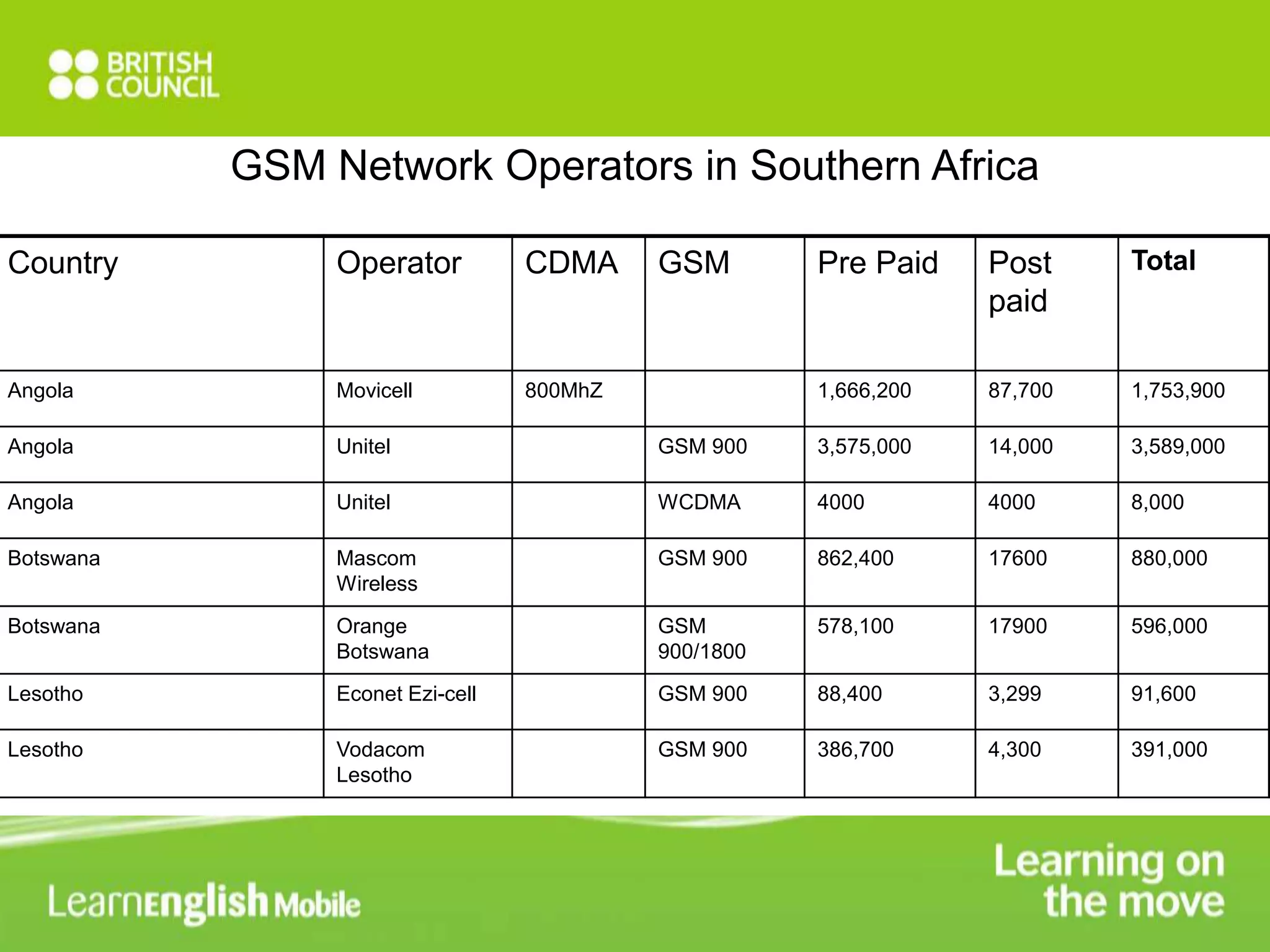

The document discusses using mobile phones to deliver English language learning content in Africa. It describes a feasibility study conducted on using SMS and IVR platforms. While SMS content was developed, the study found IVR would better support adoption given literacy levels. Challenges included complex implementation and operator costs. Initial pilots in some countries showed interest but failed to result in signed contracts due to questions around content depth and business models. Next steps included improving marketing efforts and exploring enhancing the product to include IVR.