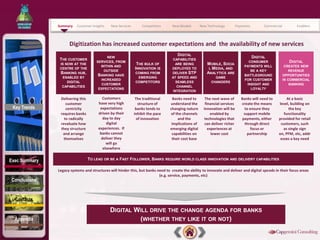

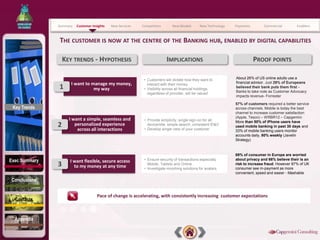

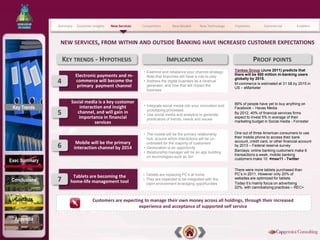

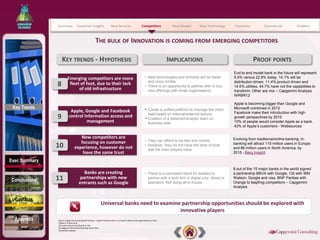

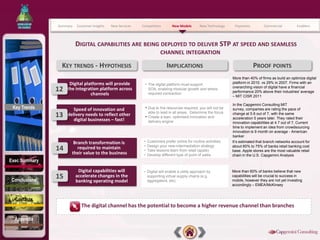

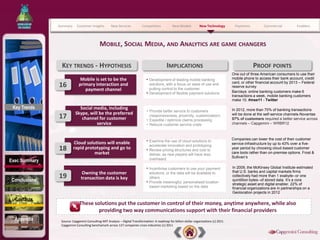

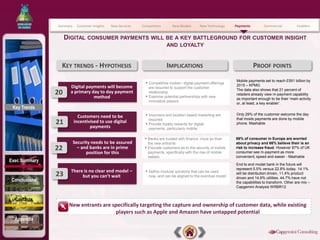

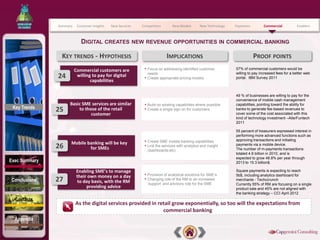

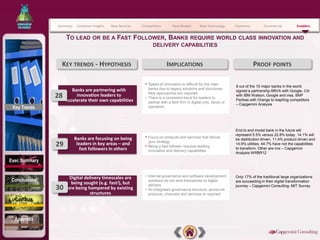

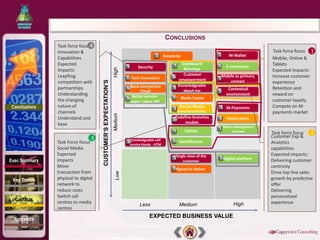

The document discusses emerging digital banking trends and identifies leading practices. It highlights that digital capabilities are putting customers at the center and increasing their expectations around managing their finances simply across all channels. Banks need to deploy digital capabilities to deliver seamless, integrated experiences at speed to meet these expectations or risk losing customers to more nimble competitors focusing on customer experience. Mobile, social media, analytics and the cloud will drive significant changes in banking models and capabilities.