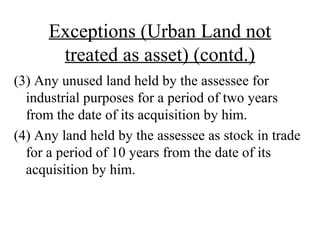

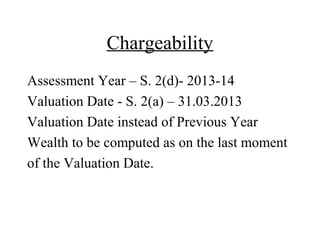

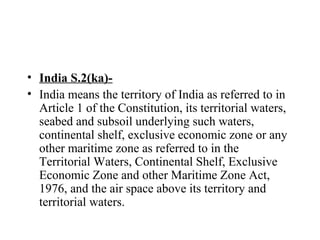

The document summarizes key aspects of the Wealth Tax Act of 1957 in India, including who is chargeable for wealth tax, how net wealth is computed, valuation rules, and assessment procedures. It outlines what constitutes an "asset" and "net wealth" under the Act. It also describes various deemed assets that get included in a person's net wealth, such as assets transferred to a spouse or minor child. Exceptions to certain assets like residential houses are also provided.

![What is Net Wealth? S. 2(m) –

Assets [S. 2(ea)] xxx

Deemed Assets u/s. 4 xxx

----

xxx

Less : Exempt Assets u/s. 5 xxx

----

xxx

Less : Debts in relation to assets

which are not exempt xxx

----

Net Wealth xxx](https://image.slidesharecdn.com/wealthtax-1-130527142551-phpapp02/85/Wealth-tax-1-5-320.jpg)