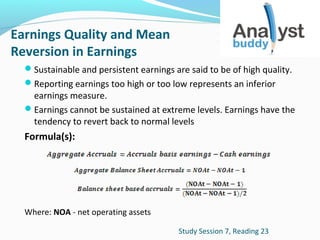

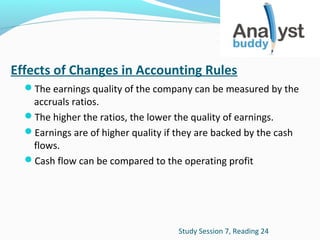

The document discusses various definitions of earnings metrics like EBITDA, operating income, and net income. It also discusses the reliability of cash flow trends compared to earnings trends, noting that sustainable earnings growth requires growth in operating cash flows over the long run. Finally, it discusses accounting treatments for different types of hedges, as well as cash versus accrual basis accounting and how management can intervene in the external financial reporting process.