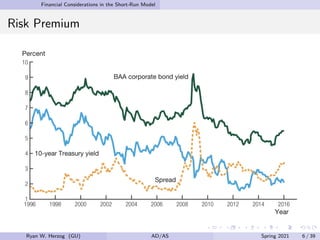

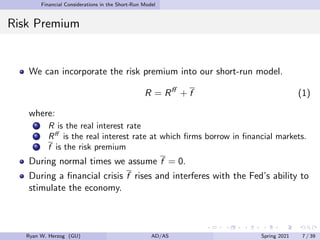

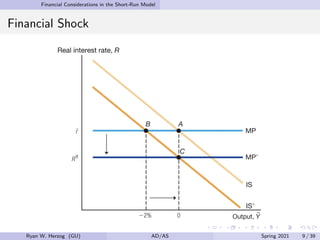

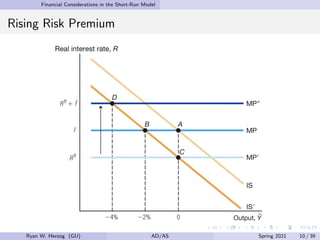

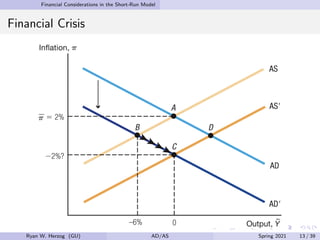

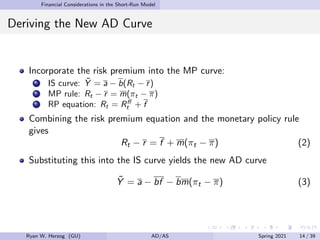

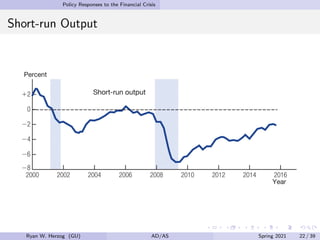

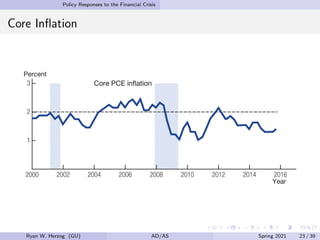

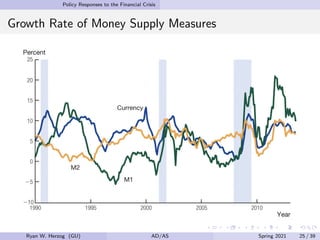

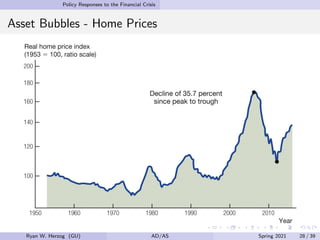

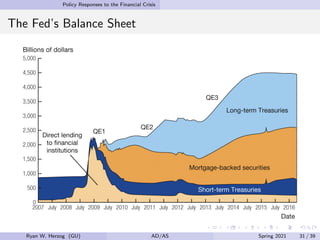

This document discusses the Great Recession and policy responses to the financial crisis. It introduces financial considerations like a risk premium into the short-run model to understand the crisis. A rising risk premium interfered with monetary policy and shifted the AD curve down. This led to deflation concerns. Policy responses included unconventional monetary policy by expanding the Fed's balance sheet, fiscal stimulus, and the TARP program. Financial reform aimed to prevent future crises and address issues like moral hazard.