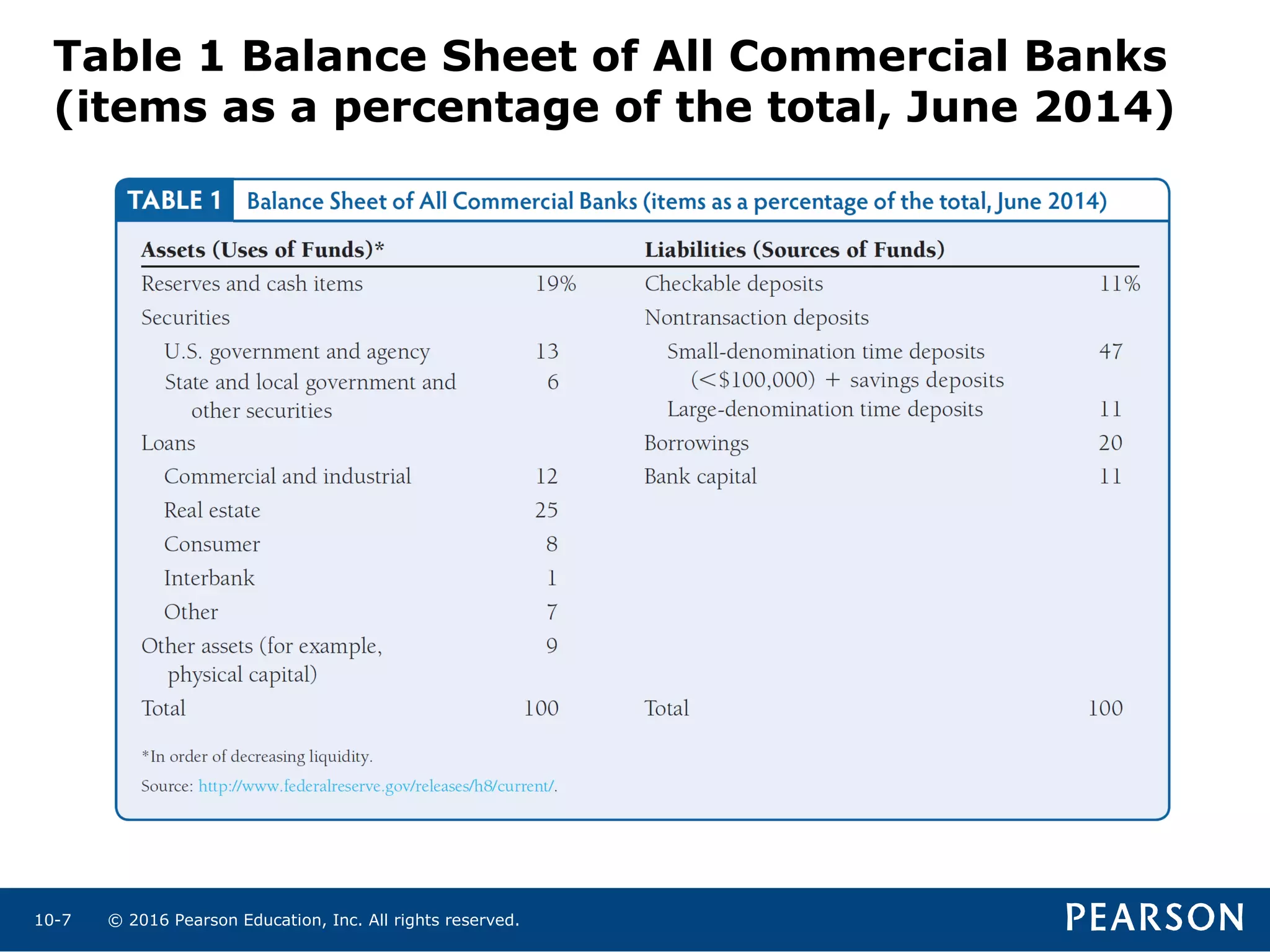

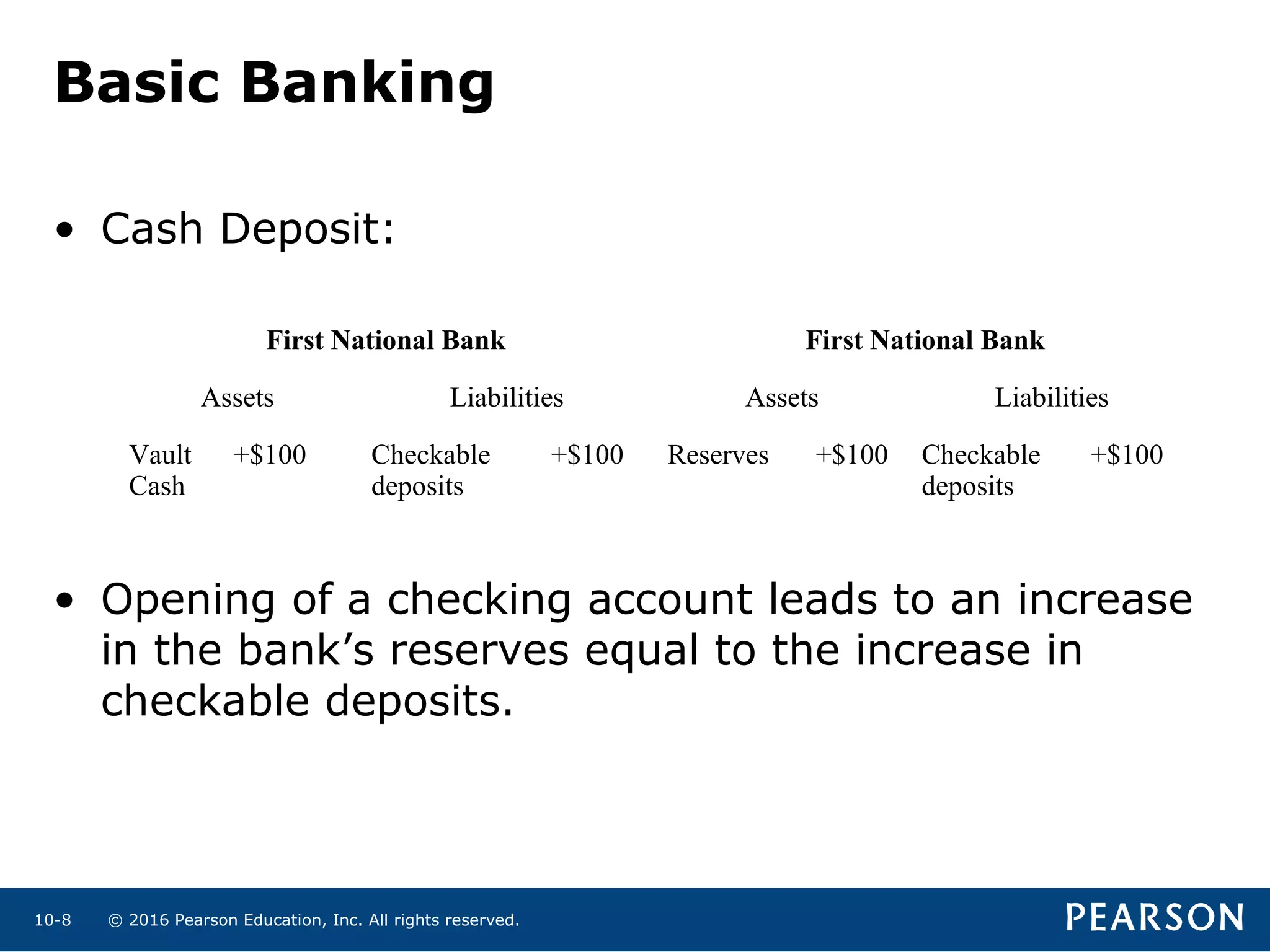

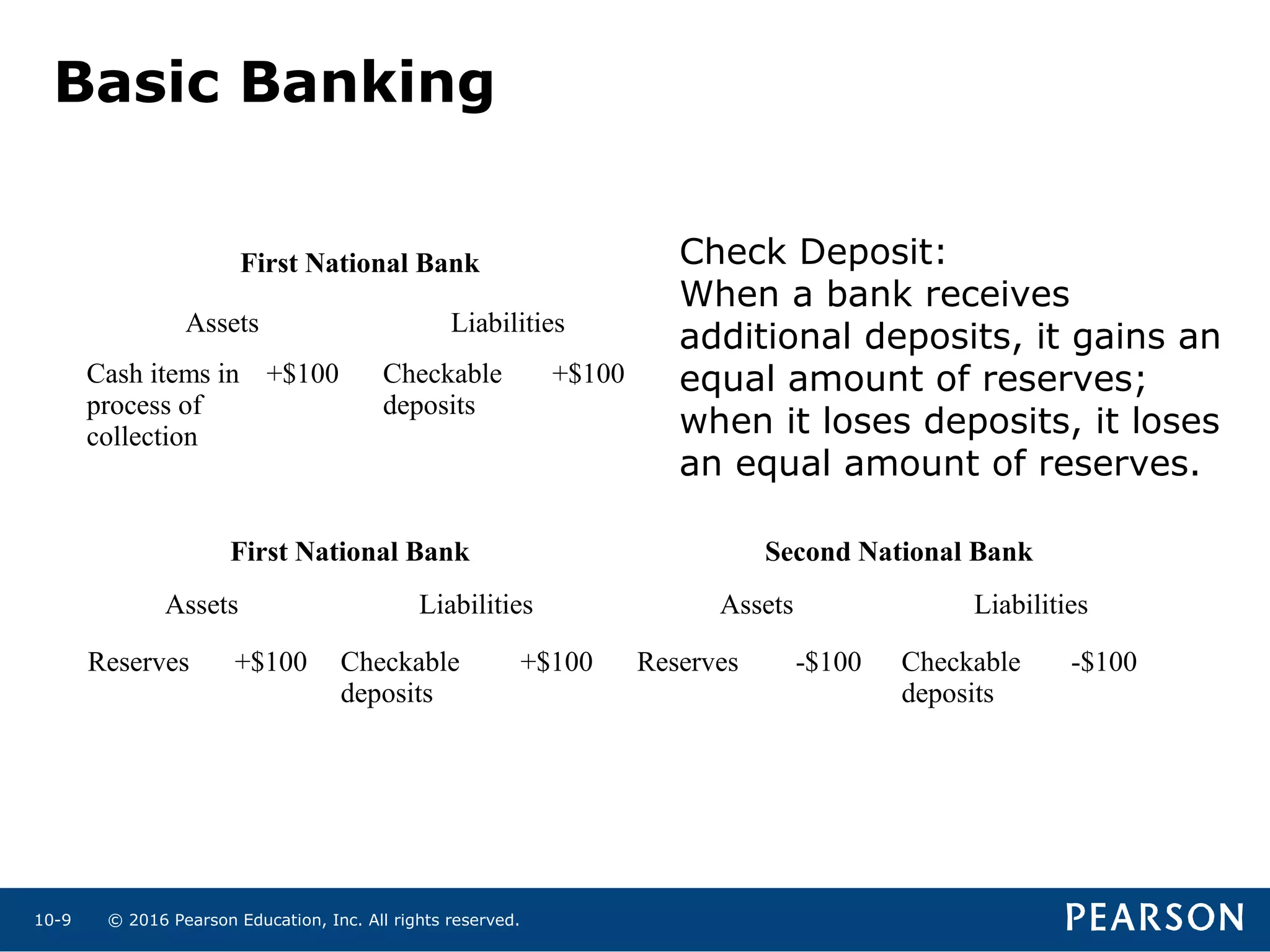

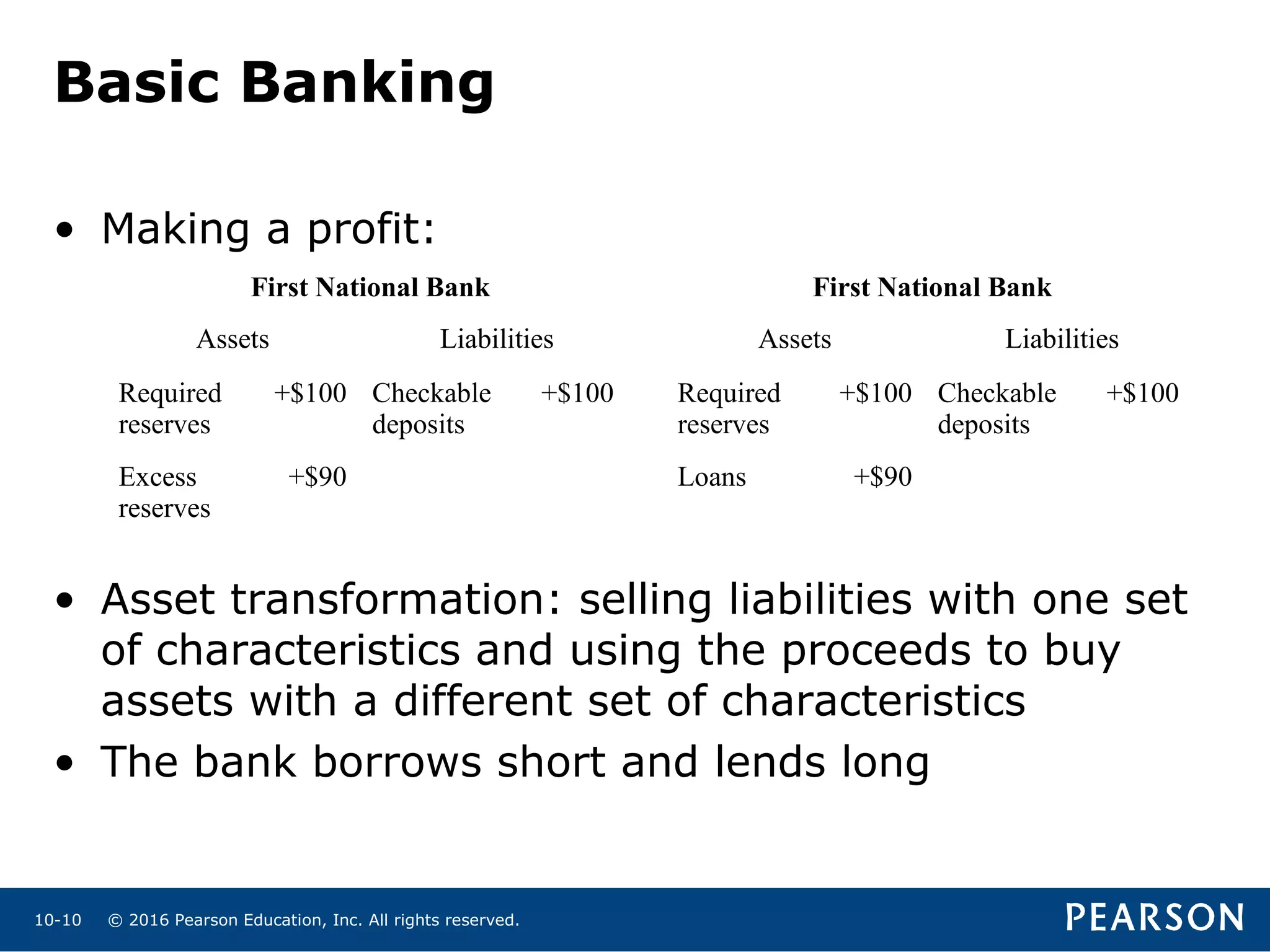

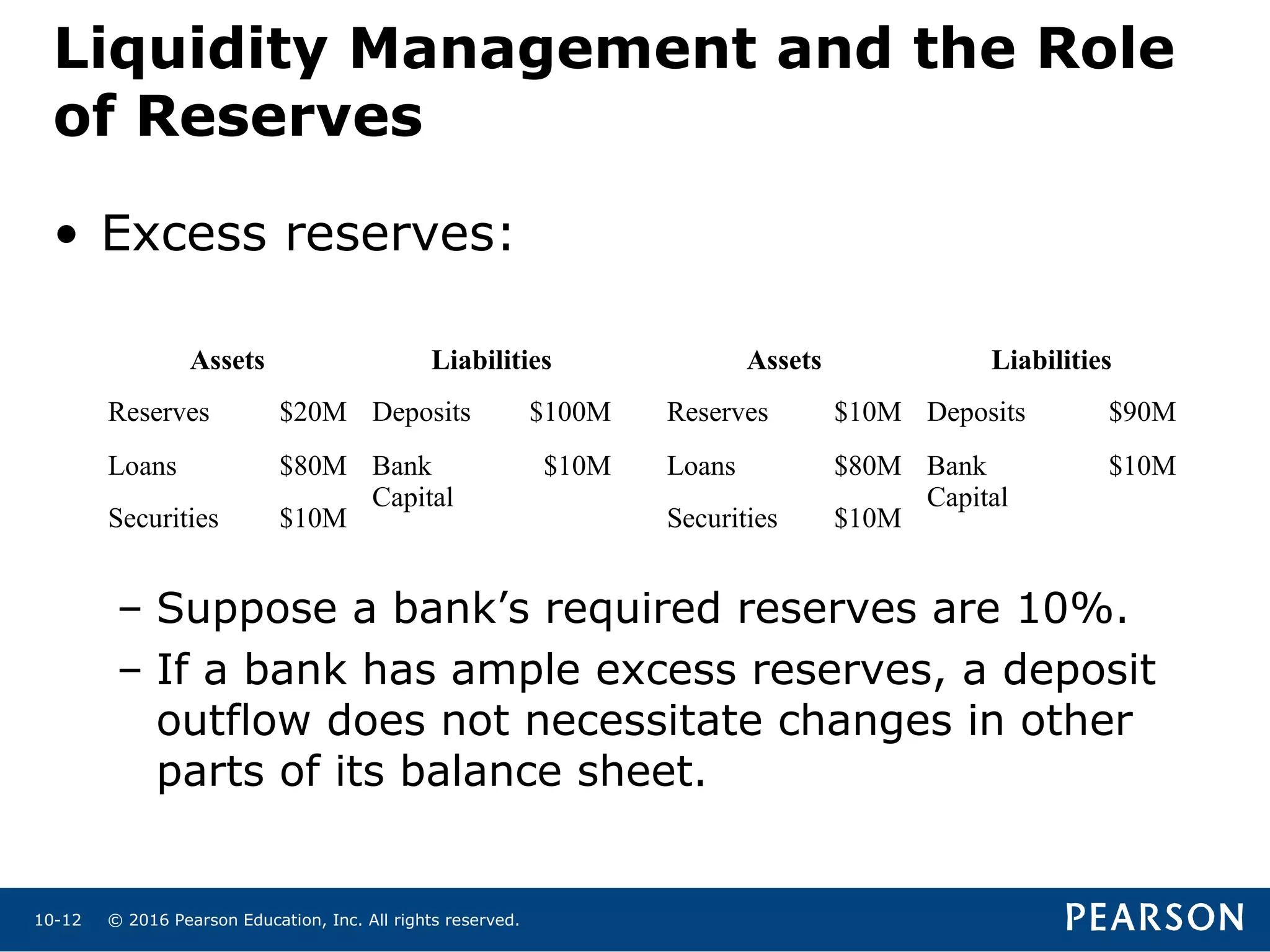

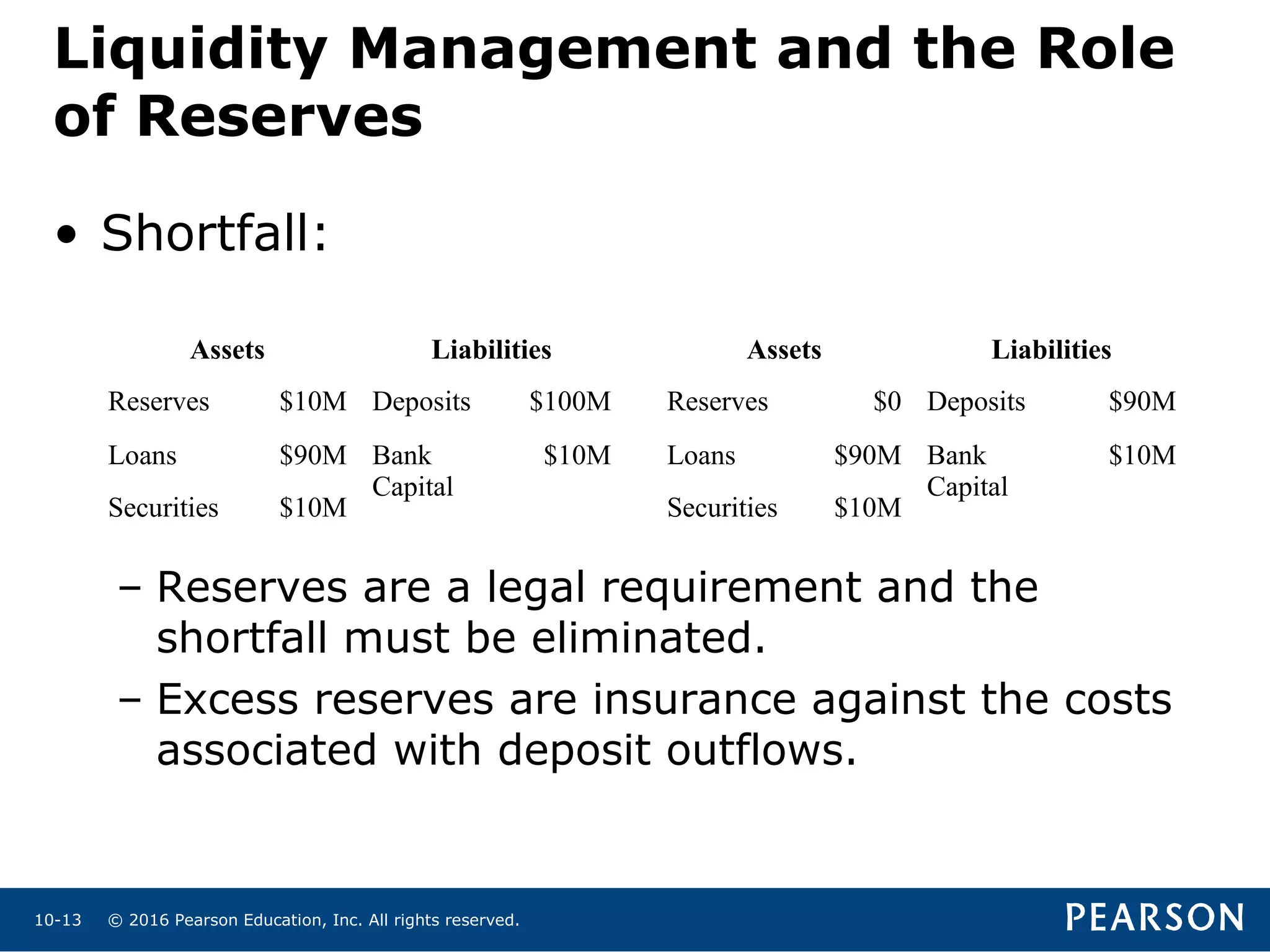

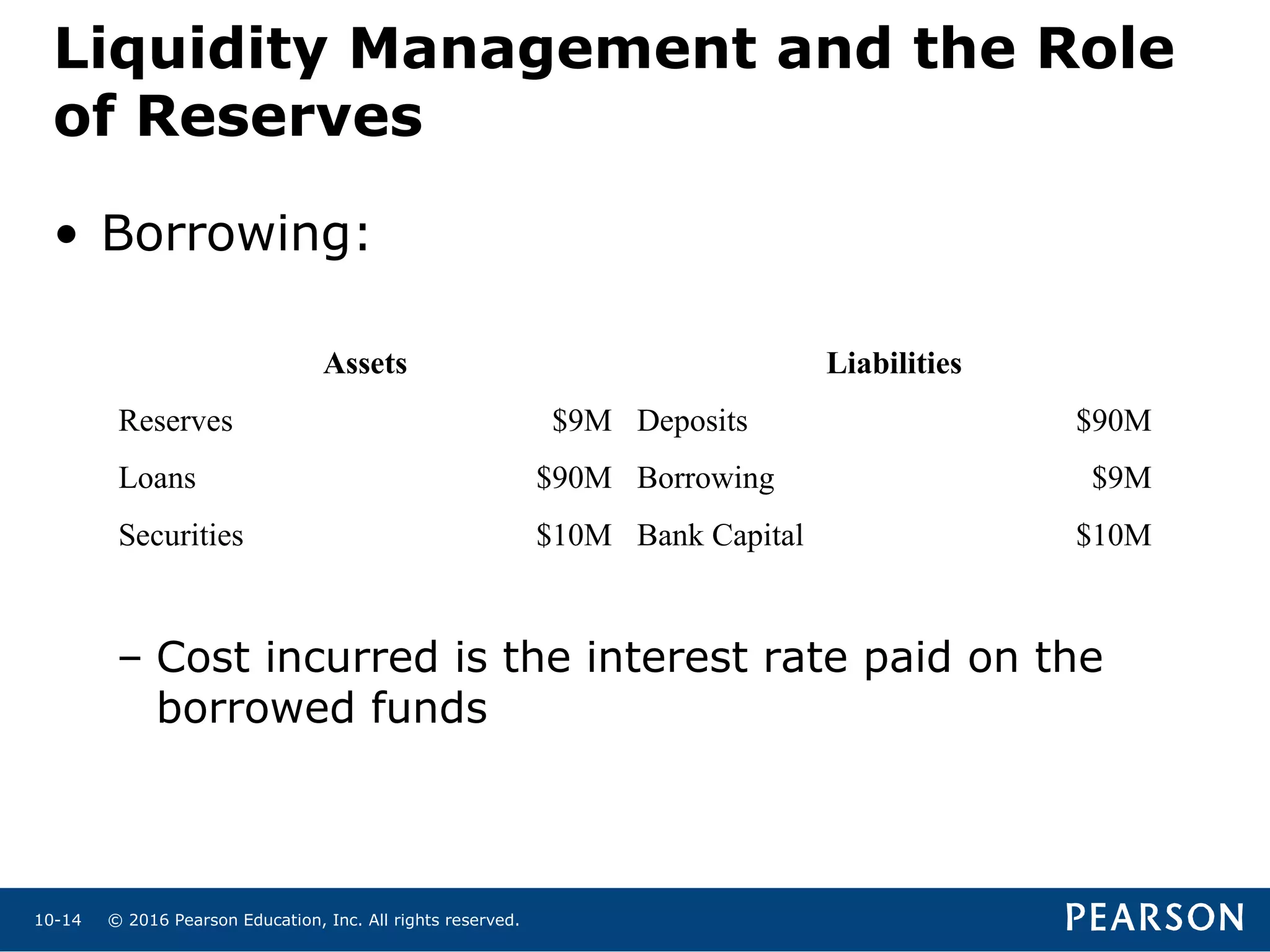

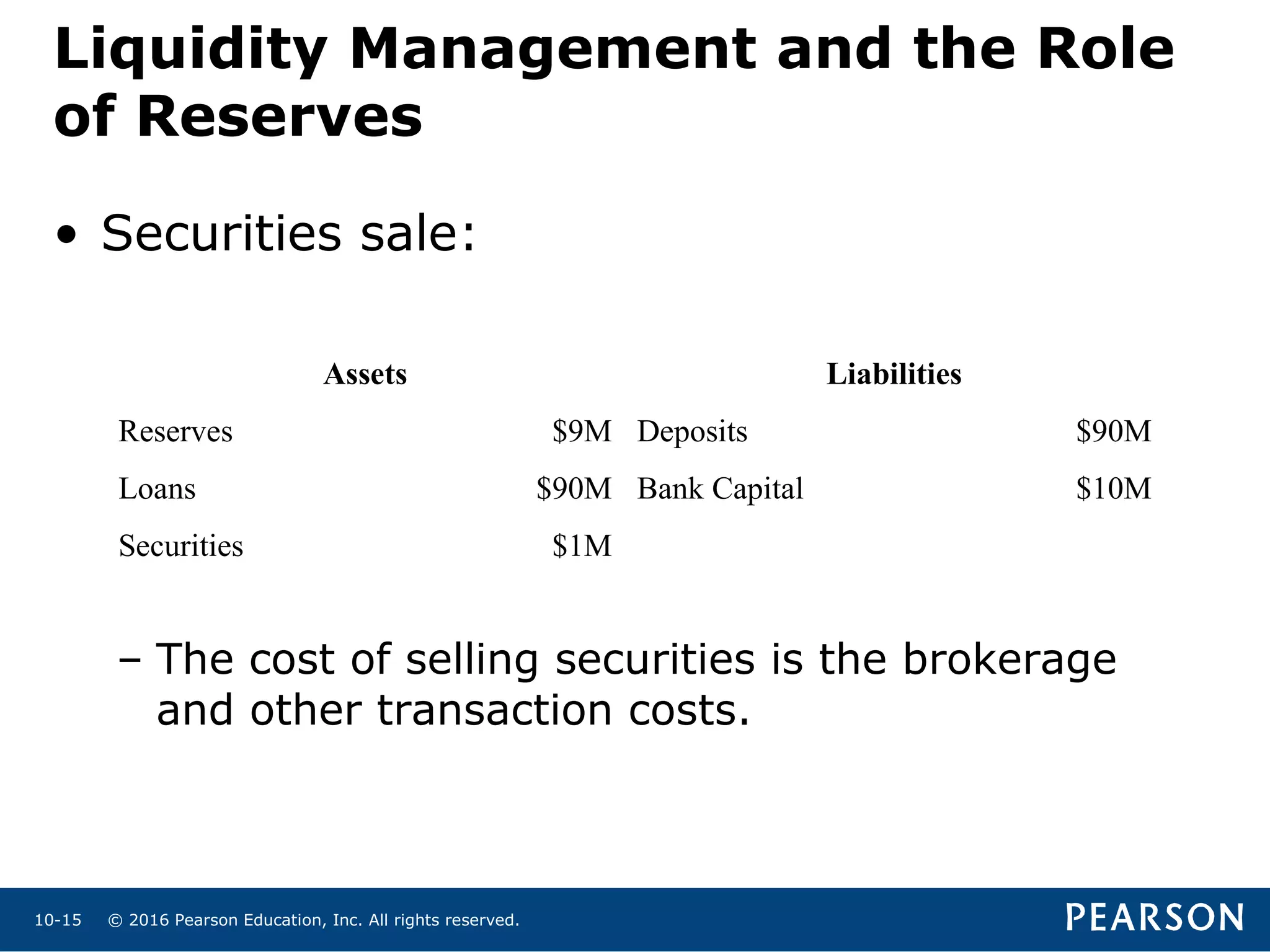

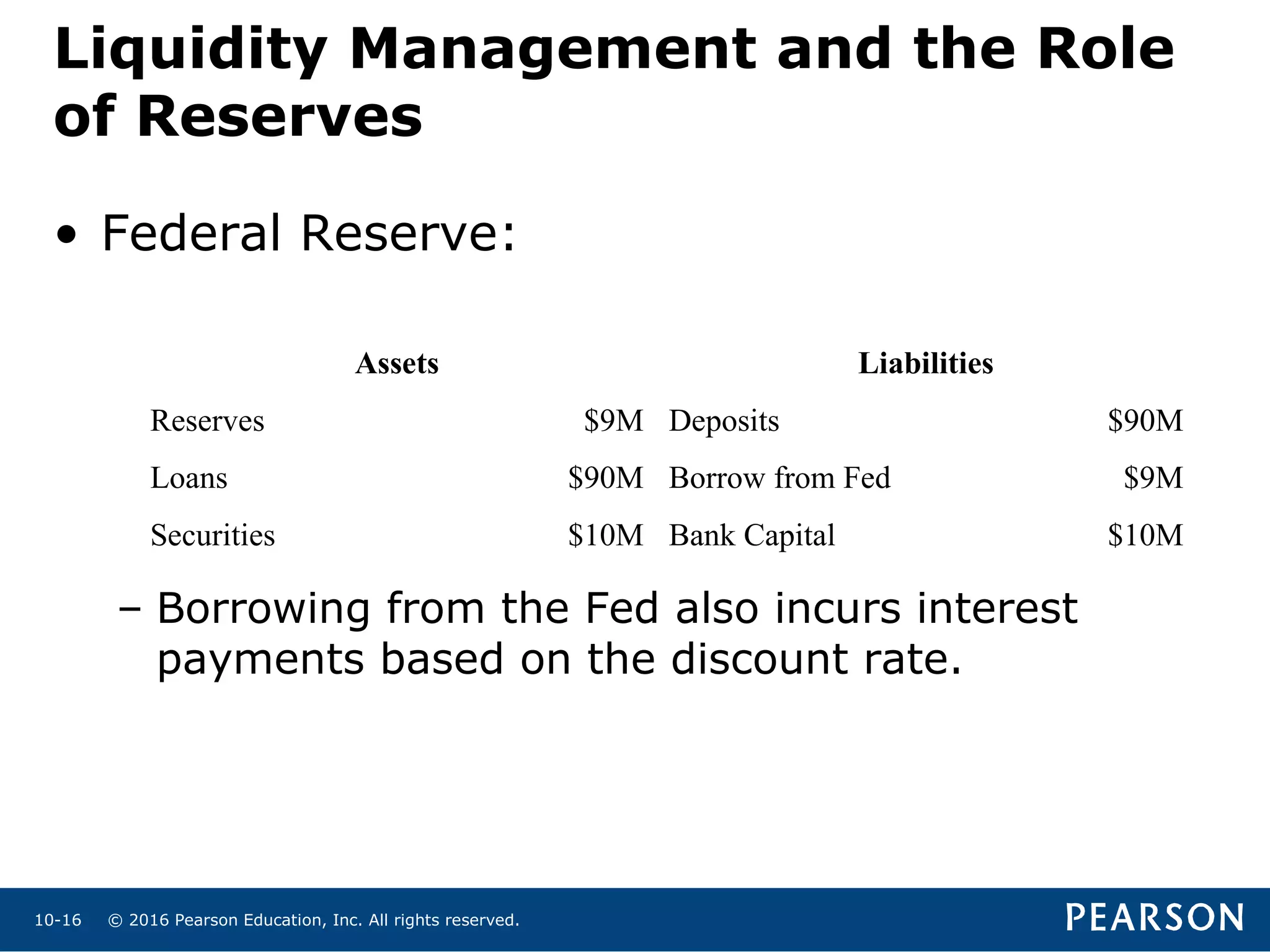

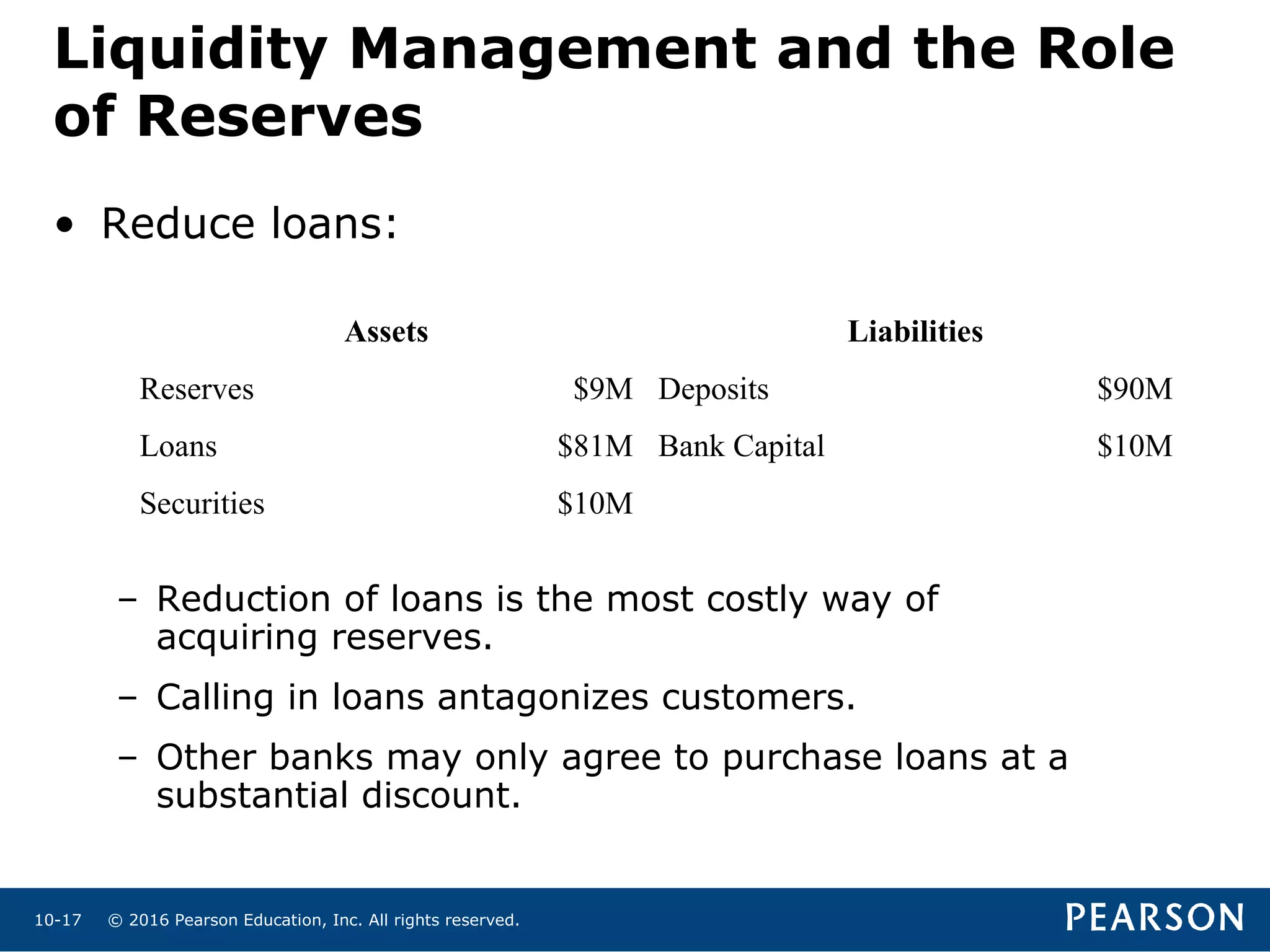

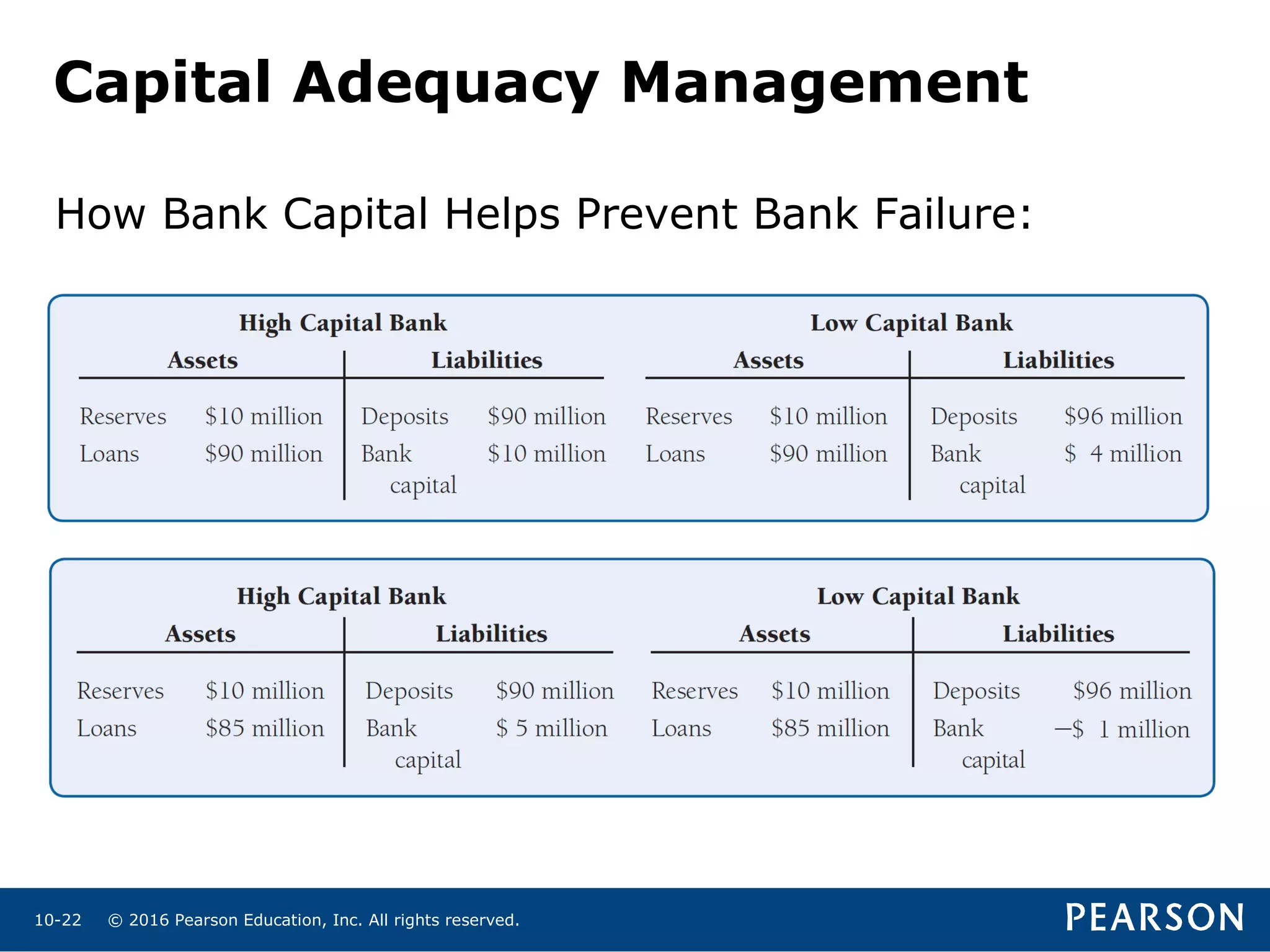

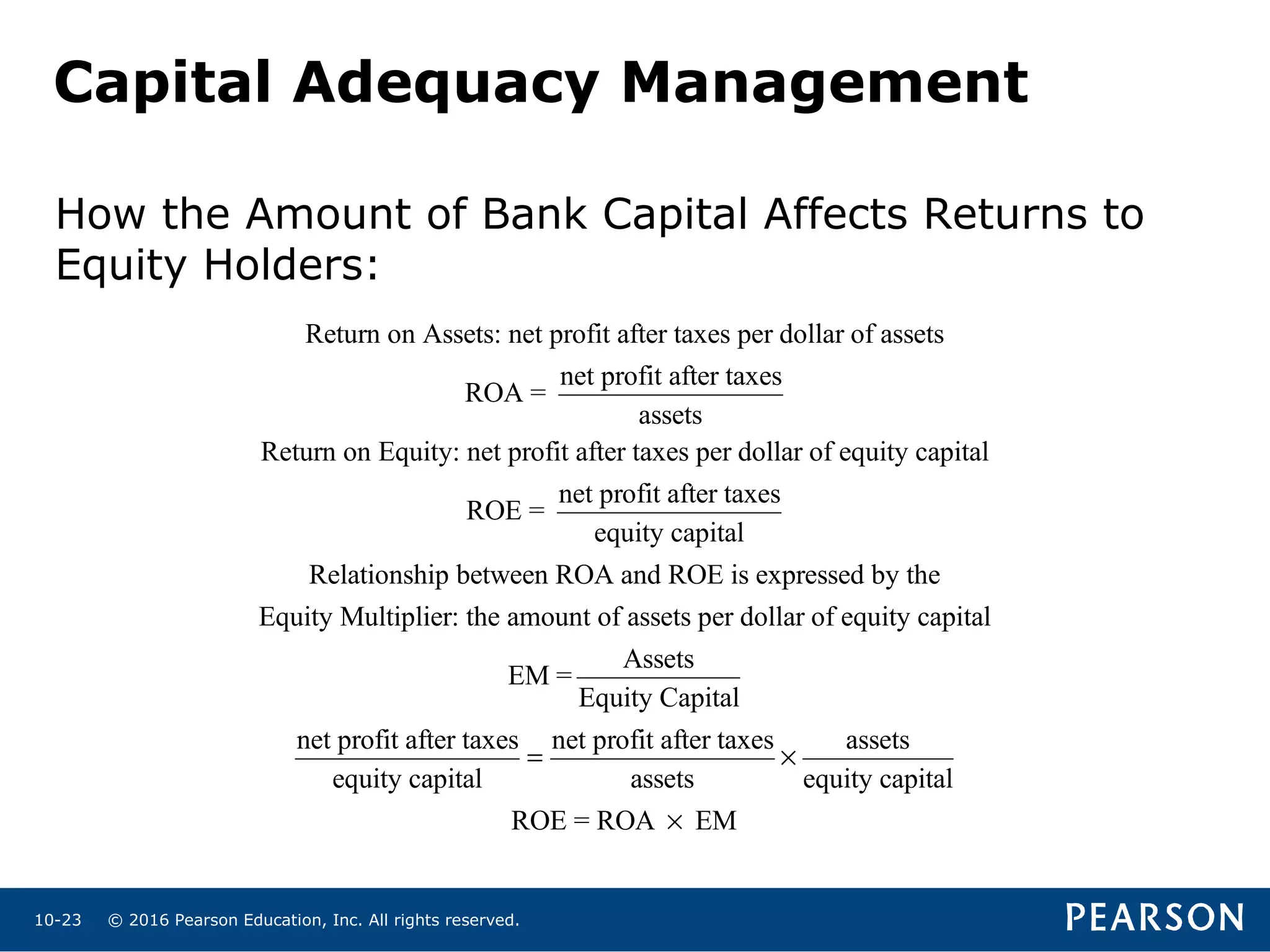

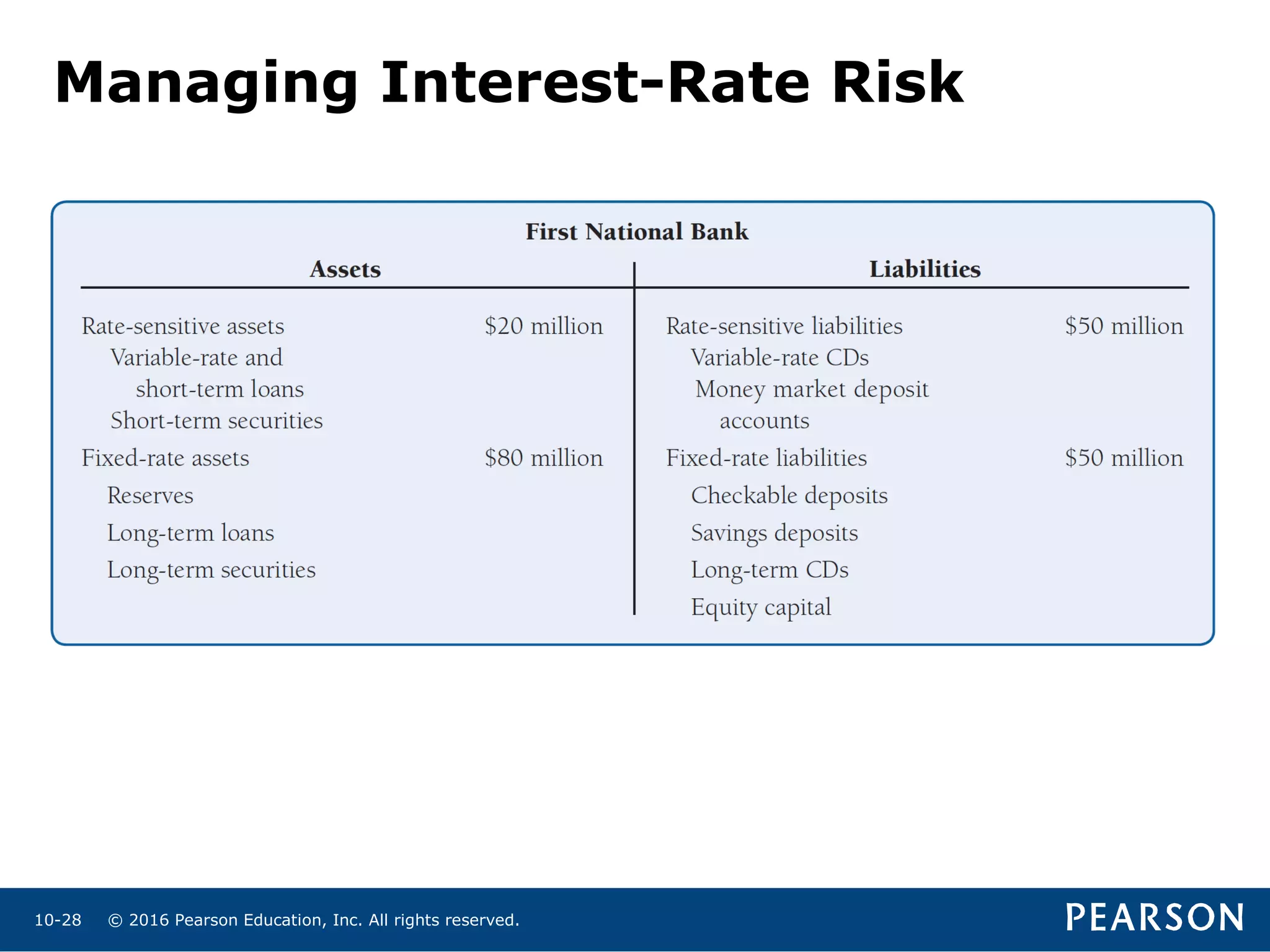

This chapter discusses how banks manage their assets and liabilities to maximize profits. It covers key aspects of bank balance sheets including reserves, deposits, loans and securities. The document outlines various strategies banks use for liquidity management, asset management, liability management, and capital adequacy management. It also discusses how banks deal with credit risk, interest rate risk, and off-balance sheet activities like loan sales and derivatives.