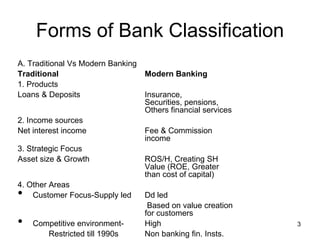

This document discusses asset liability management (ALM) in banks. It begins by outlining the key things students should understand about ALM, including bank classifications, concerns of bank managers, bank assets and liabilities, revenue sources, and risks banks face. It then covers traditional vs modern banking, forms of bank classification, common bank services, an introduction to ALM, and the objectives of asset and liability management. The document also discusses liquidity management, capital adequacy, credit risk management, and other risks impacting banks.