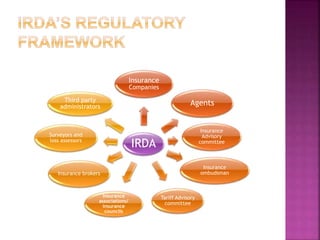

IRDA is the regulatory body for the insurance sector in India, established in 2000. It is headed by a chairman and has 10 members appointed by the Government of India. IRDA regulates and develops the insurance industry, protects policyholders' interests, and promotes an orderly growth of the insurance market. It is responsible for licensing insurance companies and intermediaries, approving training institutions, and monitoring insurance products and pricing.

![IRDA [Insurance Regulatory and Development Authority]](https://image.slidesharecdn.com/ibegropu07-171025144708/85/IRDA-Insurance-Regulatory-and-Development-Authority-8-320.jpg)