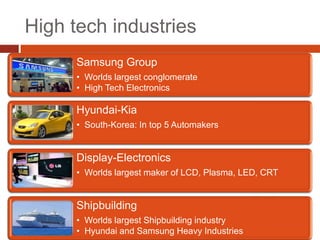

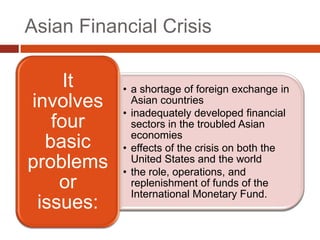

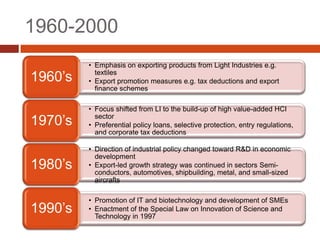

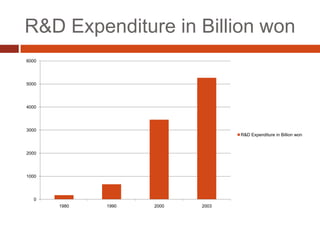

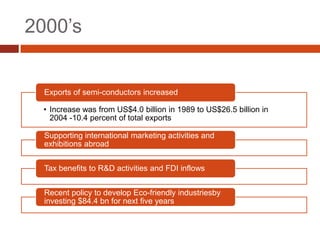

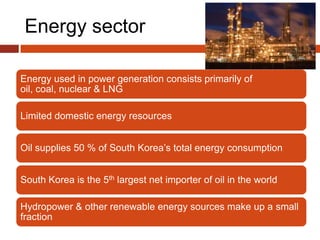

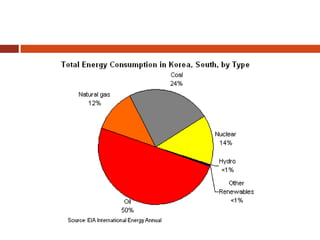

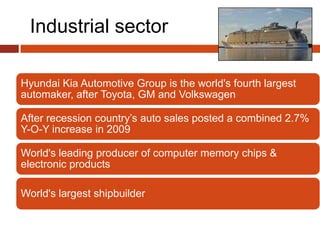

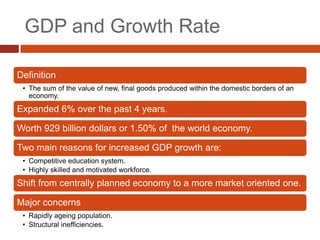

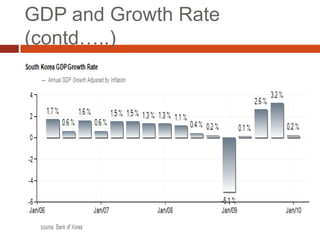

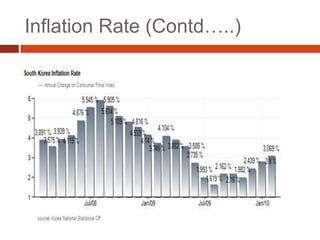

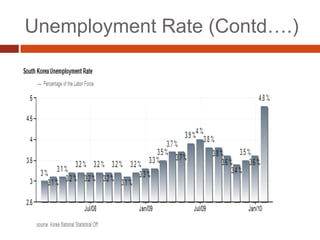

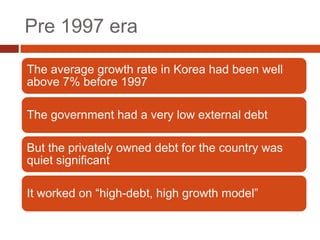

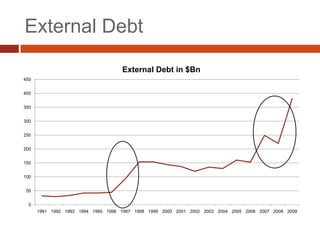

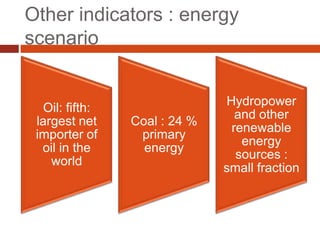

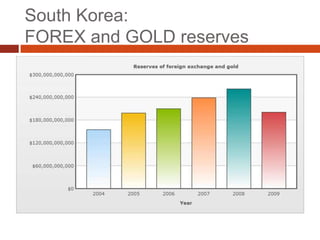

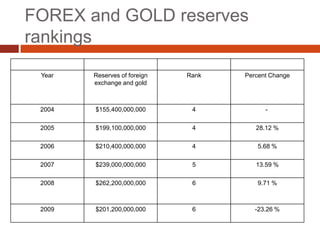

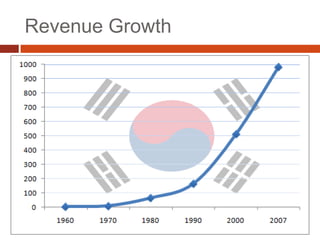

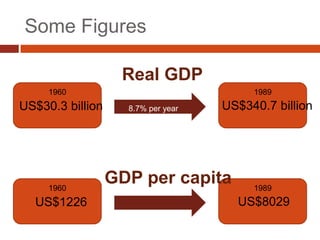

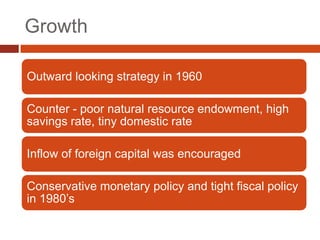

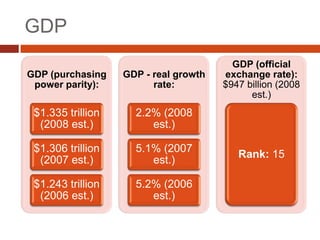

South Korea has transformed from the ashes of the Korean War into a trillion dollar economy through export-fuelled growth, industrialization, education, and urbanization. Key sectors driving the economy include electronics (Samsung, Hyundai), shipbuilding, and automotive. The economy was impacted by the 1997 Asian Financial Crisis but recovered through reforms and increasing reserves. Industrial policies shifted focus over time from light to high-tech industries and increasing R&D spending. Macroeconomic indicators like GDP growth, inflation, and unemployment are monitored while fiscal and monetary policies aim to promote growth and control inflation.

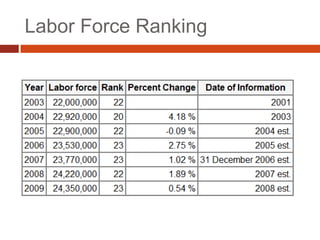

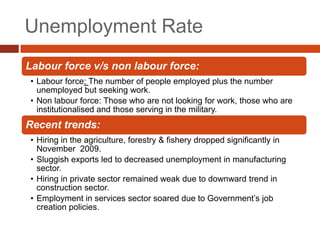

![Labor Force

Labour force

• 24.35 million (2008 est.) [Total Population of 50.06 million]](https://image.slidesharecdn.com/southkoreafinal-120127095004-phpapp02/85/South-korea-final-10-320.jpg)