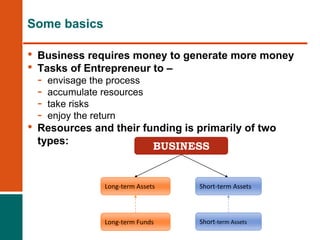

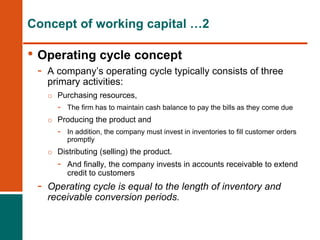

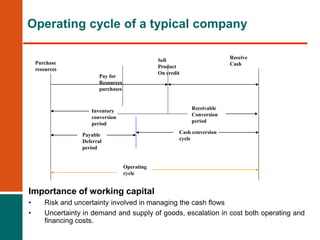

The document outlines the significance of working capital management in business, emphasizing the necessity of current assets like cash, inventory, and receivables for day-to-day operations. It discusses the concepts of balance sheet and operating cycle as they relate to working capital, along with various factors affecting profitability, risk, and liquidity. Additionally, it highlights methods for managing cash flows and sourcing working capital, along with criteria considered by banks for lending.